The COVID market bottom, plus tech/bitcoin lead, JPMorgan, 90 years of market history, and goals-based investing

The Sandbox Daily (3.23.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Three years since the COVID-19 market bottom

High beta assets assume leadership

A prescient call from JPMorgan

90 years of stock and bond portfolio performance

Goals-based investing

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.29% | S&P 500 +0.30% | Dow +0.23% | Russell 2000 -0.41%

FIXED INCOME: Barclays Agg Bond +0.24% | High Yield -0.39% | 2yr UST 3.818% | 10yr UST 3.412%

COMMODITIES: Brent Crude -1.75% to $75.35/barrel. Gold +2.39% to $2,013.6/oz.

BITCOIN: +3.21% to $28,341

US DOLLAR INDEX: +0.23% to 102.584

CBOE EQUITY PUT/CALL RATIO: 0.63

VIX: +1.57% to 22.61

Quote of the day

“Today’s ‘best practices’ lead to dead ends; the best paths are new and untried.”

-Peter Thiel, Zero to One

Three years since the COVID-19 market bottom

On March 23rd, 2020, the S&P 500 bottomed after falling -34% in 24 trading sessions – a truly staggering collapse in such a short period of time.

Because we were dealing with an unprecedented health crisis, many investors were less focused on market volatility, their portfolio, and the difficult investment results all had suffered. The sheer speed in which the market sold down numbed our senses. After all, life was at stake, so our attention was focused on much more important matters.

Three years later, the world is a very different place. But the constant – like all other cycles in history – is the market bottomed and found its footing in the face of extraordinary challenges, then proceeded to get back to basics – profits, earnings, monetary and fiscal policy, interest rates, money supply, trade, etc. etc.

Here is the trailing 3-year performance for a variety of major asset classes.

We all have our own unique financial circumstances, goals, and future plans. Stick to what matters for you. The markets will do what they do – totally out of your control – so we will get through this difficult market and years down the road, we’ll all look back at this moment and say “hey, that wasn’t so bad.”

Source: YCharts

High beta assets assume leadership

Technology stocks and Bitcoin (BTC) are back in a leadership role.

The technology stocks ETF (XLK) and Bitcoin are both trending higher from rounding bottom patterns. The correlation indicator in the bottom pane of the chart illustrates just how strong of a positive correlation they have.

The new highs in Bitcoin could bode well for tech stocks as XLK attempts to resolve higher from a similar base.

These charts are unlikely to resolve in opposite directions. If BTC can hold above its year-to-date and summer 2022 highs, we could expect large-cap tech stocks to do the same. It could happen sooner rather than later, as XLK just closed at its highest level since last August.

One consideration to keep close eye: while the Nasdaq is getting all the headlines for its strong year-to-date gains, beneath the surface it’s more New Lows than New Highs as breadth deteriorates.

Uptrends require an expansion in stocks making New Highs, so caution is warranted in this messy market.

Source: All Star Charts, Willie Delwiche

Prescient market call

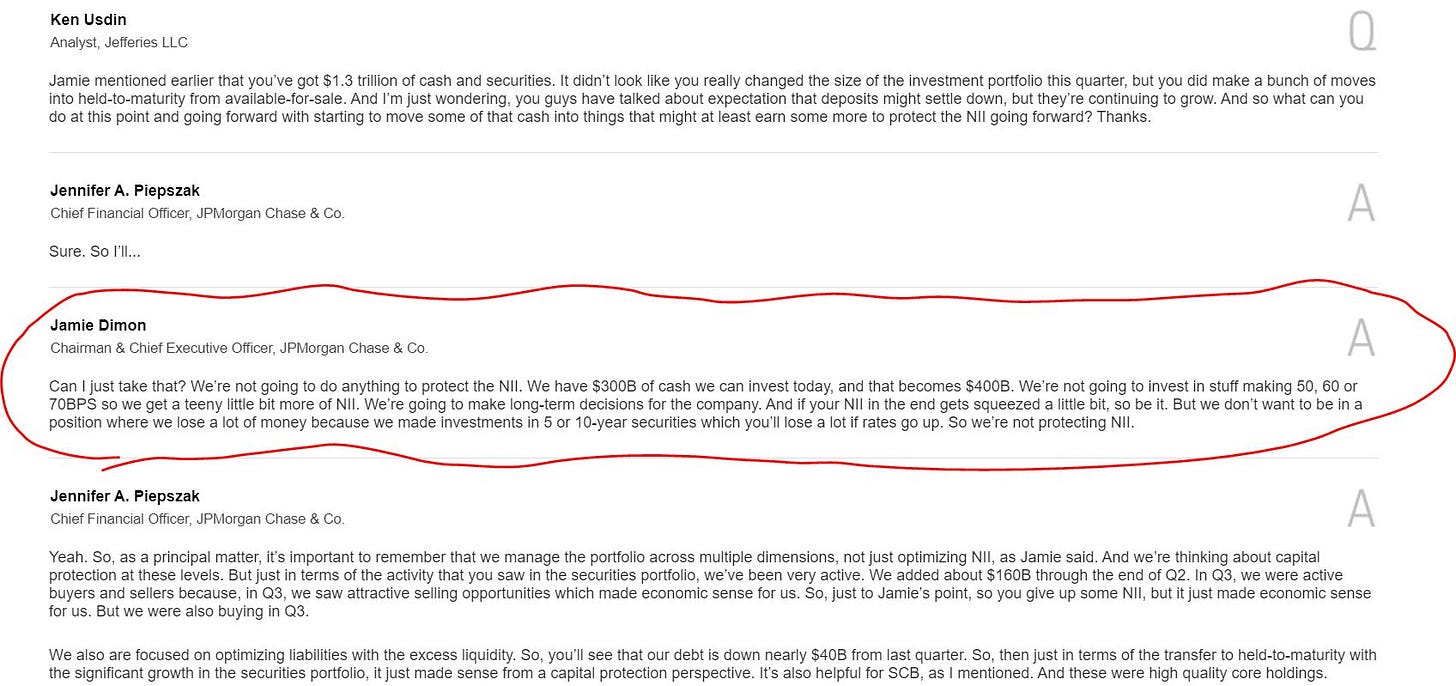

Hindsight is 20-20 but it is interesting to reflect back on the Q&A section from JPMorgan's earnings call from the 3rd quarter of 2020. And, more specifically, the comments below from CEO Jamie Dimon.

Not all banks were anxious to buy long duration bond securities when interest rates where anchored at/near 0% with the massive inflow of cash hitting deposits that came during the pandemic. As a result, the JPM balance sheet is in much better shape than many other banks across the landscape.

To be fair, JPMorgan has a diversified income base that spans wealth management, investment banking, sales & trading, consumer lending, retail banking services, and on and on – so optimizing Net Interest Income (NII) is not as high a priority as the smaller regional banks that have been exposed over the last few weeks. But, JPMorgan demonstrated yet again its uncanny ability to be an all-weather bank and endure through thick and thin.

Source: JPMorgan

90 years of stock and bond portfolio performance

A traditional 60-40 portfolio – which has lost its luster in recent years as zero-bound interest rates have led to lower bond returns – has averaged a historical return of +8.8%, with a wide dispersion range swinging from +36.7% (best annual return) to -26.6% (worst annual return). As interest rates climbed higher in the last year, this should bring better forward prospective returns and better investor sentiment.

Below is how various combinations of stock and bond asset allocation portfolios have performed over time, calling out the best returns, worst returns, and the average returns – based on Vanguard data between 1926 and 2019.

For the less visually inclined, here is the raw data set.

2022 – the yellow dot below – was a tough year for this bogey portfolio, returning -16.9%; it was the 1st year since the inception of the bond index (Bloomberg U.S. Aggregate Index) that both the S&P 500 and the Agg were negative in the same year.

Source: Visual Capitalist

One simple graphic

When it comes to personal finance, what matters is not beating some index.

What matters is meeting your goals.

Those are not the same thing.

Source: The Behavior Gap

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.