The diploma divide, plus insufficient funds, NBER on recessions, home prices plummet, and adults feeling worse off

The Sandbox Daily (5.23.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

the diploma divide

Treasury General Account approaching “insufficient funds” level

past NBER calls on recessions

home prices plummet

adults doing worse now on the rise vs. 12 months

Publisher’s note: The Sandbox Daily is taking a one-day break on Wednesday and will return on Thursday, May 25th. It is Commissioning Week in Annapolis, MD and the Blue Angels are visiting.

For now, let’s dig in.

Markets in review

EQUITIES: Russell 2000 -0.43% | Dow -0.69% | S&P 500 -1.12% | Nasdaq 100 -1.28%

FIXED INCOME: Barclays Agg Bond +0.11% | High Yield -0.52% | 2yr UST 4.321% | 10yr UST 3.698%

COMMODITIES: Brent Crude +1.92% to $77.50/barrel. Gold +0.22% to $1,997.2/oz.

BITCOIN: +1.19% to $27,211

US DOLLAR INDEX: +0.26% to 103.516

CBOE EQUITY PUT/CALL RATIO: 0.54

VIX: +7.67% to 18.53

Quote of the day

“You should write your obituary and then try to figure out how to live up to it.”

- Warren Buffett

The diploma divide

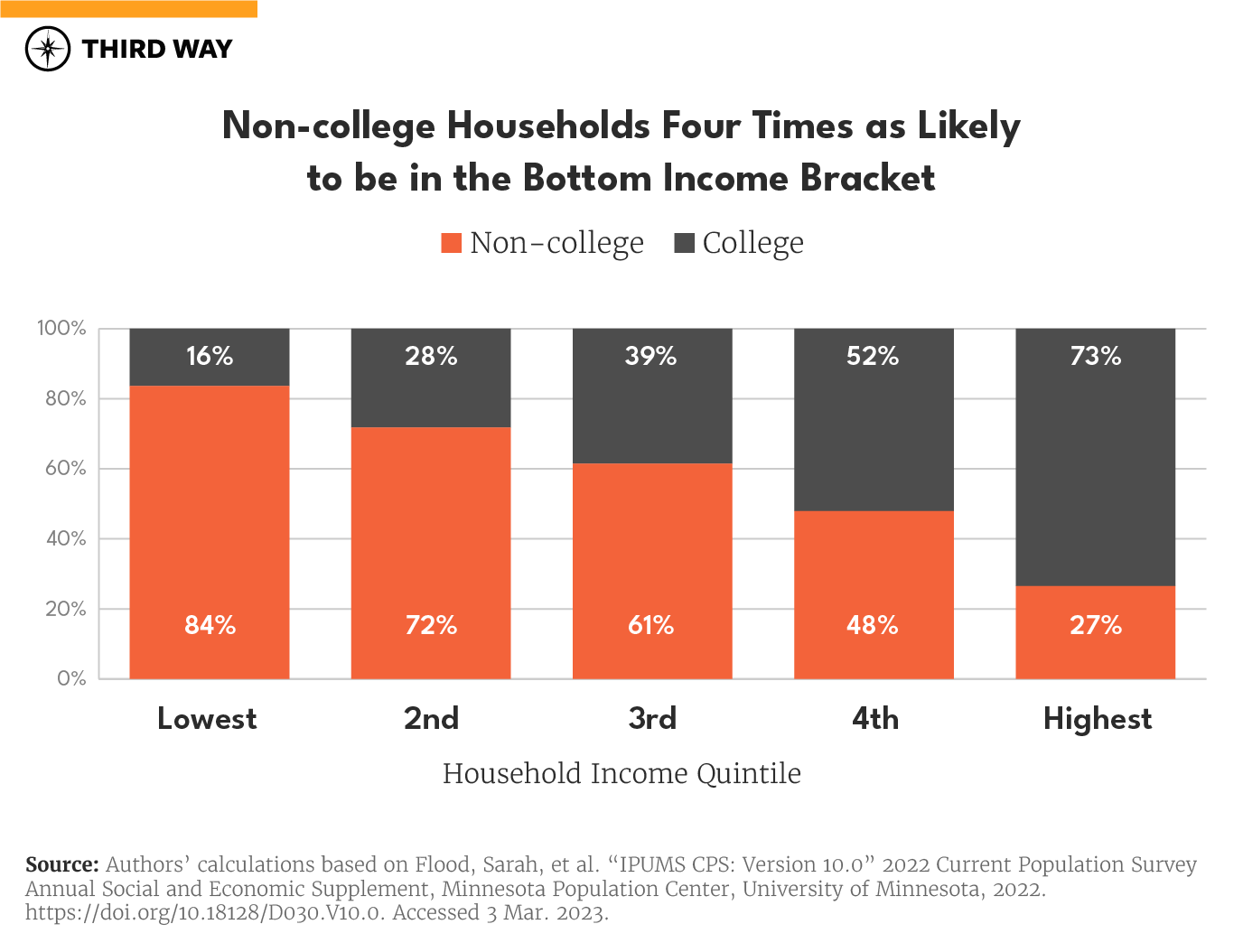

A new report from think tank Third Way highlights the different economic worlds that two groups live in: those with a college degree and those without.

The median income of non-college households is $61,000, less than half of the $127,000 college-educated households take in. Roughly 2/3rds of the working-age population in the United States, or 109 million Americans, do not have a four-year degree — compared to 63 million who do.

Spanning across the income spectrum, 3 out of 4 household heads in the top income quintile have a college degree; at the other end, 4 out of 5 households in the bottom income quintile do not have a college degree.

Meanwhile, Americans without college degrees are more likely to be denied credit than those who finished college. The share of households being denied credit in the last 5 years disproportionately affects the non-college population. Access to credit is a critical mechanism for socioeconomic advancement and everyday practical application.

Treasury General Account approaching “insufficient funds” level

Uncle Sam's checking account – aka the Treasury General Account, held at the Federal Reserve Bank of New York – is dwindling fast.

The last weekly update showed the balance on the General Account falling to just over $60 billion, its lowest level since debt ceiling discussions began.

The so-called X-date is when this account – which fluctuates depending on tax collections and government payments – no longer has enough money to meet the country's financial obligations, potentially triggering a technical default.

Markets have become increasingly sensitive to headlines around progress towards raising the debt limit in time. Although corners of the market have been reflecting debt limit-related risks for some time, markets have generally remained sanguine about those risks, consistent with the general expectation that negotiations may go down “to the wire.”

Source: Goldman Sachs Global Investment Research, Axios

Past NBER calls on recessions

The National Bureau of Economic Research (NBER) is the official arbiter of recessions.

The problem, as the Piper Sandler table below shows, is that they are, on average, about seven months too late in determining when a recession starts and over a year late in determining when a recession ends.

While it can be problematic for investors relying on the NBER, they should be aware the NBER waits for revised economic data. Further, they heavily rely on a higher unemployment rate as a key recession determinant. The labor markets tend to be lagging economic indicators as layoffs do not typically occur until a recession is underway.

Source: Piper Sandler

Home prices plummet

The median U.S. home sale price fell -4.1% ($17,603) year-over-year in April to $408,031. That’s the biggest drop on record in dollar terms and the largest decline since January 2012 in percentage terms.

April marked the third consecutive month of YoY declines following roughly a decade of increases.

The report from real estate brokerage firm, Redfin, found the largest drops in prices were in expensive California markets and in pandemic-era boomtowns, such as Austin, Texas and Boise, Idaho.

Looking forward on the horizon, New Listings dropped -26.1% YoY on a seasonally adjusted basis in April as homeowners stayed put in order to hold onto their relatively low rates.

“Elevated mortgage rates are preventing would-be buyers from buying and would-be sellers from selling. And because sellers aren’t selling, the buyers who are out there have very limited options,” Redfin chief economist Daryl Fairweather said in a statement.

Source: Redfin

Adults doing worse now on the rise vs. 12 months ago

According to a Federal Reserve survey of household wellbeing, "the share who said they were worse off financially than a year earlier rose to 35%, the highest since the question was first asked in 2014.

The survey of more than 11,000 adults was conducted in October 2022, and discusses findings related to financial well-being, income, expenses, employment, banking and credit, housing, retirement and investments, and higher education and student loans.

Source: Federal Reserve

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.