The diversification problem for U.S. based investors, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (12.6.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

the diversification problem for U.S. based investors

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.92% | Russell 2000 +0.54% | S&P 500 +0.25% | Dow -0.28%

FIXED INCOME: Barclays Agg Bond +0.28% | High Yield +0.16% | 2yr UST 4.108% | 10yr UST 4.163%

COMMODITIES: Brent Crude -1.50% to $71.01/barrel. Gold +0.26% to $2,655.2/oz.

BITCOIN: +1.85% to $100,751

US DOLLAR INDEX: +0.24% to 105.968

CBOE TOTAL PUT/CALL RATIO: 0.80

VIX: -5.69% to 12.77

Quote of the day

“Success is not final, failure is not fatal: it is the courage to continue that counts.”

- Winston Churchill

The diversification problem for U.S. based investors

A U.S. based investor diversifying their equity exposure into international assets, specifically across Europe, has been an incredibly underwhelming experience over the past decade or two.

Meb Faber, CIO of Cambria Investment Management, has publicly labeled this investing shortfall the “big bear market in diversification.” At its core, it’s been U.S. Tech / Large Cap Growth and then everything else.

On the surface, the proposition seems perfectly reasonable.

Hold a basket of stocks that differ my market cap, sector, style, AND geography. In doing so, an investor spreads risk across the board while still participating in the upside growth of the broader stock market.

Unfortunately, diversification into European equities has not worked as well as U.S. investors might have hoped due to several intertwining factors:

economic growth: European economies have faced slower growth relative to the United States due to demographic headwinds, higher debt loads, and less innovation, among other factors

sector composition: European stock markets are heavily weighted toward sectors like Financials, Energy, and Industrials, which have underperformed compared to the U.S., where the Technology and tech-adjacent Consumer Discretionary and Communication Services sectors dominate

earnings growth: U.S. companies have delivered stronger earnings growth over the past decade, driven by higher productivity, innovation, and cost efficiencies

geopolitics: Europe has experienced significant political disruptions, such as Brexit, rising populism, and tensions around EU fiscal policies; more recently, the Russia-Ukraine war has disrupted supply chains and energy markets, disproportionately impacting the European region

While diversification is still a valuable investing tenet to respect, the aforementioned factors collectively explain why allocating to European equities hasn’t delivered the expected benefits for U.S. investors.

In 2024, the underperformance has been especially acute.

European equities are lagging U.S. equities by ~22%, its worst year of underperformance since 1976.

Against the MSCI All Country World Index, this translates to the S&P 500 outperforming by roughly two standard deviations versus the long run mean.

There’s an old adage on Wall Street that says capital flows to where it’s welcome and stays where it’s well treated.

Here’s a quick magazine-cover check (courtesy of The Economist) on the prevailing sentiment in markets.

Or perhaps a meme is sufficient:

To be clear, it’s not that returns abroad have been dismal this year – see below.

A handful of select markets are doing fine.

It’s just that returns in the United States have been so much stronger on a relative basis to anything else.

Below are the annualized investment results of the United States versus other regions around the world over the last one-year, five-years, and ten-years. It isn’t even close.

Here’s Nick Colas of DataTrek Research on the data:

“One or even 5 years of performance data might be a fluke, but a decade’s worth of relative returns is hard to dismiss as market inefficiency.”

Overweighting U.S. equities remains consensus view of the general investor. I believe that positioning on a go forward basis still has merit.

U.S. stocks have dramatically outperformed over the last 1, 5, and 10 years, now making up 67% of the MSCI All Country World Index, when a decade ago it was 52%. This didn’t happen by a fluke. Innovation and earnings growth are responsible for the vast majority of that increased separation.

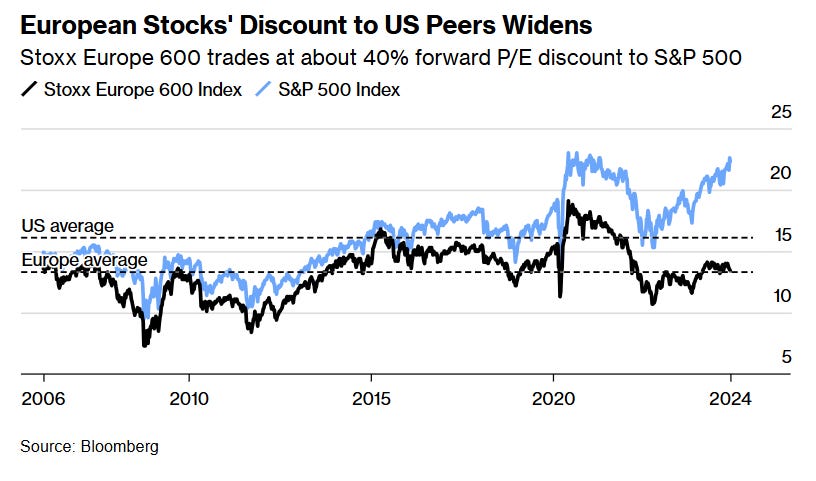

The valuation gap has been cited tirelessly as a reason to look beyond the borders of the United States. One day that will matter, but for now, it doesn’t.

No need to be the contrarian hero and try timing when this reverses in favor of Europe. Let the market tell you through price action when it does.

Source: The Economist, Eric Balchunas, Mike Zaccardi, DataTrek Research, Bloomberg

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

The Joint Account – My Husband Thinks We Should Buy Bitcoin. I’m Open to It, But Where Do We Start? (Douglas Boneparth)

Stratechery – A Chance to Build (Ben Thompson)

Of Dollars and Data – The Things You Can’t Buy (Nick Maggiulli)

Morningstar – Farewell, for Now (John Rekenthaler)

Meaningful Money – Asking the Right Questions After Setbacks (Derek Hagen)

Richard Bernstein Advisors – How Much Cash is Really on the Sidelines? (Dan Suzuki)

Carson Group – Why We Aren’t Permabulls (Ryan Detrick)

Discipline Funds – Bitcoin, Bitcoin, Bitcoin (Cullen Roche)

Liberty Street Economics – Do Import Tariffs Protect U.S. Firms? (Federal Reserve Bank of New York)

Young Money – Factory Reset (Jack Raines)

BIG Dollars – An Assassin Showed Just How Angry America Really Is (Matt Stoller)

Podcasts

Wealthion – Anthony Scaramucci and Tom Lee on Bitcoin to $250K, S&P 500 to 15,000, and the AI Revolution (Spotify, Apple Podcasts, YouTube)

Movies/TV Shows

The Penguin – Colin Farrell, Cristin Milioti (IMDB, YouTube)

Music

Peter Gabriel – Digging in the Dirt (Spotify, Apple Music, YouTube)

Books

Ryan Holiday – The Daily Dad: 366 Meditations on Parenting, Love, and Raising Great Kids (Amazon)

Pop Culture

Bryson DeChambeau – Day 16 (Instagram)

Tweet

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: