The Fed is cutting: what it means for bond investors

The Sandbox Daily (9.29.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

bond investors in a Fed rate cutting cycle

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.44% | S&P 500 +0.26% | Dow +0.15% | Russell 2000 +0.04%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.17% | 2yr UST 3.635% | 10yr UST 4.145%

COMMODITIES: Brent Crude -3.48% to $67.69/barrel. Gold +1.27% to $3,857.2/oz.

BITCOIN: +3.56% to $114,195

US DOLLAR INDEX: -0.22% to 97.939

CBOE TOTAL PUT/CALL RATIO: 0.82

VIX: +5.43% to 16.12

Quote of the day

“Most people get it backwards and seek the admiration of the collective and something called ‘a good reputation’ at the expense of self-worth for, alas, the two are in frequent conflict under modernity.”

- Nassim Taleb

The Fed is cutting: what it means for bond investors

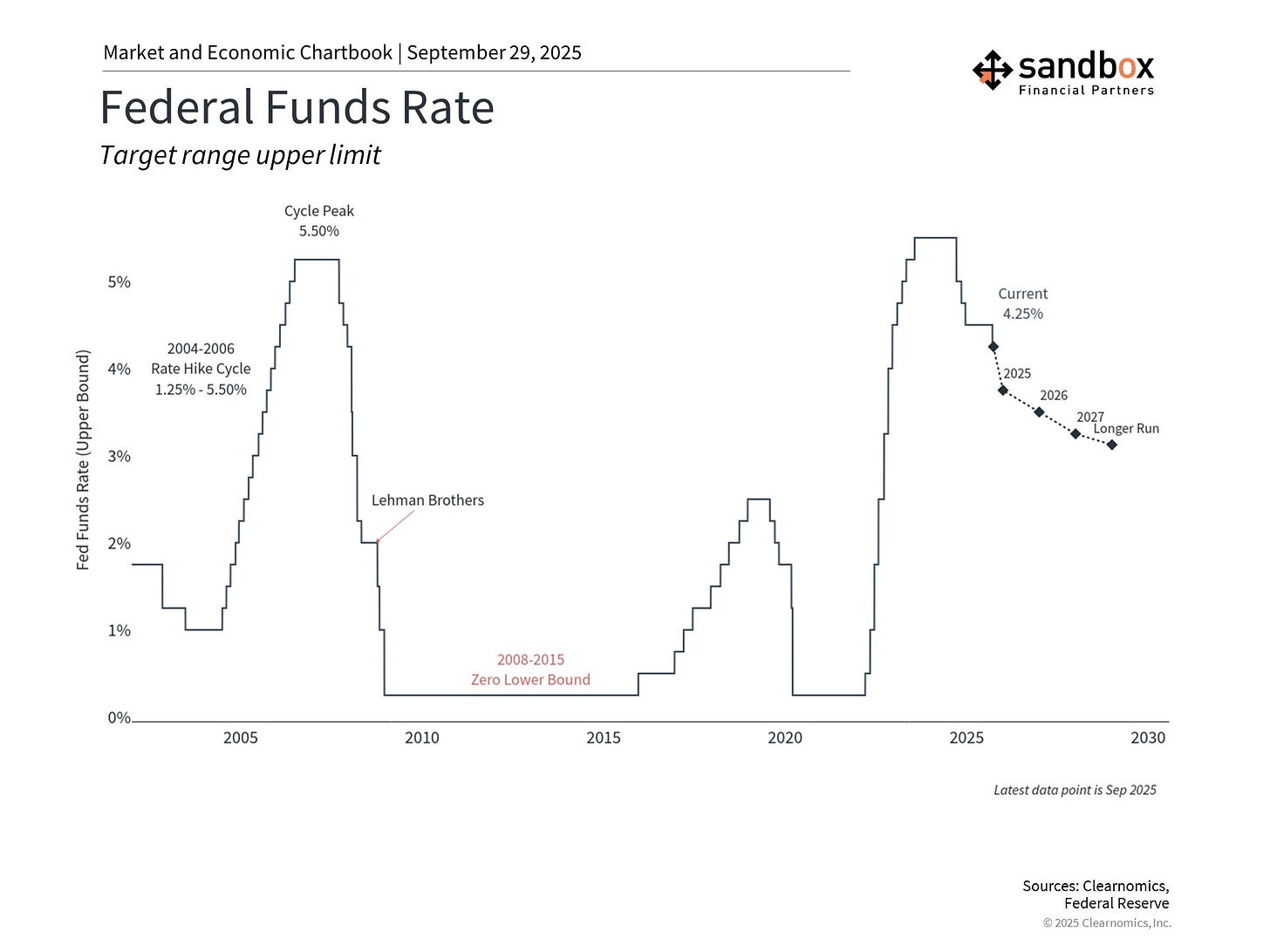

The Federal Reserve resumed its rate cutting cycle after a rare nine-month pause, continuing the easing cycle that began in September 2024.

The pace and magnitude of cuts will depend on labor market trends and inflation, which may complicate the Fed’s path.

Cash-like rates are set to come down as the Fed cuts, but that does not mean longer rates will follow suit.

As the Fed cuts interest rates, cash yields – like the yield on the 3-month U.S. Treasury bill, certificates of deposit (CD’s), and money market rates – will immediately start to come down, reducing the attractiveness of holding excess cash.

That does not mean, however, that yields across the whole yield curve fall in tandem. The curve may continue to steepen as it has in the last few weeks, driven by cash-like interest rates coming down while long-term yields remain elevated in a range of 4.00-4.50%.

In this environment, short-duration fixed income (2-5 years) looks like a sweet spot.

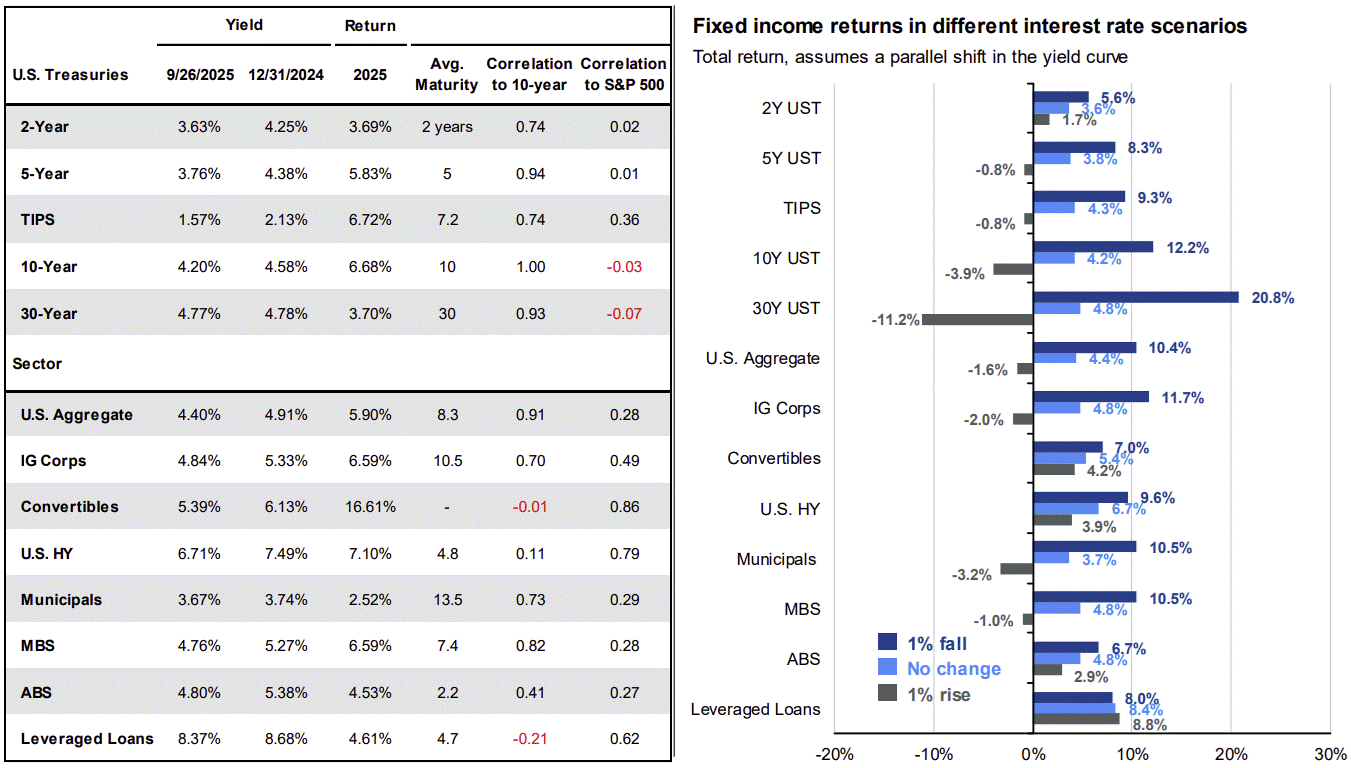

Even if all yields don’t fall further, the income in fixed income still looks attractive.

The chart below shows that even if there’s no change in yields across the yield curve, investors can expect coupons between 3.5% and 8.5% across different types of fixed income.

Yields are still compelling compared to recent history, especially in core, investment-grade parts of the market.

Despite tight credit spreads, bonds offer solid yields and can provide potential capital appreciation if yields fall dramatically across the curve. Higher yields also provide a hedge against future rate increases, limiting downside risk.

In short, higher yields should allow fixed income to deliver attractive returns across a range of different interest rate scenarios, not just if rates fall rapidly.

Sources: Clearnomics, JP Morgan Guide to the Markets

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)