The final hike, plus S&P 500 year-end outlook, job openings, and China's credit outlook cut

The Sandbox Daily (12.5.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

after the last hike

SPX year-end technical outlook

the great labor market rebalance

China’s rising debt load spurs rating agency Moody’s to lower their credit outlook

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.24% | S&P 500 -0.06% | Dow -0.22% | Russell 2000 -1.38%

FIXED INCOME: Barclays Agg Bond +0.66% | High Yield +0.09 | 2yr UST 4.577% | 10yr UST 4.167%

COMMODITIES: Brent Crude -1.27% to $77.04/barrel. Gold -0.23% to $2,037.5/oz.

BITCOIN: +5.71% to $44,192

US DOLLAR INDEX: +0.25% to 103.971

CBOE EQUITY PUT/CALL RATIO: 0.53

VIX: -1.76% to 12.85

Quote of the day

“The four most expensive words in the English language are, 'This time it’s different.' ”

- Sir John Templeton

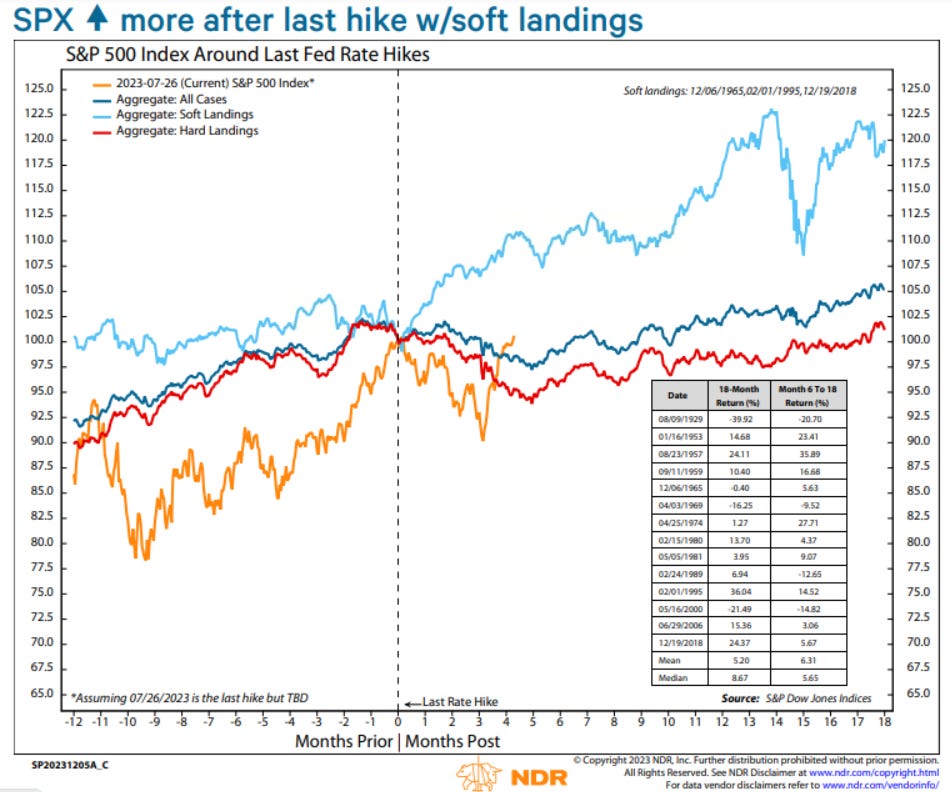

After the last hike

A soft landing should permit the cyclical bull market to continue.

If the last hike was indeed on July 26, 2023, we are approaching 5 months following the completion of the Federal Reserve’s tightening cycle.

The chart below shows S&P 500 performance around hard landings (economy enters recession) and soft landings (when the economy avoided a recession after the last hike).

The weaker performance around hard landings underscores a recession being the biggest risk to the stock market next year. The S&P 500 peaks about six months before recessions start, so a second half recession could mean a bear market starting in the 1st half.

Source: Ned Davis Research

SPX year-end technical thoughts

Despite the move up off the October lows from both 2022 and 2023, the market’s most important index has yet to break out of a multi-year consolidation pattern.

Going forward, the quality of a pullback/consolidation in terms of depth, breadth, and sentiment will be an important guidepost.

For now, the weight of the technical evidence supports the uptrend off the October 2023 low. Market breadth is broadening as investors rotate away from mega-cap leadership and favor emerging strength in mid- and small-caps.

The rise in the Relative Strength Index (RSI) suggests modest pullbacks and consolidations should be bought as investors “window-dress” portfolios into year-end – especially if yields, oil, and/or the dollar weaken further.

With a heavy slate of economic data in focus this week and next – namely Friday’s jobs report for November, Tuesday’s 12/12 CPI inflation data for November, and Wednesday’s 12/13 Federal Reserve FOMC policy announcement – yields may bounce pressuring rates, and cause stocks to digest recent gains.

Source: Piper Sandler

The great labor market rebalance

The number of available job openings in the United States for October dropped below 9 million for only the 2nd time since March 2021, further indicating that the labor market is cooling off.

According to today's Job Openings and Labor Turnover Survey (JOLTS), 8.73 million positions remained unfilled on the last business day of October, the lowest reading in two and a half years and significantly lower than the street’s consensus estimate of 9.3 million job openings.

Meanwhile, the number of job openings per unemployed worker – what’s available for whomever is looking – fell from 1.47 to 1.34 in the prior month, its lowest level since August 2021. The ratio has come down significantly from its peak level of 2.01 in early 2022, but it is still higher than 1.0 and higher than pre-pandemic.

As the Federal Reserve keeps interest rates elevated to bring down inflation, policymakers are hoping the labor market softens through lower demand for new workers rather than employers cutting jobs.

So this report is great news for the Fed, which means more good news for investors.

As the chart below shows, unemployment has simultaneously crept up, albeit slowly, in another sign that the labor market imbalance is easing – i.e. normalizing.

Source: Ned Davis Research, Bloomberg, Statista

China’s rising debt load spurs Moody’s to lower credit outlook

Moody’s Investors Service cut its outlook for Chinese sovereign bonds to negative, underscoring global concerns about the level of debt in the world’s 2nd-largest economy.

Moody’s lowered its outlook from stable to negative, while retaining a long-term rating of A1 on the nation’s sovereign bonds. China’s usage of fiscal stimulus to support local governments and its spiraling property downturn is posing risks to the nation’s economy, the grader said.

The change in Moody’s thinking comes as China’s deepening property rout triggers a shift toward fiscal stimulus, with the country ramping up its borrowing as a main measure to bolster its economy.

That general premise has raised concerns about the nation’s debt levels with Beijing on track for record bond issuance this year. See below.

China’s economy has struggled to gain traction this year as a rebound from restrictive Covid-zero policies proved to be weaker than expected and the property crisis deepened.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.