The gray economy: our world is getting older

The Sandbox Daily (11.19.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

aging demographics

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.56% | S&P 500 +0.38% | Dow +0.10% | Russell 2000 -0.04%

FIXED INCOME: Barclays Agg Bond +0.01% | High Yield +0.05% | 2yr UST 3.594% | 10yr UST 4.137%

COMMODITIES: Brent Crude -1.91% to $63.65/barrel. Gold +0.20% to $4,074.6/oz.

BITCOIN: -2.47% to $90,386

US DOLLAR INDEX: +0.59% to 100.134

CBOE TOTAL PUT/CALL RATIO: 0.91

VIX: -4.17% to 23.66

Quote of the day

“I can calculate the motions of the heavenly bodies, but not the madness of people.”

- Isaac Newton

Aging demographics

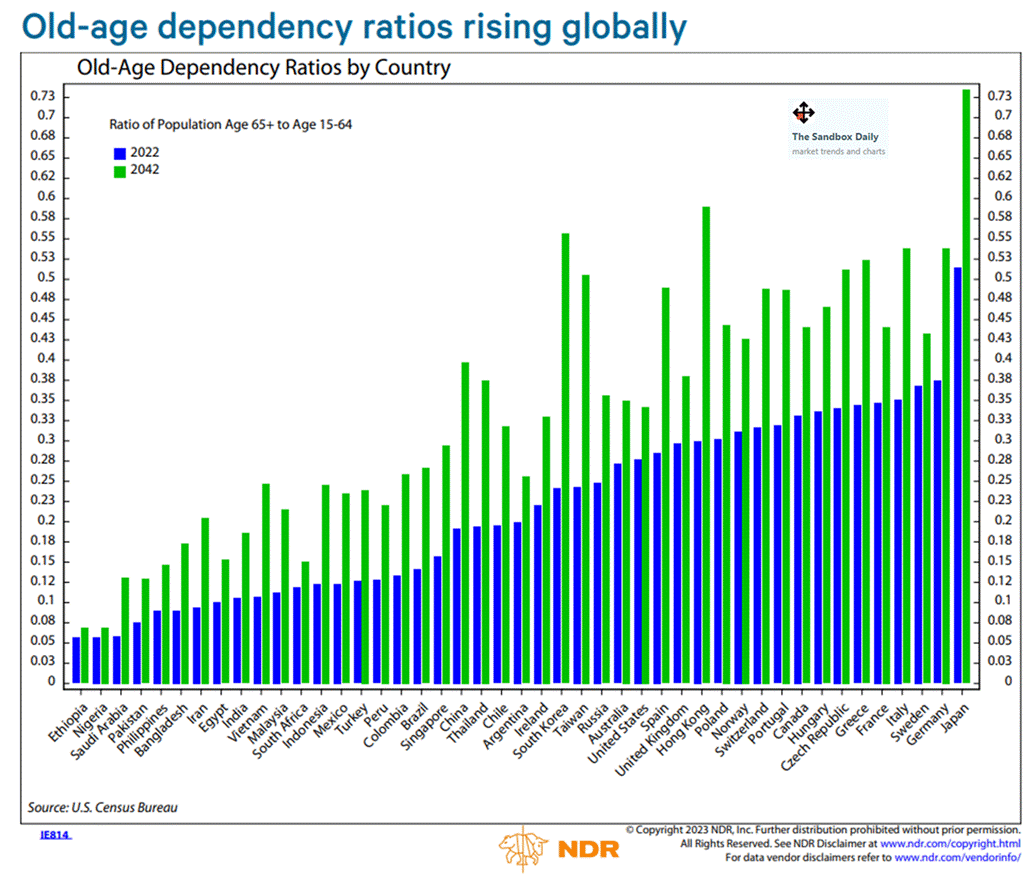

The economic challenges of an aging global population are well understood and are expected to persist in the developed world, as well as in the APAC region, in the coming years and decades.

The International Labor Organization projects 0.4%-0.5% annual labor force growth in the United States, United Kingdom, and Eurozone through 2030, while Japan and China should see their labor force shrink by 0.6% and 0.7% per year, respectively.

The economic implications stretch far beyond slower labor force growth.

An older population shifts the composition of the workforce, suppresses productivity, reshapes national savings behavior, and places substantial pressure on fiscal systems. In many developed economies, the next decade’s deficits will be driven primarily by age-related spending on healthcare and pensions.

Without faster productivity growth or more flexible immigration policies, the long-term adjustment to economic growth becomes problematic: higher taxes (more people drawing on public systems, less people paying into them) and structurally higher inflation (chronic fiscal pressures and tighter labor markets push prices higher).

This is why policymakers and investors remain focused on major secular themes that include AI and automation, robotics adoption, reducing barriers to labor mobility, immigration policy reform, and increasing labor force participation rates.

Aging demographics remain a slow-moving force in the shadows, but it will endure as a dominant macro theme shaping the foreseeable future.

Source: Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)