The great wealth transfer: planning for legacy and opportunity

The Sandbox Daily (9.11.2025)

Welcome, Sandbox friends.

It’s great to be back after a fifth appearance at Future Proof.

Most financial conferences are in decline because attendees don’t capture enough value from the experience. Future Proof has differentiated itself in that the underlying principles are grounded in content, social interaction, focused and carefully vetted “breakthru” meetings (akin to speed dating), entertainment, and relationship building within the community. Specific to that last point, building professional networks has become quite a bit more challenging with the evolution of work-from-home, especially someone like myself who primarily works in my home office in a non-financial hub of Annapolis, MD. I’ve created lasting professional relationships, built new friendships, met personal heroes of mine, and discovered new products and services that directly benefit clients of Sandbox Financial Partners.

When work is fun and engaging, I feel energized and motivated to bring my best, and that’s what Future Proof has done for me.

Below are two pictures from the panel I shared alongside Ben Carlson, Doug Boneparth, and Callie Cox. It was an absolute blast!

Onward…

Today’s Daily discusses:

the great wealth transfer

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.83% | Dow +1.36% | S&P 500 +0.85% | Nasdaq 100 +0.60%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.25% | 2yr UST 3.537% | 10yr UST 4.021%

COMMODITIES: Brent Crude -1.79% to $66.28/barrel. Gold -0.20% to $3,674.7/oz.

BITCOIN: +0.57% to $114,358

US DOLLAR INDEX: -0.27% to 97.519

CBOE TOTAL PUT/CALL RATIO: 0.82

VIX: -4.17% to 14.71

Quote of the day

“The credit belongs to the man who is in the arena.”

- Theodore Roosevelt

The great wealth transfer: planning for legacy and opportunity

“Life affords no greater responsibility, no greater privilege, than the raising of the next generation.”

This statement by former United States Surgeon General C. Everett Koop underscores what for many is the ultimate goal: leaving a lasting legacy beyond our own financial security.

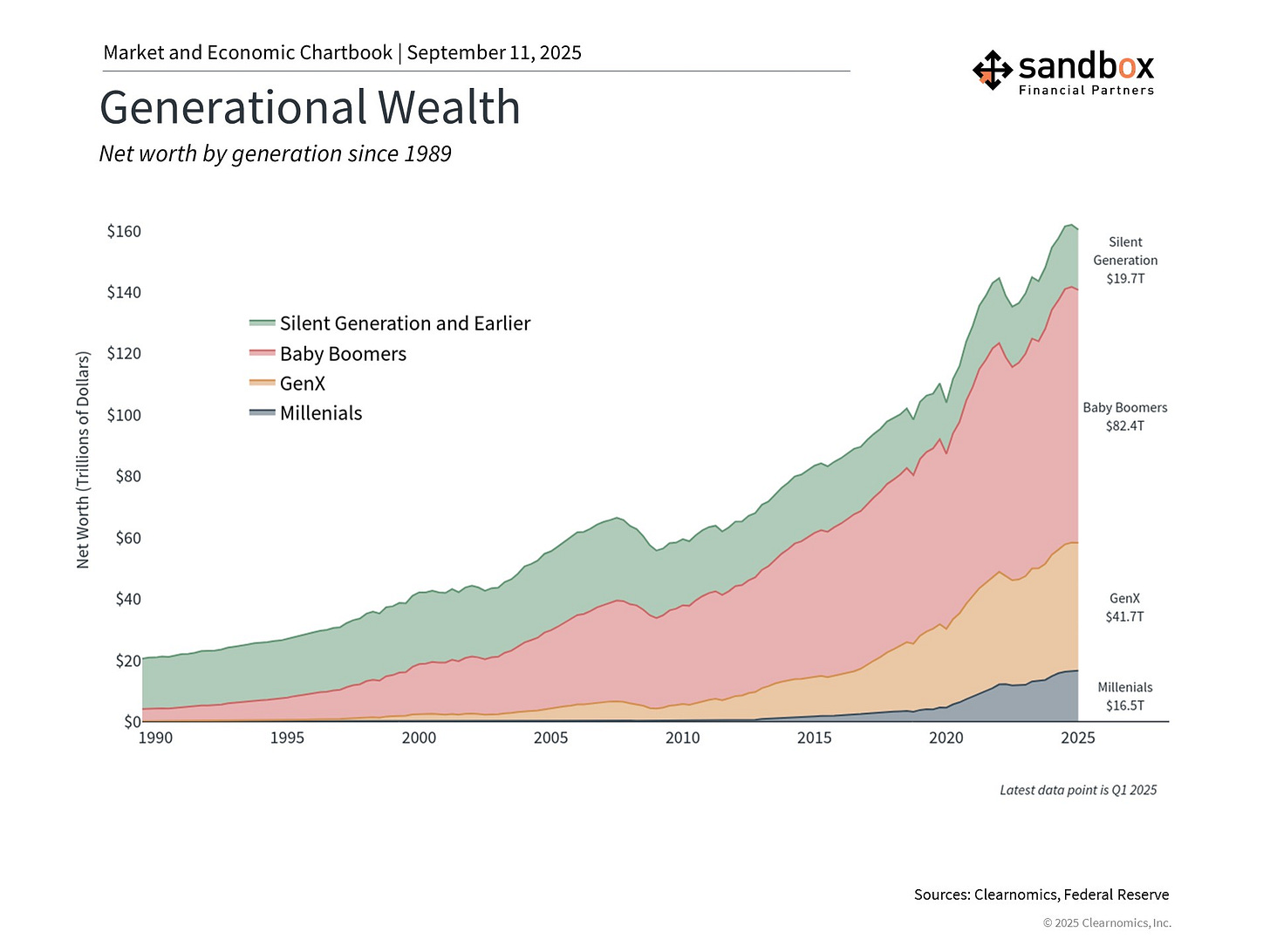

Over the next two decades, an estimated $80 trillion will transfer from the Silent Generation and Baby Boomers to younger generations. This “Great Wealth Transfer” isn’t just money changing hands – it’s reshaping how families think about financial planning, charitable giving, and legacy building.

Whether you’re preparing to leave assets or expecting to receive them, thoughtful planning can be the difference between preserving wealth and losing sight of its purpose.

Why the Great Wealth Transfer matters

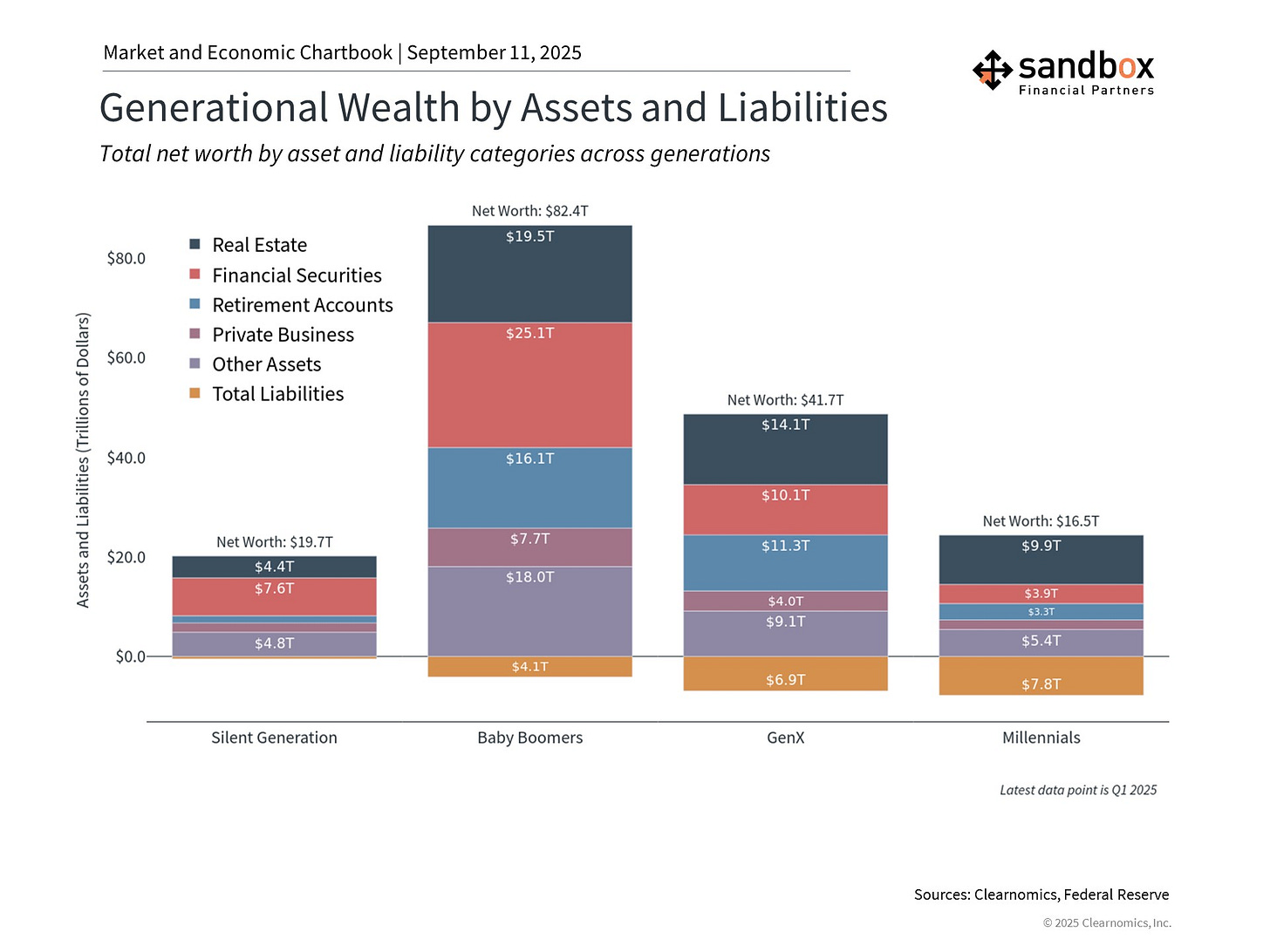

Baby Boomers, those between 61 and 79 years old in 2025, hold more than $80 trillion in wealth, much of it in retirement and brokerage accounts. Unlike previous generations that relied heavily on pensions and Social Security, today’s retirees are passing down larger and more complex asset pools through their investment portfolios.

This increase in wealth is structural, with more people living longer, an extended period of strong market performance, and a broader transformation from Defined Benefit (DB) pension plans to retirement plans like 401(k)s and individual retirement accounts (IRAs). While this change placed more responsibility on individuals to save for retirement, it also created larger pools of investable assets that will eventually pass to heirs.

The result is that more families than ever before are dealing with significant wealth transfer considerations.

Planning your wealth transfer can secure a lasting legacy

What makes this particularly important is that these assets often represent decades of disciplined saving and investing.

Today's wealth transfers frequently involve diversified investment portfolios, various tax-advantaged savings vehicles, and assets located across many different places. Add real estate or family businesses on top and the need for careful planning becomes critical to ensure smooth transitions and optimal tax treatment.

This means that estate planning is more important than ever.

While many think of estate planning as setting up a will and related documents like a durable power of attorney and advance healthcare directives, thoughtful wealth transfer encompasses more than just the assignment of assets. By considering how your wealth can create meaningful impacts, optimizing for taxation and managing complex or illiquid structures, investors ensure an orderly and deliberate transition to their heirs.

Just as Maslow's hierarchy of needs helps us understand human motivation – where basic needs like food and shelter must be met before people can focus on higher aspirations – a similar progression applies to wealth planning. Once you've built sufficient retirement savings to cover your basic needs, the focus can shift to creating meaningful impact with your wealth.

Keep in mind that many wealth transfer disputes arise not from insufficient assets, but from complex structures, unclear directives, or lack of preparation among heirs.

Strategies to optimize wealth transfers

Turning to actionable strategies, some of the most important decisions in optimizing a wealth transfer involve timing and taxes. Here are just a few impactful strategies to consider:

1. Tax-Efficient Lifetime Giving. Giving during your lifetime isn't appropriate for everyone, as it requires confidence that you won't need the gifted assets for your own retirement security, especially given increasing healthcare costs and longer life expectancies.

That said, annual gift tax exclusions allow an individual to transfer up to $19,000 per recipient in 2025 without reducing your lifetime estate tax exemption.

Lifetime giving can also provide practical benefits beyond tax savings. You can observe how recipients handle the money, provide guidance on financial management, and enjoy seeing the positive impact of your generosity.

For those interested in charitable giving, there can be significant tax advantages to gifting into a donor-advised fund (DAF).

2. Multigenerational Education Funding. Education remains one of the most enduring legacies by providing young family members with the tools and knowledge that can be leveraged into successful careers.

Direct tuition payments are exempt from gift tax limits, and 529 plans allow substantial contributions while retaining account control. For larger families, education trusts can ensure fair treatment and lasting impact.

3. Asset Location Strategies. Asset location involves strategically placing investments within different account types – taxable, tax-deferred, and tax-free – to maximize outcomes.

By thoughtfully considering your financial structures and mapping certain assets to certain bequests, you can ensure the estate gets the most out of your money.

As one example, holding highly appreciated assets until death can trigger a step-up in cost basis to flatten the unrealized gain to $0, if a security is held within a taxable account.

4. Advanced Estate Planning. For larger or more complex estates, more advanced tools may be required.

This might involve trusts that distribute assets over time, including specific provisions or charitable components that involve the next generation. These transfer extend to business interests, retirement account beneficiary designations, and coordination between different types of liquid and illiquid assets.

Coordinating across retirement accounts, business interests, and real estate requires expert guidance but can create lasting stability.

Bottom line?

The Great Wealth Transfer represents a historic opportunity to create lasting impact across generations.

Whether you're preparing to transfer wealth or expecting to receive it, thoughtful planning can help ensure your family's financial legacy serves its intended purposes.

Source: Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)