The hard part is over (Goldman outlook), plus bankruptcies, MBS/TSY disconnect, and Bitcoin HODLers

The Sandbox Daily (11.8.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

the hard part is over (Goldman Sachs outlook)

bankruptcies slow its pace in October

disconnect between 10-yr Treasury and mortgage rates

Bitcoin HODLers maintain their conviction

Today’s piece is a banger and a lot of fun.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.11% | S&P 500 +0.10% | Dow -0.12% | Russell 2000 -1.10%

FIXED INCOME: Barclays Agg Bond +0.34% | High Yield +0.05% | 2yr UST 4.936% | 10yr UST 4.492%

COMMODITIES: Brent Crude -2.24% to $79.78/barrel. Gold -0.88% to $1,956.2/oz.

BITCOIN: +1.28% to $35,847

US DOLLAR INDEX: -0.02% to 105.529

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: -2.43% to 14.45

Quote of the day

“The trend has vanished, killed by its own discovery.”

- Benoit Mandelbrot, Mathematician in The Misbehavior of Markets: A Fractal View of Financial Turbulence

The hard part is over

Today, Goldman Sachs Chief Economist and Head of Global Investment Research, Jan Hatzius, released the firm’s Macro Outlook for 2024 report titled The Hard Part is Over.

Three key takeaways emerge from the Goldman piece:

Goldman believes more disinflation is in store over the next year – namely:

right tail price changes, i.e. further softening in the verticals that experienced the biggest price increases

shelter inflation has considerably more room to fall (see chart below)

the continued normalization of labor market imbalances

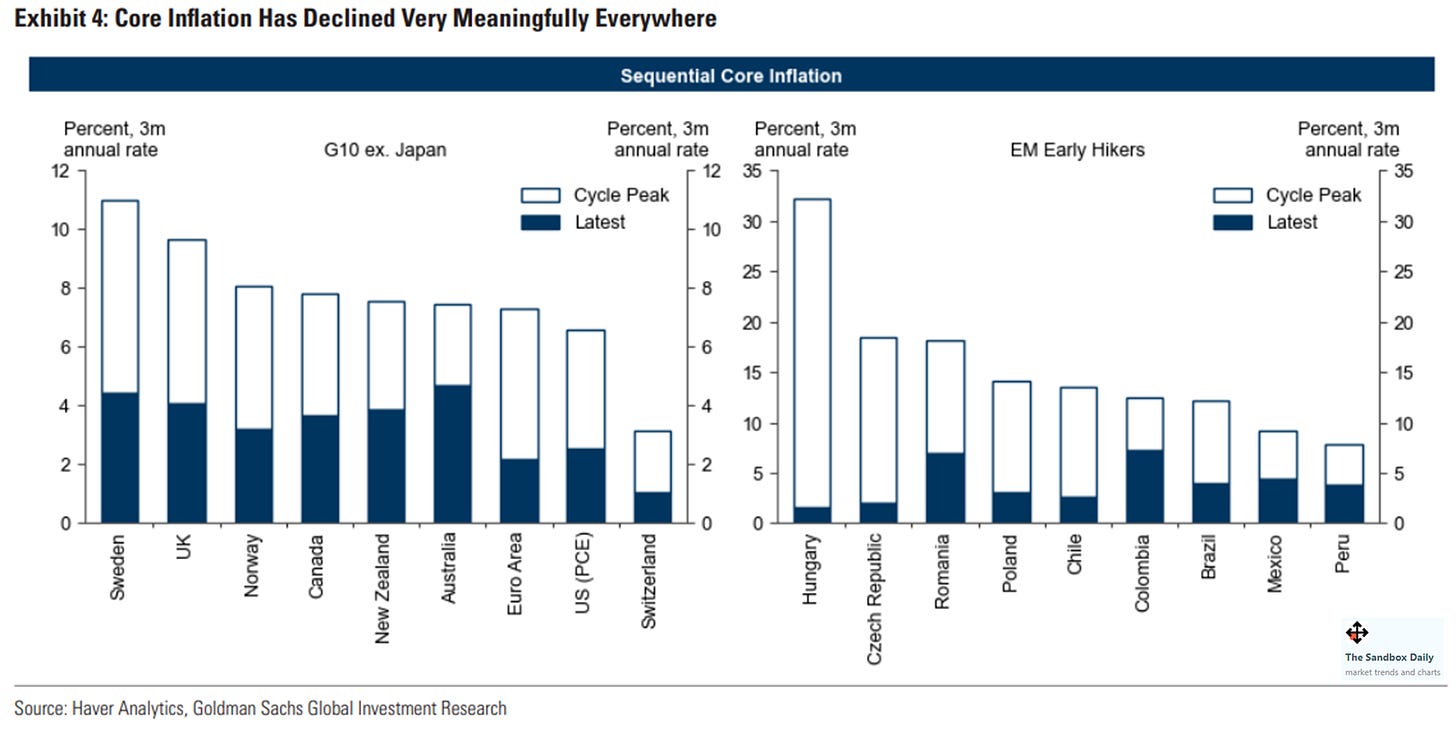

Sequential slowing of inflation is clearly evident among all G10 economies (minus Japan where higher inflation was desired), plus the EM “early hiker” economies that experienced the biggest inflation surges and thus delivered the most aggressive monetary policy tightening. See chart below.

The probability of a U.S. recession is limited. Despite the good news on growth and inflation in 2023, concerns about a recession among forecasters haven’t declined much.

Several factors contribute toward this view: strong real household income growth (see chart below), a smaller drag from monetary and fiscal tightening, and a recovery in manufacturing activity.

Most major central banks are likely finished hiking. In fact, Goldman expects an increased willingness of central banks to deliver insurance rate cuts if growth slows.

Looking at past hiking cycles confirms that major central banks are twice as likely to cut rates in response to downside growth risks once inflation has normalized to sub-3% relative to when inflation is above 5%.

Under this market backdrop, Goldman expects the returns in rates, credit, equities, and commodities to all outperform cash in 2024.

Source: Goldman Sachs Global Investment Research

Bankruptcies slow its pace in October

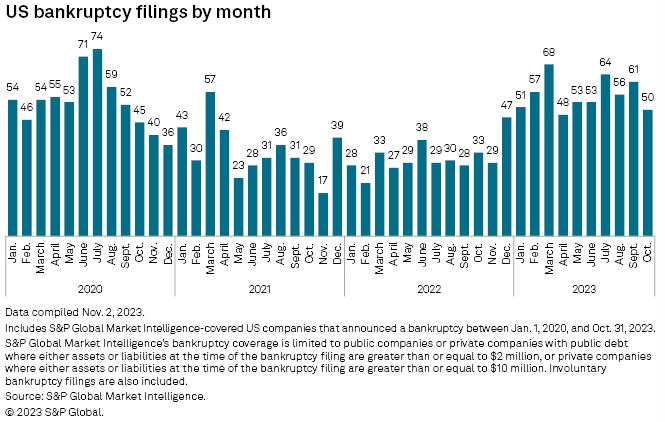

U.S. corporate bankruptcies slowed their pace in October, yet remain historically high.

2023’s total of 561 bankruptcies already surpasses the total filings seen in calendar year’s 2021 and 2022.

561 is also the highest number as of October month-end since 2010 (besides the 563 figure in 2020).

50 bankruptcy filings were entered in October, the 2nd fewest monthly total of 2023 – as the economy continues to digest higher interest rates and tighter financial conditions that have added to economic pressures.

The filings seem to be concentrated around more capital-intensive industries; no surprise, there:

Source: S&P Global Market Intelligence

Disconnect between 10-yr Treasury and mortgage rates

What is the impact of Quantitative Tightening (QT)?

In respect to mortgages, the Fed has switched gears over the last year from a net buyer of mortgage-backed securities (MBS) to net seller.

The Fed had been the largest buyer of U.S. mortgages (orange color in chart below) and the institution was buying these bonds hand over fist until early 2022 – effectively buying mortgages and doing Quantitative Easing (EQ) into the peak of a historically tight and booming housing market.

Now, with the invisible hand removed from the market, the net impact is a significant decoupling in mortgage rates.

Normally, 30-year fixed rate mortgages track the 10-year U.S. Treasury bond closely, adding a spread of roughly 150-175 basis points on top of the risk-free rate.

Today, mortgages are the highest in a generation at 7.94%, over 3 standard deviations above U.S. Treasuries.

The whole mortgage market became the Federal Reserve, and now the Fed has left the dinner table.

Rates are going up, extending maturities and duration – suddenly resulting in a dislocated mortgage market.

QT is driving mortgage rates relative to U.S. Treasuries to a historic level of tightness.

Source: Dwyer Strategy

Bitcoin HODLers maintain their conviction

Despite Bitcoin’s massive rally above $35k and rallying more than +110% year-to-date, investors aren’t selling their Bitcoin.

HODL to the moon, they say. No FUD around here.

If anything, the conviction of Bitcoin accumulators and the longer-time holders is growing stronger.

To wit, 88.5% of all Bitcoin supply hasn’t been moved/sold/transferred over the past three months for those with a 3-month or longer holding periods.

Source: Glassnode, Dylan LeClair

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.