The headlines are loud. Your portfolio shouldn’t be.

The Sandbox Daily (6.23.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

from Operation Midnight Hammer to Sylvia Boorstein: a lesson in patience

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.11% | Nasdaq 100 +1.06% | S&P 500 +0.96% | Dow +0.89%

FIXED INCOME: Barclays Agg Bond +0.20% | High Yield +0.19% | 2yr UST 3.863% | 10yr UST 4.342%

COMMODITIES: Brent Crude -8.62% to $70.37/barrel. Gold +0.02% to $3,386.2/oz.

BITCOIN: +4.85% to $103,723

US DOLLAR INDEX: -0.33% to 98.379

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: -3.83% to 19.83

Quote of the day

“It’s better to die on your feet than live on your knees.”

- Emiliano Zapata

From Operation Midnight Hammer to Sylvia Boorstein: A Lesson in Patience

President Donald Trump authorized “Operation Midnight Hammer” on Saturday night, green lighting a fleet of B-2 stealth bombers for an 18-hour flight from Whiteman Air Base in Missouri to Iran that involved multiple mid-air refuelings, plenty of decoy aircrafts, and a heavy payload of bunker-busting bombs.

In the end, the United States attacked three facilities crucial to Iran’s nuclear program.

Trump says the covert military operation was successful and the strategic sites were “obliterated.” Iran’s damage assessment and retaliatory measures remain ongoing, while the International Atomic Energy Agency, the world’s atomic watchdog, publicly stated there’s been no increase in off-site radiation levels for now.

Investors spent much of last week and the weekend trying to disentangle the fallout of this Tom Clancy novel.

After all, global war and nuclear bombs are destabilizing risks to world order.

Through Friday’s market close, the impact on stocks had been largely muted, as investors bet the back-and-forth strikes between the longtime regional foes – Israel and Iran – would not spillover into a broader inferno that meaningfully dents economic growth.

Futures markets pointed to a potentially difficult market on Monday in the wake of direct U.S. military involvement.

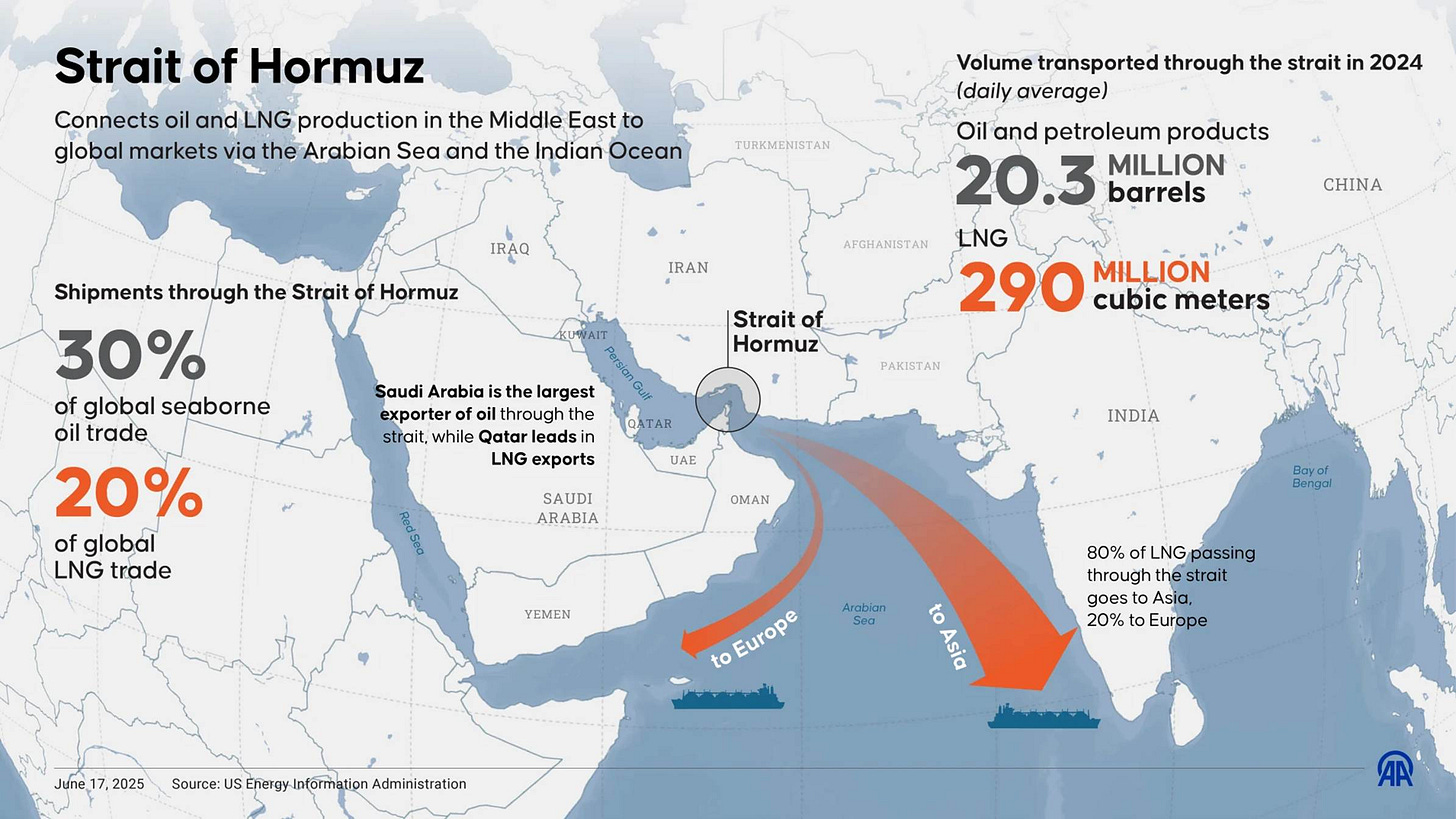

One of the big questions for investors is what happens to the price of oil. Any developments that meaningfully disrupt oil supply, including the vital Strait of Hormuz shipping route, could lead to further price spikes and become even more problematic for inflationary pressures (on top of tariffs).

And yet, the enigma of Mr. Market lives on.

Today’s scorecard: U.S. equity markets were higher, the VIX fell, and oil prices collapsed. Just like everyone predicted…

I was a double-major at the University of Michigan – Philosophy and History – on my way to law school, only to realize I had no interest writing briefs all day long.

Too stale. I needed something more vibrant and dynamic.

One book that always stuck with me from my Philosophy coursework was Sylvia Boorstein’s "Don’t Just Do Something, Sit There."

Call it hyperactivity, call it the temptation to fiddle.

We all have a tendency to make changes or add trades just to show we are actively managing our positions. Today felt like one of those days.

And yet, sometimes inaction is the best action.

For most investors at home, patience beats panic – especially in volatile, headline-driven markets where reacting emotionally can do more harm than good.

In investing, constantly reacting to headlines, market swings, or short-term noise can lead to poor decisions and unnecessary losses. Tariffs, DOGE, nuclear weapons – we’ve experienced a lot in the 1st half of 2025 !

Sylvia Boorstein's saying is a reminder that long-term success often comes from discipline, not hyperactivity.

Markets are designed to test your patience, and staying the course – especially during turbulent times – can be incredibly difficult, even for professional investors and traders.

Sometimes, the hardest (and maybe most profitable) thing to do is nothing at all.

Sources: U.S. Energy Information Administration, Trading View, Brian Feroldi

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

![Don't Just Do Something, Sit There: A Mindfulness Retreat with Sylvia Boorstein [Book] Don't Just Do Something, Sit There: A Mindfulness Retreat with Sylvia Boorstein [Book]](https://substackcdn.com/image/fetch/$s_!YUek!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0162661b-ddc1-4fd5-8b70-cbb09ed98eac_1610x2560.jpeg)