The housing market, plus Disney, S&P 500's quiet week, Dow Jones just 8.4% from ATH, and the social media universe

The Sandbox Daily (11.21.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the current state of the U.S. housing market, Disney brings back former CEO Bob Iger, a quiet week for the S&P 500, the Dow Jones is just 8.4% from all-time highs, and visualizing the world’s top social media and messaging apps.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.13% | S&P 500 -0.39% | Russell 2000 -0.57% | Nasdaq 100 -1.06%

FIXED INCOME: Barclays Agg Bond -0.06% | High Yield -0.04% | 2yr UST 4.527% | 10yr UST 3.819%

COMMODITIES: Brent Crude +0.07% to $87.80/barrel. Gold +0.22% to $1,758.5/oz.

BITCOIN: -2.86% to $15,760

US DOLLAR INDEX: +0.60% to 107.614

CBOE EQUITY PUT/CALL RATIO: 0.61

VIX: -3.29% to 22.36

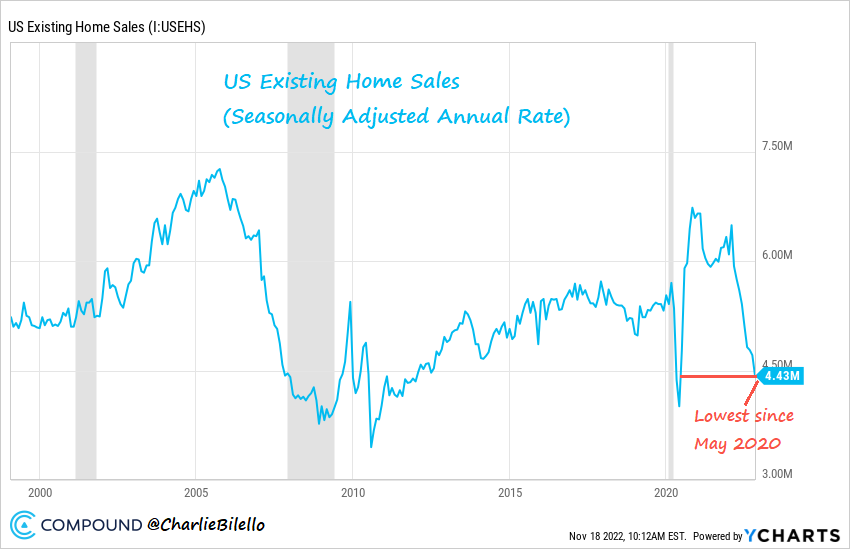

Checking in on the housing market

The debate over whether the U.S. economy is in a recession continues, but there is no doubt about the status of the U.S. housing market. This are hallmarks of what a housing recession looks like.

The U.S. Housing Market Index (measure of homebuilder confidence) fell for the 11th consecutive month to its lowest level since April 2020. 37% of builders reported cutting prices in November, with an average price reduction of -6%.

U.S. Building Permits hit a 26-month low in October, down -10% year-over-year. This is a forward-looking indicator that captures future housing starts.

U.S. Existing Home Sales fell for the 9th consecutive month, down -28% over the last year. This is the largest YoY decline since February 2008.

The median price of an existing home sold in the U.S. has now fallen -8% from its peak in June, the largest 4-month percentage decline since November 2008 to February 2009. After the last housing bubble peaked, prices fell -33%. Incredibly, the same decline today would only bring prices back to February 2020 levels.

Source: Compound Advisors

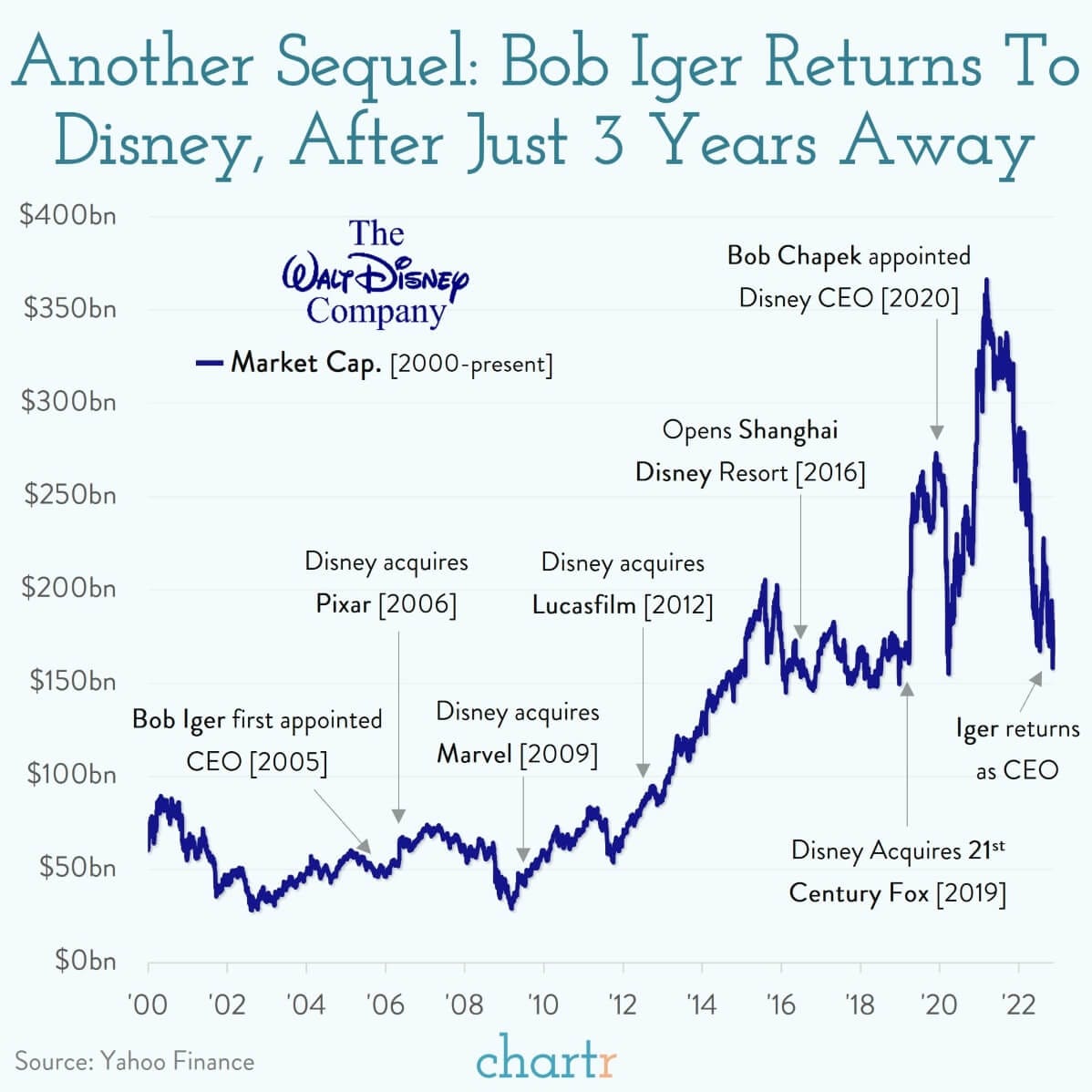

Disney loves a sequel

Disney is bringing back Bob Iger as its CEO to the house of mouse less than 3 years after stepping down from the very same post.

Over five decades in the industry, with 15 years as Disney CEO, Bob Iger crafted himself into one of the most-respected executives in entertainment. Disney flourished under Iger as he presided over transformative acquisitions of studios such as Pixar, Marvel, and Lucasfilm, as well as a mega-deal in 2019 that saw Disney win a bidding war against Comcast for ~$71bn worth of assets from 21st Century Fox.

However, after a successful Disney+ boom during the pandemic, it's the streaming business that is the root of the company's problems. Disney’s enormous parks business has recovered well from the pandemic, and is now essentially subsidizing the mounting losses at Disney’s streaming services. Add in high-profile spats with Ron DeSantis over Florida’s so-called “Don’t Say Gay” law and with actress Scarlett Johansson over her compensation for Black Widow, it is clear ousted CEO Bob Chapek was quickly losing favor with Disney investors, its board, and the stock price (down -41% year-to-date).

Source: Chartr

Last week was quiet

Just when 2022 was getting known for noise, the markets quieted down last week. For the first time in five weeks, the S&P 500 did not move 3% in one direction or the other. For the first time this year, no trading day last week saw the S&P 500 move 1% or more in either direction. We begin a new week with the S&P 500 not having moved 1% or more in either direction in six straight days. It has been a year since it has had a longer streak of small swings.

In the past half century, the only years with more 1% daily moves than 2022 were 2008 and 2002.

Source: All Star Charts

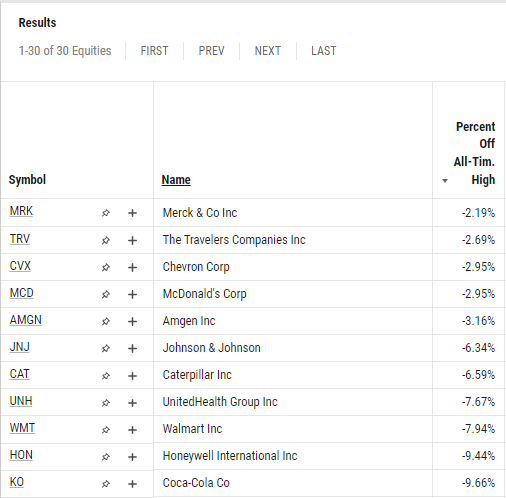

Dow Jones just 8.4% from all-time highs

In case you missed it: the Dow Jones Industrial Average is currently just 8.4% away from its all-time daily closing high.

Just 11 of the 30 names are trading less than 10% off their respective all-time highs.

These are the 30 stocks that are often overlooked yet showing some tremendous (price-weighted) strength in the face of difficult markets. Many of these names are bellwethers in their respective sectors, so keeping an eye on these companies will give context to where the market is going.

Source: Sandbox Financial Partners

Visualizing the world’s top social media and messaging apps

In 2022, the social universe is looking more crowded than in previous years.

The scale of Meta Platforms (Facebook, WhatsApp, Messenger, Instagram) and Alphabet (Youtube) still dominate thanks to their global reach, but there are a number of smaller networks fighting for market share. China has its own ecosystem of large social and messaging platforms – the largest of these being WeChat.

The only platform in the top 20 that is not based in either the U.S. or China is the privacy-focused messaging app, Telegram. The Dubai-based company has a unique backstory. It was created after the founders of Russian social network VK left the country after resisting government pressure to release data on the social network’s users in Ukraine.

Today, there are also a number of smaller, special interest platforms. OnlyFans, for example, is focused on adult content creators. Parler and Truth Social appeal to users who want fewer constraints on the content they post and consume. BeReal aims to create more authentic moments by prompting users to post a photo at a random time each day.

Source: Visual Capitalist

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.