The ingredients fueling the AI boom are in short supply

The Sandbox Daily (12.9.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

lofty AI ambitions grounded by earthy limitations

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.21% | Nasdaq 100 +0.16% | S&P 500 -0.09% | Dow -0.38%

FIXED INCOME: Barclays Agg Bond -0.09% | High Yield -0.11% | 2yr UST 3.615% | 10yr UST 4.188%

COMMODITIES: Brent Crude -0.66% to $62.08/barrel. Gold +0.51% to $4,239.1/oz.

BITCOIN: +1.47% to $92,413

US DOLLAR INDEX: +0.17% to 99.251

CBOE TOTAL PUT/CALL RATIO: 0.91

VIX: +1.62% to 16.93

Quote of the day

“Stop waiting to feel ready. Ready is not a feeling, it’s a decision.”

- Unknown

The ingredients fueling the AI boom are in short supply

It’s easy to overlook how important access to cheap power is for societies. It is essential for both commerce and the quality of life. But, as economies embrace artificial intelligence, the price and availability of power is becoming a top concern.

AI has taken businesses and the markets by storm. Its promise of additional productivity could boost profits and raise standards of living. For AI adherents, the sky is limit.

But those lofty ambitions may be grounded by earthy limitations.

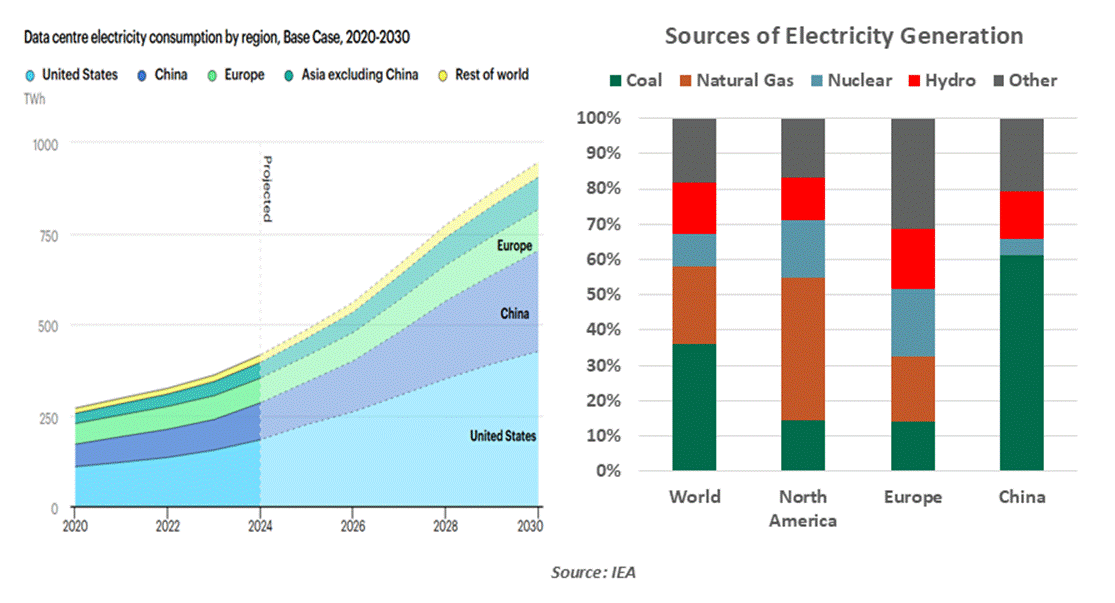

It is going to take a lot of electrons to deliver AI solutions: data centers are expected to account for 20% of the increase in global electricity usage through 2030. These facilities will compete with residences and factories for power; both will likely pay more for energy in the years ahead.

Producing more electricity will require more fuel. Extraction of coal and natural gas will have to increase; transport channels for those commodities will have to be widened. Construction of new plants, windmills, solar farms, and dams will require capital. Pipelines will have to be extended. Capacity for shipping liquified natural gas will need to be enhanced.

Servers generate a lot of heat. Managing their temperatures requires water-based cooling systems. Water is scarce in some areas where data center construction has been most active, setting up potential conflict with farmers and residents.

Transmission will also be a significant challenge. Power cables are typically made of copper, and yet, Bloomberg anticipates a global shortage of 6 million tons of that metal over the next 10 years. Much of the infrastructure supporting electricity systems around the world are aged and may not be able to safely handle increased loads without significant modernization.

Delivery of electricity in many parts of the world relies on a patchwork of networks that haven’t been optimized, aren’t especially resilient, and are vulnerable to physical and technological attacks. As more and more essential functions come to be steered by AI, the greater the opportunity for bad actors to create disruption.

So, as we get excited about the future possibilities of AI, we also need to avoid taking the availability of power for granted and understand the constraints on existing infrastructure.

There are many problems to solve and tradeoffs to reconcile.

Sources: Goldman Sachs Global Investment Research, Bloomberg, International Energy Agency

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)