The K-shaped economy reigned supreme in 2025. It’s not changing in 2026.

The Sandbox Daily (1.6.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

pessimism persists

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.37% | Dow +0.99% | Nasdaq 100 +0.94% | S&P 500 +0.62%

FIXED INCOME: Barclays Agg Bond -0.02% | High Yield +0.02% | 2yr UST 3.459% | 10yr UST 4.163%

COMMODITIES: Brent Crude -2.04% to $60.50/barrel. Gold +1.17% to $4,503.8/oz.

BITCOIN: -0.81% to $93,584

US DOLLAR INDEX: +0.33% to 98.597

CBOE TOTAL PUT/CALL RATIO: 0.89

VIX: -1.01% to 14.75

Quote of the day

“We’re not trying to be smarter than everyone else – just slightly less stupid.”

- JC Parets, All Star Charts in The Four Basic Fade Groups

Pessimism persists

While some have applauded this administration’s reforms, the anxiety and uncertainty they created is reflected across sentiment measures.

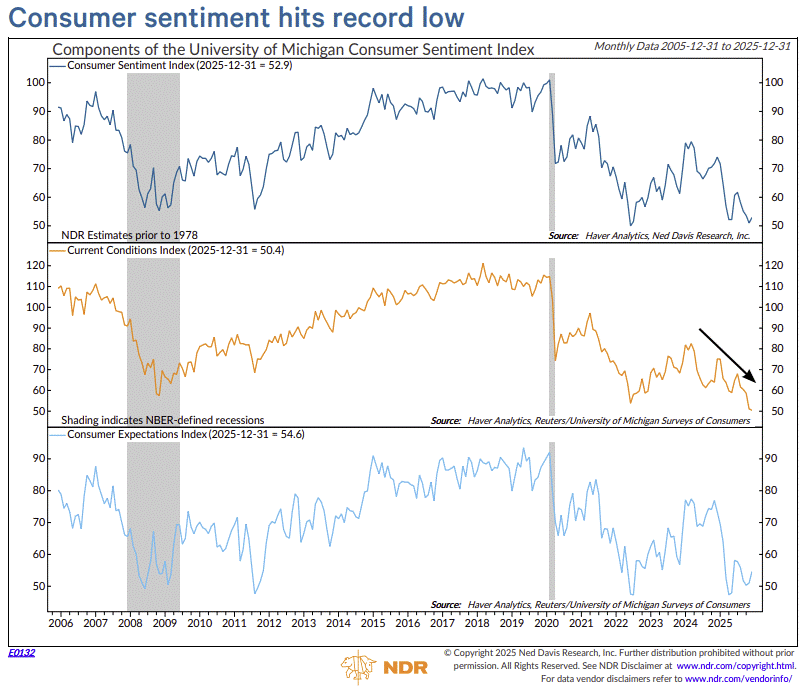

The Reuters/University of Michigan Consumer Sentiment Index’s Current Conditions Index just hit a record low in December.

This survey, which began collecting data back in 1946, measures how consumers feel right now about their personal finances and the economy in a broad sense. That means, despite record high stock prices and $2 prices at the gas pump, consumers find 2026 to be the worst set of conditions over the last 80 years.

The UofM survey is more closely linked to lower income workers than others.

Anemic job and wage growth, persistent inflation, higher borrowing costs like credit cards, and appreciating asset prices have led economists to recycle a term from the 2010s, the K-shaped economy, to describe the disparity between the haves and the have nots.

“When people talk about the K-shaped economy, they’re talking about an economy that is being experienced very differently across the population” stated Joanne Hsu, the director of the Surveys of Consumers at UofM.

The wealthier cohorts are represented by the upper diagonal line and continue to spend confidently as the wealth effect from higher financial asset prices provides support.

The lower wealth cohorts represent the lower diagonal line and scramble to make ends meet.

This bifurcation is becoming more and more pronounced across economic data (hard) and survey data (soft).

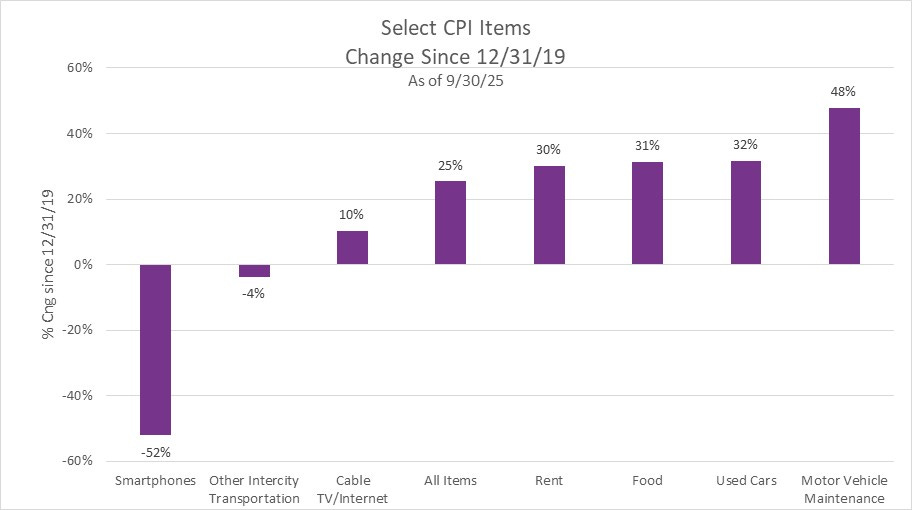

The pessimism around current conditions also tell me that consumers still hate the persistent sting from inflation, which disproportionately affects the lower wealth cohorts. The cumulative price stacking over the past five years, call it 20-30% across most categories, really doesn’t sit will with folks because it’s a permanent wealth tax.

And they’re reminded of inflation every day, from the grocery store to their electric bill.

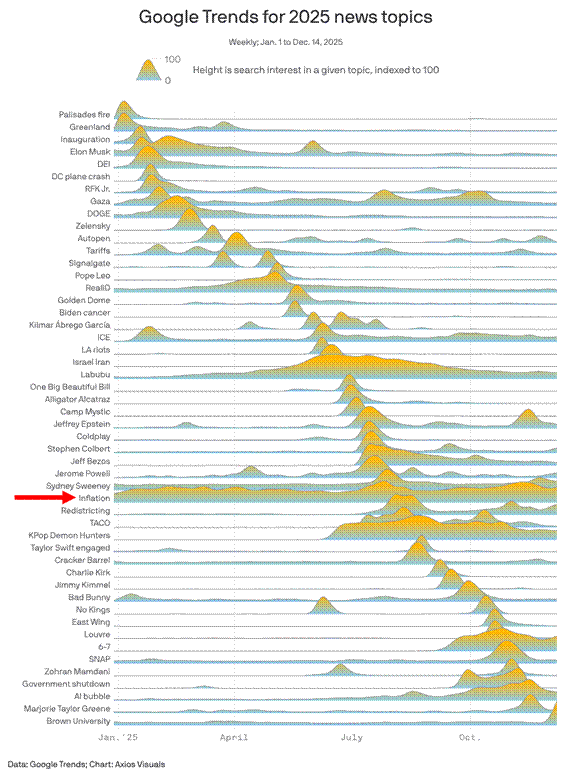

You can see its prevalence in Google search trends, which remains steady all year despite most news topics coming and going.

The growth story in the U.S. economy remains very segmented and lumpy. And, from my perch, the K-shaped economy points towards a shift in the risk outlook for 2026 and 2027.

The risk of a 4.6% unemployment rate that grinds higher is a lot more significant than the risks to core CPI moving marginally higher. As hiring weakens, the risk is that consumption begins to ease, as well.

For now, the upper income brackets remain the work horse of this consumer-driven economy. After all, the top 10% of households are responsible for half of all spending.

The risk is that they begin to cool, as well.

Sources: Ned Davis Research, University of Michigan, Daily Chartbook

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)