The manufacturing economy, plus Apple, 2023 IPO window, and rate expectations

The Sandbox Daily (12.6.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

the diminishing U.S. manufacturing economy

Apple (AAPL) reclaims $3 trillion

closing the dismal 2023 IPO window

a dose of humility, rates edition

Let’s dig in.

Markets in review

EQUITIES: Dow -0.19% | Russell 2000 -0.21% | S&P 500 -0.39% | Nasdaq 100 -0.56%

FIXED INCOME: Barclays Agg Bond +0.26% | High Yield +0.11% | 2yr UST 4.597% | 10yr UST 4.113%

COMMODITIES: Brent Crude -3.91% to $74.18/barrel. Gold +0.37% to $2,043.9/oz.

BITCOIN: -0.38% to $43,766

US DOLLAR INDEX: +0.12% to 104.179

CBOE EQUITY PUT/CALL RATIO: 0.57

VIX: +0.93% to 12.97

Quote of the day

“Pessimism makes for good stories. Optimism makes for good portfolios.”

- Callie Cox, eToro

Year-end outlook with Anastasia Amoroso

Yesterday, clients and friends of the Sandbox community were invited to a wide-ranging conversation with the ever-gracious Anastasia Amoroso, Chief Investment Strategist at iCapital, where we covered macro, markets, and timely themes confronting investors.

Feedback thus far has been exceptional – Anastasia crushed it!

More to come soon…

And now, back to our regularly scheduled programming.

The diminishing U.S. manufacturing economy

Manufacturing now makes up a small share of the U.S. economy by almost any measure, including overall output and employment.

Manufacturing accounts for just 10.3% of U.S. GDP and manufacturing employment makes up 8.3% of total U.S. employment.

While there are also non-economic arguments (e.g., national security) for the importance of domestic manufacturing, especially in specific sectors, manufacturing no longer plays a dominant role in the U.S. economy.

Source: Goldman Sachs Global Investment Research

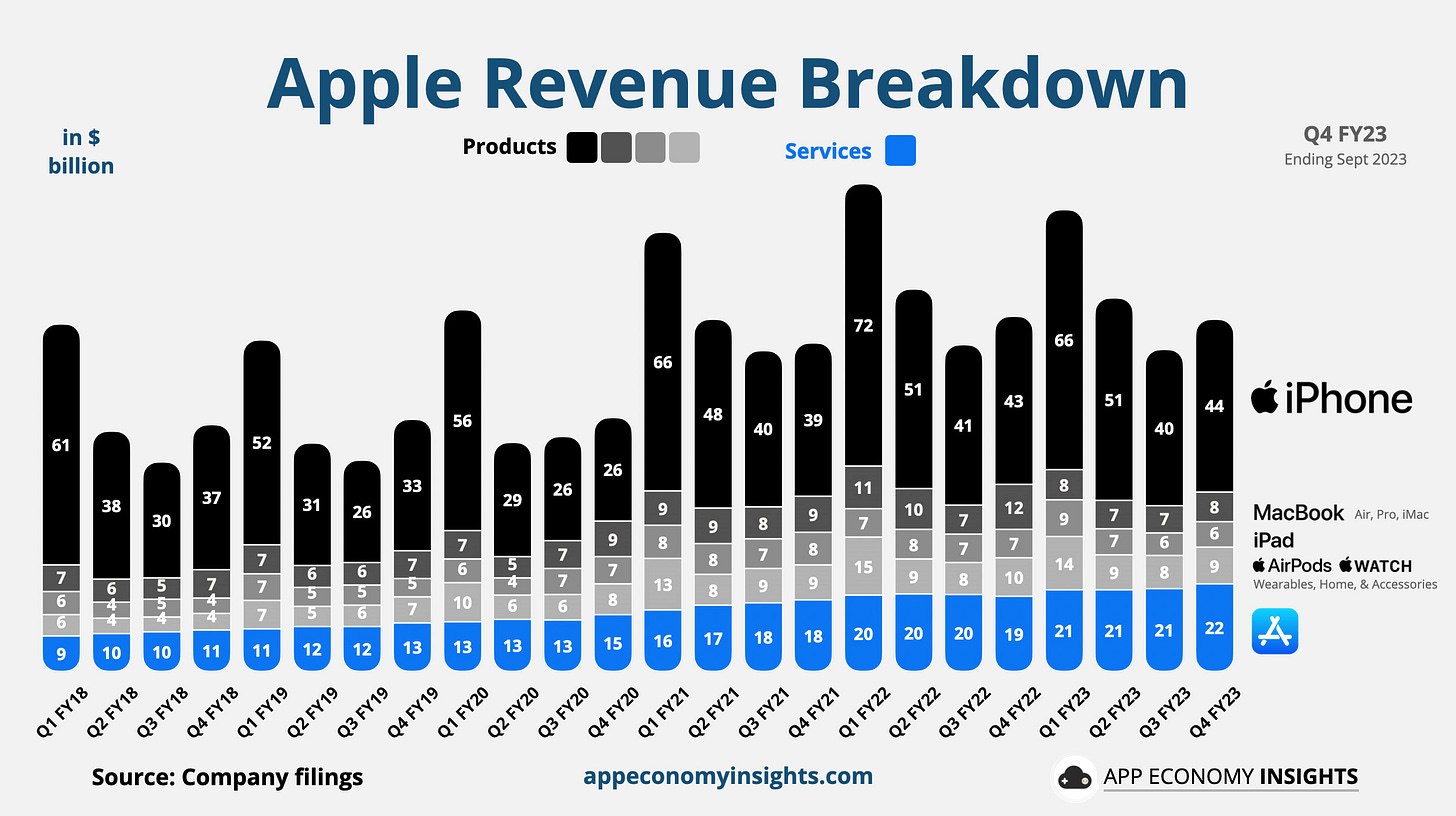

Apple reclaims $3 trillion in market cap

Apple’s market capitalization has, once again, crossed the $3 trillion threshold – the 1st time since August.

Apple is the only U.S. company to ever reach this threshold.

Apple is a critically important stock for the market and for the average investor.

Apple’s weight in the S&P 500 index is 7.4%, while it comprises 11.3% of the Nasdaq 100 – the largest constituent weighting in both indexes.

It’s also the apple of Warren Buffett’s eye, too.

Apple's stock price has surged by over 48% in the past year, despite facing challenges like slowing growth – the tech giant’s overall sales have fallen for 4 straight quarters, as measured by YoY quarterly revenues.

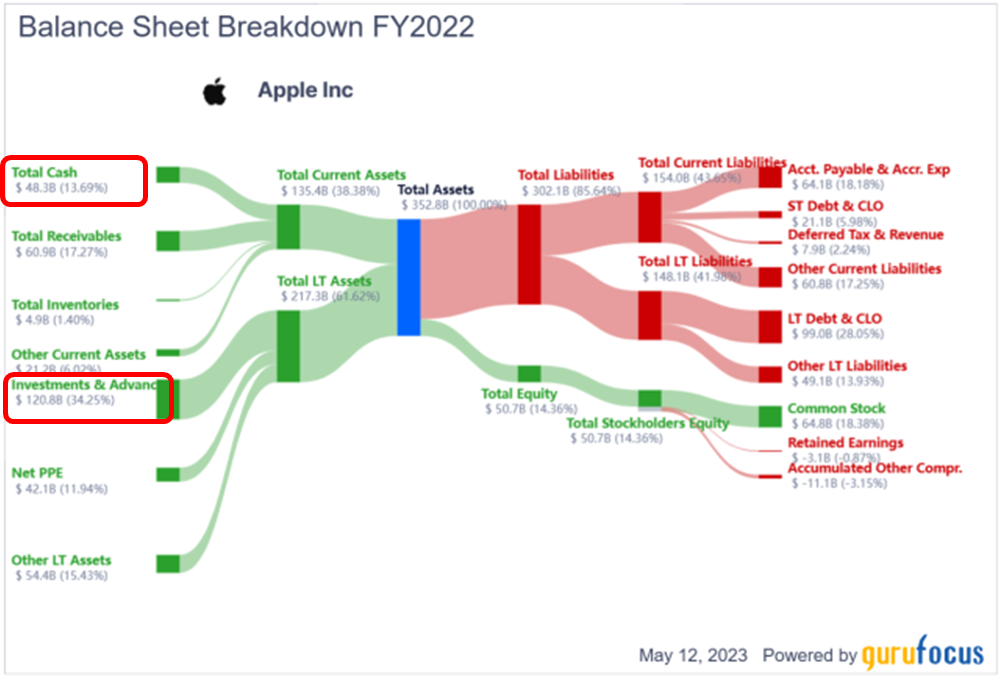

Investors view Apple as a financial stronghold with a robust product portfolio, solid cash flow, and a commitment to shareholder returns (namely buybacks).

But the most impressive thing about Apple?

Apple exited its final quarter of fiscal year 2023 with over $162 billion in cash, equivalents, and marketable securities on the balance sheet. After subtracting $111 billion of debt, we’re left with a net cash position of about $51 billion at the end of the quarter.

Source: Apple, CNBC, YCharts, App Economy Insights, Genuine Impact, State Street, Invesco, Yahoo Finance

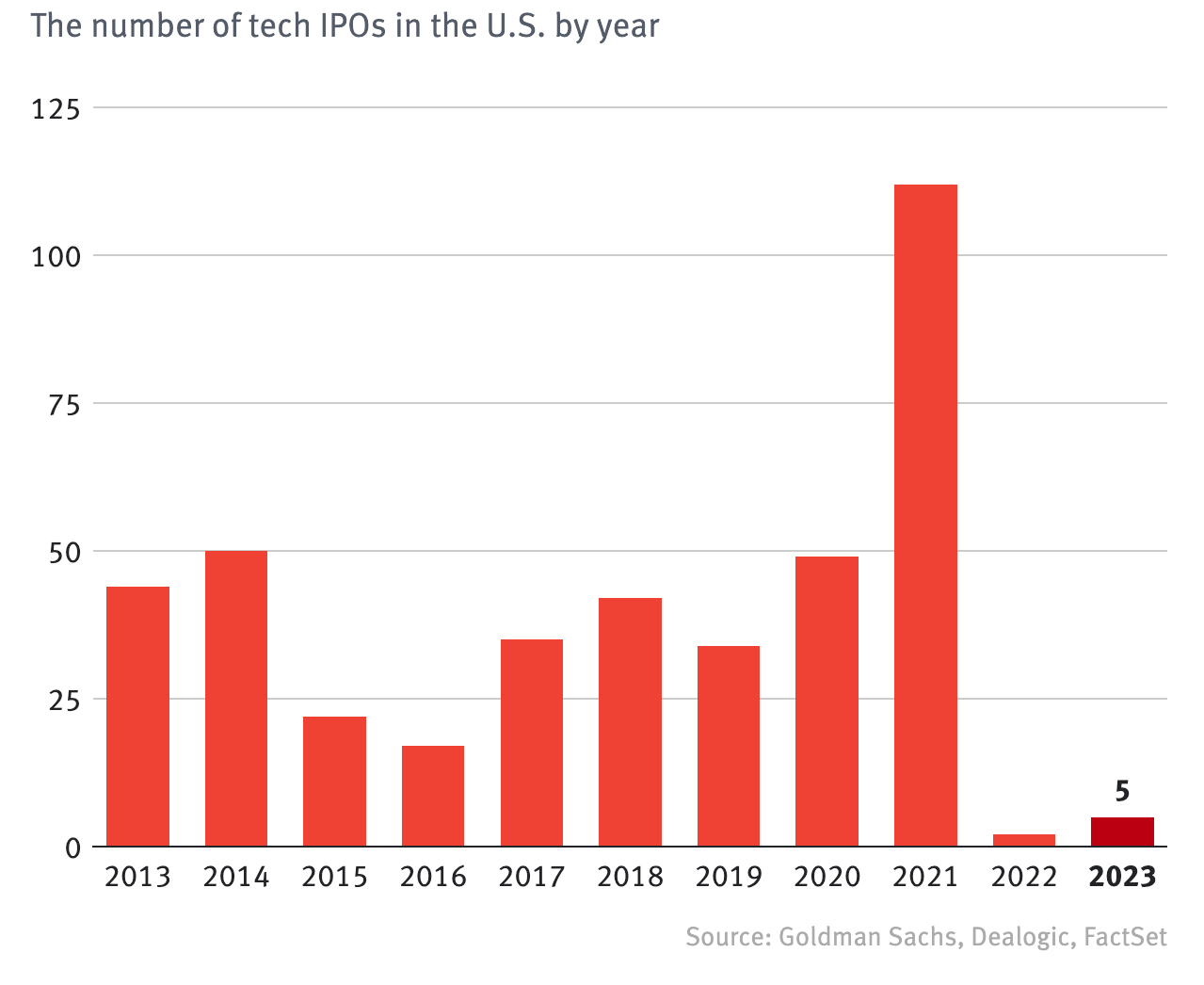

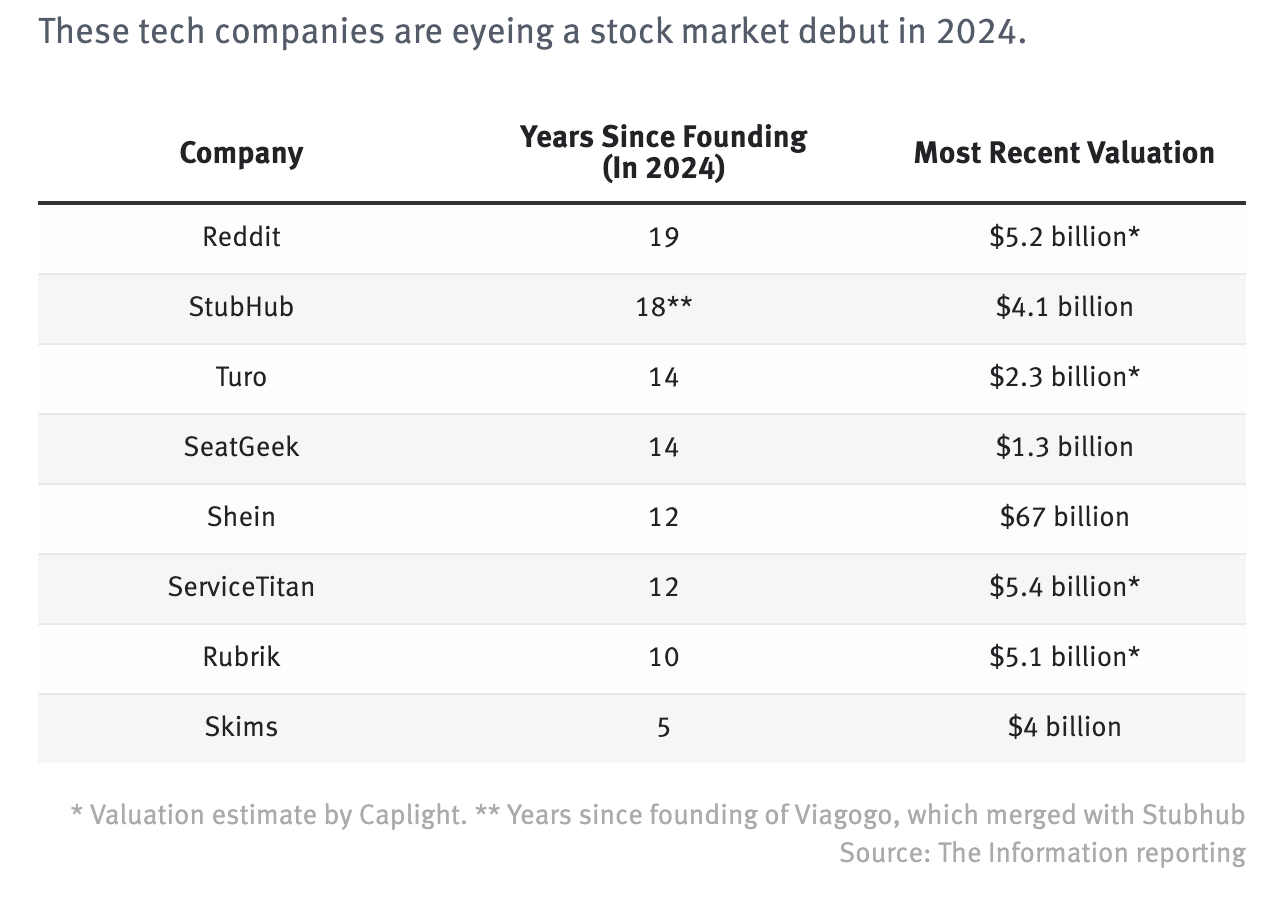

Closing the dismal 2023 IPO window

The tech initial public offering (IPO) market, much like the broader U.S. and global landscape, continues to run cold.

Weak and volatile price action the last couple years, a general lack of risk appetite, depressed valuations, higher interest rates, and an uncertain policy backdrop have all contributed to depressed IPO conditions.

Tech IPOs have totaled a whopping 5 new listings in 2023, down from 112 at the peak of the cycle back in 2021.

Some tech “startups” as old as nearly ~20 years could all be weighing exits in 2024:

This phenomena is a global endemic. The last quarterly window to show YoY growth for IPOs was back in Q3 of 2020!

Source: The Information, FactSet

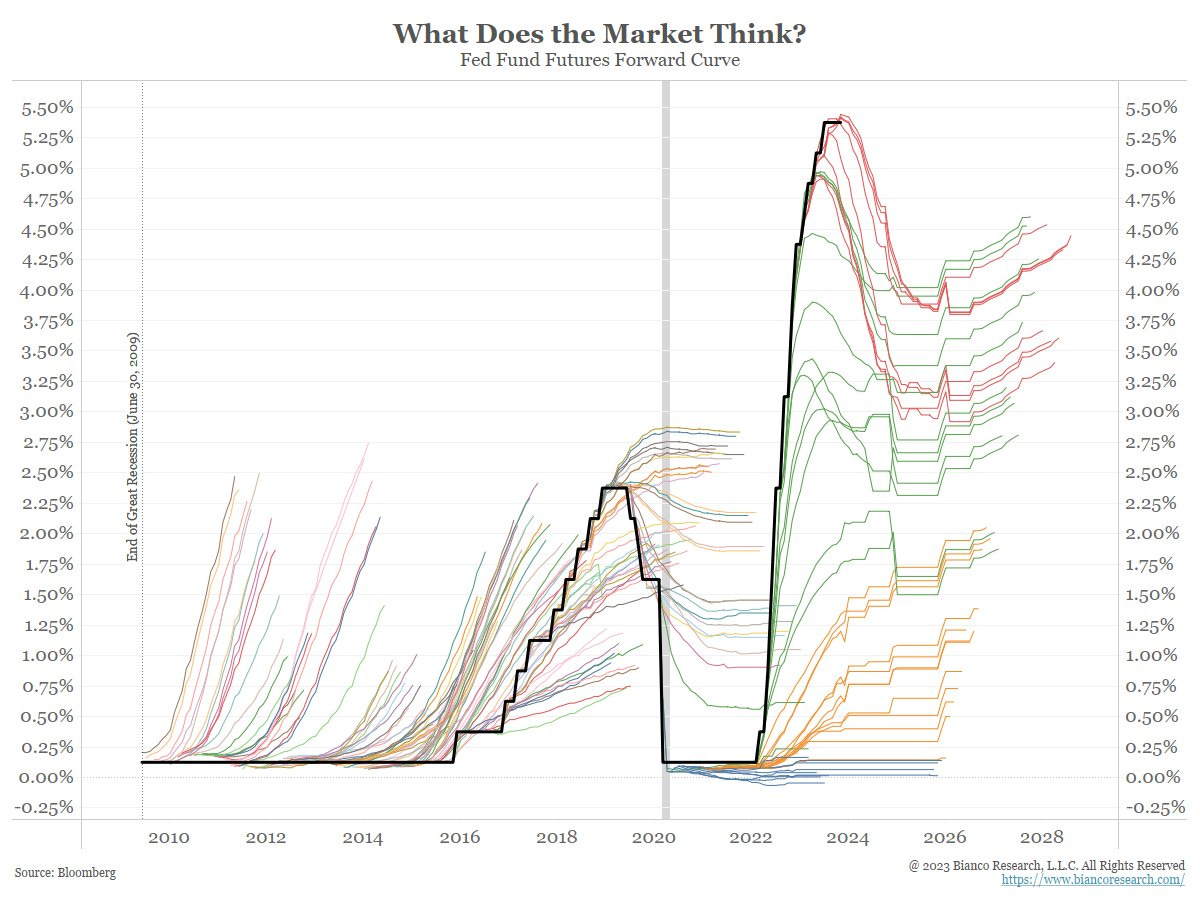

A dose of humility, rates edition

Given the incredible runup in rates this fall and subsequent repricing of cuts baked into markets next year, the bond market, and perhaps more importantly, forward expectations of where rates are heading next have moved all over the place.

Sometimes we all need a friendly reminder that the market is always wrong about the Fed and where the target interest rate is heading.

The black line is the actual Fed Funds Rate; the eyelashes coming off the black line are the future expectations of the Fed Funds Rate. Notice how those lines never track each other, not even a smidge...

Source: Bianco Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.