The market's price tags remain high, plus an evening with Barry

The Sandbox Daily (11.18.2025)

Welcome, Sandbox friends.

Every now and again, you get to meet your hero. For me, Barry Ritholtz is on that short list. Boy, he does not disappoint. Tonight’s conversation/podcast with Patient Capital CEO Samantha McLemore was well worth the drive from the suburbs into DC.

Keep making good decisions !!

Today’s Daily discusses:

the market’s price tags remain high

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.31% | S&P 500 -0.83% | Dow -1.07% | Nasdaq 100 -1.20%

FIXED INCOME: Barclays Agg Bond +0.06% | High Yield +0.02% | 2yr UST 3.575% | 10yr UST 4.121%

COMMODITIES: Brent Crude +1.01% to $64.84/barrel. Gold -0.09% to $4,070.7/oz.

BITCOIN: +0.95% to $92,883

US DOLLAR INDEX: +0.02% to 99.604

CBOE TOTAL PUT/CALL RATIO: 0.97

VIX: +10.32% to 24.69

Quote of the day

“In times of rapid change, experience could be your worst enemy.”

- J. Paul Getty

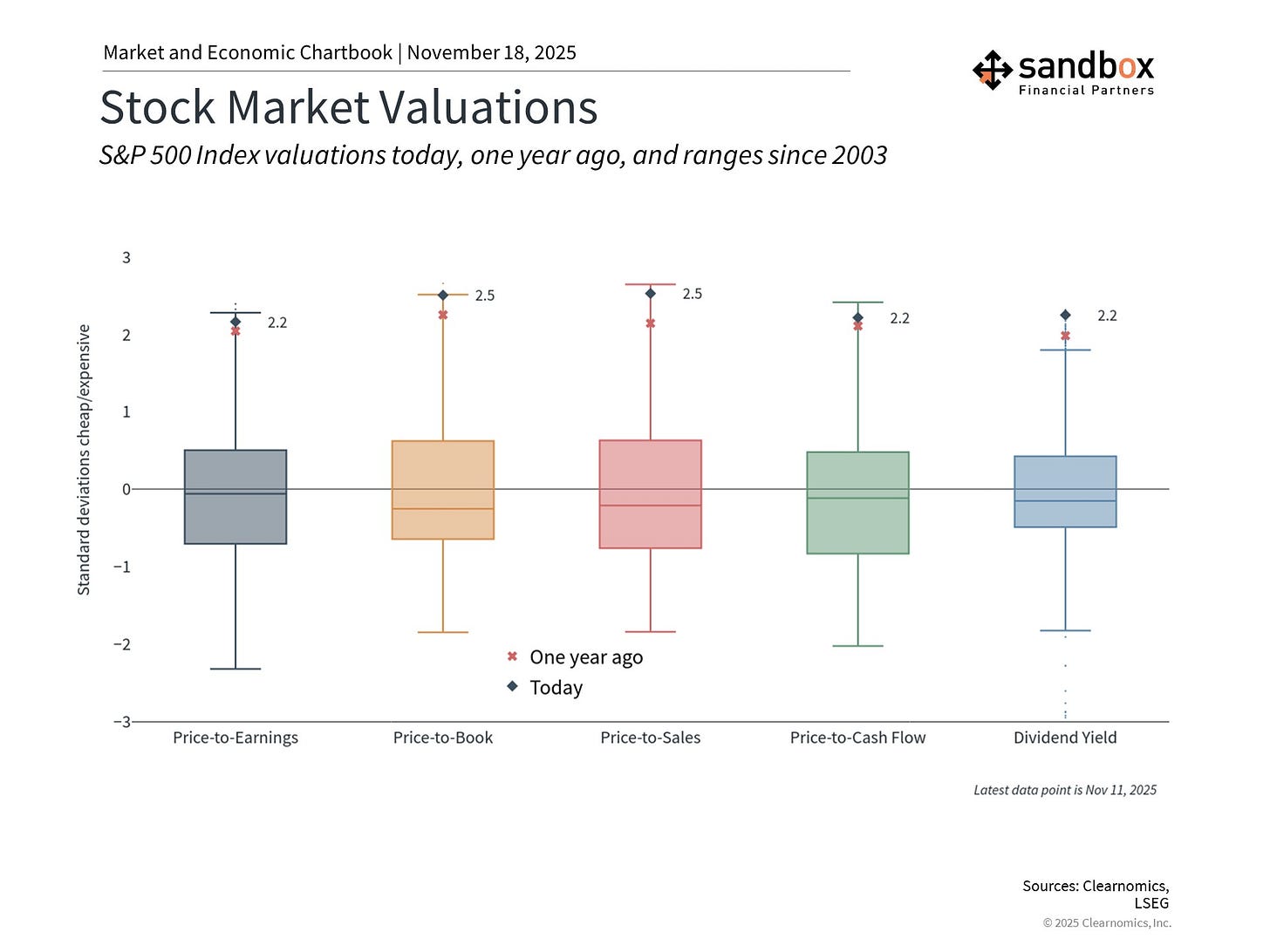

The market’s price tags remain high

Why are valuations important to long-term investors?

Simply put, valuations are among the best tools that investors have to gauge the attractiveness of the stock market over years and decades.

Stated differently, starting valuations have historically been one of the strongest predictors of future returns.

Stock prices alone only tell you what something costs today; valuations tell you what you’re actually getting for your money.

That’s why valuation levels tend to be correlated with long-term portfolio returns – buying when markets are cheap improves the odds of higher future returns, while buying when markets are expensive can be a headwind.

But, valuations are not crystal balls.

They are not precise market-timing signals, nor do they account for every nuance driving markets from month to month.

Instead, valuations function as guideposts. They help investors calibrate expectations and align asset allocations with long-term financial goals, rather than get caught up and chopped up by short-term noise.

Viewed this way, valuations become less about predicting what happens next and more about preparing for the range of outcomes that markets can deliver.

As shown below, most common valuation measures are now well above their long run averages, as well as valuations just one year ago.

Source: Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)