The most important themes and charts that defined 2023 (part IV)

The Sandbox Daily (12.14.2023)

Welcome, Sandbox friends.

This will be our final post of the week summarzing the key themes and charts that defined the economy and markets in 2023.

Today’s Daily discusses:

honoring Charlie Munger

ChatGPT explodes onto the global consciousness

breadth Thrusts support more room for this bull to run

U.S. deficit spending raising concerns over long-term economic health

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +2.72% | Dow +0.43% | S&P 500 +0.26% | Nasdaq 100 -0.15%

FIXED INCOME: Barclays Agg Bond +0.81% | High Yield +0.44% | 2yr UST 4.426% | 10yr UST 3.956%

COMMODITIES: Brent Crude +2.89% to $76.74/barrel. Gold +0.13% to $2,047.6/oz.

BITCOIN: +0.41% to $42,942

US DOLLAR INDEX: +0.07% to 102.023

CBOE EQUITY PUT/CALL RATIO: 1.16

VIX: +2.38% to 12.48

Quote of the day

“Every morning in Africa, a gazelle wakes up. It knows it must outrun the fastest lion or it will be killed. Every morning in Africa, a lion wakes up. It knows it must run faster than the slowest gazelle or it will starve. It doesn't matter whether you are the lion or a gazelle – when the sun comes up, you'd better be running.”

- Proverb

Honoring Charlie Munger

Charlie Munger, a name that reverberates throughout the investment community with an echoing tone of unmatched reverence, passed away in November at the age of 99.

As the right-hand man of the “Oracle of Omaha,” Munger was an investment titan in his own right, amassing a fortune through his unparalleled acumen and unflinching dedication to value investing.

He was sharp as a tack, he dispelled profound wisdom, and he had wit.

In honor of his legacy, enjoy this portrait which contains his most important rules for living a good life and avoiding bad outcomes.

Source: Vishal Khandelwal

ChatGPT explodes onto the global consciousness

Did AI save the stock market in 2023? Maybe, maybe not.

There is no denying that OpenAI and its ChatGPT product ignited the boom in AI, the most important new technology since the advent of the internet.

One way to measure success? ChatGPT gained 1 million users in just 5 days, the fastest product adoption in history (until Threads did that in 1 hour during its own product launch).

Source: Statista

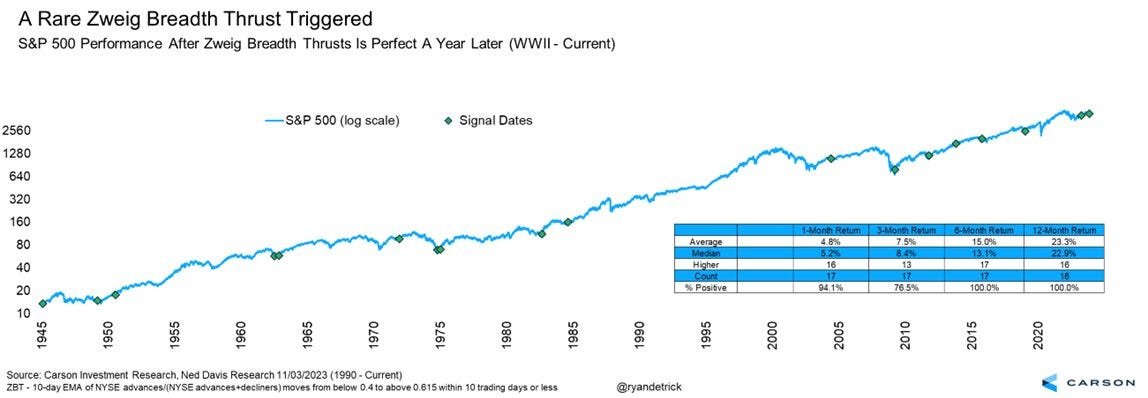

Breadth Thrusts support more room for this bull to run

Market technicians had a pretty good 2023, so in their honor we take a look at two significant technical markers – a breadth thrust – that both fired recently and give support to this bull market.

A breadth thrust is a technical indicator which determines market momentum, often signaling the start and/or persistence of uptrends.

A very bullish breadth indicator – the Zweig Breadth Thrust (ZBT) – triggered on Friday, November 3rd.

A ZBT occurs when the 10-day exponential moving average of the NYSE Percentage of Up Issues rises from below 40% (indicating an oversold market) to above 61.5% within 10 days. In plain English, the Advance-Decline numbers suddenly go from not so good to REALLY good in a short amount of time.

ZBT’s are a very rare occurrence and possess a good track record of coming in the vicinity of major lows – higher 12 months later after every signal since World War II.

More recently, another breadth thrust just triggered this week when 55% or more of the constituents in the S&P 500 index rose to trade at new 20-day highs.

When this occurs, the S&P 500 index is higher 6-months later 82.8% of the time with a median gain of +9.7% and higher 12-months later 96.6% of the time with a median gain of 15.8%.

And one thing we know from experience is that breadth thrusts are NOT evidence of exhaustion.

In fact, it’s quite the opposite. We regularly see clusters of breadth thrusts near the beginning of new uptrends and early in bull markets.

Source: Ryan Detrick, McClellan Financial Publications, SentimenTrader, Grant Hawkridge

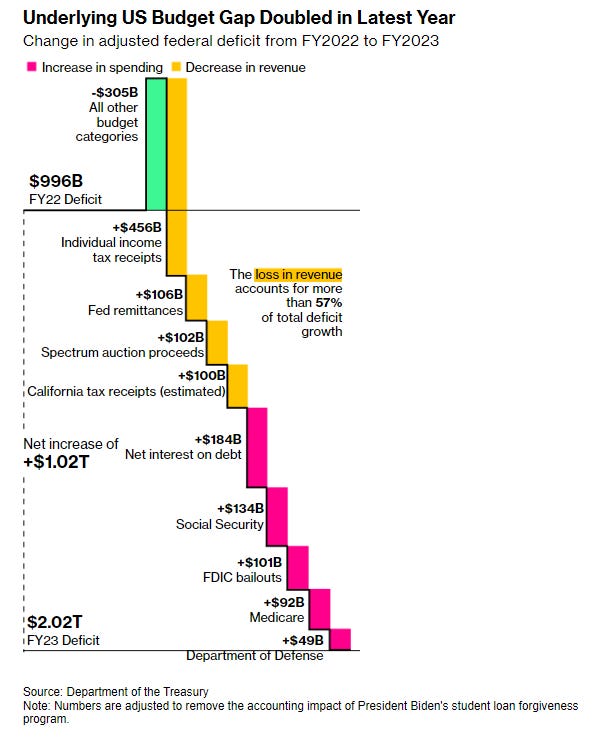

U.S. deficit spending raising concerns over long-term economic health

Many economists, politicians, and macro pundits believe America's swelling national debt is going to cause a crisis or lead to a significant destabilizing credit event in markets.

In fact, this led the credit rating agencies themselves to downgrade America’s credit rating outlook.

When interest rates were surging this fall, the spotlight intensified on the U.S. budget deficit and ongoing interest expense that will be required of the U.S. Treasury.

This narrative overwhelmingly became the talk of the tape.

The amount the U.S. paid as interest expense on the Federal debt jumped nearly 40% in fiscal-year 2023 to more than $659 billion; in the current fiscal year, interest spending is on track to surpass $800 billion.

And as one Treasury auction after another came up this fall, many were questioning who would buy up all this new supply.

With the Fed no longer an active buyer of Treasurys (transitioning from a net buyer to net seller), we were witnessing a vacuum in demand from a key source. Obviously, this intensified the spotlight on foreign investors, who own the largest share of outstanding of Treasury bonds (30%):

Much of the conversation centered on the policy of deficit spending (as a % of GDP), which has ballooned over the past ~15 years.

In fact, the U.S. government had a $2 trillion budget deficit for the fiscal year through September, a gap that's $1 trillion more than the prior year. This next chart helps us understand the sources of our deficit:

The surge in the national debt helped explain why yields on longer-term U.S. Treasuries reached new highs unseen since before the Global Financial Crisis, with the government needing to issue ever more debt to cover the shortfall of revenues relative to spending.

Source: Peter Peterson Foundation, Goldman Sachs Global Investment Research, Bloomberg

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

👏👏