The most important themes and charts that defined 2023 (part III)

The Sandbox Daily (12.13.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Wall Street consensus got 2023 very, very wrong

banks' unrealized losses swell

monetary policy will downshift gears in 2024

corporate bankruptcy filings flare up

inflation is yesterday’s problem

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +3.52% | Dow +1.40% | S&P 500 +1.37% | Nasdaq 100 +1.27%

FIXED INCOME: Barclays Agg Bond +1.26% | High Yield +1.53% | 2yr UST 4.443% | 10yr UST 4.026%

COMMODITIES: Brent Crude +1.83% to $74.58/barrel. Gold +2.41% to $2,041.3/oz.

BITCOIN: +3.61% to $42,745

US DOLLAR INDEX: -0.89% to 102.938

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +0.99% to 12.19

Quote of the day

“There are no points awarded for difficulty. Nobody cares how much effort you put into researching a stock, how detailed your spreadsheet is or how complicated your options strategy is. For many people, a diversified buy-and-hold strategy is the most reasonable way to invest.”

- Morgan Housel in 16 Rules for Investors to Live By

Wall Street consensus got 2023 very, very wrong

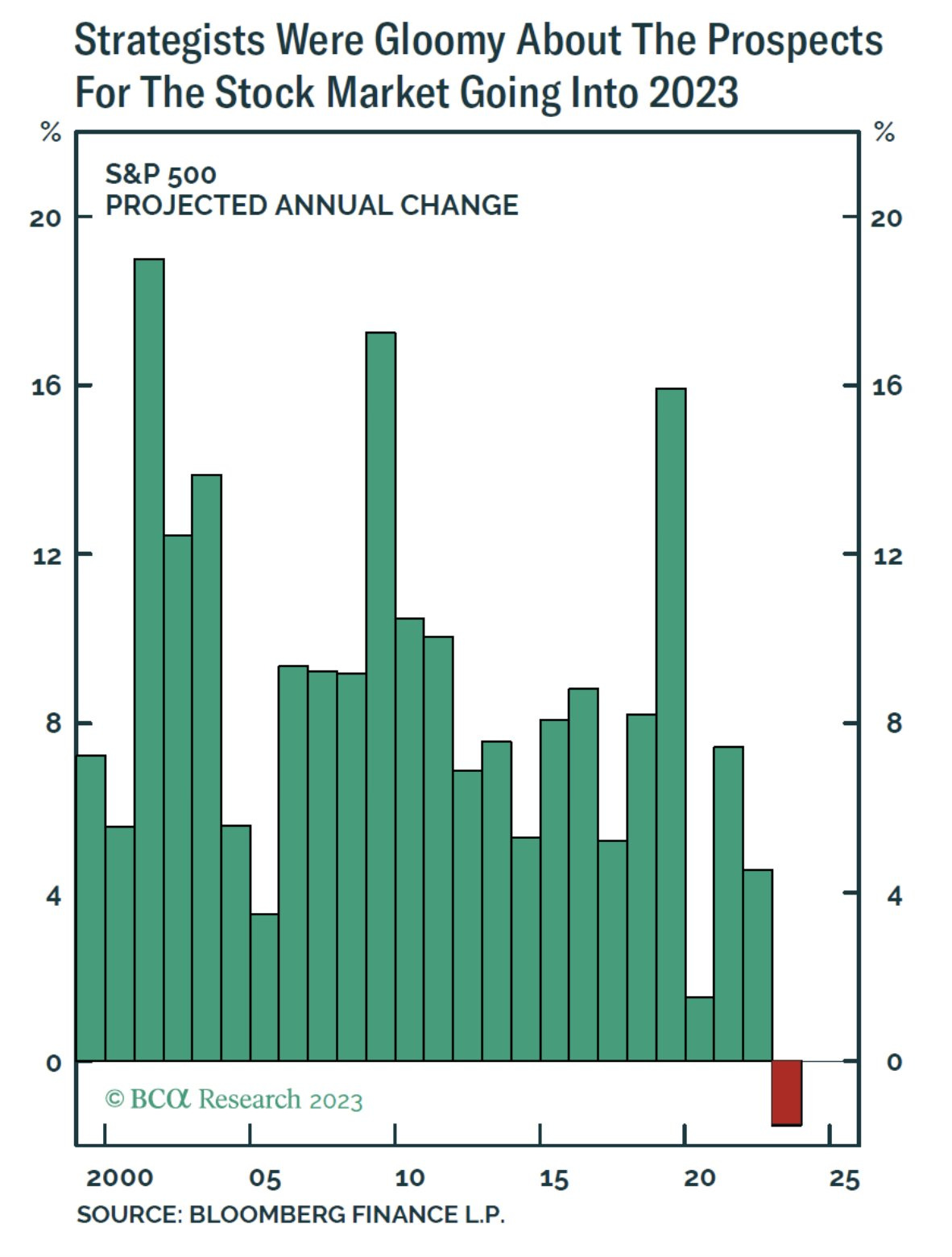

12 months ago, the consensus forecast by Wall Street strategists called for an outright fall in the stock market in 2023, the 1st time this century that they had predicted a loss.

Well, Wall Street strategists could not have been more wrong.

As it turns out, predicting the future – 12 months out – in financial markets is a rather difficult proposition.

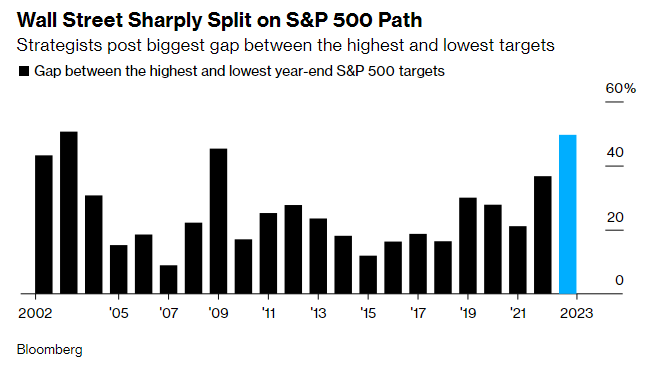

In fact, even as 2023 crossed the halfway mark, strategists were very divided about where markets were headed next.

Heading into July, there was a ~50% difference between the most bullish year-end S&P 500 target (Fundstrat’s Tom Lee saw it rising nearly +10% more to 4,825) and the most bearish call (Piper Sandler had stocks down some -27% to 3,225).

This meant that the range between the highest and lowest of year-end targets was the widest since 2003.

Clearly, this was a difficult market to call with any level of conviction.

Yet, even with the S&P 500 index up ~16% and the Nasdaq 100 index up ~39% at the halfway point (!!), many strategists failed to adjust their outlooks in light of changing market conditions – and stuck to their original year-end targets (or made minor, modest adjustments).

That meant the 2nd half outlook was the most bearish on record.

Well, here is where 2023 stands as of this afternoon, with the Dow Jones Industrial Average printing a fresh record all-time closing high today:

Forecasting stock markets 12 months out is a tough business.

The business cycle persists, market conditions change, positioning and sentiment shifts, narratives adjust.

As we look towards 2024, it’s important to develop a framework in how you will manage your portfolio and risk exposures in the new year. It’s also equally important to keep an open mind as the economy and market unfolds, while holding your outlook on a short leash.

Source: Bloomberg, BCA Research, Seth Golden

Banks' unrealized losses swell

Two weeks ago, the Federal Deposit Insurance Corporation (FDIC) released its 3rd-quarter update on the health of the nation's banks.

Big picture? The banking system is sound, with high and stable profits and solid scores on the performance of most loans.

Zoom in, however, and you’ll find the 3rd quarter surge in interest rates — which pushes down the value of fixed-income securities — inflicted material (unrealized) losses on their balance sheets.

FDIC-insured banks reported unrealized losses — essentially the difference between the price they paid for bonds in their investment portfolio and the current market price for those securities — of $683.9 billion in the third quarter. Remember, banks don't have to actually realize the losses on their balance sheets unless they sell the bonds.

Notice the losses experienced on bank balance sheet in the Great Financial Crisis (2008-09) or the previous Fed tightening cycle (2018) pale in comparison to present day.

Source: FDIC

Monetary policy will downshift gears in 2024

Over the past two-ish years, the Federal Reserve has been hiking interest rates in a deliberate attempt to restrict the flow of capital, bring down aggregate demand, and slow the economy into a soft landing.

Besides the 1977-1980 tightening cycle, the current interest rate hiking cycle has been the fastest and highest on record. Reference the bright red line in the chart below.

At the same time, the Federal Reserve is utilizing the 2nd monetary policy tool available at their disposal: Quantitative Tightening, or “QT.”

For years, the Fed was a buyer of Treasurys and Mortgage bonds to bring ample liquidity into the market and keep borrowing costs low. Over the last year, the Fed has stepped back – going from a net buyer to a net seller. Again, the goal has been to reduce liquidity, tighten financial conditions, and slow down the economy.

Below is a snapshot of the Fed’s $8 trillion portfolio, where it is unwinding up to $60bn in Treasury bonds & $35bn in MBS to mature each month:

The good news for 2024? Monetary policy is now downshifting from its most restrictive phase to perhaps a maintenance phase as we endure the latter innings of the tightening cycle.

That seems crystal clear in light of today’s FOMC announcement to hold rates steady at the current policy rate of 5.25-5.50%, while also signaling to the market that rate cuts are on the horizon.

And when studying the past 8 Fed tightening cycles, you can see bond yields were down each time by an average of 100 bps roughly 8 months following the final rate hike.

The last hike of this cycle was at the end of July, so we are roughly “5 months” past the final hike. With that in mind, the 10-year has dropped from its mid-October 2023 peak of ~5.0% to ~4.0% today.

Many believe we are entering that time period where those long and variable lags from restrictive monetary policy will begin to take hold.

The Federal Reserve will remain data dependent over the coming months and be sure to balance upside risks to the economy as well as downside risks as it pertains to exercising their monetary policy tools.

Source: Dwyer Strategy, J.P. Morgan

Corporate bankruptcy filings flare up

2023’s total of 591 corporate bankruptcies is on pace for its worst mark since 2010, excluding the pandemic year of 2020.

Source: S&P Global Market Intelligence

Inflation is yesterday’s problem

What goes up, must come down.

Average price growth across a wide basket of goods and services, as measured by headline CPI inflation, ramped up steadily from early-2021 to mid-2022 as supply chains squeezed the availability of goods, government programs put checks directly into the pockets of the populace, and consumers went on a spending spree after experiencing months/years in lockdowns from the coronavirus.

Then, inflation peaked. For headline inflation, it reached +9.06% YoY growth in June 2022.

What’s followed has been an orderly and steady stair-step down process in price growth in 14 of the 17 months since.

Now, inflation remains above the Fed’s mandated target of 2.0% price growth, but underlying conditions are showing the prices continue to moderate while long-term inflation expectations remain modest.

Source: YCharts

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.