The new world order is being priced in gold

The Sandbox Daily (1.7.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

disengagement from the USD-based Western financial system

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.06% | Russell 2000 -0.29% | S&P 500 -0.34% | Dow -0.94%

FIXED INCOME: Barclays Agg Bond +0.10% | High Yield -0.02% | 2yr UST 3.472% | 10yr UST 4.151%

COMMODITIES: Brent Crude -0.64% to $60.31/barrel. Gold -0.72% to $4,463.8/oz.

BITCOIN: -1.73% to $91,073

US DOLLAR INDEX: +0.15% to 98.727

CBOE TOTAL PUT/CALL RATIO: 0.90

VIX: +4.27% to 15.38

Quote of the day

“Life is not about waiting for the storm to pass but learning to dance in the rain.”

- Vivian Greene

The new world order is being priced in gold

One of the defining tenets of the post-covid New World Order is the disengagement from the U.S. dollar-centric Western financial system.

Gold sits at the center of that shift.

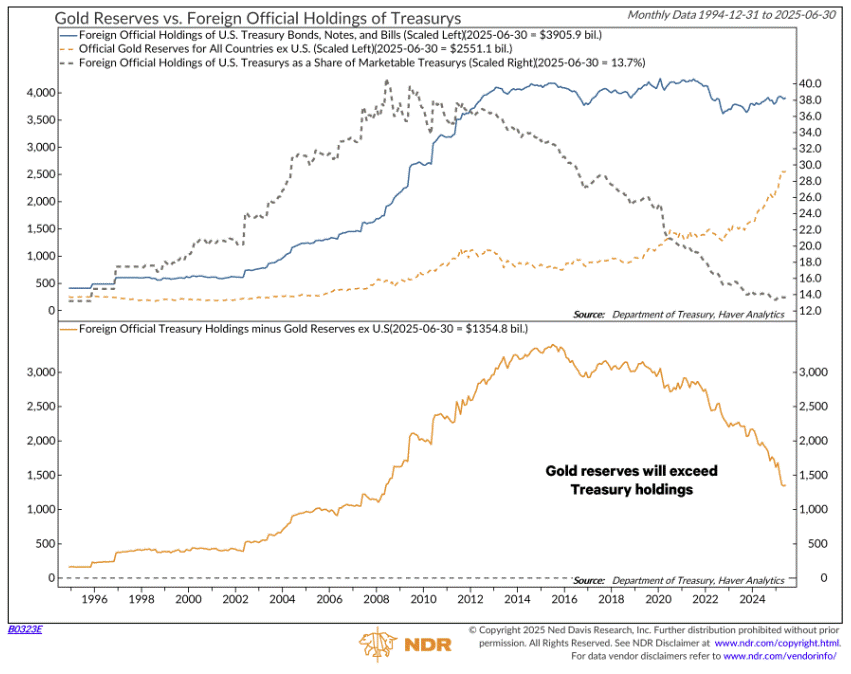

The chart below tells the story by comparing foreign official holdings of U.S. Treasurys and gold.

Foreign ownership of U.S. Treasurys has been remarkably stable in dollar terms since 2012, averaging roughly $4.0 trillion (blue line). Over the same period, however, the supply of Treasurys has exploded. The result is a dramatic decline in foreign ownership as a share of the market – from over 40% a decade ago to under 14% today (black dashed line).

At the same time, foreign official holdings of gold have surged. As of the end of Q2 2024, global central banks held roughly $2.5 trillion in gold – double the value from just three years ago (gold dashed line).

If current trends persist, it’s not difficult to imagine a world where the value of foreign gold reserves exceeds the value of their Treasury holdings.

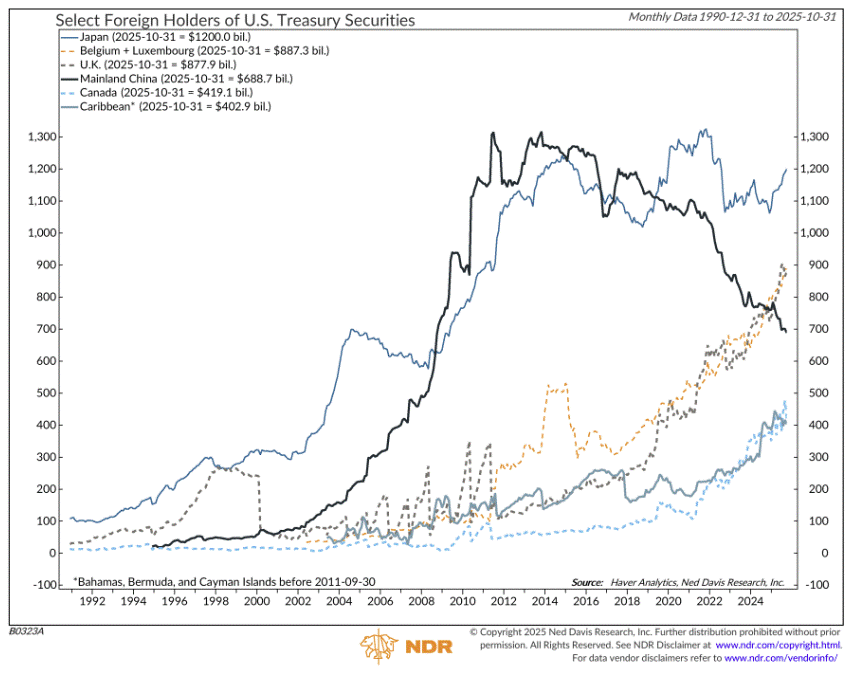

Not surprisingly, China has played a central role in this transition.

At its peak, China was the largest foreign holder of U.S. Treasurys at $1.3 trillion. Today, that figure is nearly half that level. China has also aggressively reduced its exposure to U.S. agency mortgage-backed securities, cutting holdings by $100 billion to $168 billion.

As long as China still holds Treasurys and agency MBS to sell, its gold accumulation is likely to continue.

This shift has meaningful consequences for the global monetary system.

Gold’s rising importance has propelled it to the 2nd-most valuable reserve asset, overtaking the euro last year. That milestone reflects a broader loss of confidence in fiat currencies and the desire for reserves that sit outside the political and financial infrastructure of the West.

Gold is once again functioning as a monetary anchor – quietly, steadily, and increasingly by design.

Sources: Ned Davis Research, St. Louis Fed

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Thanks for the analysis. I think you mean Q2 2025 here though: "As of the end of Q2 2024, global central banks held roughly $2.5 trillion in gold – double the value from just three years ago (gold dashed line)."

Brilliant analysis on the MBS drawdown. China slashing $100B in agency mortgage-backed securiteis while stockpiling gold says alot about where the real de-dollarization is happening. I remember back in 2019 when everyone thought Treasury holdings were the only metric that mattered, but the MBS shift is probly the more revealing signal of long-term strategic repositioning.