The NFL is BACK!!!, plus the business cycle, stocks loved by Wall Street, and AI exuberance

The Sandbox Daily (9.7.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

the NFL is BACK !!!

stocks bottom first

stocks most loved by Wall Street

AI exuberance

Let’s dig in.

Markets in review

EQUITIES: Dow +0.17% | S&P 500 -0.32% | Nasdaq 100 -0.73% | Russell 2000 -0.99%

FIXED INCOME: Barclays Agg Bond +0.31% | High Yield +0.34% | 2yr UST 4.934% | 10yr UST 4.232%

COMMODITIES: Brent Crude -0.87% to $89.63/barrel. Gold +0.30% to $1,947.8/oz.

BITCOIN: +2.45% to $26,318

US DOLLAR INDEX: -0.16% to 104.891

CBOE EQUITY PUT/CALL RATIO: 0.98

VIX: -0.35% to 14.40

Quote of the day

“Show me the charts and I'll tell you the news.”

- Bernard Baruch

The NFL is BACK !!!

Seven months after the Kansas City Chiefs won the Super Bowl, the defending champs take on the Detroit Lions tonight at 8:20pm ET on NBC.

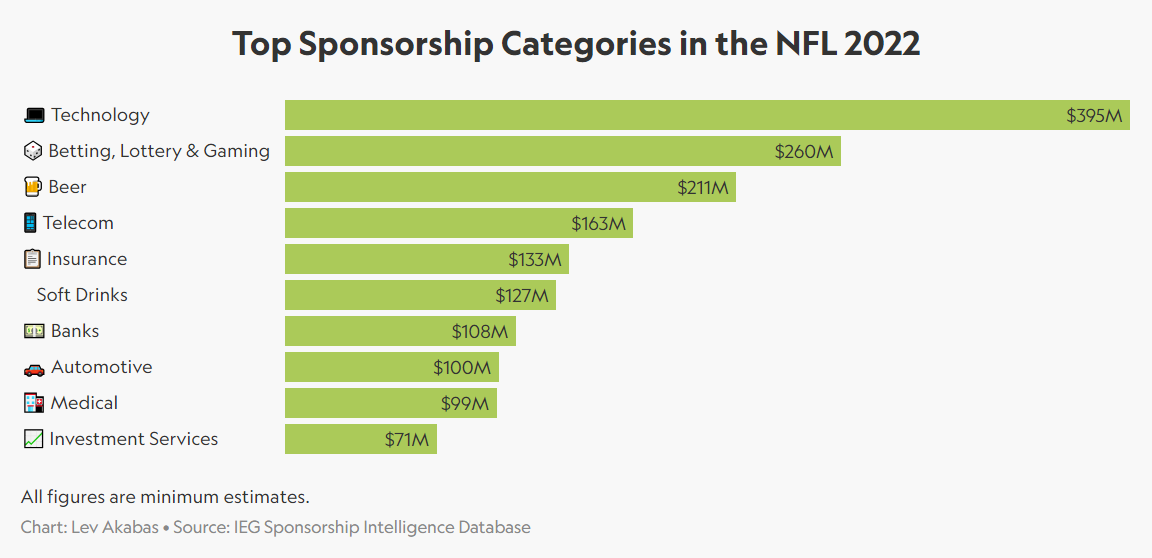

The NFL remains the most popular among major U.S. sports leagues, and consequently, the one attracting the most sponsorship dollars.

According to IEG data cited by Sportico, sponsorship revenue for the NFL and its teams grew to $1.88 billion (~4%) in the 2022-23 season, surpassing all other leagues comfortably and 15% ahead of the next closest (NBA).

The NFL marketplace of sponsorship dollars skews heavy towards tech, the “sin” interests, and, of course, beer.

This year, the NFL is shifting away from traditional TV and toward streaming services, with more football games being exclusively streamed this season. Peacock (CMCSA), Amazon (AMZN), and Disney’s (DIS) ESPN+ will air streaming-exclusive games this season.

Some other fun factoids to get you ready for the upcoming season:

Source: ESPN, Sportico, Statista

Stocks bottom first

Stocks usually bottom before earnings-per-share growth (EPS), jobs, and gross domestic product (GDP) start to improve. We’ve seen cycles time and time again; reference the chart below.

The stock market is a forward-looking mechanism in which stocks sniff out better times and rally in the face of bad news. It stops going down while GDP, employment, and earnings deteriorate.

Last year stocks took their drubbing during the bear market, bottoming in June and completing the retest in October. U.S. GDP dipped negative for two consecutive quarters in the 1st half of 2022, meeting the textbook definition of a recession despite the White House assuring it was not. The earnings valley has lasted three consecutive quarters (4Q22 – 2Q23). The final frontier, the surprisingly unshakable labor market, is all that remains.

Was 2022 a textbook trough in the cycle?

Source: Michael Cembalest

What stocks Wall Street loves most

The Russell 1000 benchmark is a stock market index that represents the 1,000 largest companies by market capitalization in the United States.

This universe of 1,000 companies is accompanied by more than 18,000 individual analyst ratings that generally fall under three buckets: buy, hold, and sell. Currently, roughly 55% of all analyst ratings in the Russell 1000 are "buy" ratings.

Below is a list of the current stocks that have the highest percentage of "buy" ratings.

Source: Bespoke Investment Group

AI exuberance

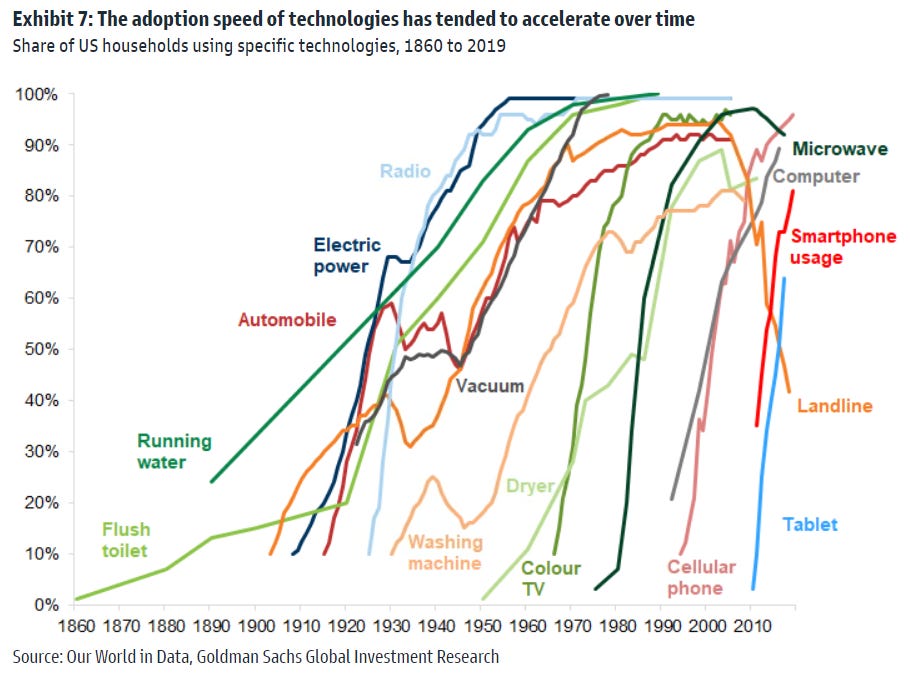

Investors have correctly identified this new major cycle of innovation lead by AI compute will have a profound impact on growth and profitability in the future, the same way prior technology waves of significance have driven outperformance among the technology sector and pushed valuations higher.

The speed in which a breakthrough technology emerges and reaches commercial scale is becoming easier over time as technology evolves unto itself, capital floods into the space, and new companies and products expand network effects.

Today’s technologies achieve scale in months and years while prior generations took decades.

What’s more, while the leading tech companies of the 2020s will most likely remain dominant in their respective markets, rapid innovation – particularly around machine learning and AI – will likely create a new wave of tech superstars and products/services that are not yet imagined.

Source: Goldman Sachs Global Investment Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.