The S&P 500 index rejected Strategy (MSTR), a major blow to crypto treasury companies

The Sandbox Daily (9.18.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Strategy’s denial of S&P 500 inclusion is a blow to crypto treasuries

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +2.51% | Nasdaq 100 +0.95% | S&P 500 +0.48% | Dow +0.27%

FIXED INCOME: Barclays Agg Bond -0.28% | High Yield +0.22% | 2yr UST 3.572% | 10yr UST 4.110%

COMMODITIES: Brent Crude -0.56% to $67.57/barrel. Gold -1.03% to $3,679.5/oz.

BITCOIN: +1.14% to $117,407

US DOLLAR INDEX: +0.53% to 97.385

CBOE TOTAL PUT/CALL RATIO: 1.06

VIX: -0.13% to 15.70

Quote of the day

“God grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference.”

- Reinhold Niebuhr

Strategy’s denial for S&P 500 inclusion is a blow to crypto treasuries

Earlier this month, the inclusion committee for the S&P 500 rejected Strategy (MSTR) from being added to the world’s most prominent index for stocks.

This despite Strategy technically meeting the various criterion for inclusion, such as market cap, liquidity, and profitability, among others.

To me, this signals that the committee, which can apply broad discretion beyond just its quantitative eligibility requirements, has concerns about adding corporations that are effectively Bitcoin holding companies.

This rejection is a blow not only to CEO/Bitcoin maxi Michael Saylor and Strategy, but to other corporate crypto treasuries that have proliferated in recent months in attempt to replicate Strategy’s crypto accumulation model.

Why is this important?

For starters, companies and their shareholders have good reason to be added to the S&P 500: an estimated $22 trillion is attached to products that track or are benchmarked to the index, according to Bloomberg ETF analyst James Seyffart.

Beyond the obvious share price appreciation that accompanies an index addition, the more material risk is something more foreboding.

Strategy’s addition to other major stock indexes, such as the Nasdaq 100, MSCI USA, MSCI World, Russell 2000, and CRSP US Total Market Index, has allowed bitcoin to quietly intrude upon investor portfolios, perhaps without their knowledge or overt consent.

The rejection by the S&P 500 committee suggests this encroachment via a back door may have reached its limits.

Going one step further, one important development to monitor going forward is those other index providers, which already included Strategy or other corporate crypto treasuries into their indexes, might rethink their approach.

Along this front, Nasdaq has begun requiring certain companies holding crypto assets to seek shareholder approval before issuing new shares to fund crypto purchases.

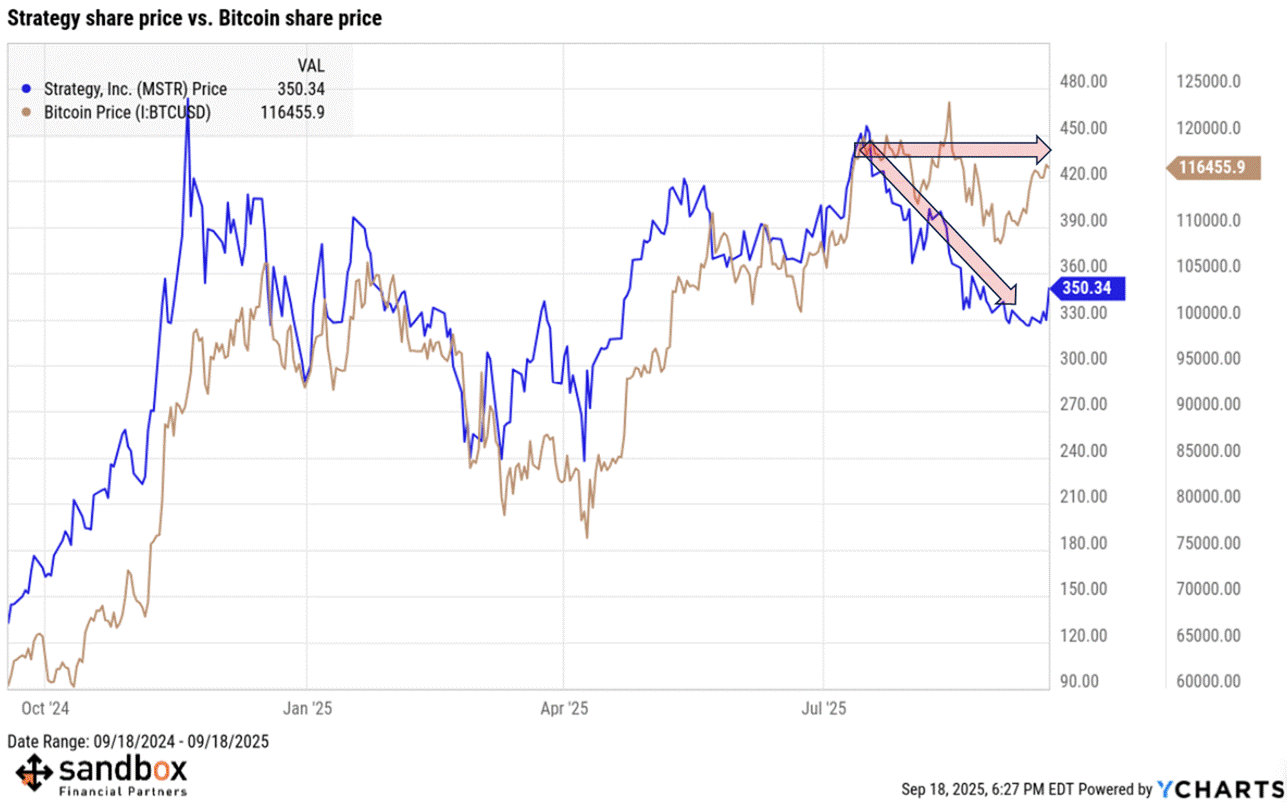

The Strategy omission hit crypto treasury stocks at a time when their share prices have come under pressure due to overcrowding and investor fatigue – as reflected in their share prices. Strategy, which normally tracks the price of bitcoin like a shadow, has recently diverged from its underlying.

If corporate crypto treasuries lose momentum, one must raise questions about the sustainability of their business model.

After all, the proliferation of the bitcoin ETFs and futures products across most major brokerages and wire houses have made Bitcoin holding companies much less valuable.

It’s likely corporate treasuries will need to venture into other business lines – where crypto lenders, brokerages, and derivatives desks have already built a bespoke ecosystem – in order to remain competitive for investor’s attention and their dollars. Think crypto-backed lending, token-linked convertibles, structured payouts, etc.

As more questions are raised about the sustainability of corporate treasuries, the risk is that both investors and index providers shift their preference away from corporate treasuries towards crypto native companies with real operating businesses.

Sources: YCharts, James Seyffart

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)