The Sandbox Daily (10.12.2022)

3rd quarter earnings season preview, Cathie Wood and her ARKK, SPAC King Chamath Palihapitiya, Producer Price Index (PPI)

Welcome, Sandbox friends.

Today’s Daily discusses the earnings season preview from FactSet, the staying power of Cathie Wood’s ARK Innovation Fund, an update on SPAC king Chamath Palihapitiya, and the Producer Price Index (PPI) report for September.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.05% | Dow -0.10% | Russell 2000 -0.30% | S&P 500 -0.33%

FIXED INCOME: Barclays Agg Bond +0.08% | High Yield +0.17% | 2yr UST 4.295% | 10yr UST 3.902%

COMMODITIES: Brent Crude -2.33% to $92.41/barrel. Gold +0.50% to $1,677.5/oz.

BITCOIN: +0.93% to $19,191

US DOLLAR INDEX: -0.03% to 113.257

CBOE EQUITY PUT/CALL RATIO: 0.77

VIX: -0.18% to 33.57

FactSet earnings season preview

It's earnings season, with the S&P 500 heavyweights PepsiCo and Delta Air Lines and the big banks set to report 3rd quarter results this week. Investors' big fear: companies will reveal that the combination of inflation and slowing economic growth has eaten into profits.

Just 65 companies in the S&P 500 have warned that 3rd quarter results are likely to disappoint, while 41 companies have delivered earnings upgrades. And S&P 500 companies are expected to report that on average, revenue jumped by nearly +9% last quarter YoY. But profits are only expected to grow by +2.8% YoY, the most lackluster increase since the worst days of the COVID pandemic in 2020.

Of the 11 sectors in the S&P 500, only four – energy, airlines, real estate, and consumer discretionary industries like restaurants and hotels – are expected to show overall growth. Without the 21 energy companies in the S&P 500, the bottom lines of the remaining companies would actually drop, by -4.2% on average, according to Bank of America. Meaning, the earnings growth is coming from the energy sector.

Lastly, the strong dollar is bad news for multinational companies. Although the recent rise in the dollar is a boon to U.S. travelers, it's bad news for exports, which make up about 40% of sales for S&P 500 companies. A strong dollar means American goods are more expensive to overseas buyers, and less profitable back home when foreign revenues are converted into dollars.

Source: FactSet

The staying power of Cathie Wood’s ARKK

The ARK Innovation ETF (ARKK), the flagship product of Ark Investment Management and its Chief Investment Officer Cathie Wood, is an actively-managed Exchange Traded Fund (ETF) that seeks investment in companies of disruptive innovation – or the “introduction of a technologically enabled new product or service that potentially changes the way the world works.”

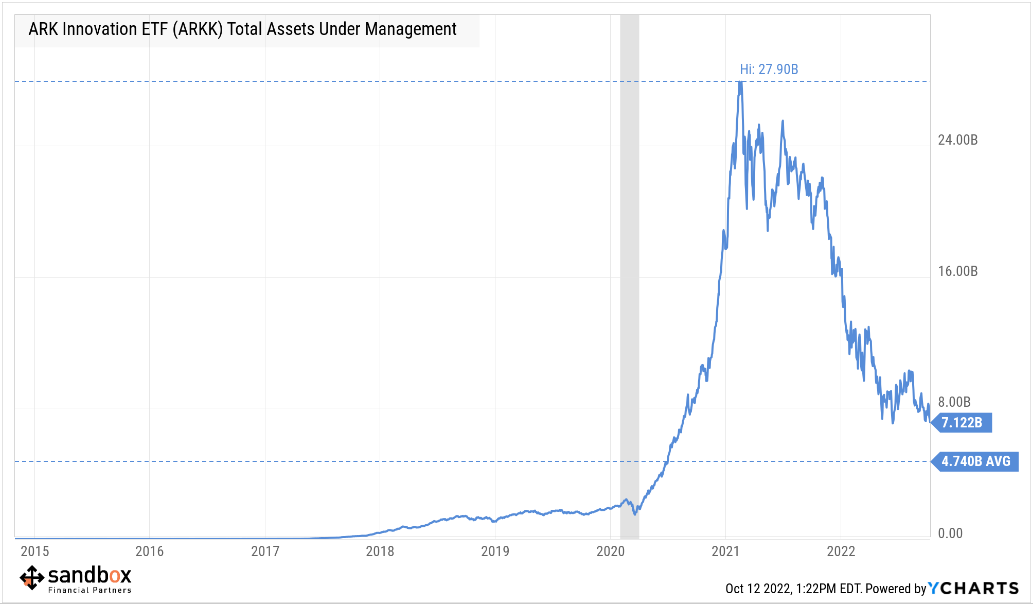

Launched on October 31, 2014 with $2mm in Assets Under Management (AUM), the net flows of the fund capture the story of this niche strategy and its wild ride. Just prior to the pandemic in February 2020, ARKK’s AUM was $2.4bn. It then catapulted many times over to reach an apex of $27.9bn in February 2021 on the heels of low interest rates, investor enthusiasm, and easy monetary policy. Today, ARKK has cooled off as the market has viciously brought down extended P/E multiples and AUM is now $7.1bn. Most astonishing of all, especially in light of its performance history (more on that next), 2022’s net flows into ARKK is +1.2bn, which is among the top 3% of all ETFs.

Meanwhile, ARKK’s performance history looks quite similar to its AUM chart, but is best understood by unbundling its performance across different time horizons.

Inception to February 19, 2020 (pre-COVID high): +196.2% cumulatively, or +22.71% annualized

February 19, 2020 to March 18, 2020 (COVID drawdown): -42.5% cumulatively, or -99.93% annualized

March 18, 2020 to February 12, 2021 (the accumulation phase): +351.4% cumulatively, or +426.94% annualized

February 12, 2021 to October 12, 2022 (bubble bursts): -77.17% cumulatively, or -58.86% annualized

Total performance, since October 2014 inception: +75.71%, or +7.34% annualized

On a risk-adjusted basis, ARKK has been a difficult position to hold throughout its history. However, unlike many former high-flying funds that collapsed after its peak, it is quite possible that ARKK will buck the trend and maintain its popularity among the investing public because it benefits from a unique set of variables: massive liquidity, daily transparency, its role as a complement to index funds, the true believers of disruptive tech, and manager Cathie Wood’s active social media presence. So even in periods of significant underperformance and rising interest rates, ARKK has unique properties that keep investors interested.

Source: Ark Investment Management, Eric Balchunas

SPAC king, dethroned

Speaking of 2021 high-flyers, it seemed at one moment the SPAC trade centered around Chamath Palihapitiya, the venture capitalist and founding partner of Social Capital, co-host of the All-In Podcast, early Facebook executive as early as 2007, part owner of the Golden State Warriors, and self-designated SPAC King.

Chamath championed the market for the Special Purpose Acquisition Company (SPAC) – a blank-check vehicle taking private companies to public markets by going directly to market without the traditional IPO marketing roadshow – by reserving the ticker symbols IPOA to IPOZ with the U.S. Securities and Exchange Commission (SEC), one SPAC for each letter of the alphabet: IPOA, IPOB, IPOC, and so on. Here is a flow chart showing how the process works and the general timeline associated with SPACs.

In 2020 and 2021, Chamath launched four SPACs: Virgin Galactic (SPCE), Opendoor Technologies (OPEN), Clover Health Investments (CLOV), and SoFi Technologies (SOFI). With interest rates held near 0% and market momentum fueling inflows into non-cash generating Tech investments, Chamath’s SPACs initially did just fine. But, when central banks around the world started to announce tandem interest rate hiking cycles and Quantitative Easing (QE) monetary policies, the party was over. These stocks have had a rough go of it over the last year – all down more than 70%.

What’s more, Mr. Palihapitiya announced he was closing two SPACs last month without merging with an acquisition target and thus returning $1.6 billion to investors. Two simple reasons: valuation and volatility. Folding his cards and walking away from the table. This seemed like the perfect bookend to close the window on the SPAC craze of 2019-2021.

Source: Chamath Palihapitiya Substack, TechCrunch, Bloomberg, PricewaterhouseCoopers

Producer price inflation hotter than expected

The Bureau of Labor Statistics reported its Producer Price Index (PPI) climbed +0.4% in September after a -0.2% decline in August. Economists had forecasted a slower rate of +0.2%. Compared to a year earlier, the headline PPI index was up +8.5%, down from +8.7% in August as energy prices eased. Excluding the more volatile components of food and energy, core PPI prices rose +0.3% last month and are up +7.3% YoY.

Both headline PPI and core PPI had peaked earlier this year but remain several times higher than pre-pandemic, as cost pressures are still elevated.

Source: Ned Davis Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.