The Sandbox Daily (10.13.2022)

Reflecting on today's Consumer Price Index (CPI) report for September

Welcome, Sandbox friends.

Today’s Daily discusses the talk of the tape -> the Consumer Price Index (CPI) report from September. Everything else took a back seat to today’s wild price action.

Let’s dig in.

Markets in review

EQUITIES: Dow +2.83% | S&P 500 +2.60% | Russell 2000 +2.41% | Nasdaq 100 +2.30%

FIXED INCOME: Barclays Agg Bond -0.33% | High Yield +0.22% | 2yr UST 4.468% | 10yr UST 3.956%

COMMODITIES: Brent Crude +2.48% to $94.70/barrel. Gold -0.29% to $1,672.7/oz.

BITCOIN: +1.37% to $19,402

US DOLLAR INDEX: -0.76% to 112.464

CBOE EQUITY PUT/CALL RATIO: 0.74

VIX: -4.86% to 31.94

CPI shows inflation rages on

The Consumer Price Index (CPI) increased +0.4% MoM in September, above the consensus of +0.3%. The main drivers were essentials such as shelter, food, and medical care. Gasoline prices declined, mostly due to continued draws on the Strategic Petroleum Reserve (SPR), providing some temporary respite for consumers. But core CPI, which excludes the more volatile food and energy components, jumped another +0.6% MoM, a repeat of the prior month’s gain, and above the consensus of +0.5%.

On a YoY basis, the headline CPI print eased to +8.2% from +8.3% in the prior month. But core CPI inflation accelerated to +6.6% from +6.3% in the month before. It blew past its previous peak of +6.5% back in March and is now the highest inflation rate since August 1982!!

Source: Ned Davis Research, Bloomberg

Diving into the details

Some categories are still showing persistent and extreme behavior (food, natural gas, transportation), while others show continued easing (gasoline, used cars).

Now here is that same data but showing the year-over-year changes to highlight some of the extremes at the top end.

Fuel Oil: +58.1%

Gas Utilities: +33.1%

Gasoline: +18.2%

Electricity: +15.5%

Transportation: +14.6%

Food at home: +13.0%

New Cars: +9.4%

Overall CPI: +8.2%

Used Cars: +7.2%

Shelter: +6.6%

Medical Care: +6.5%

Source: U.S. Bureau of Labor Statistics, Charles Schwab

The shelter category is most concerning

The owners’ equivalent rent (OER) category increased +0.8% MoM, the largest monthly increase in that index since June 1990. OER is up +6.7% YoY and now climbing to fastest pace on record. This is painful for the average American and continues to speak to the housing affordability crisis gripping so many people.

Keep in mind that while home price growth has already started to moderate, there is a significant policy lag of 12 to 18 months before that is reflected in a meaningful way in the CPI data itself. As a result, shelter will continue to be a source of higher inflation into 2023. The Shelter category accounts for 32.5% of headline inflation.

Source: U.S. Bureau of Labor Statistics, Liz Ann Sonders

The Fed’s difficult proposition

Such broad-based inflation pressures continue to reflect supply/demand imbalances. Consumer demand remains strong – supported by low unemployment, excess savings accumulated during the pandemic, and the ongoing post-pandemic shift back toward more services consumption versus goods. At the same time, while some supply chain problems have eased, others such as labor shortages have endured. This underscores the difficult task for the Fed to bring inflation down without causing a recession – the desired “soft landing.”

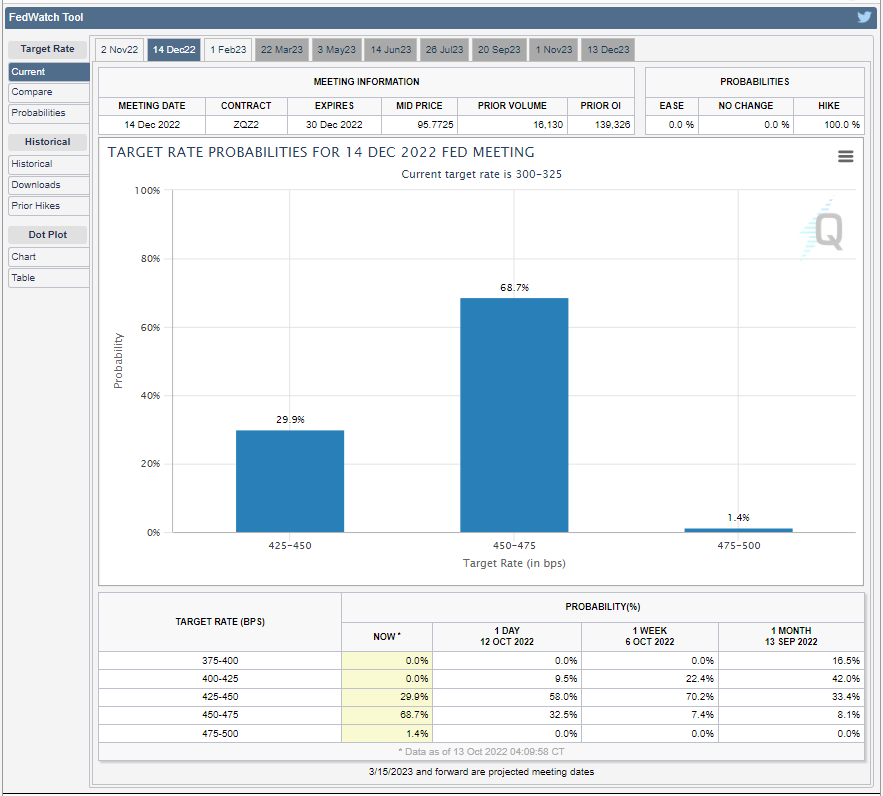

The Federal Reserve’s upcoming policy meeting is November 1-2. With this singular data point, Fed rate hike expectations turned decidedly hawkish following today’s CPI report and suggests the Federal Reserve has more work to do in the months ahead. The market now prices another 0.75% rate hike at the next meeting at a near 100% certainty.

In fact, the Fed’s December 13-14 meeting – the final FOMC meeting in 2022 – is strongly suggesting (68.7%) a 0.75% rate hike. One week ago, the market had only priced a 7.4% chance of a 75 bps hike!

The Federal Reserve has already hiked the target interest rate 300bps. The market is now implying two more consecutive 75 bps hikes. By the end of 2022, it is looking like the Fed Funds rate will be 4.50% - 4.75% after starting the year at 0.00% - 0.25%!!

Source: CME FedWatch Tool

The Fed fell way behind the curve

During the Federal Open Market Committee (FOMC) meetings, the Fed Presidents release their report Summary of Economic Projections that shows the committee’s projections of key economic data, including but not limited to gross domestic product (GDP) growth, the unemployment rate, inflation, and the target Federal Funds Rate range. As recently as June 2021, the Fed committee projected the Fed Funds target range to be 0.1%-0.6%. Now, we are looking at a possible range of 4.50% - 4.75% by year’s end. The smartest people in the room who are directing Monetary Policy swung and missed badly! This will be a major stain on their credibility for years to come.

Source: Federal Reserve

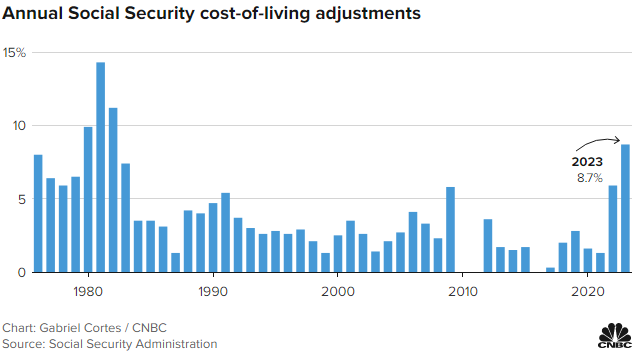

Social Security cost-of-living adjustment will be 8.7% in 2023, highest increase in 40 years

One silver lining to this inflation mess? The annual COLA adjustment. Social Security beneficiaries will get an 8.7% increase to their benefits in 2023, the highest increase in 40 years. The average Social Security retiree benefit will increase $146 per month, to $1,827 in 2023, from $1,681 in 2022.

“This is a really exceptionally good news day for older Americans, because their COLA is going up, their [Medicare] premiums are going to go down, and that means a lot more money in everyone’s pocket every month,” said Cristina Martin Firvida, vice president of government affairs at AARP.

Source: Social Security Administration, CNBC

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.