The Sandbox Daily (10.14.2022)

Stock volatility, Moët Hennessy Louis Vuitton, and a weekly market recap

Welcome, Sandbox friends.

Today’s Daily discusses the volatility strangling U.S. equity markets, fashion juggernaut Moët Hennessy Louis Vuitton, and a brief recap to snapshot the week in markets.

Let’s dig in.

Markets in review

EQUITIES: Dow -1.34% | S&P 500 -2.37% | Russell 2000 -2.66% | Nasdaq 100 -3.10%

FIXED INCOME: Barclays Agg Bond -0.48% | High Yield -0.32% | 2yr UST 4.496% | 10yr UST 4.022%

COMMODITIES: Brent Crude -3.01% to $91.72/barrel. Gold -1.60% to $1,650.2/oz.

BITCOIN: -0.94% to $19,183

US DOLLAR INDEX: +0.83% to 113.301

CBOE EQUITY PUT/CALL RATIO: 0.66

VIX: +0.25% to 32.02

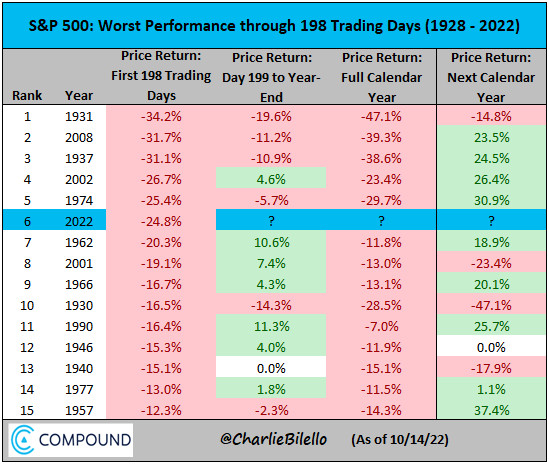

A most volatile year for stocks

The S&P 500 index fell -2.37% today, its 53rd decline of 1% or more this year. That's already the most downside volatility we've experienced since 2009. AND there's still two and a half months to go…

We can only find a few years in history in which the S&P 500 index was down more than 2022 at this point in time (198 trading days):

1931 (Great Depression)

2008 (Global Financial Crisis/Recession)

1937 (Recession)

2002 (Dot Com Bubble/Recession)

1974 (High Inflation/Recession)

Source: Charlie Bilello

LVMH’s resilience gives luxury space a boost amid economic gloom

With geopolitical turmoil, soaring inflation and sinking stock markets, you might not imagine the current economic landscape would make the best backdrop for luxury goods spending sprees. LVMH’s latest results, however, strongly suggest otherwise.

Moët Hennessy Louis Vuitton (LVMH) reported on Tuesday that its sales had jumped 28% in the first 9 months of 2022, a remarkable growth rate especially after achieving a record year in 2021. Sales in their Fashion and Leather Goods division jumped a particularly impressive 31%.

If you think of a random high-end luxury product, there’s a reasonable chance it is owned by LVMH. The company’s 75 brands, which LVMH calls "houses," include Louis Vuitton, Christian Dior, Tag Heuer, Loro Piana, Bulgari, Hublot and — the most recent addition — Tiffany & Co.

Founded in 1987 following the merger of Louis Vuitton and Moët et Chandon and Hennessy, LVMH’s CEO Bernard Arnault has been a prolific dealmaker in the luxury space, with, ironically, an eye for a bargain. The company’s ~$16bn acquisition of Tiffany & Co. last year, which roughly doubled the size of their Watches & Jewelry division, is a classic move of the company’s buy-scale-diversify playbook.

Arnault, who has been dubbed the "wolf in cashmere," isn't resting on his laurels. LVMH has recently acquired a minority stake in Queens based brand Aimé Leon Dore.

Source: Chartr

The week in review

Stocks: Stocks finished mostly lower as Thursday’s release of the September Consumer Price Index report added to market volatility. On Thursday, the S&P 500 Index’s rally marked the fifth largest intraday reversal from a low in the history of the index while breaking a six-day losing streak. Investor sentiment, as measured by the spread between bulls and bears in the American Association of Individual Investors (AAII) data, is still in extreme territory as it is more than two standard deviations below its long-term average.

Bonds: The Bloomberg Aggregate Bond Index finished the week lower as yields increased as Thursday’s hotter-than-expected inflation report raised expectations that the Fed will maintain its hawkish stance for the rest of this year. High Yield corporate bonds, as tracked by the Bloomberg High Yield index, lost ground for the week, following their equity counterparts. The move higher in Treasury yields this year has put upward pressure on most other business and consumer interest rates, as well residential mortgage rates.

Commodities: After OPEC+ announced a 2 million barrel per day reduction in oil production last week in which oil gained over 10%, the commodity actually lost ground over the course of the week. The metals finished negative for the week as both gold and silver lost ground after finishing higher for the prior two straight weeks.

September’s Sticky CPI: September headline inflation eased slightly to +8.2% year-over year from +8.3% in August. Core inflation rose +6.6% from a year ago, the highest rate since 1982. The nagging pressure on core inflation will likely put pressure on the Federal Reserve to stay aggressive. The biggest risk is inflation becoming entrenched in some sectors such as services as inflation cools in other sectors.

Fed Talk: The Federal Reserve released minutes from their September meeting. The Fed will calibrate the pace of tightening according to global conditions. The Committee will take into account financial and international developments, and this reassurance from the Fed should provide some relief for investors nervous about the ripple effects from volatility in the currency markets and derivatives markets. The Minutes confirmed Fed officials are watching the job openings rate for clues about labor market tightness.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.