The Sandbox Daily (10.4.2022)

August JOLTS report, ten worst SPX calendar year starts, cryptocurrency, 10-yr U.S. Treasury, U.S. dollar, and 3 billion people who can't afford a healthy diet

Welcome, Sandbox friends.

Today’s Daily discusses the easing of labor conditions as reported in today’s Job Openings and Labor Turnover Survey (JOLTS) August report, the ten worst S&P 500 starts to a year, reviewing the state of cryptocurrency, historical context to the rise in the 10-yr U.S. Treasury rate, the U.S. dollar takes a breather, and the share of global population unable to afford a healthy diet.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +3.91% | Nasdaq 100 +3.14% | S&P 500 +3.06% | Dow +2.80%

FIXED INCOME: Barclays Agg Bond +0.26% | High Yield +2.15% | 2yr UST 4.097% | 10yr UST 3.635%

COMMODITIES: Brent Crude +3.55% to $88.61/barrel. Gold +1.54% to $1,734.1/oz.

BITCOIN: +3.64% to $20,289

US DOLLAR INDEX: -1.32% to 110.204

CBOE EQUITY PUT/CALL RATIO: 0.71

VIX: -3.42% to 29.07

Early signs of labor slack

Signs of softening labor demand have begun to emerge, although labor market conditions are still too tight for the Fed’s comfort. Job openings sharply plunged -10.0% to 10.053 million in August, the lowest level since June 2021, per today’s Job Openings and Labor Turnover Survey (JOLTS) report from the Labor Department. It was the 4th decline in the past 5 months, and the 1.1 million decline in vacancies was the biggest drop since April 2020. Excluding the pandemic, it was the biggest monthly drop in job openings since July 2009.

While the number of vacancies remains extremely high on an absolute basis, the ratio of job openings per unemployed fell to 1.67 from 1.97 in the prior months, indicating some easing in labor market conditions. Although the labor market is still far from balanced, the downtick in this ratio points to some moderation in wage growth.

At the same time, the quits rate, a measure of voluntary job leavers as a share of total employment, held at 2.7% as some 4.2 million Americans quit their jobs in August – the quits rate is off its cycle peak in late 2021 but higher than at any time in the prior two expansions. It shows that worker optimism about future job prospects remains high.

Elsewhere, Layoffs picked up 5.0% to 1.460 million, the highest level since March 2021, although that is still well below the pre-pandemic level of about 1.9 million. Hires were little changed, ticking up 0.6% to 6.277 million.

Source: Ned Davis Research, Bloomberg

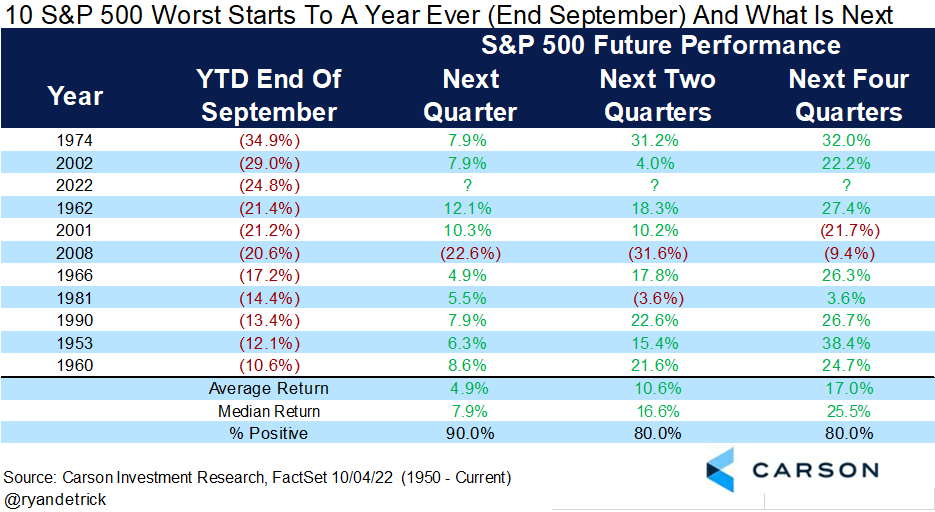

Ten worst SPX starts to a year (since 1950)

2022 is the third worst start to a year ever for the S&P 500 (since 1950). When looking at forward prospective returns, the following quarter was up nine of ten times, with 2008 as the major exception. A year later? Higher eight times with an average return of +17.0%. Stocks don’t have to bounce right here, but history suggests it is more likely than not. And when you consider current sentiment, positioning, and market internals, this market could be overdue for a bounce.

Source: Ryan Detrick, CMT

Crypto state of play

September’s market swoon for risk assets had investors thinking of the old Green Day song, “Wake Me Up When September Ends.” Equities have now declined six of the last seven weeks and the September performance was particularly jarring (especially in light of price action since January 1st) – the Dow fell -8.84%, S&P 500 fell -9.34%, and the Nasdaq 100 slipped -10.60%.

Both Bitcoin and Ether also traded down, but it seems the major crypto assets have recently decoupled from their high correlation with legacy equity markets. Since the summer lows, neither Bitcoin nor Ether have put in new year-to-date lows, holding above key long-term support levels – unlike their equity counterparts. What’s more, the absolute performance off the summer bottom for both bitcoin (+9.2%) and ether (+47.5%) is notable.

What’s hard to ignore is the lack of volatility in the most long-duration asset on the market: Bitcoin. Below is All Star Charts quantifying volatility through the width of the standard 20-day Bollinger bands – demonstrating Bitcoin’s price stability is at the highest level in over two years. As Bitcoin price action has coiled between 18000-24000, a period of shrinking volatility like this historically has often been met with violent unwinds – in either direction. So when we see these periods of notable reductions in volatility, pay close attention because the resolution often sets the tone for weeks and months to come.

Source: Eaglebrook Advisors, All Star Charts

Historical context to the rise in the 10-yr U.S. Treasury rate

The yield on the 10-year Treasury yield is up over 3.4% from its August 2020 lows and has already seen the biggest move higher in yields since 1983-84, when rates moved higher by 3.8%. Since the 1980s, the average trough-to-peak increase in 10-year Treasury yields has been closer to 2.5%, but that includes large rate increases in early 1980s when Treasury yields were much higher. Since 2000, the average increase in the 10-year yield during major moves higher is only around 1.8%. Clearly, we’re not in normal times but the move on the 10-year Treasury yield since it bottomed in August 2020 has been significant.

Because of the Fed’s stated desire to front-load rate hikes to anchor long-term inflation expectations, the current rate hiking cycle is the most aggressive campaign since the early 1980s in both the speed and magnitude of rate hikes. The Fed has signaled that more interest rate hikes will likely be necessary to arrest the generationally high consumer price increases we’re currently experiencing. Markets have priced in a terminal fed funds rate around the mid-4% area.

Source: LPL Research

Dollar takes a breather

Today was a big drop for the U.S. Dollar Index, dropping -1.32% and its fifth straight daily decline. The dollar has round-tripped its post-September FOMC meeting spike and is back to where it traded on September 6th. If dollar weakness persists, risk assets should continue to catch a bid as the strong dollar had been a major headwind to risk appetite.

Source: Bespoke Investment Group

The share of population unable to afford a healthy diet

According to the UN Food and Agriculture Organization (FAO), more than 3 billion people could not afford a healthy diet in 2020, an additional 112 million more people than in 2019. The increase was partly because of rising food prices, with the average cost of a healthy diet rising by 3.3% from 2019 levels.

Surely, this trend will (unfortunately) continue in the wrong direction once we see data on 2021 and 2022 – given the outrageous food costs that’s been reported in government inflation data. As of August 2022, the FAO food price index was up 40.6% from average 2020 levels.

This map shows the share of people unable to afford a healthy diet in 138 different countries, as of 2020 (latest available data).

Source: Visual Capitalist

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.