The Sandbox Daily (10.5.2022)

Twitter, OPEC+, small caps, EV battery manufacturers, the Fed's balance sheet

Welcome, Sandbox friends.

Today’s Daily discusses the abrupt Twitter announcement that Elon Musk is honoring the Merger Agreement at $54.20, the OPEC+ announcement to sharply cut to global oil production, a big thrust in small caps, the top EV battery manufacturers, and the Federal Reserve’s balance sheet.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.08% | Dow -0.14% | S&P 500 -0.20% | Russell 2000 -0.74%

FIXED INCOME: Barclays Agg Bond -0.52% | High Yield -0.39% | 2yr UST 4.146% | 10yr UST 3.755%

COMMODITIES: Brent Crude +2.04% to $93.67/barrel. Gold -0.31% to $1,725.1/oz.

BITCOIN: -0.44% to $20,261

US DOLLAR INDEX: +1.04% to 111.209

CBOE EQUITY PUT/CALL RATIO: 0.72

VIX: -1.79% to 28.55

Twitter confirms Elon Musk’s buyout offer, says transaction will close at $54.20 per share

Elon Musk is buying Twitter, after all.

After months disparaging the target company and spending countless (billable) hours trying to back out of the ironclad Merger Agreement, Elon Musk and his legal team abruptly reversed course and submitted in writing their intention to proceed in closing of the transaction undersigned on April 25, 2022 per the original terms and conditions, as well as the offering price of $54.20 – valuing Twitter at $44 billion, a rich valuation given the market reset in 2022.

In the end, Elon Musk decided to buy Twitter for $44 billion after deciding to not buy Twitter for $44 billion.

Source: Dr. Parik Patel

OPEC+ announces sharp cut to global oil production

The Organization of Petroleum Exporting Countries and its allies (OPEC+) today formally agreed to a 2 million barrels per day oil reduction in quotas from November onward, as the announcement comes amid one of the tightest oil markets on record and ahead of a potential decline in Russian exports later this year. OPEC+'s stated rationale behind the cuts was two-fold. First, they acknowledged heightened macro concerns that require a proactive approach to stabilize the market and protect their own economies from the risk of a global slowdown. Second, they maintain that the world is too short of spare capacity, and that oil prices need to be higher (especially relative to other energy prices) in order to incentivize appropriate investment.

The headline cut will not only further tighten fundamentals – lending support to prices – but also help remedy the large exodus of oil investors that has left prices underperforming both fundamentals and other cyclical asset classes.

“The president is disappointed by the shortsighted decision by OPEC+ to cut production quotas while the global economy is dealing with the continued negative impact of Putin’s invasion of Ukraine,” the White House said in a statement after the meeting.

Source: Goldman Sachs

A big thrust for small caps

Stocks and risk assets kicked off the new week, month, and quarter on very strong footing. The chart below shows the two-day rate of change in the iShares Russell 2000 ETF (IWM).

With the exception of the pandemic lows of early 2020, we’d have to go all the way back to 2011 to find a two-day stretch as favorable as Monday and Tuesday.

Short-term breadth thrusts like these mean little without confirmation. Not only do we need price to confirm the action, we need additional longer-term breadth thrusts to follow and validate the current one

Source: All Star Charts

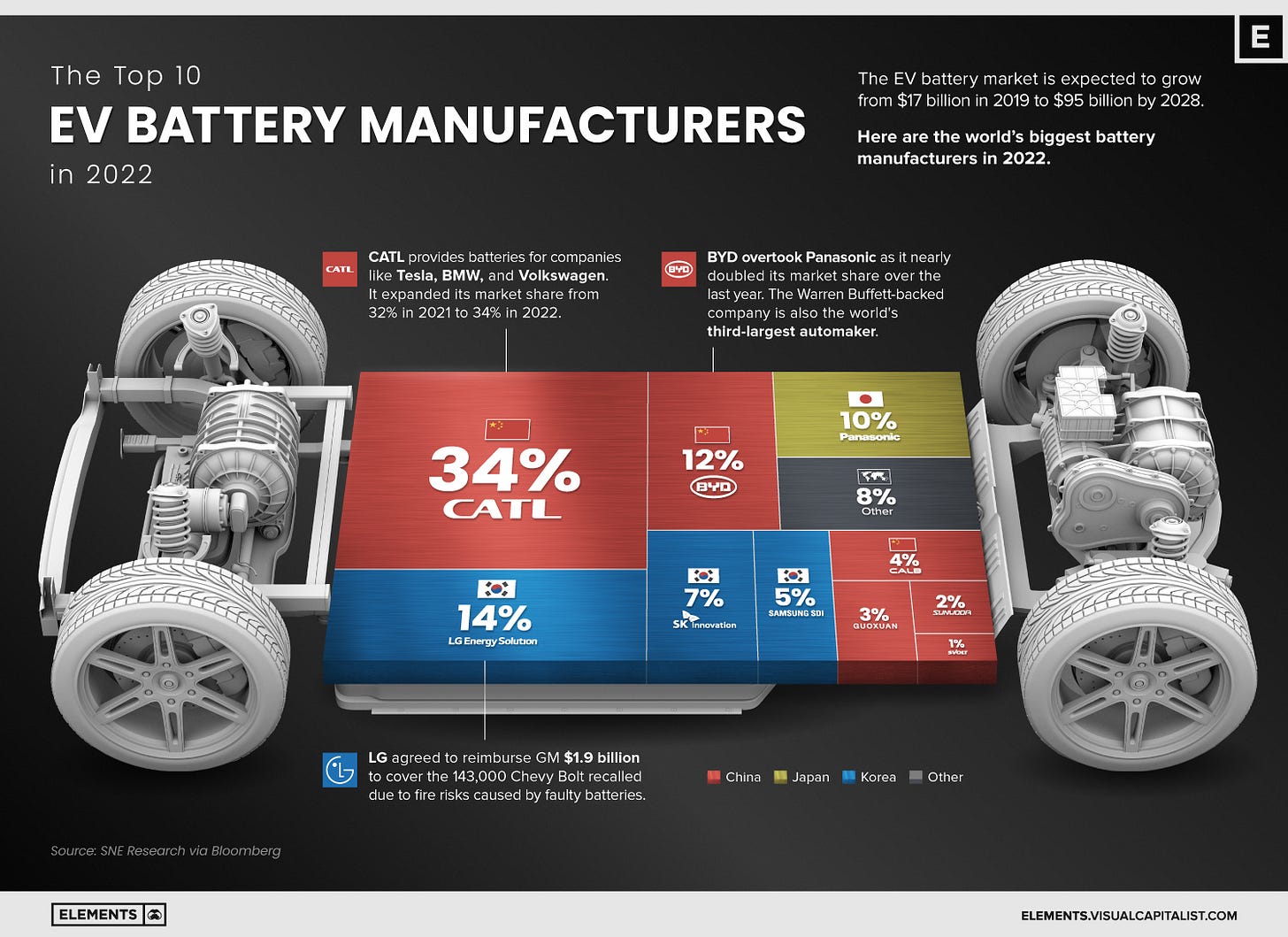

Top 10 EV battery manufacturers in 2022

The global electric vehicle (EV) battery market is expected to grow from $17 billion to more than $95 billion between 2019 and 2028. With increasing demand to decarbonize the transportation sector, companies producing the batteries that power EVs have seen substantial momentum. Despite efforts from the United States and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers. The top 10 producers are all Asian companies – currently making up 56% of the EV battery market, followed by Korean companies (26%) and Japanese manufacturers (10%).

Electric vehicles are here to stay, while internal combustion engine (ICE) vehicles are set to fade away in the coming decades. As battery makers work to supply the EV transition’s increasing demand and improve energy density in their products, we can expect more interesting developments within this industry.

Source: Visual Capitalist

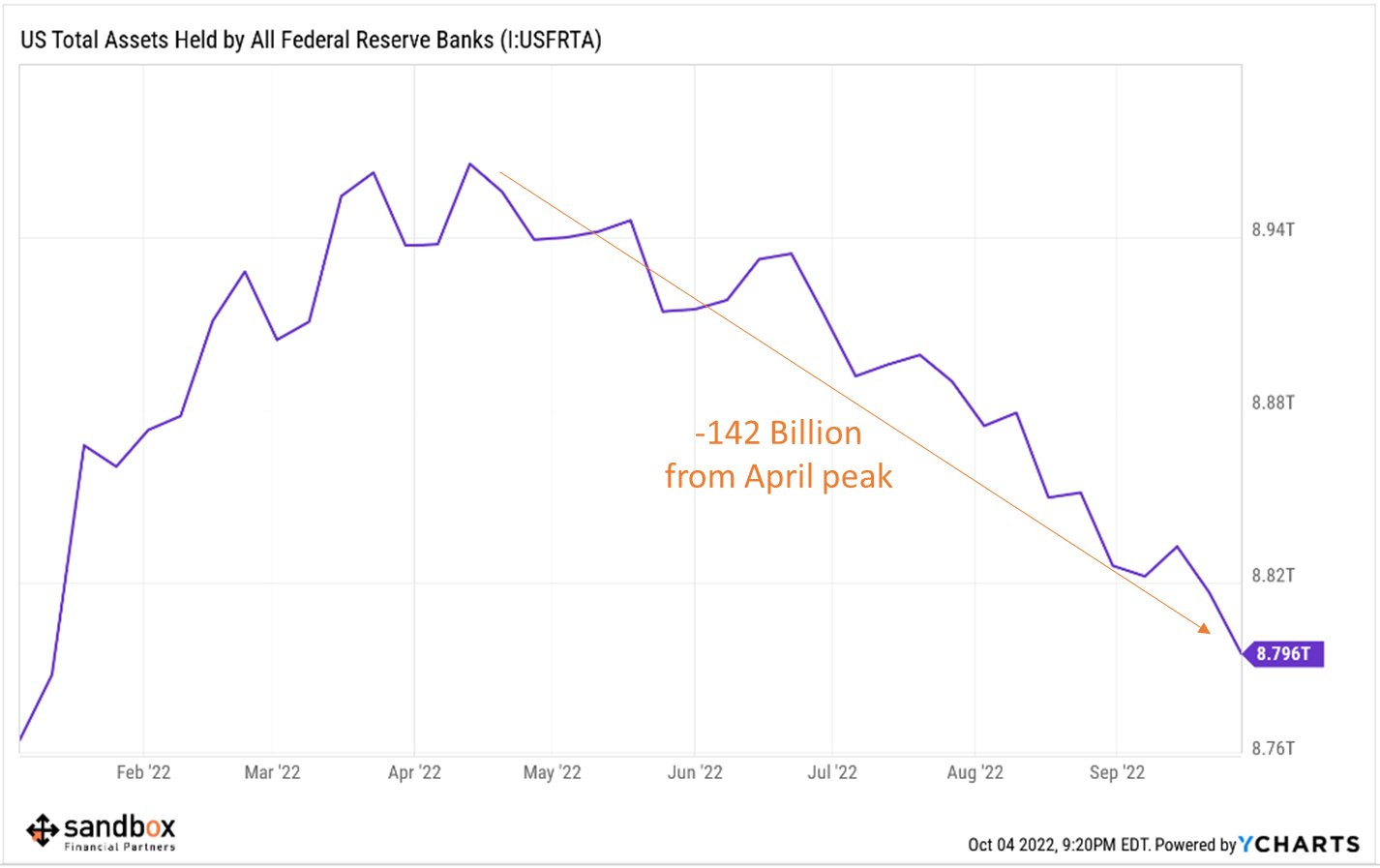

The Fed’s balance sheet

One major headwind to U.S. Treasury prices is the Federal Reserve exiting the market as it unwinds its +$9 trillion portfolio – meaning the Fed is no longer an active buyer. If you recall, during the pandemic, the Fed was purchasing U.S. Treasury securities and agency mortgage-backed securities (MBS) to foster smooth normal market functioning and support the flow of credit to households and businesses by providing accommodative financial conditions.

Now, the Fed has reversed course and initiated various policy measures to tighten financial conditions as it steps up efforts to stomp out persistent inflation. As part of its Quantitative Tightening (QT) program, the Fed is allowing $60bn in Treasury bonds & $35bn in mortgage-backed securities (MBS) to mature each month – beginning September 1 after a slimmed down effort over the summer months of $47.5bn/month – without rolling or replacing into new purchases, effectively removing liquidity from the plumbing in the system.

Unfortunately, when we zoom out, the Federal Reserve still has a long way to go in shrinking its balance sheet and reversing the $5 trillion in pandemic stimulus packages. A loooooooonnnnggg way.

Source: Sandbox Financial Partners

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.