The Sandbox Daily (10.7.2022)

TikTok, venture capital, Fed's repo facility, September BLS jobs report, NYSE market breadth, and a weekly market recap

Welcome, Sandbox friends.

Today’s Daily discusses the big numbers behind TikTok parent company ByteDance, venture capital shows a dramatic pullback in funding, a look at the Fed’s repo facility on market liquidity, the September jobs report from the Bureau of Labor Statistics (BLS), breadth on the New York Stock Exchange remains in a bear state of mind, and a brief recap to snapshot the week in markets.

Let’s dig in.

Markets in review

EQUITIES: Dow -2.11% | S&P 500 -2.80% | Russell 2000 -2.87% | Nasdaq 100 -3.88%

FIXED INCOME: Barclays Agg Bond -0.53% | High Yield -1.22% | 2yr UST 4.312% | 10yr UST 3.888%

COMMODITIES: Brent Crude +3.72% to $98.45/barrel. Gold -0.63% to $1,709.3/oz.

BITCOIN: -2.13% to $19,605

US DOLLAR INDEX: +0.46% to 112.747

CBOE EQUITY PUT/CALL RATIO: 0.71

VIX: +2.75% to 31.36

The big numbers behind TikTok parent company, ByteDance

The Wall Street Journal released an in-depth report revealing the latest financials of TikTok’s parent company ByteDance, detailing just how expensive going viral really is. As a private company based in Beijing, ByteDance has closely guarded its finances and doesn’t publicly disclose results, but according to a financial report shared with employees, people are getting a rare look inside the private company’s closely guarded finances.

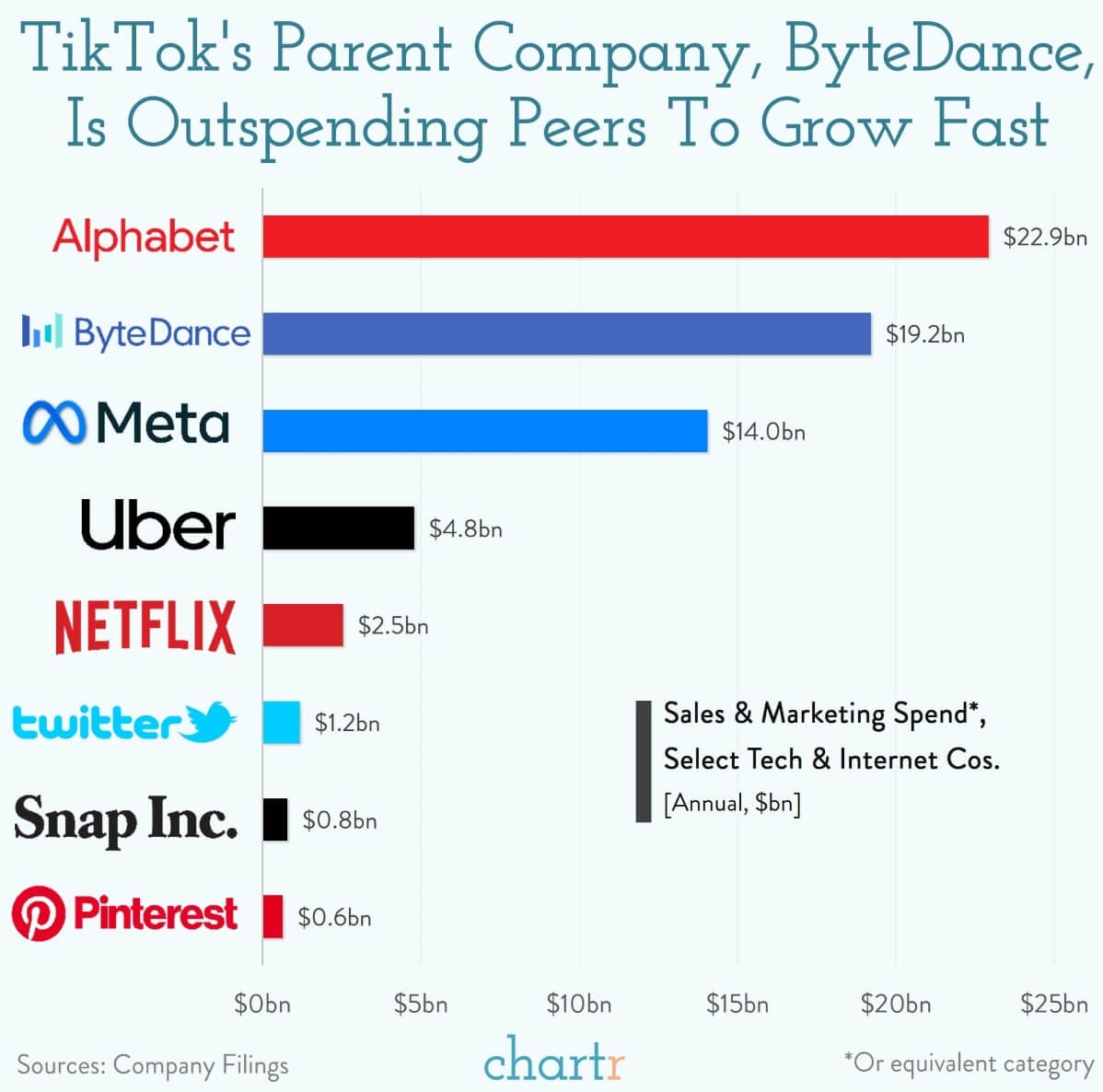

The attention-grabbing number in the WSJ report is ByteDance’s marketing spend where, all told, the company spent $19.2bn last year. That’s about $5bn more on marketing than even Meta Platforms Inc. spends, a company (formerly known as Facebook) that’s part way through a massive rebranding and has captured the largest social media audience on the planet via Instagram and Facebook. ByteDance's level of spend on user acquisition is truly unprecedented — the marketing spends of Snap, Twitter, and Pinterest combined are just one-seventh of the Chinese company's budget.

Impressively, ByteDance — a holding company for multiple tech platforms — are seeing a real return on those marketing dollars. Revenue jumped +80% last year to more than $61.7bn — although costs have also expanded as the company focuses on growth and led to a -$7.15bn operating loss — and it’s easy to understand why they're in a big hurry to get to scale, as social media competition seems to be heating up again after years of little innovation. Meta Platforms has been pouring resources into Reels, their direct competitor to TikTok, and YouTube has introduced YouTube Shorts to attract fans of the short-video format.

Source: Wall Street Journal, Chartr

Global venture capital pullback is dramatic for the 3rd quarter

The big global venture capital pullback we were all expecting is truly here. Venture and growth investors in private companies scaled back their investment pace significantly as the slump in the public markets stretched into the third quarter.

Venture funding for the third quarter of 2022 totaled $81 billion, down by $90 billion (-53%) year over year and by $40 billion (-33%) quarter over quarter, per a report from Crunchbase. Breaking out the $81 billion by category: $7.4bn were Angel/Seed investments, $33.8bn to Early Stage, $35.7bn to Late Stage, and $4.2bn to Technology Growth.

While funding for the most recent quarter will increase a little in the coming months as stealth fundings are announced, this is a huge drop in funding compared to prior quarters. This past quarter is the lowest quarterly funding amount since the first quarter of 2020, with $70.6 billion in venture funding.

There is pressure in the venture funding markets with record funds raised by venture capital firms in 2021 and into 2022. Many believe that this buildup of dry powder will create new investment pressures as we move into 2023.

Source: Crunchbase

The Fed’s repo program is reducing market liquidity

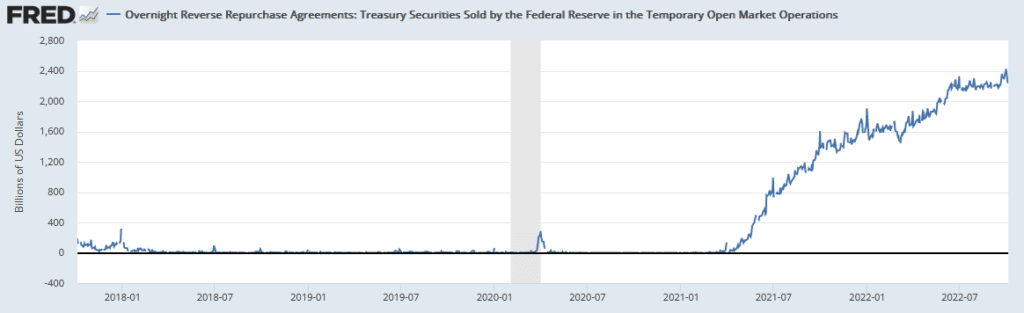

The Federal Reserve has a big hand when it comes to market liquidity. While the Fed's balance sheet, via Quantitative Easing (QE) and Quantitative Tightening (QT), garners a lot of attention from investors, its overnight reverse repo program is not closely followed. The Fed's repo program has been around for almost 20 years, but until late 2021, it was rarely used. The program allows banks and large institutional investors to park cash overnight at the Fed. The Fed uses the repo program to help manage the Fed Funds rate toward its target rate.

The Fed's repo program has become an enticing place to invest cash overnight. The problem, however, is that the cash, aka liquidity, is essentially removed from the banking system. Therefore, the liquidity is unavailable as collateral to buy other assets. As the program grows, liquidity declines. The Fed's repo book peaked at $2.425 trillion on September 30. As of Tuesday, it stands at $2.233 trillion. We would like to see the program decline. In doing so, it will push liquidity back into the markets.

Source: Lance Roberts

Labor market still too tight

The economy added 263,000 nonfarm payroll jobs in September, slightly below the consensus estimate of 275,000 and the slowest monthly gain since December 2020.

The unemployment rate fell to 3.5% (from 3.75%), indicating very little slack in the labor market. This is only a tick higher than the previous low mark of 3.4% in 1969.

Average hourly earnings showed scant signs of easing. They rose a steady +0.3% from the prior month, and were up +5.0% YoY, a modest deceleration from +5.2% in August and a peak rate of +5.6% back in March. Average hourly earnings are growing at a slower pace than inflation and putting a dent in consumer purchasing power.

The market is having mixed feelings from reading the September jobs report. Yes, the persistent gain in jobs could keep alive the dream for a soft landing. But, the tighter labor conditions will likely keep the Federal Reserve on track for another aggressive rate hike next month.

Source: Ned Davis Research, LPL Financial

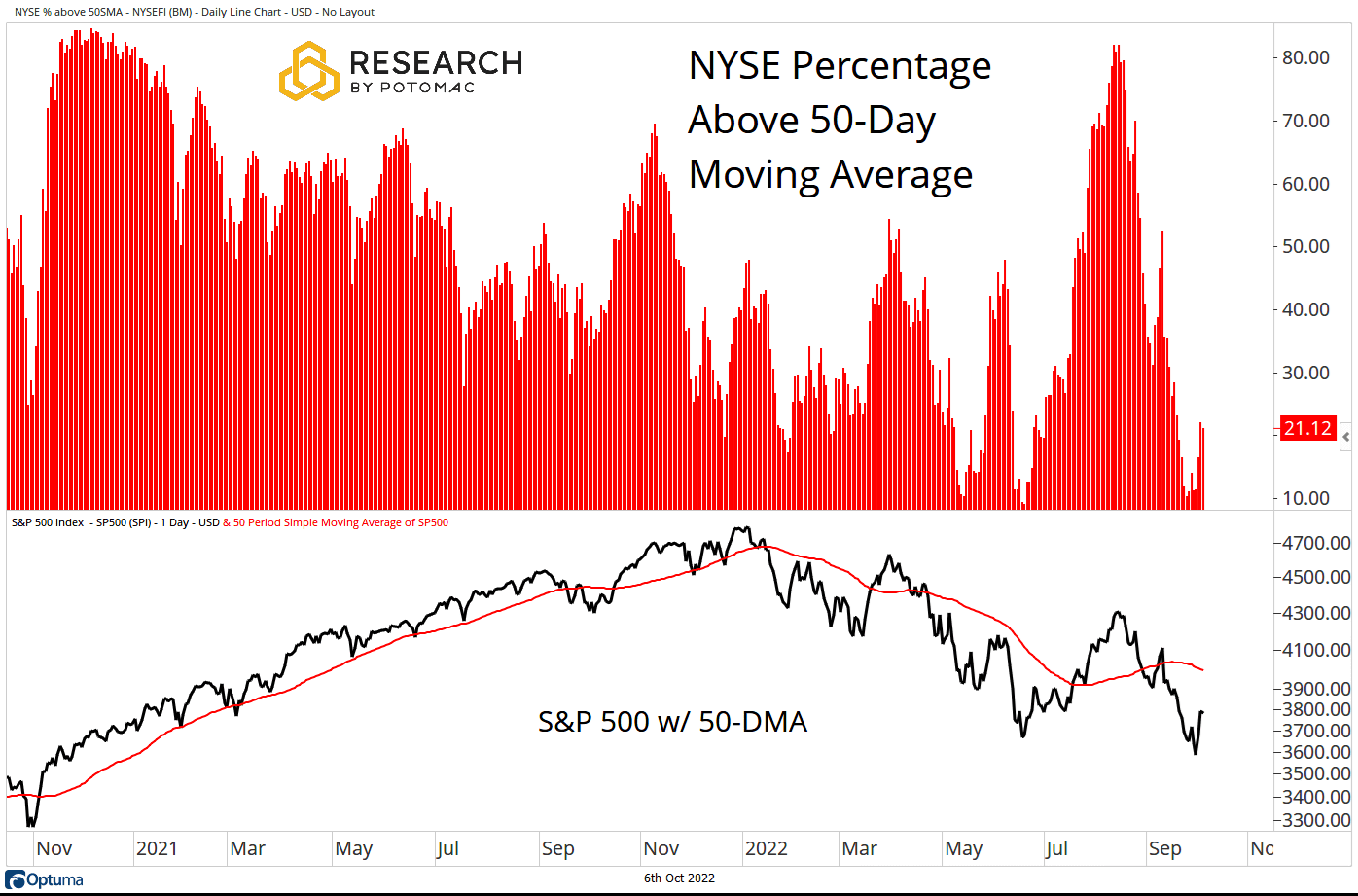

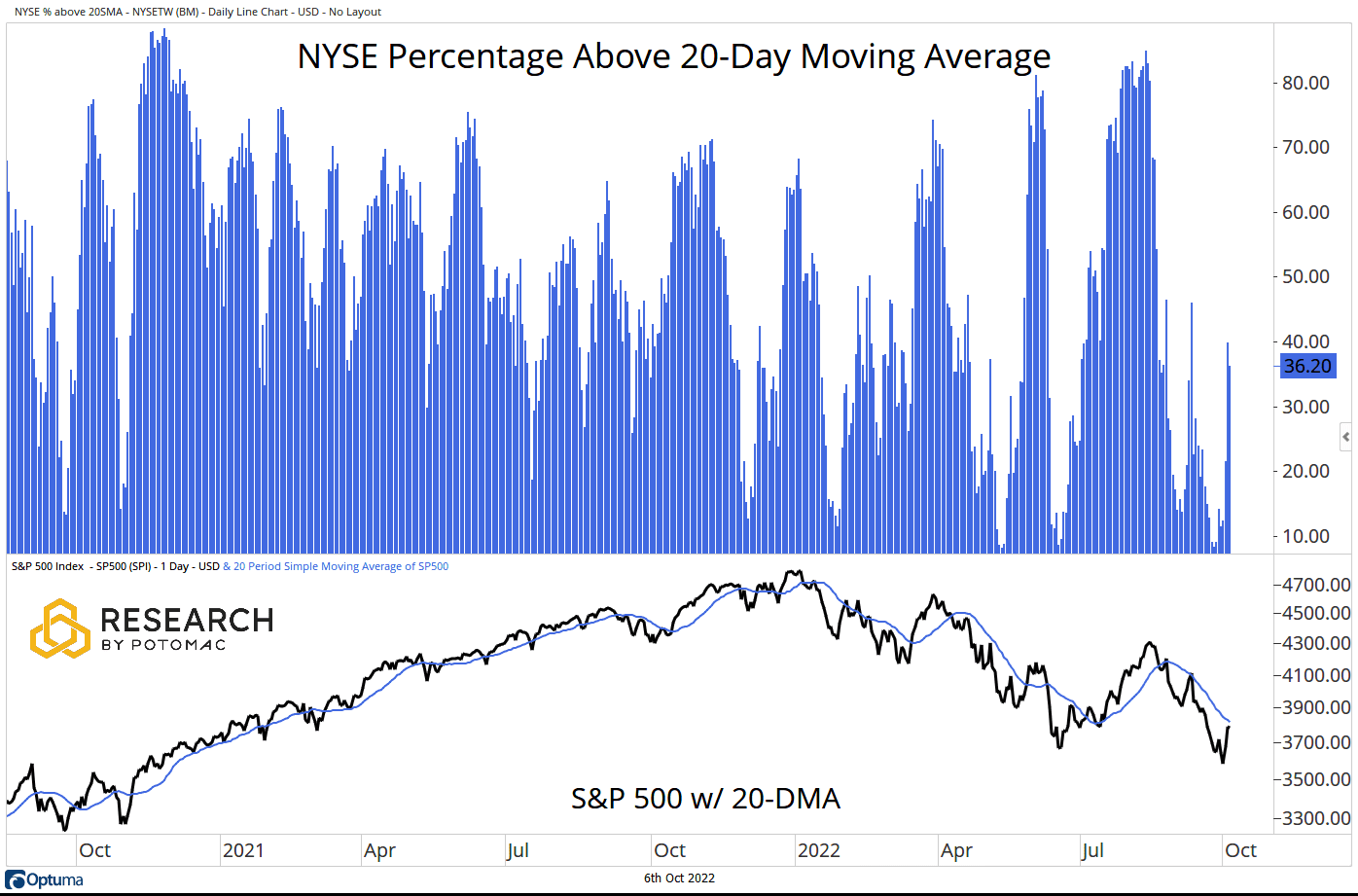

Breadth on the New York Stock Exchange remains in a bear state of mind

The NYSE Advance/Decline Line remains in a downtrend, below the 50-day moving average, after making a low for the cycle last week. There has been a small improvement this week, but there is still a lot of work to be done under the surface of the S&P 500, which is also in a downtrend below a declining 50-day moving average.

The 5-day moving averages of issues on the NYSE making new 52-week and 6-month lows have pulled back as equities have made a countertrend rally this week. While not a requirement for a market bottom, a less intense low would help the bull case. Last week we noted that these metrics hit the same level as were seen in June.

The percentage of NYSE issues trading above their respective 50-day moving averages moved to 21% from 13% last week. The S&P 500 is below its 50-day moving average.

The percentage of issues on the NYSE trading above their respective 20-day moving averages stands at 36%, up from 14% last week. The index remains below its declining 20-day moving average.

Source: Potomac Fund Management

The week in review

Stocks: Stocks finished higher as the S&P 500 Index ends its streak of five losing weeks in the past six. This week’s gains, Friday’s losses notwithstanding, can be credited to deeply oversold conditions and pervasive negative sentiment as the Federal Reserve (Fed) remains unrelenting in its raise-and-hold policy on interest rates. Next week, investors will be eagerly anticipating Thursday’s September Consumer Price Index report as well as the start of the third quarter earnings season.

Bonds: The Bloomberg Aggregate Bond Index finished the week higher as yields declined amid expectations that the Fed will maintain its hawkish stance the rest of this year following Friday’s hotter-than-expected jobs report. High-yield corporate bonds, as tracked by the Bloomberg High Yield index, managed to finish the week higher, mirroring their equity counterparts. This week, the two-year Treasury yield, which is the most sensitive to Fed policy, rose above 4 percent again as it responded to the chorus of Fed speakers underscoring the central bank’s commitment to curbing inflation as the dollar moves higher.

Commodities: Oil prices increased this week as OPEC+ announced a 2 million barrel per day reduction in oil production. This comes on the back of Europe’s continued energy supply concerns stemming from Russia’s invasion of Ukraine. West Texas Intermediate crude oil prices increased more than 10% through the past five days. The metals had a positive showing as both gold and silver have finished higher for the second straight week.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.