The Sandbox Daily (7.19.2022)

EQUITIES: Russell 2000 +3.50% | Nasdaq 100 +3.13% | S&P 500 +2.76% | Dow +2.43%

BONDS: Barclays Agg Bond -0.11% | High Yield 1.32% | 2yr UST 3.242% | 10yr UST 3.028%

COMMODITIES: Crude Oil +0.94% to $107.27/barrel. Gold -0.08% to $1,709.3/ounce.

BITCOIN: +9.10% to $23,513

VIX: -3.16% to 24.50

CBOE EQUITY PUT-CALL RATIO: 0.54

US DOLLAR INDEX: -0.63% to 106.689

Positioning is historically weak = bullish signal

BofA’s survey of fund managers shows extreme risk aversion.

Source: BofA Global Research, The Daily Shot

Crypto rallies as inflation expectations ease

Inflation expectations likely peaked in mid-June with commodities, yields, breakeven rates, and Fed expectations having declined quite rapidly since. On Friday, the University of Michigan’s survey reported a decline in inflation expectations, with consumers expecting one-year ahead inflation to be 5.2% vs. 5.3% prior, and five-to-ten years ahead to be 2.8% vs. 3.1% prior. Bitcoin has rallied 17.7% since the peak in inflation expectations, while Ether has rallied 48.9% - illustrating its ability to bounce when macro conditions warrant.

Source: Eaglebrook Advisors, Bloomberg

China home prices are broadly declining

China’s bank and property stocks rose after regulators sought to defuse a growing consumer boycott of mortgage payments by urging banks to increase lending to developers so they can complete unfinished housing projects. China is looking to stem the protests that have flared up at 100 housing projects across 50 cities, threatening to spread the real estate crisis to the banking system. Regulators met with banks last week to discuss the boycotts, while state media have cited analysts warning that the stability of the financial system could be hurt if more home buyers follow suit. The boycotts over project delays also pose a risk to the broader housing market by keeping potential homebuyers on the sidelines.

Source: Bloomberg, National Bureau of Statistics

ECB is looking more closely at a half-point hike this week

The European Central Bank may consider raising interest rates on Thursday by double the quarter-point it outlined just last month because of the worsening inflation backdrop. Such a move would mark a sharp deviation from guidance that the majority of Governing Council members have stuck to since it was laid out at the June 9 policy meeting and would bring the ECB more in line with the global drive for outsized hikes. The projected rate hike would be the first time in more than a decade.

Source: Bloomberg

Mothers still aren't fully back to work

Employment levels for mothers of young children are still lagging their pre-pandemic mark, according to a new analysis of women's economic recovery from jobs site Indeed. And overall, women's employment has not yet returned to its February 2020 level — although men's employment has, according to the Bureau of Labor Statistics. Though women are almost back to where they were before, the reverberations of this era will linger – women who left the labor market missed out on months of job experience and paychecks which are likely to weigh on gender wage disparities for years to come. On the plus side: the shift to remote work and more flexibility for some workers seems here to say, and has been beneficial to working parents.

Source: Axios, Hiring Lab

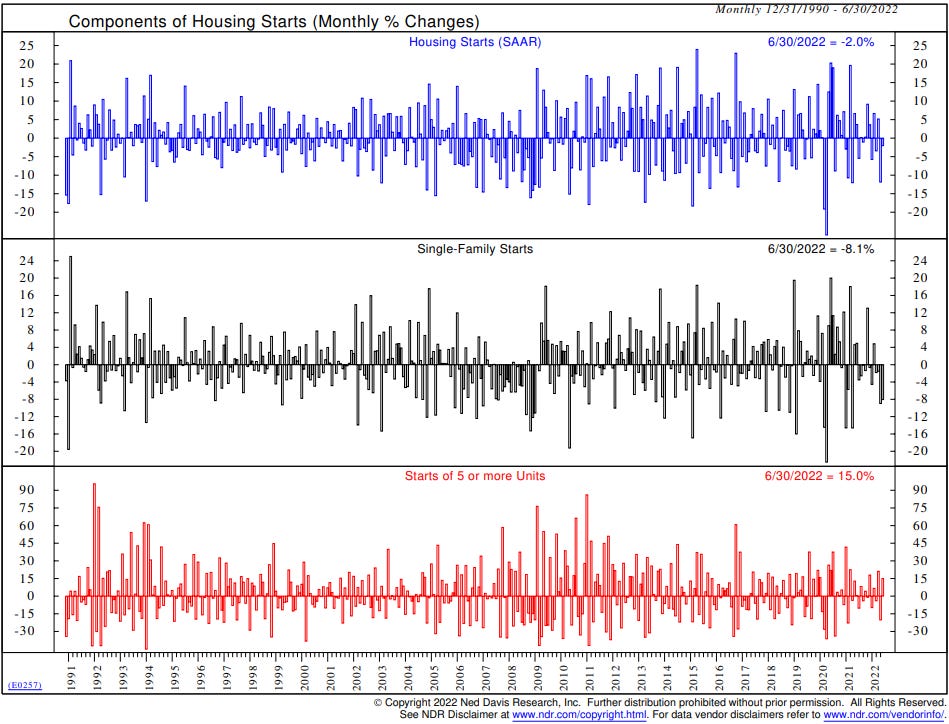

Housing starts decline despite strong multifamily

Housing starts fell 2.0% in June, down in three of the past four months, to a 1.559 million unit annual rate, the lowest level since last September, and slightly below the consensus of a 1.59 million unit rate. The slump in builder confidence in July to its lowest level in this cycle suggests more weakness in housing starts in the coming months. The decline last month was led by an 8.1% slide in single-family starts to a 982,000 unit annual rate, a two-year low. This market segment contracted for the fourth consecutive month and in six of the past seven months. In contrast, multifamily starts rebounded 15.0% to a 568,000 unit annual rate, the second most since January 2020. Looking further back, this was close to the highest level of multifamily construction since 1986.

Source: Ned Davis Research

Economy will be the hot button topic come November

Here is the importance of issues as Americans consider their vote for Congress.

Source: Gallup

That’s all for today.

Blake