The Sandbox Daily (7.20.2022)

EQUITIES: Russell 2000 +1.59% | Nasdaq 100 +1.55% | S&P 500 +0.59% | Dow +0.15%

FIXED INCOME: Barclays Agg -0.08% | High Yield +0.44% | 2yr UST 3.236% | 10yr UST 3.030%

COMMODITIES: Crude Oil -0.60% to $106.71/barrel. Gold -0.93% to $1,712.0/ounce.

BITCOIN: +0.40% to $23,357

VIX: -2.53% to 23.88

CBOE EQUITY PUT/CALL RATIO: 0.59

US DOLLAR INDEX: +0.36% to 107.063

Netflix earnings de-FAANGed?

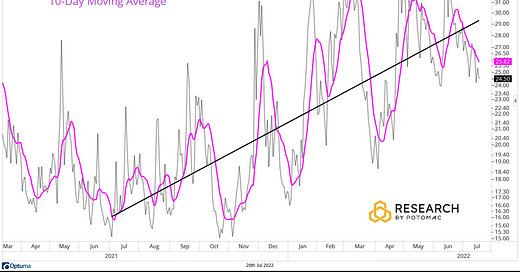

Netflix (NFLX) lost fewer subscribers than expected during the 2nd quarter – after losing 200k subscribers in the 1st quarter of 2022, Netflix said in its earnings report yesterday that an additional 970k subscribers left the platform in the last three months. That’s less than the 2.0mm Netflix had predicted it would lose, but still a notable development given it was the first back-to-back sequential net subscriber loss in its history. Meanwhile, NFLX Q2 revenues were only up +8.6% over the prior year, its slowest YoY growth rate since 2012. Looking to the future, management discussed the plan to unveil its ad-supported tier in early 2023, while also mentioning their desire to crack down on password sharing.

Source: Charlie Bilello, YCharts

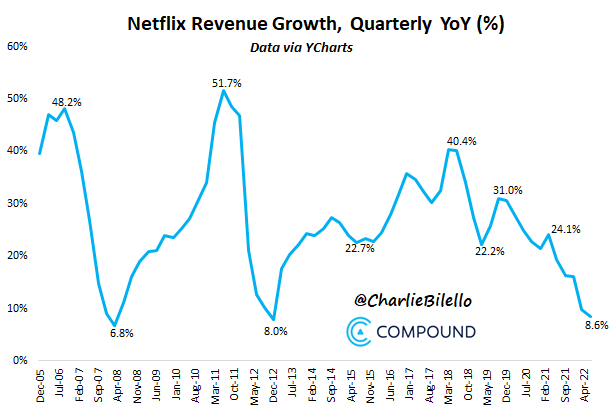

BofA warns investor pessimism is at dire levels with Bull & Bear indicator in the ‘max bearish’ zone

Investors are feeling skittish about the future prospects of the global economy. In its closely watched July Global Fund Manager Survey – headlined “I’m so bearish, I’m bullish” – Bank of America reported a “dire level of investor pessimism.” Global growth and profit expectations sank to an all-time low, while recession expectations were at their highest since the pandemic-fueled slowdown in May 2020. The latest Fund Manager Survey, published Tuesday 7/19, was carried out between July 8 and July 15 and included responses from hundreds of investors who collectively manage hundreds of billions of dollars’ worth of assets.

Source: Bank of America Global Research, Forbes

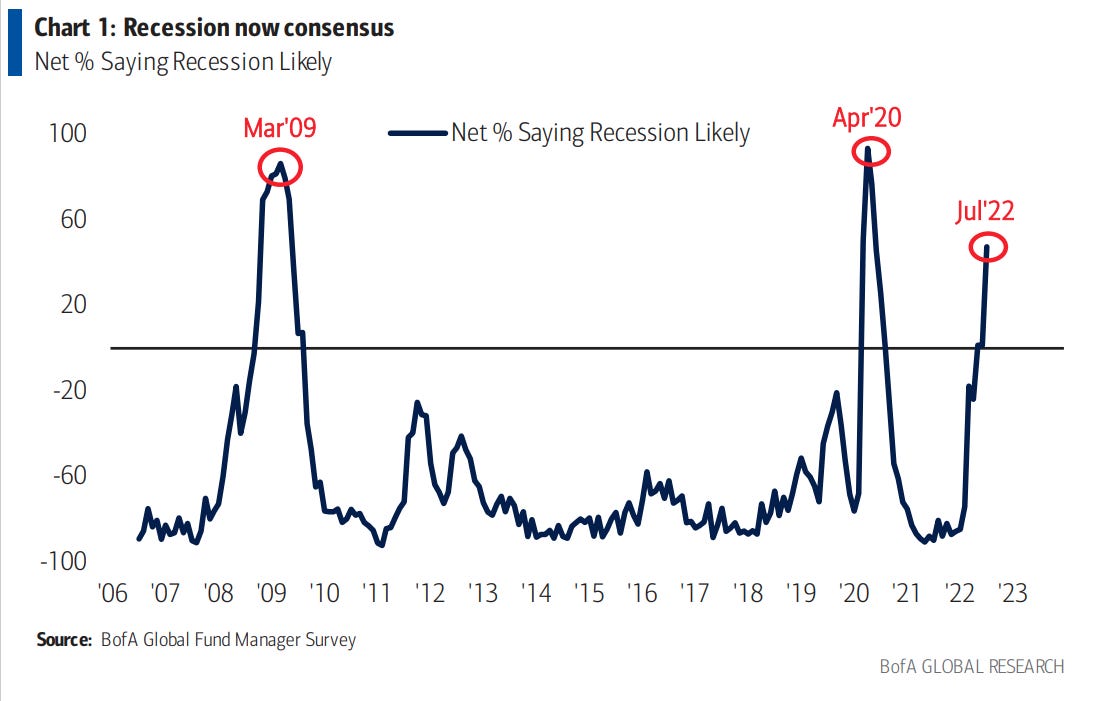

Sentiment check

The CBOE S&P 500 Volatility Index (VIX) continues to drift lower, below the 30-level and the declining 10-day moving average. We want to be clear that the index remains elevated and with a rising trend. Bulls would like to see the recent series of lower highs meet with a lower low for the 10-day moving average to signal a possible trend reversal.

Source: Potomac Fund Management

The QQQs make a break

The bulls finally have some upside momentum to work with as the Nasdaq 100 broke back above its 50-day moving average yesterday. The 50-DMA smooths out daily price action and gives investors a read on the short-term directional trend of the market. This moving average is still drifting lower for major indices, but getting price back above the 50-day is the first step in the process of turning downtrends back into uptrends.

You can see yesterday's break above the 50-day for the Nasdaq 100 (QQQ) in the chart below. Not only did QQQ re-take its 50-day, but it also closed above two previous highs made over the last month that were acting as resistance. It's not an "all-clear" signal by any means, but this is certainly more positive action than we've seen for most of 2022.

The break back above the 50-DMA for the Nasdaq 100 ended a 68-trading day streak of closes below it. As shown below, the Nasdaq has rarely been below its 50-DMA for this long, and 68 days was tied for the longest streak since 2008.

Source: Bespoke Investment Group

The energy pinch is easing

Benchmark prices for energy are falling in commodities markets, taking some of the fuel off of the inflationary fire that U.S. policymakers have been battling. Driving the news – both crude oil and wholesale gasoline prices have rolled over since June, signaling that the worst of the recently elevated energy costs might have passed – Brent Crude Oil spot price is down -11.75% since the peak in June, while wholesale gasoline is down -9.95%. Prices have eased for a number of demand-related reasons: China’s economy posted its slowest quarterly GDP growth since the COVID crisis, global demand for crude has been hurt by a dollar at 20 year highs, fears of a US recession has cooled expectations, and $5 gasoline prices at the pump have nudged consumers to drive less.

Source: Axios, FactSet

Airplane manufacturer, Boeing, scores a major order

Struggling aerospace manufacturer Boeing scored a big win this week as Delta Air Lines ordered 100 Boeing 737 MAX 10 jets, in a deal that could be worth up to $13.5bn for the planemaker. That's a strong showing of confidence in the latest version of the MAX range, which was hit with a global grounding ruling in 2019 after two fatal MAX 8 crashes in which 346 people lost their lives. Although Boeing’s recent delivery figures for the flagship 737 are beginning to take off again, the safety concerns have put Boeing behind its fierce rival Airbus and its narrow-body equivalent the A320, which became the world’s bestselling airplane back in 2019. Competition between the two manufacturers has been roaring for decades and Delta's show of faith in the 737 MAX 10 line is a big step in the right direction for Boeing after a tumultuous few years.

Source: Chartr

Existing home sales slide amid falling affordability

Existing home sales fell 5.4% in June, its fifth consecutive decline, to a 5.12 million unit annual rate, the lowest level in two years. Consensus was for a much smaller 0.6% pullback. The weakness comes amid a quick runup in mortgage rates from a record low at the start of this year to their highest level since the Global Financial Crisis. Combined with the double-digit rise in home prices, this has dramatically weakened housing affordability, leading to the cyclical slowdown in housing market activity.

Source: Ned Davis Research

Breaking down time

Who we spend time with evolves across our lifetimes. As we go through life we build personal relationships with different people – family, friends, coworkers, partners. These relationships, which are deeply important to all of us, evolve with time. In adolescence we spend the most time with our parents, siblings, and friends; as we enter adulthood we spend more time with our co-workers, partners, and children; and in our later years we spend an increasing amount of time alone.

Source: Our World in Data

That’s all for today.

Blake