The Sandbox Daily (7.22.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the reversal in oil prices, tech's hiring freeze, the financial sector’s retreat to the GFC highs, copper crashing, supply chain indices moderating, Google search results for inflation, and the troubling numbers behind newspaper circulation.

Let’s dig in.

EQUITIES: Dow -0.43% | S&P 500 -0.93% | Russell 2000 -1.62% | Nasdaq 100 -1.77%

FIXED INCOME: Barclays Agg Bond +0.80% | High Yield -0.13% | 2yr UST 2.972% | 10yr UST 2.750%

COMMODITIES: Crude Oil -2.21% to $103.47/barrel. Gold +0.63% to $1,742.2/ounce.

BITCOIN: -2.48% to $22,565

VIX: -0.35% to 23.03

CBOE EQUITY PUT/CALL RATIO: 0.63

US DOLLAR INDEX: -0.30% to 106.587

Oil’s stunning reversal

Crude oil prices have now fallen back to the level they were at when Russia launched its invasion of Ukraine back in late February.

Source: Bespoke Investment Group

The big tech hiring freeze

Yesterday Google announced a hiring freeze, with the search engine giant putting a pause on all hiring for 2 weeks as the company reviews their "headcount needs". That announcement adds Google's name to the growing list of tech companies that have announced hiring freezes or slowdowns. Earlier this week Apple announced its intentions to slow hiring into 2023, while Meta announced a halt of hiring on some of its key engineering roles a few weeks ago and Microsoft is pulling a number of open jobs in the company's cloud and security divisions. Not-quite-so-big-tech companies Twitter and SNAP are also feeling the squeeze, with both reporting slowing sales and ad revenue this morning.

Even if only short-lived, the announcements end a decade of almost non-stop hiring for much of big tech. A decade ago Google employed just 32,000 people; today its parent company has more than 156,000. In the same time frame Facebook went from 3,200 employees to more than 71,000 Metamates, while Apple and Microsoft both added more than 90,000. How long it takes to thaw out the freeze is likely to depend on if — or perhaps when — the US economy falls into a recession.

Source: Chartr

Financials back to GFC highs

Financials are arguably the most important sector in America. The Great Financial Crisis was kind of a big deal. Financials as a sector peaked on May 31st of 2007, almost 5 months before the S&P500 made its final high. Then we saw one of the most epic collapses in stock market history. What I don't see ANYONE talking about is the fact that we are now back to that level. Financials are exactly where they were just before the beginning of one of the most, if not the most, epic crashes of all time:

Source: JC Parets, All Star Charts

Copper crashing

Some important components of inflation are moderating. The prices of most commodities have fallen considerably over the last two and a half weeks. Copper is down -33% from its all-time high in March and at its lowest level since 2020.

Source: Charlie Bilello

Supply chain overhang showing evidence of moderating

Supply chains are easing, evidenced by a material improvement in supply chain indices. The NY Fed has a supply chain index (Bloomberg: GSCPI) and as this chart below shows:

the index is at the best level since March 2021

this index was at its worst in December 2021

with supply-chain inflationary pressures abating sharply, steady improvements are being made in real time

this takes pressure off the Fed, putting a bid under equities

Source: Tom Lee, Fundstrat

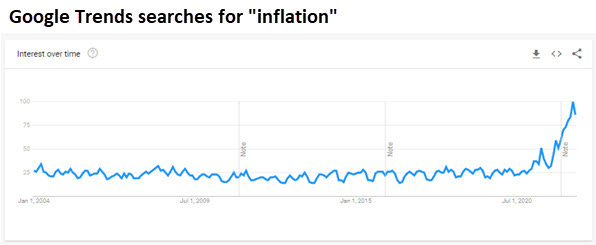

Google “inflation”

Inflation is at the forefront of concerns for consumers and investors. Consider this Google Trends graph for search engine inquiries about "inflation."

Source: SentimenTrader

Goodbye print

Newspaper circulation plummeted. That's old news, but the numbers in the table below, which Harvard journalism institution Nieman Foundation's NiemanLab published last week, are nothing short of stunning.

Source: Herb Greenberg, Empire Financial Research

That’s all for today.

Blake