The Sandbox Daily (7.25.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the earnings season underway, the Fed’s 7/27 policy announcement, a peak ahead to Thursday’s 2nd quarter Gross Domestic Product (GDP) release, non-recessionary bear markets post World War II, trucker labor markets, the crash in copper prices, cross-market relationships monitoring risk appetite, the latest Bloomberg MLIV Pulse survey looking at investor confidence, and the removal of 100,000 kg of plastic from the Great Pacific Garbage Patch (GPGP).

Analysts are calling this the most important week of the summer as we digest big tech earnings, the 2nd quarter GDP advance report, and the Federal Reserve’s policy decision.

Let’s dig in.

EQUITIES: Russell 2000 +0.60% | Dow +0.28% | S&P 500 +0.13% | Nasdaq 100 -0.55%

FIXED INCOME: Barclays Agg Bond -0.37% | High Yield -0.03% | 2yr UST 3.008% | 10yr UST 2.794%

COMMODITIES: Crude Oil +1.02% to $104.53/barrel. Gold -0.38% to $1,735.6/ounce.

BITCOIN: -6.57% to $21,166

VIX: +1.43% to 23.36

CBOE EQUITY PUT/CALL RATIO: 0.70

US DOLLAR INDEX: -0.09% to 106.382

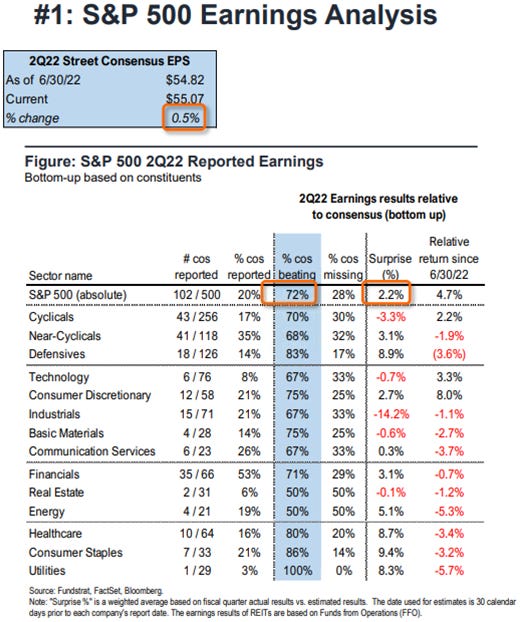

Earnings season is front and center

This week alone: 35% of the S&P 500 is scheduled to report earnings, representing 49% market capitalization of the index. We will hear results and outlooks from 174 companies, including tech titans Apple, Amazon, Google, Facebook, and Microsoft. Thus far, we’ve seen 20% of $SPX report where overall earnings results are beating estimates by a median of 7%; results remain mixed, but on balance, better-than-expected when considering the weakening backdrop and outlook. Despite higher costs and a major decline in consumer sentiment, 2Q22 operating margins have remained resilient at 12.8%, above their long-run average of 9.9%. Earnings season may likely be determined by this week alone – taking the entire market down on a path to undercutting the June lows if we see a deteriorating consumer read-through and poor outlooks (miss/guide down) OR strengthen this counter trend rally into something more durable for 2H22 (beat/raise).

Source: Fundstrat

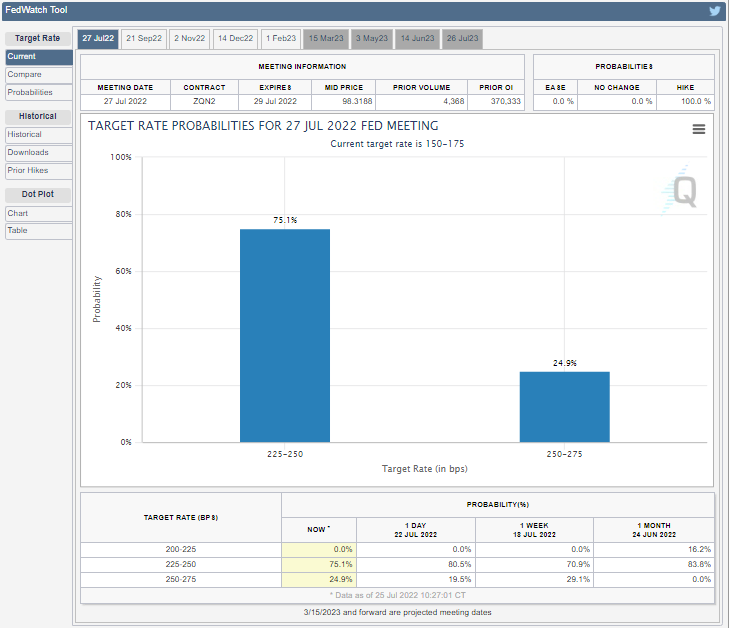

All eyes on the Fed

This week brings the fifth Federal Reserve rate-setting meeting of the year, with the odds strongly favoring a 75 basis points hike. This would bring the target rate to 2.5%, the level it reached at the peak of the last rate-hiking cycle in 2019. Former Treasury secretary Lawrence Summers believes the Fed will have to do a lot more to bring inflation under control, and cast doubt that a recession can be avoided. More optimistic is current Treasury Secretary Janet Yellen, who does not see any "broad-based weakness" in the economy, and expressed her belief the Fed will be successful in its fight with inflation. The announcement will be announced on Wednesday at 2pm ET.

Source: CME FedWatch Tool, Bloomberg

Economic growth

Q2 GDP will be released on Thursday, and it could show that the US economy shrunk for two straight quarters. Recently we’ve witnessed meaningful reversals in commodity markets, declining gas prices, slashing prices to lower inventory buildup, a pickup in weekly jobless claims, housing data suggesting higher rates is cooling demand, and a flattening yield curve – key measures suggesting inflation seemingly inflected lower. The drumbeats of recession have been getting louder over the past few months, which is showing up in the historically weak consumer sentiment data. While the colloquial definition of a recession is two consecutive quarters of negative growth, the more formal definition comes from a committee of economists, the National Bureau of Economic Research (NBER), which looks for a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Source: Sandbox Financial Partners

Non-recessionary bears

Bear markets (and near bears) that take place without a recession avg 23.8% and last more than seven months. The current bear was 23.6% and more than five months long. Pretty normal as crazy as that sounds and feels.

Source: Ryan Detrick, YCharts

What shortage?

At the height of the supply chain crisis, transportation companies pointed to a shortage of truckers as a contributing factor. Truckers and labor advocates were quick to say low pay, poor working conditions, and high turnover were driving the problem. Yet, employers managed to find and hire 115,500 new truckers since the depths of the pandemic in May 2020. The surge in hiring comes amid big increases in wages and demand for trucks to deliver all the stuff we've been buying for the past few years, as well as the coronavirus health risks of the pandemic subsiding and stimulus payments fading into the rear view. Average weekly earnings were 10.8% higher YoY in May for drivers in freight trucking, while 20,000 more long-haul truckers gained employment in May alone – the largest monthly addition of new truckers since 1997 when the Bureau of Labor Statistics started tracking, according to a Goldman research note.

Source: Bureau of Labor Statistics, Axios

Copper has crashed

It’s been a rough couple of months for copper, a base metal in which its market is highly cyclical and driven by good old-fashioned supply and demand. If you’ve read about copper recently, its because analysts use copper prices to predict the health of the broader economy – we use it in construction, appliances, consumer electronics, transportation markets, EV vehicles, and on and on. Copper has experienced a 4-sigma decline, matching or exceeding prior pullbacks.

Source: Thrasher Analytics

Risk-on / risk-off picture

As markets have rallied off the June 16th $SPX low, we are seeing a lot of indicators flashing favorable short-term signals, however it’s important to continue looking for trend reversal confirmation. These four cross-market relationships are worth monitoring:

$SPHB vs $SPLV below level.

$RCD vs $RHS below level.

#copper vs #gold below level.

$HYG vs $IEI above level.

Source: Grant Hawkridge, All Star Charts

Investor skepticism

Investors lack confidence that the Fed can tame the worst inflation in four decades without driving the economy into a recession. Over 60% of 1,343 respondents in the latest Bloomberg MLIV Pulse survey said there’s a low or zero probability that the US central bank can rein in consumer-price pressures without causing an economic contraction. The survey was conducted July 18-22 and included retail and professional investors.

Source: Bloomberg

A big thank you to The Ocean Cleanup

More than 100,000 kg of plastic has been removed from the Great Pacific Garbage Patch (GPGP) since System 002’s deployment in August 2021, sweeping an area of ocean comparable to the size of Luxembourg or Rhode Island. After sorting and filling up containers of waste, The Ocean Cleanup brings the material back to shore for proper disposal and recycling.

Source: The Ocean Cleanup

Welcome to The Sandbox Daily, a community of market participants for market participants to encourage thought leadership and embrace intellectual enlightenment.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations and/or securities discussed within The Sandbox Daily.

That’s all for today.

Blake