The Sandbox Daily (7.27.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the Federal Reserve announcement hiking the overnight target interest rate by 75bps, a look at historical bull and bear markets, weakening consumer confidence, the search for Recession, the S&P 500 sitting under overhead supply, the economics of Google, gasoline prices in steady decline, the mobility of labor, and saying goodbye to Choco Taco.

Let’s dig in.

EQUITIES: Nasdaq 100 +4.26% | S&P 500 +2.62% | Russell 2000 +2.39% | Dow +1.37%

FIXED INCOME: Barclays Agg Bond +0.32% | High Yield +1.10% | 2yr UST 2.984% | 10yr UST 2.785%

COMMODITIES: Crude Oil +2.46% to $107.48/barrel. Gold +0.93% to $1,751.3/oz.

BITCOIN: +8.15% to $22,663

VIX: -5.87% to 23.24

CBOE EQUITY PUT/CALL RATIO: 0.76

US DOLLAR INDEX: -0.68% to 106.456

Fed hikes 75 basis points

Federal Reserve officials raised interest rates by 75 basis points for the second straight month and Chair Jerome Powell said a similar move was possible again, rejecting speculation that the US economy is in recession. Policy makers, facing the highest inflation pressures in 40 years, lifted the target for the federal funds rate on Wednesday to a range of 2.25% to 2.5%. Policy makers next gather Sept. 20-21; the two monthly readings on inflation and employment due before then will help determine the Fed’s next move. Chairman Powell also stated the committee would set policy on a meeting-by-meeting basis rather than offer explicit guidance on the size of their next rate move, as he has done recently – the comments about a moderation in the pace of rate increases sparked a rally in US stocks as Powell spoke.

Source: Bloomberg

All successful investors must endure discomfort

It’s near impossible for anyone to successfully time the market with any degree of accuracy for extended periods of time. We believe it is important to remember one of the fundamental concepts of investing: “staying the course.” Below is a chart that clearly demonstrates how bull markets have historically beaten the bears, despite how painful it may feel during the correction and the wall of worry we constantly climb. It’s a powerful reminder of the importance to remaining invested through difficult market environments and extending your time horizon to improve portfolio returns. As Warren Buffett once said, “Our favorite holding period is forever.”

Source: MFS Investment Management

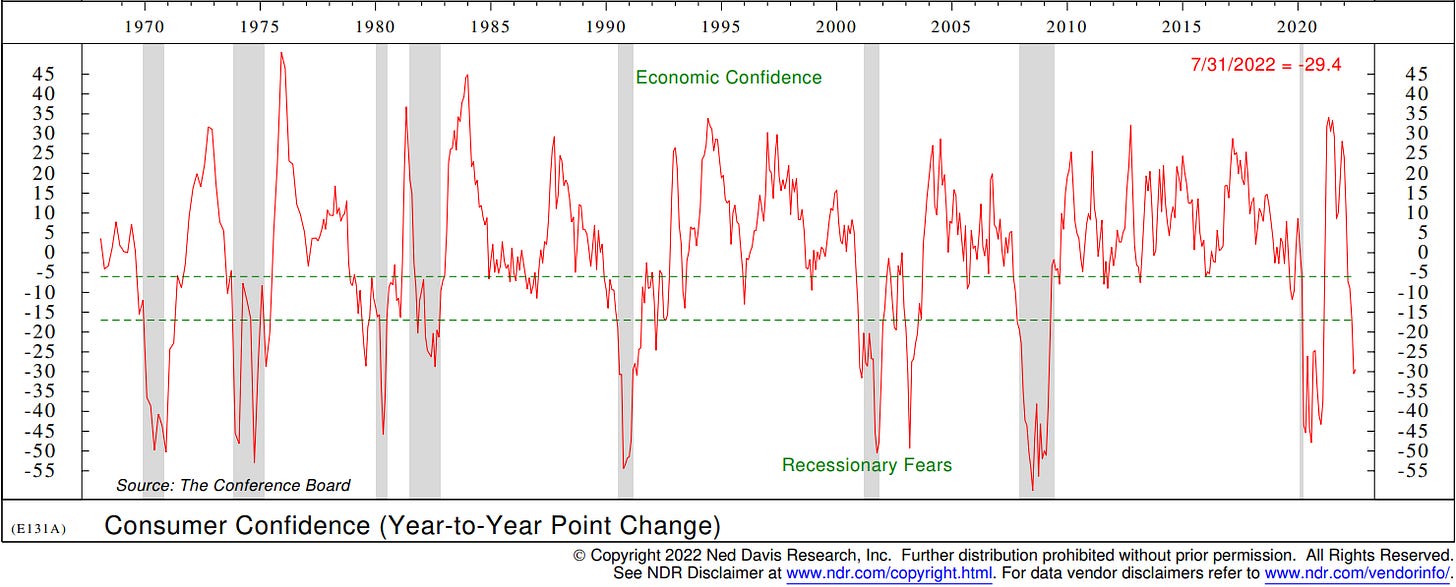

Consumer confidence weakens further

The reading from the Conference Board’s Consumer Confidence Index came in below consensus falling in July, its third consecutive monthly decline, arriving at the lowest level since February 2021. The index is down 29.4 points from a year ago, which historically has been associated with falling economic activity and rising recessionary fears. The decline in confidence this month was driven by consumers’ assessment of both the present situation and consumer expectations components (i.e. future business conditions, future job availability, and future income growth). Consumer confidence fell across most income and all demographic groups.

Source: Ned Davis Research

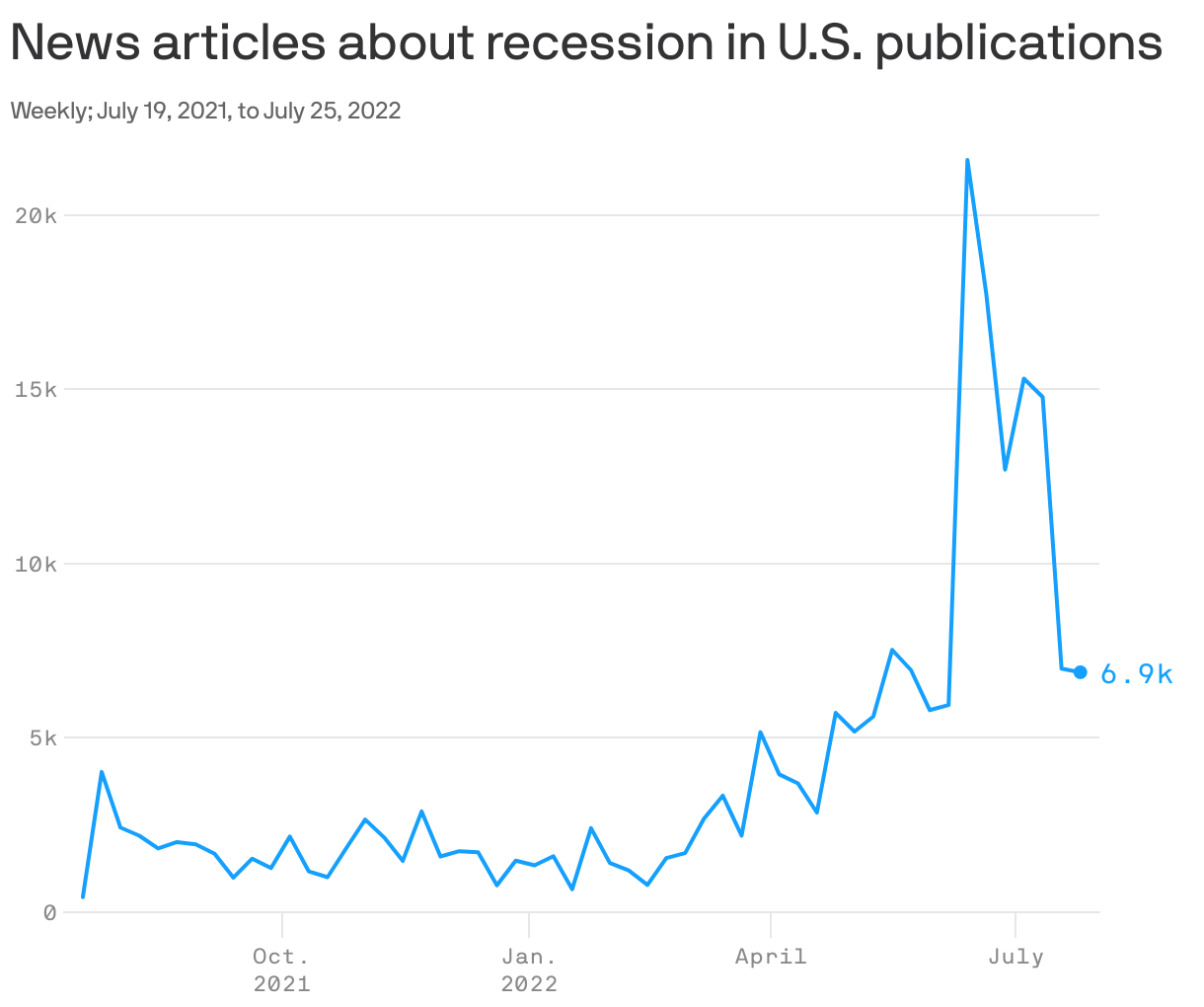

The search for recession

Many things cause Americans to think we're in a recession, including rising gas prices, falling stocks, and consumer confidence at historically low levels. One key component is simply the amount of recession chatter in the media. In the U.S., there were 6,882 such stories in the week ending July 25, down 68% from 21,576 in the week of June 13, around the time that both gas prices and mortgage rates were peaking. A surge in media recession stories can create self-fulfilling bad vibes, and increase the likelihood of an actual recession. What’s next: if the 2Q22 GDP advanced figure is negative tomorrow, expect a massive increase in recession stories due to the fact that the colloquial definition of a recession is two consecutive quarters of negative prints.

Source: Axios.

*Author’s note: Recession is mentioned within the headline or first paragraph of articles algorithmically determined to be about the economy.

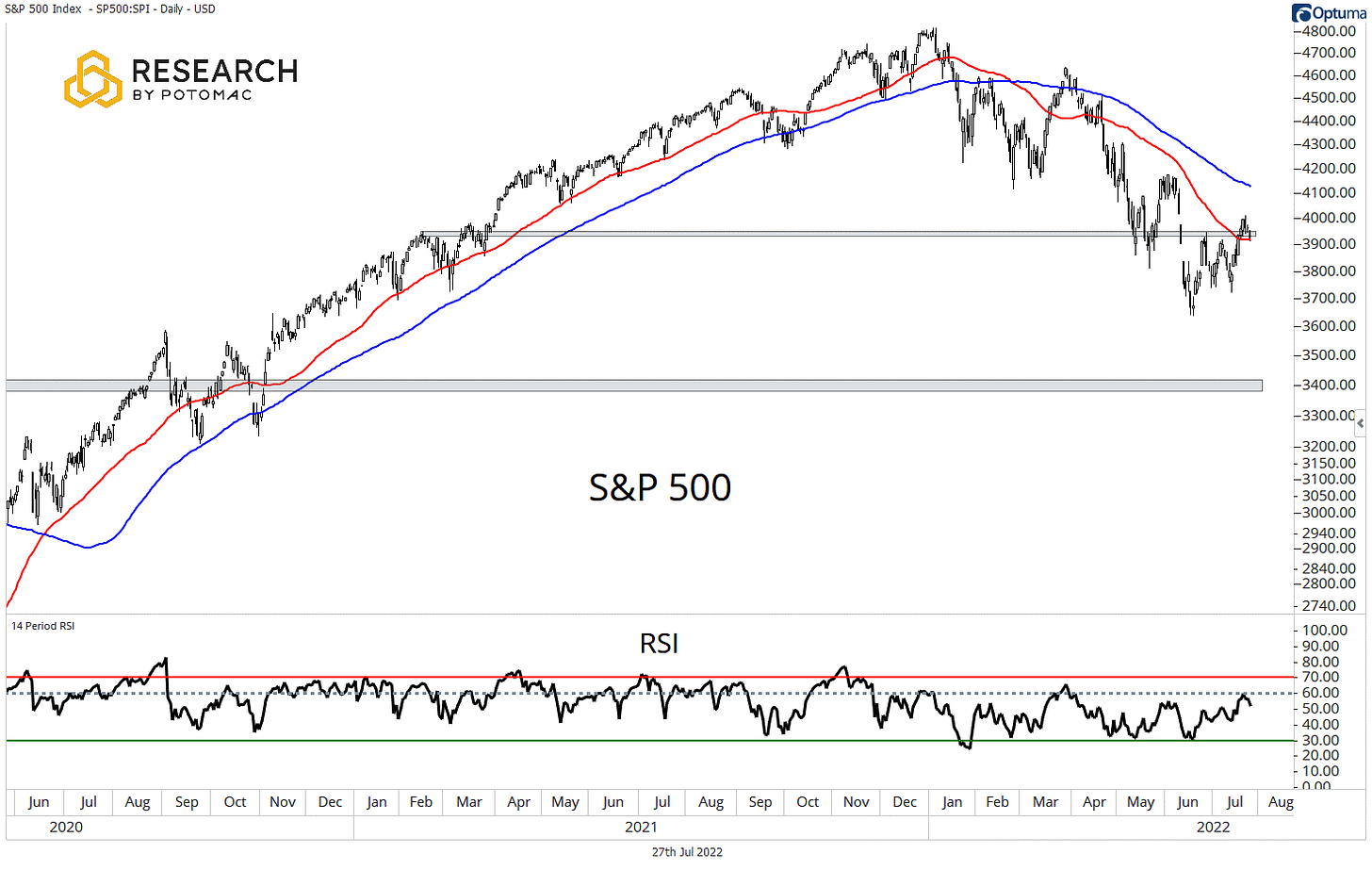

S&P 500 ready for resistance

The S&P 500 is doing battle with resistance in the 3,900 – 4,000 zone and the 50-day moving average. The index is still below the declining 100-day moving average, which is coming into line with the early June peak. Thus far, the rally from the June lows has done nothing more than producing a lower high, keeping the bears in control of the trend. Meanwhile, momentum remains in a bearish regime, unable to break above 60 on the current rally attempt. Holding above the 50-day and then moving above the 100-day are needed for the bulls to continue to make a strong case.

Source: Potomac Fund Management

The economics of Google

It's still all about Search. That was the five-word soundbite that you might have come away with had you combed through Alphabet's latest quarterly update yesterday. Although the company reported a slowdown, Alphabet still managed to grow its second quarter revenue some 13% in the last year. Whilst not a home-run performance, it was something of a relief following the recent reports of digital ad rivals Snapchat and Twitter, both of which disappointed investors. Google Search, which still represents more than half of Alphabet's total business, saw ad sales grow 14% in the most recent quarter — significantly outperforming YouTube which only grew 5%. That confirms a long-held theory that the search ad market might be less fickle than the social media ad market. Despite concerns of ad-spending in a slowing market, people are still searching Google for things – which the company knows how to monetize well!

Source: Chartr, Alphabet, Koyfin

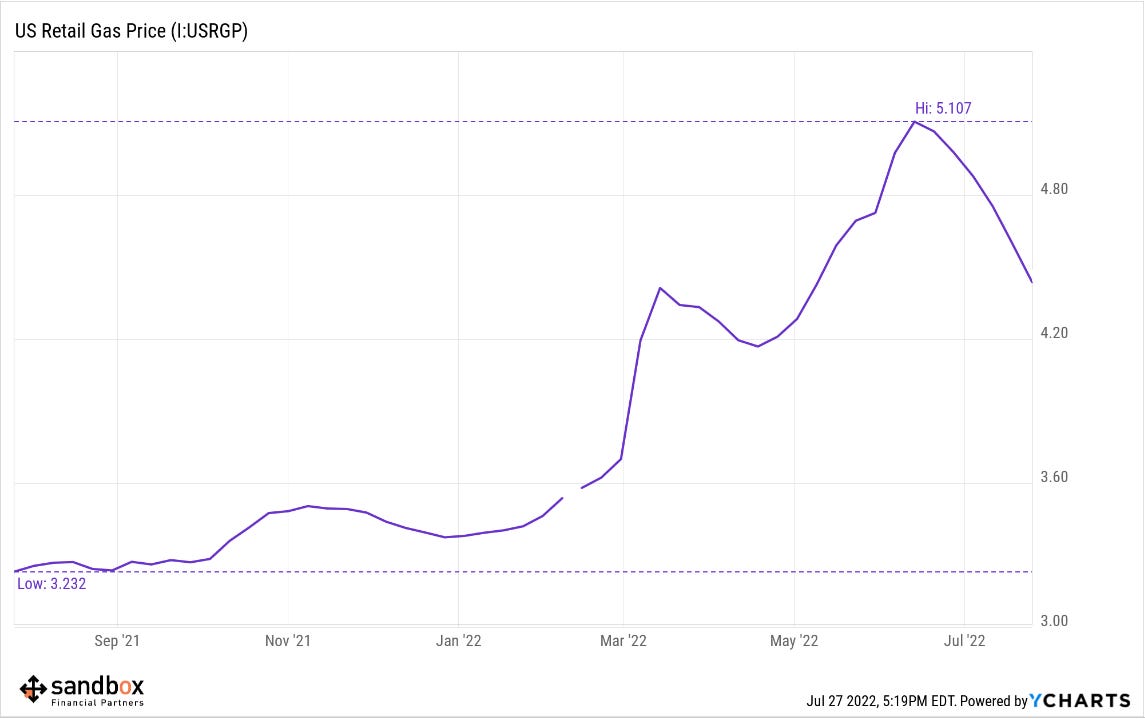

Make it 42!

For the 42nd straight day, average #gasprices have declined from the recent June high of $5.01/gal, falling to $4.303/gal today. 14 states are paying less than an average of $3.99, with a few more states set to join potentially today: Iowa and Florida, to make it 16. Over 50,000 stations under $4.

Source: GasBuddy, YCharts, Sandbox Financial Partners

Mobility in labor

A recent study run by the CFA Institute posed the question among its membership community: “leaving aside any personal circumstances or expected career progression, how different, if at all, do you think your current job role will be in 5-10 years’ time?” Overall, 37% of respondents surveyed believe their role will be substantially different, with fintech leading the subcategories at 63% which is not all that surprising given the breakneck pace of technological developments occurring within the space. Given the explosion in Work-From-Home (WFH) arrangements and flexible office policies, the future of the global workforce will likely experience more turnover than ever before and a greater focus on enhancing one’s individual career path as the pendulum shifts from the employer to the employee.

Source: CFA Institute

Goodbye, Choco Taco

The Choco Taco is being discontinued after 39 years of production. Citing “an unprecedented spike in demand across our portfolio,” Klondike parent company Unilever announced this week that it’s retiring the Choco Taco to focus on keeping its other ice cream products in stock. The Choco Taco was created in 1983 by Alan Drazen, a Philly-based former Good Humor truck driver.

Source: Morning Brew

That’s all for today.

Blake

Welcome to The Sandbox Daily, a community of market participants to encourage thought leadership and embrace intellectual discourse within the spheres of markets, fundamental and technical analysis, business, and investor behavior. Market information, data, and relationships change constantly – the Daily is steadfastly committed to delivering high-quality and timely content to help all investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations and/or securities discussed within The Sandbox Daily.