The Sandbox Daily (7.29.2022)

Earnings, Wages, the Fed's PCE measure, Community Solar, and a Weekly Recap

Welcome, Sandbox friends.

Today’s Daily discusses the 2nd quarter earnings season to date, wage and salary growth as measured by the Employment Cost Index, yesterday’s Personal Consumption Expenditures Index report, the Community Solar Program launched this week from the Biden administration, and a performance recap to snapshot the week in markets.

Let’s dig in.

EQUITIES: Nasdaq 100 +1.81% | S&P 500 +1.42% | Dow +0.97% | Russell 2000 +0.65%

FIXED INCOME: Barclays Agg Bond -0.03% | High Yield +0.30% | 2yr UST 2.891% | 10yr UST 2.656%

COMMODITIES: Brent Crude +2.68% to $109.98/barrel. Gold +0.76% to $1,782.7/oz.

BITCOIN: -0.49% to $23,955

VIX: -4.48% to 21.33

CBOE EQUITY PUT/CALL RATIO: 0.67

US DOLLAR INDEX: -0.49% to 105.825

Taking stock of 2nd quarter earnings season

172 companies reported earnings this week within the S&P 500, representing 49% market capitalization of the index and included the tech giants $MSFT, $GOOGL, $META, $APPL, and $AMZN. Of the 258 companies that have reported so far (52% of the S&P 500), overall earnings results are beating estimates by a median of 7%. And 73% of those reporting are beating estimates (below the five-year average of 77%). The blended earnings growth rate for the second quarter is 5.4% today, which would mark the lowest growth rate reported by the index since 4Q20 (4.0%).

Looking ahead, analysts expect earnings growth of 6.7% for 3Q22 and 6.7% for 4Q22. For CY 2022, analysts are predicting earnings growth of 8.9%.

Source: FSInsight, John Butters (FactSet)

Wage gains continue in 2Q22

U.S. labor costs increased strongly in the second quarter as a tight jobs market boosted wage growth, which could keep inflation elevated and give the Federal Reserve cover to continue its aggressive interest rate hikes.

Wages and salaries rose at a record pace last quarter: +1.3% from the previous quarter and +5.3% from a year earlier, according to the Employment Cost Index – a report produced by the Bureau of Labor Statistics (BLS) that is widely accepted as a broad gauge of waves and benefits. Private-sector wages jumped ahead at an even faster +5.7% pace. That's welcome news for workers (though many still aren't seeing pay keep up with inflation), but it's a problem for the Fed. Brisk pay hikes may make it difficult to slow inflation if businesses keep jacking up prices to offset rising labor costs.

Source: Reuters, Bureau of Labor Statistics

Fed’s preferred inflation measure remains hot

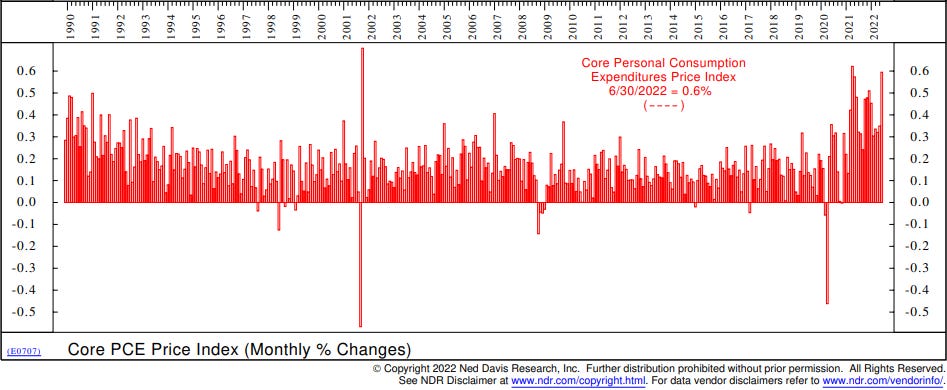

The Federal Reserve's preferred gauge of inflation reaccelerated this month and the print came in even higher than economists expected. The Core Personal Consumption Expenditures Index, or “Core PCE” for short which strips out food and fuel costs, rose 0.6% last month after holding at 0.3% since February, effectively shooting down any hopes this measure could be leveling off. It was the second biggest gain since October 2001, and nearly the biggest increase since February 1984.

While Core PCE remains below its cycle peak of 5.3% YoY back in February, the current annualized rate of 4.8% YoY is far above the Federal Reserve’s target of 2.0%. Competition for workers remains fierce as employers have to keep bidding up wages for new hires.

Source: Ned Davis Research

Community Solar Program from the Biden administration

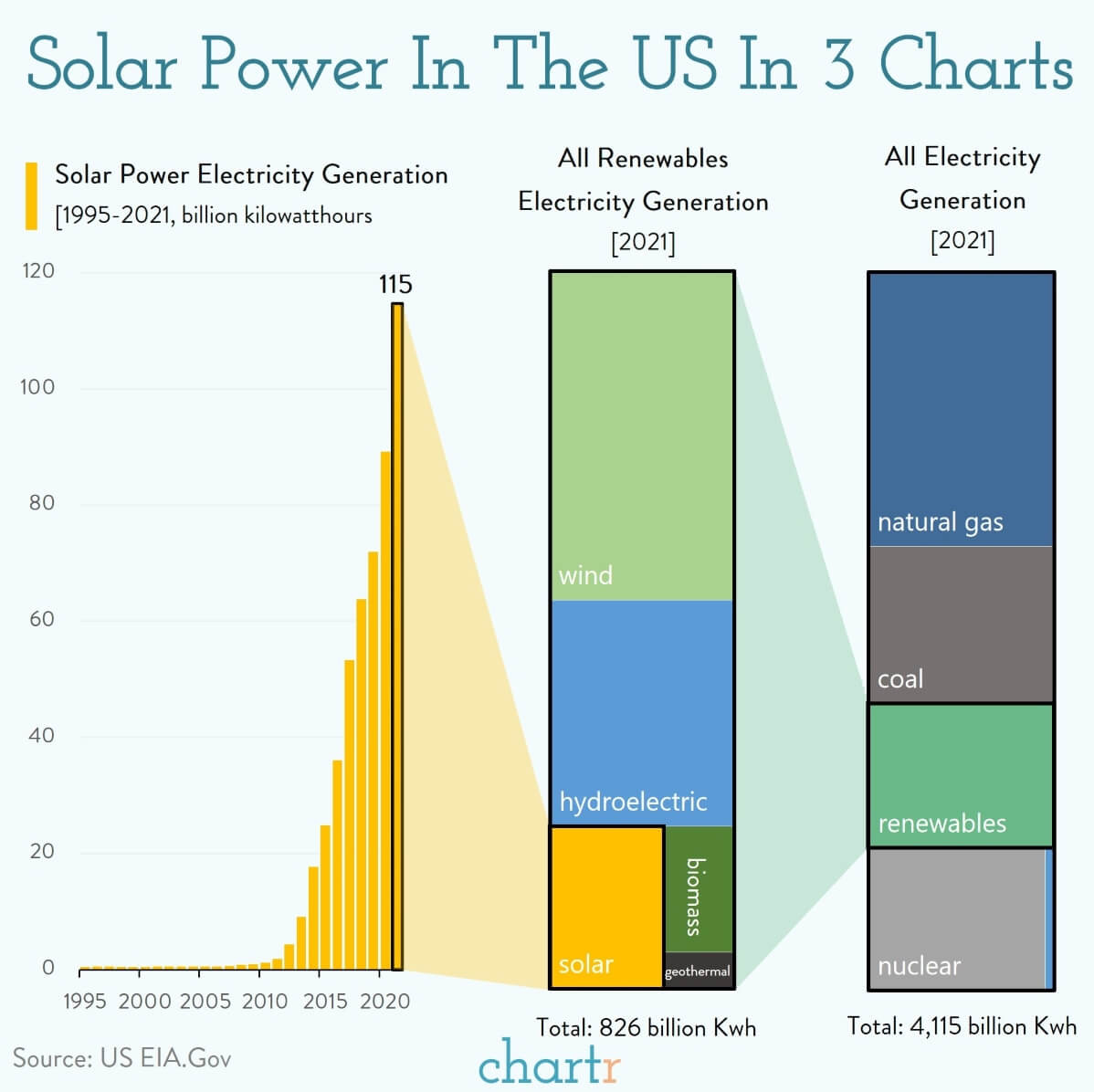

This week the Biden administration unveiled a new plan to get lower-income households hooked up to solar power. The plan is to expand access to "community solar" projects, where many households can share the benefits from one larger set of solar panels. After a solar farm is built, residents can then subscribe to get credit back on their electricity bills — the idea being that this subsidy will encourage solar uptake for those households that might not be able to afford the tens of thousands of upfront costs associated with installing solar. The White House is coordinating efforts with the Department of Housing and Urban Development (HUD) and the Department of Energy (DOE).

Data from the EIA shows how quickly solar power electricity generation has grown in the US. In the last 5 years electricity generated by solar power has more than tripled, to around 115 billion kilowatt-hours. That's quick progress, but it still only leaves solar as 14% of the total share of renewables electricity, and even less (roughly 3%) of all electricity generated. There's a long way to go.

Source: Chartr, The White House

The week in review

Stocks: The major U.S. market indexes finished higher this week as growth and value names witnessed solid gains. The latest batch of second quarter earnings results were not as weak as some analysts had feared. Signs of cooling inflation and easing fears of Federal Reserve overtightening likely helped entice some equity buyers to come back into the markets. Developed international stocks had a positive week as Eurozone Q2 preliminary GDP readings surprised to the upside.

Bonds: The Bloomberg Aggregate Bond Index finished higher this week as the 10-year U.S Treasury bond yield dropped to below 2.65%. Bond investors are pricing in slower economic growth and a belief that inflation pressures will moderate. High-yield corporate bonds, as tracked by the Bloomberg High Yield index, gained ground following a solid week for equities.

Commodities: Oil prices rebounded while natural gas has now seen four straight weeks of gains. Energy supply challenges in Europe will continue to be a factor in energy prices as future Russian supplies appear to be in question. The major metals, gold, silver, and copper, had a solid week amid a tough year. Gasoline prices continue to subside nationally after topping out at $5.01 in mid-June.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a community of market participants to encourage thought leadership and embrace intellectual discourse within the spheres of markets, fundamental and technical analysis, business, and investor behavior. Market information, data, and relationships change constantly – the Daily is steadfastly committed to delivering high-quality and timely content to help all investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations and/or securities discussed within The Sandbox Daily.