The Sandbox Daily (8.15.2022)

Key interest rate cut from the People's Bank of China, collapse in Empire Manufacturing Index, Apple's increasing importance to the S&P 500 Index, and a strengthening Market Breadth measure

Welcome, Sandbox friends.

Today’s Daily discusses the unexpected rate cut from the People’s Bank of China, the August collapse in the Empire Manufacturing Index, Apple’s place in the S&P 500 index, and a review of market breadth following strong equity markets off the mid-June lows.

Let’s dig in.

EQUITIES: Nasdaq 100 +0.75% | Dow +0.45% | S&P 500 +0.40% | Russell 2000 +0.23%

FIXED INCOME: Barclays Agg Bond +0.12% | High Yield -0.18% | 2yr UST 3.195% | 10yr UST 2.793%

COMMODITIES: Brent Crude -5.22% to $93.03/barrel. Gold -1.12% to $1,795.1/oz.

BITCOIN: -0.99% to $24,095

VIX: +2.15% to 19.95

CBOE EQUITY PUT/CALL RATIO: 0.50

US DOLLAR INDEX: +0.83% to 106.507

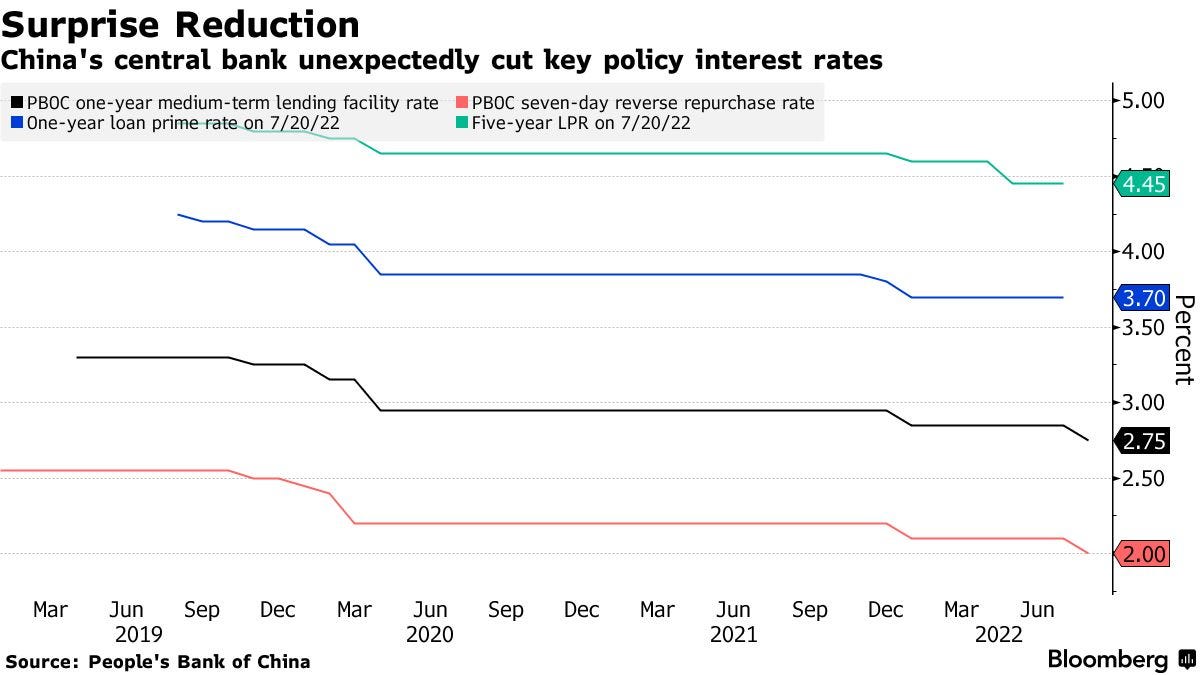

China shocks with rate cut as data show ‘alarming’ slowdown

China’s economic slowdown deepened in July due to a worsening property slump and continued coronavirus lockdowns. China’s central bank unexpectedly cut both the one-year and seven-day lending rates by 10 basis points in an effort to shore up faltering growth.

Retail sales, factory output, hiring, and investment all slowed and missed economists estimates in July – highlighting the breadth of the economic challenge facing policy makers in a politically sensitive year for leader Xi Jinping. The surveyed jobless rate for those aged 16-24 climbed to 19.9%, a record high. The raft of weak data poses a major headwind for the Communist Party as it gears up for a major congress in coming months that’s expected to give President Xi Jinping a precedent-defying third term in power. The fresh evidence of China’s slowdown adds to the headwinds facing the global economy this year, which is already reeling from the fallout from Russia’s invasion of Ukraine and efforts by central banks in the U.S., Europe, and beyond to tame decades-high inflation by materially increasing borrowing costs.

Source: Bloomberg

Empire manufacturing activity contracts sharply

The Empire State General Business Conditions Index sank 42.4 points in August to -31.3, much worse than the consensus of 5.0. Excluding the pandemic, this was the steepest monthly drop on record and the lowest level of the index since March 2009, when the economy was still mired in the Global Financial Crisis. New orders and shipments plummeted. Unfilled orders contracted for the third consecutive month, while delivery lead times shortened for the first time in nearly two years, indicating that backlogs and supply chain issues are no longer a pressing problem, as demand has contracted. Inventory growth slowed. Payrolls growth also slowed, while the average workweek shortened.

Source: Ned Davis Research

Apple’s growing significance to the S&P 500 Index

Apple Inc.’s (AAPL) 7.3% weight in the S&P 500 today is the largest weighting we’ve seen for any individual company going back to 1980. Apple fell -26.76% at its 2022 calendar year low as recently as June 16th, but clearly the market extended too far to the downside on this name. Now returning just -2.48% YTD, the broader market could not reclaim its footing until its largest constituent had bottomed out. There are many narratives driving Apple’s stock price, and therefore its market capitalization, that are well documented, but perhaps none more so important than share buybacks. Apple has bought back $522 billion in stock over the past 10 years, which is greater than the market cap of 494 companies in the S&P 500.

Source: Charlie Bilello

Market breadth using 50 day moving average (DMA) shows tremendous strength

The percentage of S&P 500 constituents that are currently trading above their 50 day moving average (DMA) is 92.4%, while we are seeing similar strength across style (Nasdaq Comp, 77.0%) and market capitalization (Russell 2000, 83.3%). This is not to suggest the market low is in for the year, but market technicians feel much more confident on the long-side when a substantial amount of issues are advancing altogether and exuding strength across many market factors at once (size, style, geography, sector, etc).

Source: Liz Ann Sonders, Bloomberg

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.