The Sandbox Daily (8.17.2022)

Saudi Aramco, 50% retracements, U.S. Retail Sales, U.K. inflation, and meditation apps

Welcome, Sandbox friends.

Today’s Daily discusses the behemoth oil giant that is Saudi Aramco, 50% retracements for the S&P 500 index, the flat Retail Sales report, inflation in the United Kingdom hitting double digits, and meditation apps.

Let’s dig in.

EQUITIES: Dow -0.50% | S&P 500 -0.72% | Nasdaq 100 -1.21% | Russell 2000 -1.64%

FIXED INCOME: Barclays Agg Bond -0.59% | High Yield -1.03% | 2yr UST 3.285% | 10yr UST 2.902%

COMMODITIES: Brent Crude +0.77% to $93.05/barrel. Gold -0.75% to $1,776.3/oz.

BITCOIN: -2.97% to $23,245

US DOLLAR INDEX: +0.14% to 106.649

CBOE EQUITY PUT/CALL RATIO: 0.53

VIX: +1.07% to 19.90

Sizing up the Saudi Arabian oil giant, Saudi Aramco

Saudi Aramco, the world’s biggest oil firm, announced earlier this week a staggering $48.4bn of net income for the second quarter — an eye-watering sum even by their standards. The Saudi Arabian company, which is largely state-run, is the latest to benefit from rising oil and energy prices, as many countries attempt to wean themselves off Russian supplies.

It's hard to convey how big Saudi Aramco truly is — but the best bet is to compare it against the behemoths of big tech. Incredibly, Aramco’s net income more than doubles Apple’s comparatively measly $19.4bn in their latest quarter — and it takes adding Microsoft, Meta and Tesla to get to a number that's even slightly comparable to what Aramco pulled in for Q2.

Aramco’s results this year will be a huge boon for the state’s Public Investment Fund (PIF) — the financial body that invests on behalf of the government and seeks to expand Saudi prospects beyond oil. The PIF’s portfolio is certainly diverse: so far they’ve bought a soccer team, set up a controversial golf series, and are even attempting to establish a mirrored metropolis to “revolutionize our current way of life.”

Source: Chartr

50% retracements are bullish signals

The S&P 500 is currently returning -10.41% year-to-date. The index bottomed on June 16th closing down -23.07%, meaning we have now recovered over 50% of the 2022 losses – a important technical development (50%) that market technicians view as constructive when viewing market direction and sentiment. Of the 19 past occurrences in the post- World War II era that the S&P 500 entered a bear market, the 50% retracement test signaled the end of the market’s decline all but one time. Another feather in the bull’s cap…

Source: Hamilton Lane

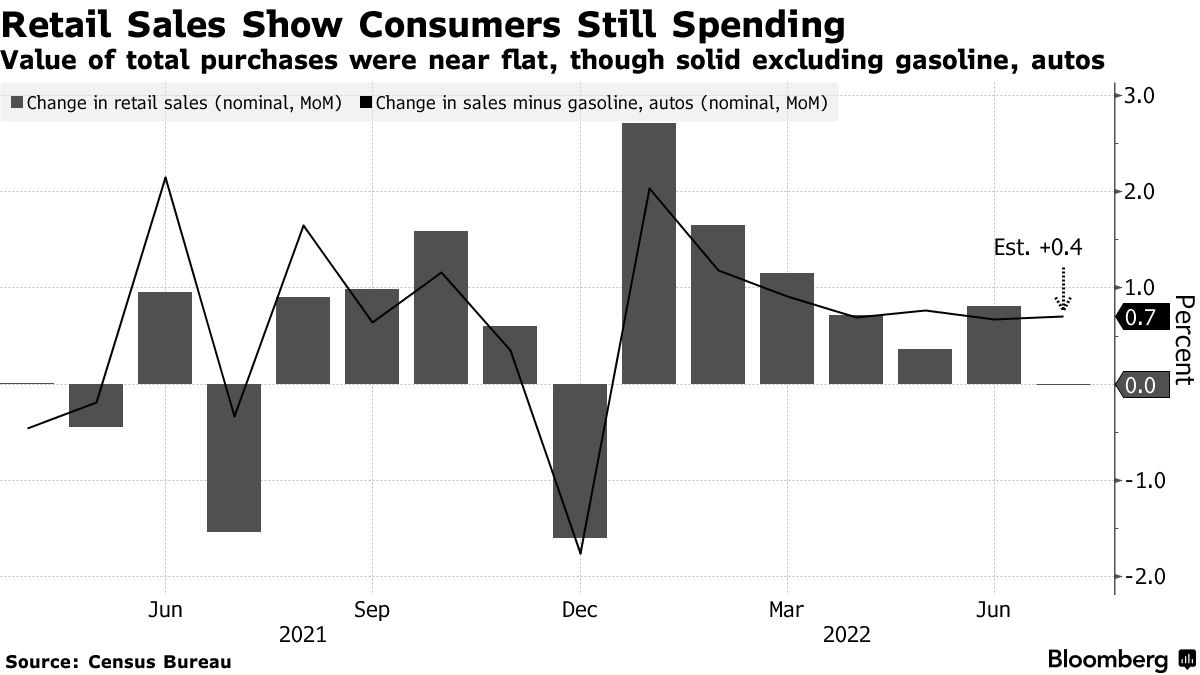

U.S. retail sales little changed last month as fuel, autos drop

Retail sales were flat in July, slightly worse than the consensus of a 0.1% gain. Vehicle sales were a drag, falling 1.6%, which is surprising, given that earlier reports from the Department of Commerce showed that both unit sales and new vehicle prices increased last month. The decline in revenue suggests consumers steered toward cheaper vehicles amid rising financing costs. Gas station sales dropped 1.8%, matching its biggest decline since November 2020, as gasoline prices came down. Excluding vehicles, retail sales rose 0.4%, better than the consensus for an unchanged reading. Excluding both vehicles and gasoline, sales were up 0.7%, a near steady pace over the past several months, and stronger than the historical average of 0.4%.

For many Americans, the significant pullback in gasoline prices has boosted sentiment and likely freed up cash to spend elsewhere. Even so, widespread and persistently high inflation is eroding workers’ paychecks and forcing many to lean on credit cards and savings to keep up. That presents an enduring headwind to the resilience of consumers in the months ahead.

Source: Bloomberg, Ned Davis Research

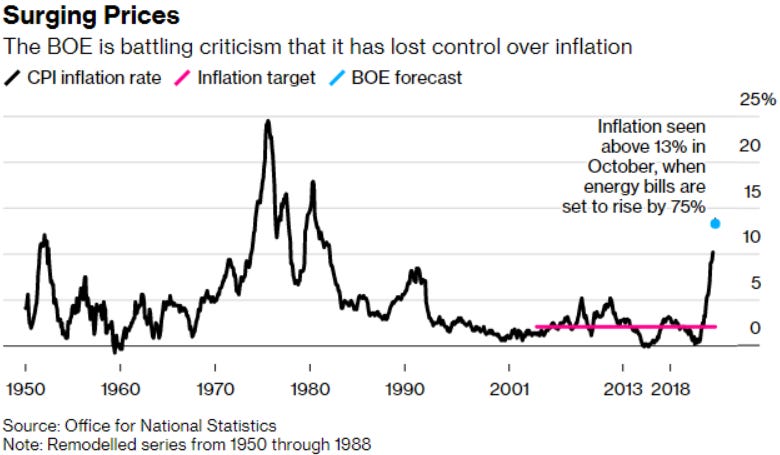

U.K. inflation hits double digits for the first time in 40 years

United Kingdom inflation accelerated more than expected last month to the highest in 40 years, intensifying a squeeze on consumers and adding to pressure for action from the government and Bank of England. The Consumer Prices Index rose 10.1% in July from a year earlier after a 9.4% gain the month before. The reading was higher than expected by both the BOE and private-sector economists. The figures add to a cost-of-living crisis, with wages falling further behind rising prices for goods and services of all kinds. Investors moved to price in 2 percentage points of increases in the BOE’s key rate to 3.75% by May next year.

Source: Bloomberg

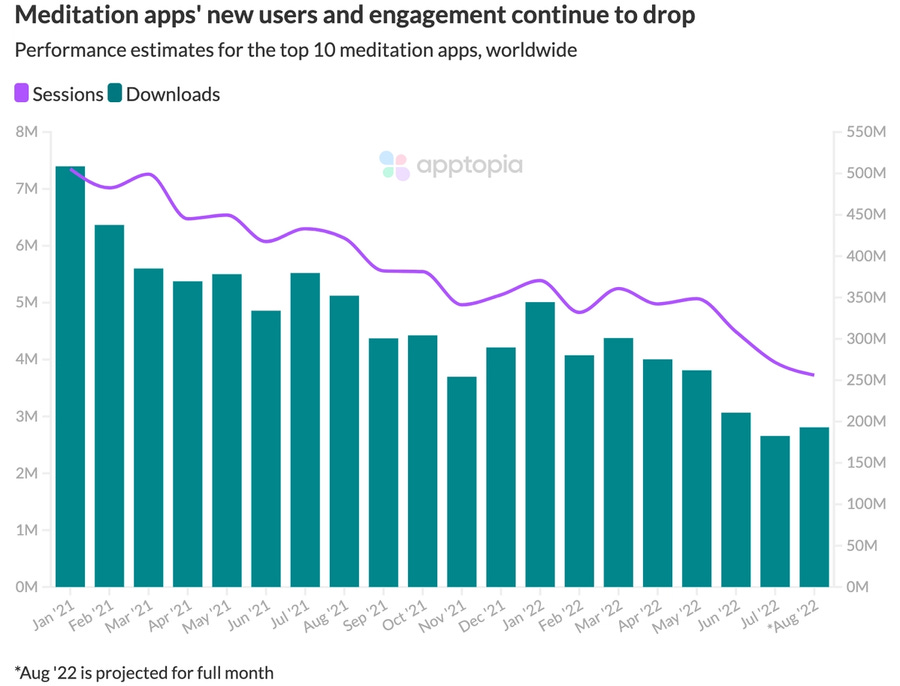

Breathe in, breathe out

Meditation apps like Calm and Headspace are facing steep usage declines from their pandemic peaks. An analysis by Apptopia found that people just aren’t into doing breathing exercises narrated by Matthew McConaughey, Idris Elba, or Kate Winslet right now – another anecdotal example of pandemic trends normalizing among consumer behavior.

User sessions of Calm are down 26.4% since last July, and 60.3% for its primary rival, Headspace. On average across the industry, meditation apps are seeing a 30% decline in usage over the past 90 days. The slowdown in usage is leading to layoffs, where Calm – the first unicorn in the meditation app space – said it had laid off 20% of its employees, or roughly 90 people.

It’s not all doom and gloom, however, as both Calm and Headspace announced annual sales growth for Q2, and the premium meditation subscriptions that have become a somewhat common employee perk in the last few years remain a sticky health benefit offered by corporate America.

Source: Morning Brew, Apptopia

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.