The Sandbox Daily (8.18.2022)

Bullish AAII sentiment reading, SPAC deals go cold, slide in Existing Home Sales, China's housing market, Silver showing historical relative weakness, and Remote Working

Welcome, Sandbox friends.

Today’s Daily discusses the highest bullish sentiment reading in 2022, SPAC deal-making goes on ice in July, the slide in U.S. existing Home Sales, China’s problematic housing market, Silver’s lowest reading of relative strength vs. the S&P 500, and the stickiness of remote working.

Let’s dig in.

EQUITIES: Russell 2000 +0.68% | Nasdaq 100 +0.26% | S&P 500 +0.23% | Dow +0.06%

FIXED INCOME: Barclays Agg Bond +0.20% | High Yield +0.15% | 2yr UST 3.213% | 10yr UST 2.884%

COMMODITIES: Brent Crude +3.95% to $96.76/barrel. Gold -0.25% to $1,771.8/oz.

BITCOIN: -0.95% to $23,039

US DOLLAR INDEX: +0.80% to 107.506

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: -1.71% to 19.56

Bullish sentiment reading reaches highest mark of the year

Both bullish and bearish retail sentiment readings nudged higher in the latest survey. The American Association of Individual Investors (AAII) reported bullish sentiment increased to 33.3% from 32.2% – this is the highest level of bullish sentiment since December 30, when it was at 37.7%.

Bearish sentiment also rose for the first time in six weeks, albeit fractionally, to 37.2% from 36.7%.

In fact, with more bears than bulls once again this week, the bull-bear spread has now been negative for 20 straight weeks.

Why does this matter? Investor sentiment washed out in June, corresponding roughly in time with the market lows, and bullish sentiment was nowhere to be found – surveys suggested investor optimism was lower in June 2022 than during the March 2020 Covid lows and the 2008-2009 Global Financial Crisis! These types of sentiment readings are often clustered around market bottoms, leading to weak/defensive positioning and capitulation. It’s generally at these moments when the market can and will pivot, if the market setup supports the reversal (Federal Reserve policy, market structure, fund flows, VIX implied fear, corporate earnings, interest rates, etc.).

Source: Tony Dwyer, Canaccord Genuity, Bloomberg, AAII, Bespoke

SPAC deal-making activity goes cold

According to a report from Dealogic, Special Purpose Acquisition Companies (SPACs) raised $0 in the month of July, the first month in five years that no new SPACs raised money. SPACs were one of the hottest investments on Wall Street early last year, booming alongside cryptocurrencies, meme stocks, and other speculative trades, as an easy way for buzzy startups to raise money and go public. Fast forward 18 months and much of the air is out of the bubble. Shares of many companies that went public via SPAC-listing have tanked. Some of the target firms have already been acquired by other companies. Some startups that previously agreed to go public by combining with a SPAC are calling off deals and electing to raise money privately. There are still a few SPAC deals being done, but they are few and far between. The chart below shows how fast SPACs burst onto the scene as a hot investment only to quickly fade.

Source: Wall Street Journal, Renaissance Capital

Existing home sales slide and prices decline

Sales of previously owned US homes fell 5.9% in July, its sixth consecutive monthly decline, to a 4.81 million unit annual rate, the lowest level since May 2020. The consensus was for an even greater 6.3% pullback. The nearly 26% decline in existing home sales since January marks the steepest six-month plunge in housing records back to 1999! This monthly report from the National Association of Realtors adds to the rash of softening real estate data we’ve witnessed over the past few months. The continued weakness comes from the combination of higher mortgage rates, waning consumer demand, and higher home prices having dramatically lowered housing affordability.

Source: Ned Davis Research, Bloomberg

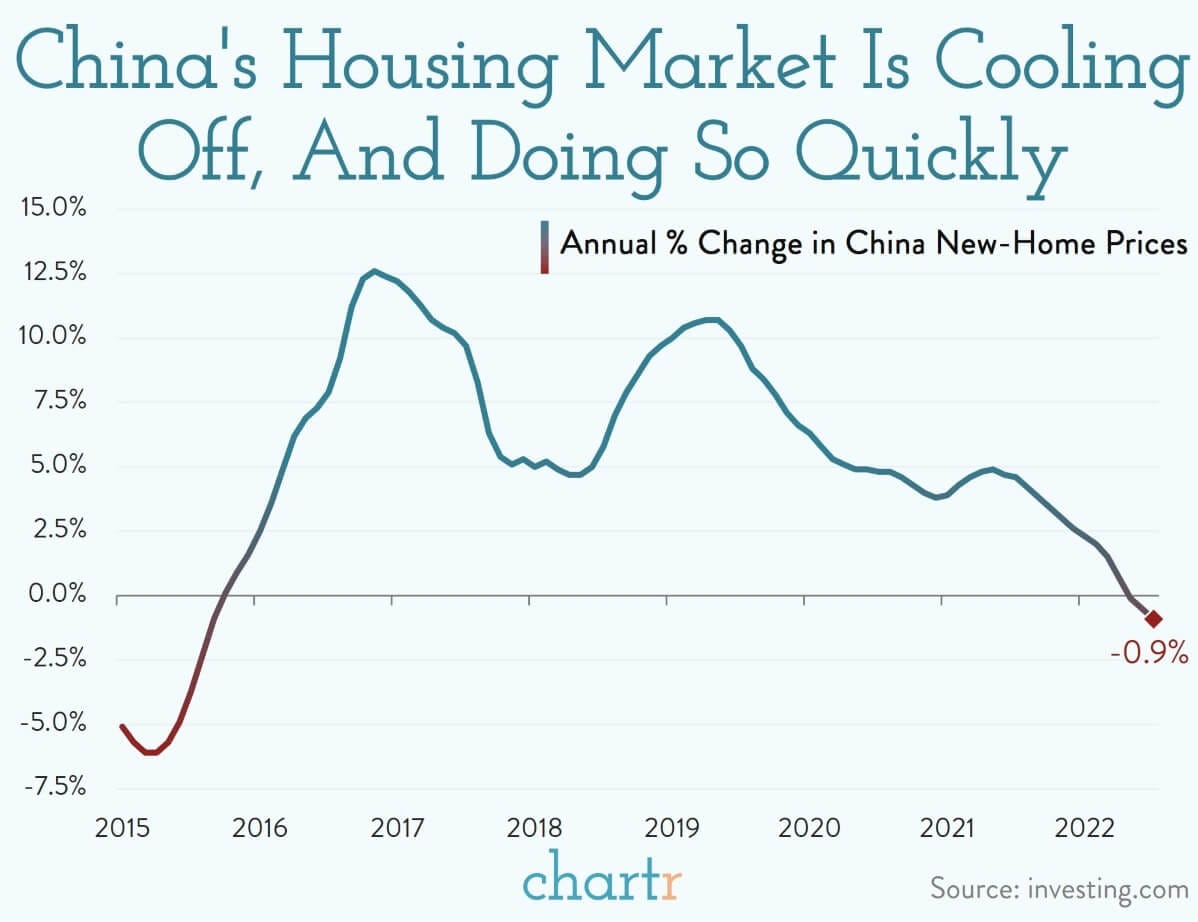

China’s problematic housing market

The Chinese housing market has missed the inflation memo. New data out this week showed Chinese new-home prices in the country falling roughly 1% in the last year, breaking more than 6 consecutive years of rising prices. Although a relatively small drop, the fall in new-home prices is just the latest piece of evidence that paints a concerning picture for the largest residential property market in the world. Sales of apartments by the country's largest developers have fallen for 13 months straight and hundreds of buildings that were presold have been left unfinished — leading some homeowners to stop paying their mortgage, a rare show of dissent in the country. All told, the WSJ estimates that billions of square meters of residential homes have been started, but not yet completed, in the last decade.

Chinese officials are doing all they can with numerous policies aimed at reinvigorating the sputtering sector and keeping the increasingly indebted property developers in business. Certainly, China’s government is behaving as if the country is in recession – hat tip to the real estate bust and Zero Covid Policy. The People’s Bank of China cut interest rates unexpectedly, and the government is increasing its budget deficit. These small moves are not really going to change the macroeconomic situation, but they do provide independent confirmation that the government is deeply worried. And with China, that’s usually as reliable an indicator of recession as we’re going to get.

Source: Chartr, Noahpinion

Silver hits new all-time lows relative to stocks

The iShares Silver ETF (SLV) has never in its history been worth less than it is today relative to the S&P 500 index. Gold isn’t faring much better. So if you're wondering whether it's better to invest in Rocks or Stocks, this chart continues to point to the trend being in favor of the stocks vs. the reliable underperformance out of the rocks:

Source: All Star Charts

Remote work is sticking

When the pandemic hit in early 2020, many businesses quickly and significantly expanded opportunities for their employees to work from home, resulting in a large increase in the share of work being done remotely. Now, more than two years later, how much work is being done from home? According to firms responding to the Fed’s August regional business surveys, about 20% of all service work and 7% of manufacturing work is now being conducted remotely, well above shares before the pandemic, and firms expect little change in these shares a year from now.

Within the service sector, there was a great deal of variation in the amount of remote work being done. For industries typically geared toward office work, such as professional and business services and financial services, the share of hours worked remotely was above 50%, on average. However, in industries typically relying on face-to-face contact with customers, such as restaurants, bars, retailers, and hotels, remote work accounted for less than 10% of work for the average firm.

And as might be expected, firms reported that workplace attendance does vary by day of the week, but not by much. Fridays and, to a lesser extent, Mondays are days where attendance is lowest.

Source: Liberty Street Economics, Federal Reserve Bank of New York

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.