The Sandbox Daily (8.19.2022)

Monthly options expiry, bond inflows, countdown to FOMC, Airbnb's resiliency, and a weekly market recap

Welcome, Sandbox friends.

Today’s Daily discusses the ~$2 trillion of monthly options contracts expiring today, the recent inflows into fixed income, the countdown to the September 21 FOMC meeting, Airbnb’s post-pandemic resiliency, and a performance recap to snapshot the week in markets.

Let’s dig in.

EQUITIES: Dow -0.86% | S&P 500 -1.29% | Nasdaq 100 -1.95% | Russell 2000 -2.17%

FIXED INCOME: Barclays Agg Bond -0.65% | High Yield -1.02% | 2yr UST 3.238% | 10yr UST 2.976%

COMMODITIES: Brent Crude -0.70% to $95.91/barrel. Gold -0.59% to $1,760.7/oz.

BITCOIN: -9.44% to $21,209

US DOLLAR INDEX: +0.56% to 108.081

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +5.32% to 20.60

August options expiry

With August shaping up to be the calmest month this year for U.S. stocks, traders were closely watching Friday’s roughly $2 trillion of option contract’s expiration for hints whether the tranquility will last. Since January, U.S. stocks have lurched lower in the third week of most months. That happens to be in the run-up to the date on which most stock options expire, the third Friday of the month. The turbulence around this event – known colloquially as OpEx, for options expiration – has become a source of fascination to many market observers, because it upends market structure and the traditional relationship between options and their underlying assets.

Today, in particular, happens to also coincide with a confluence of factors that should lift volatility in the coming weeks: short-term overbought conditions as registered by Registered Strength Index (RSI) across many stock indices, the S&P 500 index running into overhead supply at the 200 daily-moving average, and the looming central banker summit next week at the Jackson Hole Economic Symposium.

Source: Bloomberg, Goldman Sachs

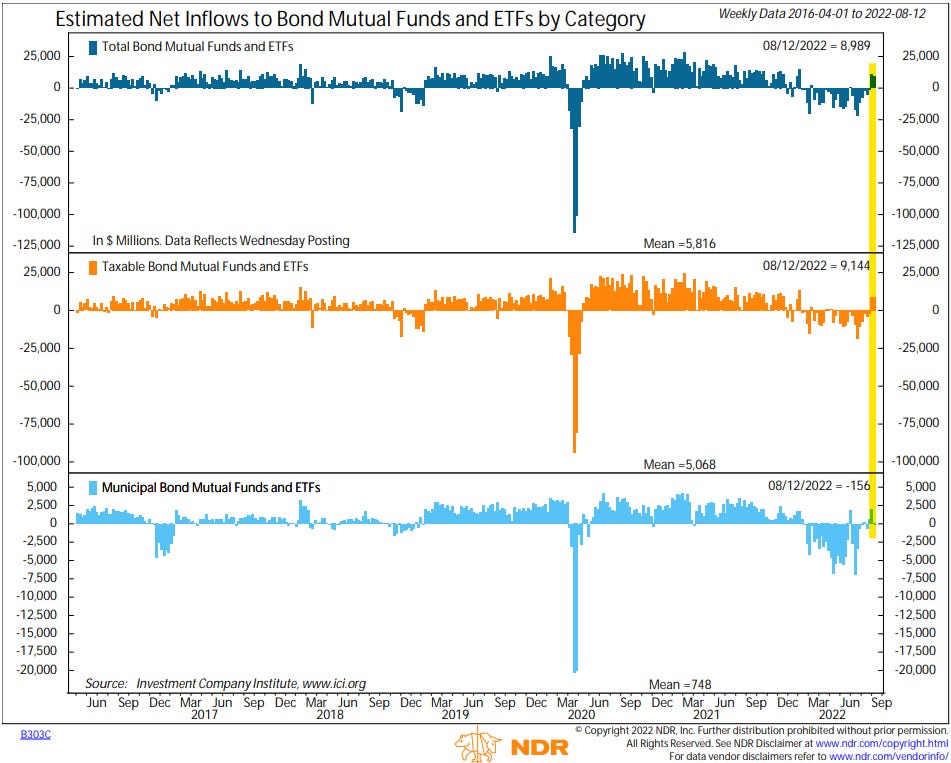

Bond inflows have returned

Better valuations, falling inflation (actual and expected), and higher reinvestment yields has resulted in the two biggest weeks of inflows into bond funds and ETFs since the first week of January. After relentless outflows week after week in 2022, bond inflows topped $10.5 billion in the first week of August and added another $9 billion in the latest week.

Source: Ned Davis Research

Countdown to FOMC

Following the release of the Federal Reserve minutes from last month’s Federal Open Market Committee meeting, the market is pricing in a 50-basis-point hike in September and again in November before settling at a terminal rate of 3.50% to 3.75% by December. Since March, the Federal Reserve has hiked the target interest rate a total of 225 basis points across four separate meetings, after anchoring the Fed Funds Rate at 0% in the wake of the COVID-19 pandemic. Here are the target rate probabilities based on fed funds futures:

Source: All Star Charts

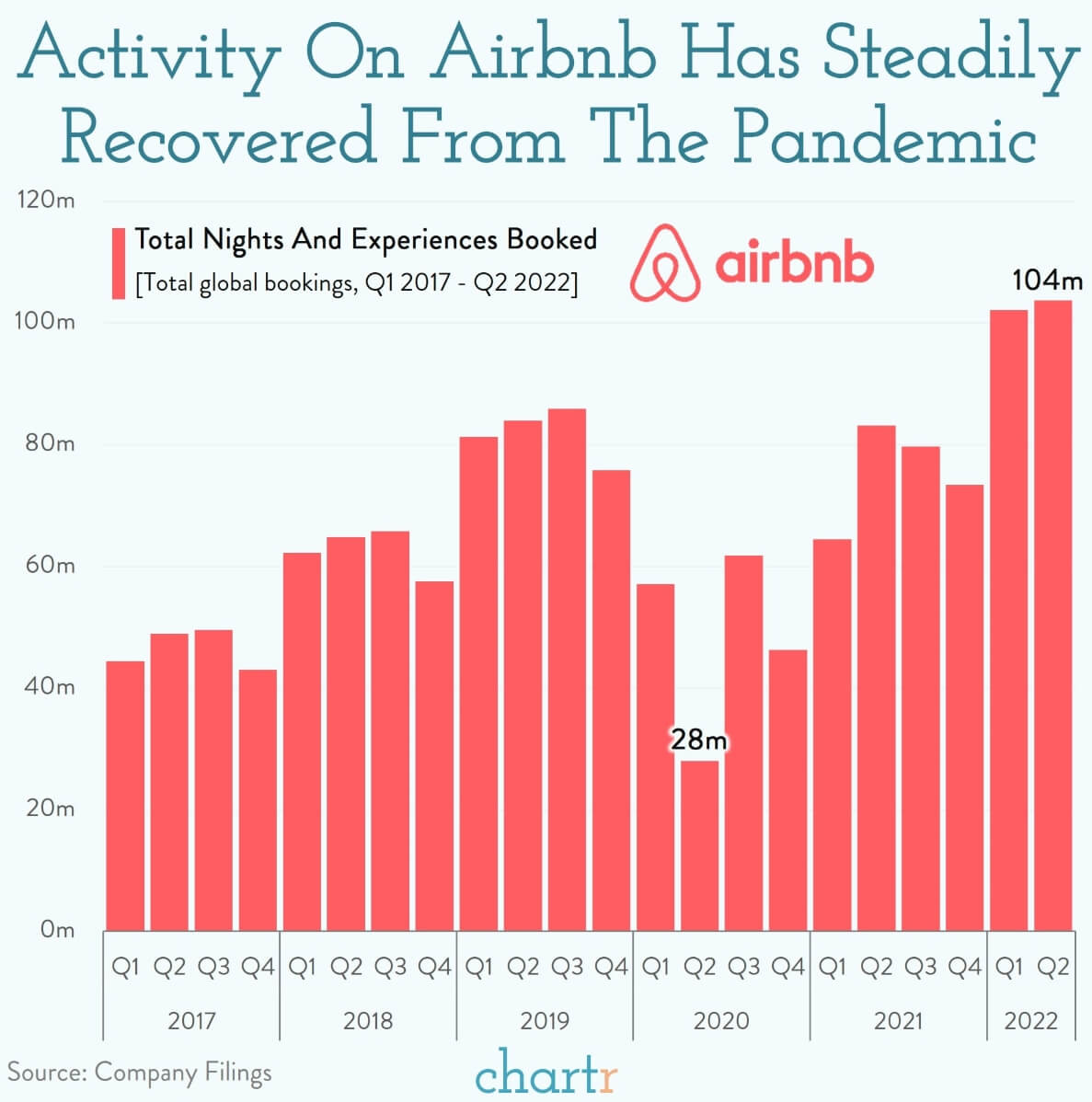

Airbnb shows resilience in the wake of the pandemic

When the COVID-19 pandemic gravely threatened vacation travel in the face of a global shutdown and an incredibly uncertain future, Airbnb got to work in reshaping the company and the culture of vacation rentals – the San Francisco-based home-rental company has been reporting a boom in activity (bookings and experiences) from customers demanding to get away, sharply reduced expenses and ad spending, announced a $2 billion share buyback plan earlier this month when it reported quarterly earnings, and forecasted a record 3rd quarter in terms of revenue.

These move come in the wake of a solid 12 months for Airbnb, which has seen the number of stays and experiences booked on the site bounce back above pre-pandemic levels. Reservations hit the 100 million mark for the second consecutive quarter, equating to $17bn of gross booking value, which suggests the company can afford to be a little more selective with their admissions policies. It's hard to deny the impact that Airbnb has had since being founded in 2008. Consumers got options beyond traditional hotels and hosts had a new way to monetize their otherwise-empty homes.

Source: Chartr

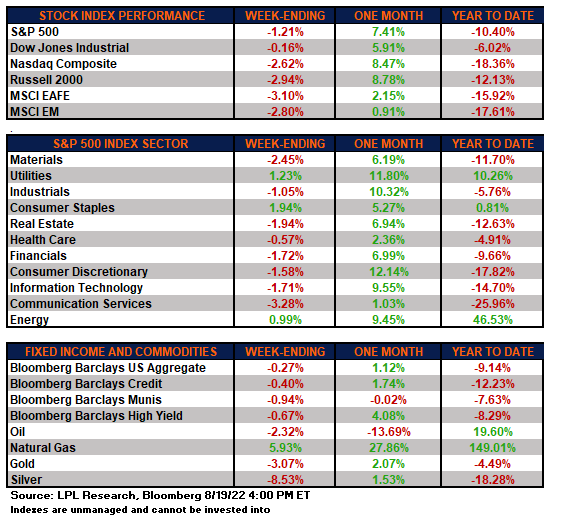

The week in review

Stocks: Markets across the board pulled back this week as the S&P 500 Index ended its streak of four straight weekly gains, the longest such streak since November 2021. Concerns about China’s economic landscape along with an all-time record increase in German producer prices in July caused equity investors to pause on adding new money to stocks. A big options expiration likely also contributed to some late-week volatility. Amid the ongoing Eastern European conflict, Europe’s reliance on Russian energy has increased challenges for the global economy.

Bonds: The Bloomberg Aggregate Bond Index finished the week lower as bond investors continue to reassess prospects for economic growth following last week’s better-than-expected inflation reports. This week’s FOMC minutes indicated that the Fed remains steadfast in its hawkish stance, which weighed on fixed income markets this week. High-yield corporate bonds, as tracked by the Bloomberg High Yield index, lost ground as equites sold off.

Commodities: Amid continued energy supply concerns in Europe from the Eastern European conflict, natural gas returned over 4%. U.S. natural gas prices are near their highest level in 15 years, up almost 150% year-to-date. Copper prices finished marginally lower after reaching a 5-week high amid a challenging year for the industrial metals. Despite its rebound over the past month, Reuters reports that global copper speculators are anticipating a downturn in the industrial metal as the latest data shows more funds with bearish positions vs. bullish on the London Metal Exchange and COMEX.

Fed Talk: Minutes from the last Federal Open Market Committee meeting were released on Wednesday. The Federal Reserve (Fed) indicated that it likely would not pull back on its hawkish sentiment until inflation retreats substantially. They did not provide specific guidance for future increases, but the Fed indicated that they would be watching data closely before making an interest rate decision. The minutes noted that some Fed members expressed concern that it could overshoot with rate hikes, underscoring the importance of being data-dependent.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.