The Sandbox Daily (8.2.2022)

Quarterly report from the New York Fed on Household Debt and Credit, S&P 500 earnings’ revisions for 3Q22, June JOLTS report, crypto's strong month in July, and falling gas prices

Welcome, Sandbox friends.

Today’s Daily discusses the Quartertly Report on Household Debt and Credit released this morning by the New York Fed’s Center for Microeconomic Data, S&P 500 earnings’ revisions for the 3rd quarter, the June JOLTS report showing that job openings saw the largest one-month decline since the onset of the pandemic, crypto’s strong month in July, and falling gas prices.

Let’s dig in.

EQUITIES: Russell 2000 -0.05% | Nasdaq 100 -0.30% | S&P 500 -0.67% | Dow -1.23%

FIXED INCOME: Barclays Agg Bond -1.02% | High Yield -0.46% | 2yr UST 3.057% | 10yr UST 2.752%

COMMODITIES: Crude Oil -0.32% to $99.71/barrel. Gold -0.59% to $1,777.2/oz.

BITCOIN: -0.52% to $22,998

VIX: +4.77% to 23.93

CBOE EQUITY PUT/CALL RATIO: 0.67

US DOLLAR INDEX: +0.83% to 106.325

Household debt surged 2% in Q2, hitting a record-high of $16.15 trillion

Total household debt increased by $312 billion during the second quarter of 2022, and balances are now more than $2 trillion higher than they were in the fourth quarter of 2019, just before the COVID-19 pandemic recession, according to the Quarterly Report on Household Debt and Credit from the New York Fed’s Center for Microeconomic Data. All debt types saw sizable increases, with the exception of student loans. Mortgage balances were the biggest driver of the overall increase, climbing $207 billion since the first quarter of 2022. Credit card balances saw a $46 billion increase since the previous quarter, reflecting rises in nominal consumption and an increased number of open credit card accounts. Auto loan balances rose by $33 billion.

Although debt balances are growing rapidly, households in general have weathered the pandemic remarkably well, due in no small part to the expansive programs put in place to support them. Further, household debt is held overwhelmingly by higher-score borrowers, even more so now than it has been in the history of our data. However, there are pockets of borrowers who are beginning to show some distress on their debt as upticks in delinquency transition rates are visible in aggregate.

Source: Liberty Street Economics, Federal Reserve Bank of New York

Analysts making larger cuts than average to EPS estimates for S&P 500 companies for Q3

Given the decline in GDP for a second straight quarter, have analysts lowered EPS estimates more than normal for S&P 500 companies for the third quarter? The answer is yes. During the month of July, analysts lowered EPS estimates for the third quarter by a larger margin than average. The Q3 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q3 for all the companies in the index) decreased by 2.5% (to $57.98 from $59.44) from June 30 to July 28. During the past 20 years (80 quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 1.7%; analysts typically reduce earnings estimates during the first month of a quarter.

Source: FactSet

June JOLTS report shows job openings saw the largest one-month decline since the onset of the pandemic

Job openings fell 5.4% in June, its third consecutive decline, from 11.3 million to 10.7 million, the lowest level since last September. It was led by fewer open positions in retail trade, wholesale trade, and state and local government education. The number of unemployed per job opening ticked up to 0.55 from 0.53, indicating some softening in labor demand. Nevertheless, with 1.8 jobs available for every unemployed person, labor market conditions are still very tight. The job market has been a bright spot in an economy otherwise losing momentum and possibly heading toward a recession as the Federal Reserve aggressively raises interest rates.

Source: Bureau of Labor Statistics, Ned Davis Research, Bloomberg

Strong month for crypto

Whether we've entered a "recession" or not, markets rallied after last week's FOMC and GDP reports as the expectations for peak policy rates continue to decline, supporting renewed risk-appetite for investors. Bitcoin and Ether post their best months since October and January 2021, respectively, gaining 27.1% and 70.3% in the 31 days of July. Crypto's bounce illustrates the importance of maintaining conviction as Ether rallies above the June 12th breakdown point, the day in which Celsius paused withdrawals. After three straight months of declines and calls for a “crypto winter,” maintaining patience and discipline while extending your time horizon will allow HODLers of digital assets to weather these tumultuous times with clearer heads.

Source: Eaglebrook Advisors

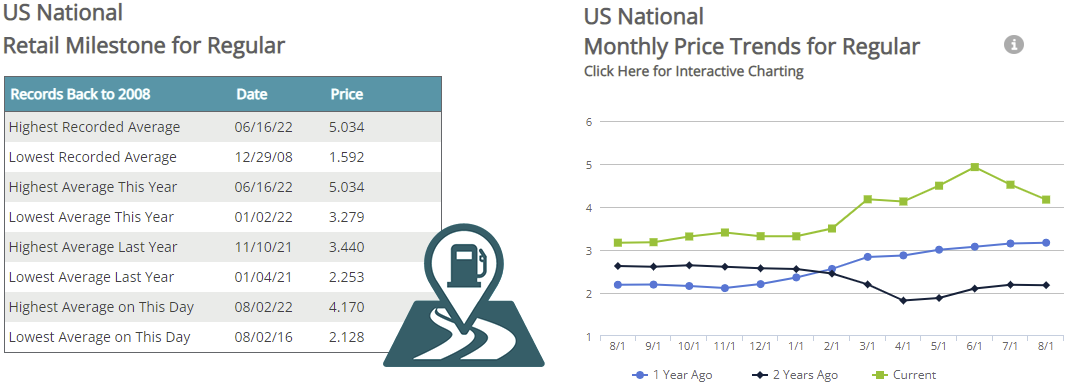

Gas prices continue to roll over

Gas prices have dropped 47 days in a row, falling to $4.168/gal as a national average. The recent high for the national average gas price was $5.034/gal on June 16th. Twenty states have an average of $3.99 or less, including roughly 80,000 gas stations.

Source: Gas Buddy

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.