The Sandbox Daily (8.24.2022)

Hedge Funds cut leverage during the 1H22 stock market rout, Baker Hughes rig count as one measure of the tight U.S. oil supply, U.S. dollar strength, and Zoom's disappointing earnings

Welcome, Sandbox friends.

Today’s Daily discusses a Goldman Sachs research report that shows Hedge Funds hunkered down by cutting leverage during the 1st half of 2022, a brief introspection of the U.S. oil supply, the strong U.S. dollar applying pressure everywhere, and reviewing Zoom’s disappointing quarterly earnings report.

Let’s dig in.

EQUITIES: Russell 2000 +0.84% | S&P 500 +0.29% | Nasdaq 100 +0.28% | Dow +0.18%

FIXED INCOME: Barclays Agg Bond -0.26% | High Yield +0.12% | 2yr UST 3.403% | 10yr UST 3.109%

COMMODITIES: Brent Crude +1.56% to $101.78/barrel. Gold +0.17% to $1,764.2/oz.

BITCOIN: +0.94% to $21,691

US DOLLAR INDEX: +0.08% to 108.598

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: -5.35% to 22.82

Hedge fund leverage has stabilized since June lows but remains near the lowest levels since March 2020

Stymied by an uncertain market environment and poor recent returns, hedge funds cut leverage and increased portfolio concentrations, Goldman Sachs equity team wrote in a company note yesterday after analyzing 795 hedge funds with $2.4tn of gross equity positions as of June 30th. Exposure data calculated by Goldman Sachs Prime Services show hedge fund net leverage that registers in the 11th percentile vs. the last three years, and 27th percentile vs. the past five years. Hedge fund net leverage has declined substantially from its highs in early 2021.

The recent stabilization of hedge fund leverage is consistent with the typical patterns around previous equity market drawdown troughs. In five previous 10%+ S&P 500 corrections since 2011, hedge fund net leverage and the long/short performance of popular hedge fund positions have usually inflected higher around the market trough, just as they did near the recent S&P 500 low in mid-June. In these episodes, leverage continued to rise gradually and hedge funds continued to outperform modestly during the subsequent few months. This pattern would suggest further upside to hedge fund length and the outperformance of popular positions through the remainder of 2022 if the equity market remains stable or continues to climb, although clear downside risks remain.

Source: Goldman Sachs

Depressed U.S. oil rig counts

One major source applying upward pressure on the price of oil is quite simple – supply. Setting aside the foreign supply that Russia provides to the international market (which is currently offline due to economic sanctions), the domestic supply in the United States still remains far below historical measures and below where demand currently is.

You see, the Baker Hughes oil rig count is currently at 762. As its name implies, this data measures the number of functioning oil rigs in the U.S. at any given time – an important business barometer for the drilling industry and its suppliers, and acts as a leading indicator of demand for products used in drilling, completing, producing, and processing hydrocarbons.

At 762, the oil rig count is up a lot over the past couple of years. It bottomed at 244 in August 2020 – so that means the rig count is up nearly 212% from its bottom. That sounds great, but from 2011 through 2015, the U.S. oil rig count fluctuated between 1,600 and 2,000. And in much of 2018 and 2019, it was fluctuating between 800 and 1,000. In other words, U.S. rig counts are up significantly from their COVID-19 pandemic bottom. But they still aren't anywhere close to where they should be during an oil and gas boom, however many of the exploration and production (E&P) companies within the oil and gas industry are slows to ramp up these early stages of production.

Source: Sandbox Financial Partners, Empire Financial Research

The U.S. dollar wrecking ball

The U.S. dollar is the strongest it’s been in twenty years, which is wreaking havoc on risk assets, such as stocks and cryptocurrencies (these two groups are often indirectly correlated).

The U.S. Dollar Index, which is a measure of the market’s indication (or value) of the U.S. dollar relative to a basket of six foreign currencies (the euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona), has been gaining in 2022 due to dollar strength from higher relative interest rates and a flight to quality, safe haven assets – as well as weakness in the euro (h/t energy crisis, recession fears) and yen (stagnant growth).

When the dollar is strong, it helps push down inflation by making imports cheaper for American buyers. But it will also make exports of American agricultural and manufactured good more expensive to foreign buyers, potentially hurting factory towns and the farm belt.

Source: Sandbox Financial Partners, Axios

Zoom's gloom

Yesterday, Zoom Video Communications Inc. (ZM) reported its slowest ever quarter of revenue growth, with sales rising just 8% over the last year as the company struggles to convert its user base into paying customers.

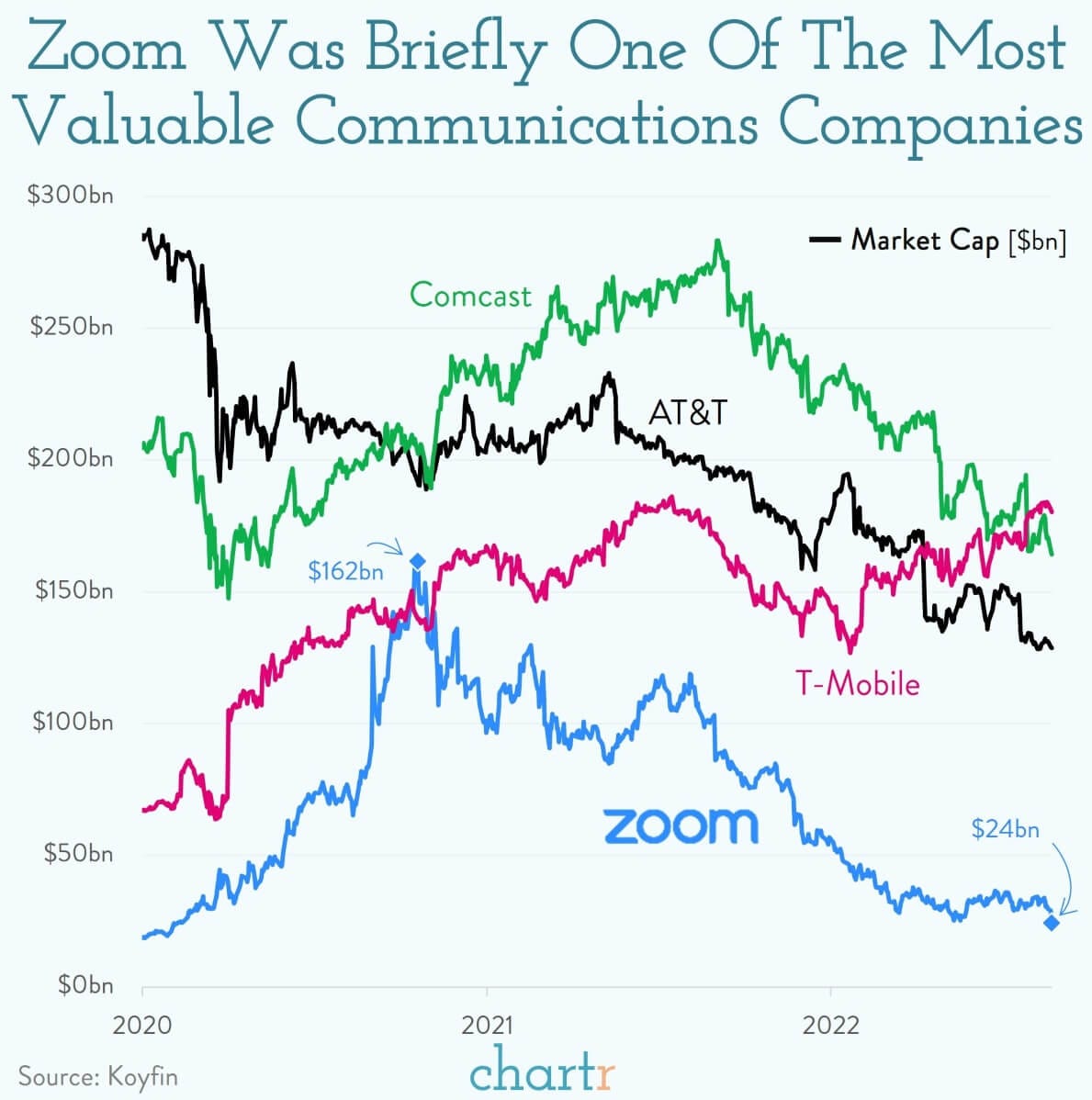

The struggling online segment, combined with a deceleration in the enterprise side of the business, got investors concerned, sending Zoom's share price down another 16% yesterday – leaving the company's market cap at less than $25bn. That's a fraction (less than one-sixth) of what the business was worth at the height of Zoom-mania when its valuation was comparable to some of the largest telecom and communications companies in the country, like Comcast, AT&T and T-Mobile.

Although the company's share price chart in the last 22 months is the stuff of CEO nightmares, Zoom remains a cash-flow-machine, generating another $500m+ from its operations in the second quarter, as well as becoming a verb in the same you “Uber” to a destination or “Google” the answer to a question – drivers that lead to Zoom’s outsized valuation during the pandemic.

In fact, in what may be the pandemic-defining chart (remember oil briefly trading below $0 and the whole WFH tech trading boom?), below is a ratio chart measuring the market capitalization of Exxon Mobil (XOM) versus Zoom Video Communications (ZM) – showing that during the heart of the pandemic, Zoom briefly overtook Exxon Mobil’s market cap (!!), only to fast-forward to today in which the market seems to have healed this imbalance and sees Exxon Mobil at 16x times Zoom.

Source: Chartr, CNBC

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.