The Sandbox Daily (8.25.2022)

The Biden Adminstration's student loan relief program, 2022 bond returns, S&P 500 market breadth technicals, soaring utility bills, and the 30-year fixed rate mortgage rises to 5.55%

Welcome, Sandbox friends.

Today’s Daily discusses the Biden Administration’s student loan relief program, 2022 bond returns in historical context, S&P 500 market breadth measures after a strong run-up from the mid-June lows, 1-in-6 Americans struggling with their electricity bills, and U.S. 30-year mortgage rates rise to 5.55%.

Let’s dig in.

EQUITIES: Nasdaq 100 +1.75% | Russell 2000 +1.52% | S&P 500 +1.41% | Dow +0.98%

FIXED INCOME: Barclays Agg Bond +0.55% | High Yield +0.94% | 2yr UST 3.372% | 10yr UST 3.031%

COMMODITIES: Brent Crude -1.50% to $99.70/barrel. Gold +0.53% to $1,770.8/oz.

BITCOIN: -0.75% to $21,571

US DOLLAR INDEX: -0.24% to 108.417

CBOE EQUITY PUT/CALL RATIO: 0.63

VIX: -4.56% to 21.78

Relief for student debt

The Biden Administration has announced three student loan policy changes:

federal student debt forgiveness up to $10k per borrower – and up to $20k per borrower in many cases (Pell Grant recipients) – among households with income up to $250k

a continuation of the pause on current student loan payments through year-end, after which payments will resume

an income-driven repayment plan that would cap monthly payments to 5% of a borrower’s discretionary income (from 10% under an existing program).

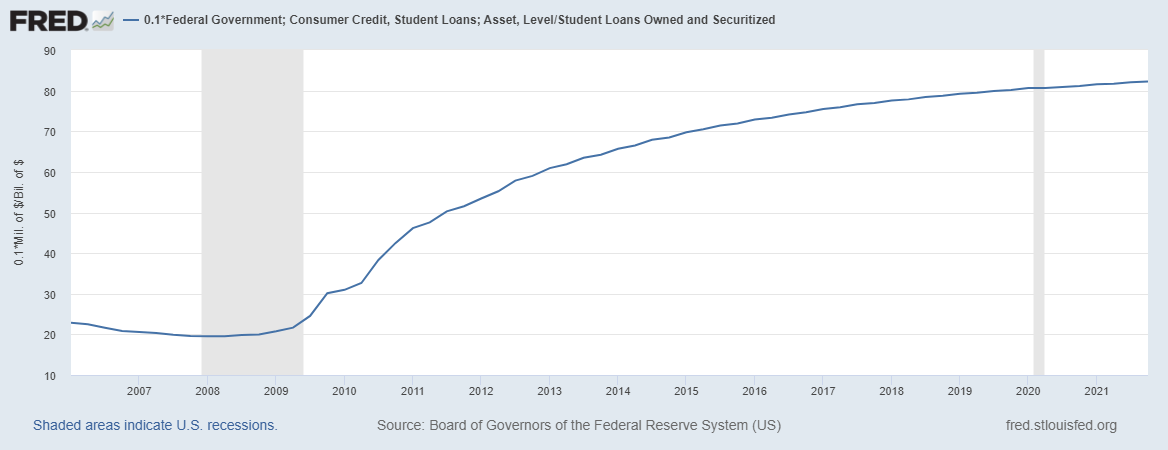

45 million Americans have up to $1.45 trillion in student loans – an amount greater than any other consumer debt besides mortgages.

And the most important thing to understand about student loans in America is that the overwhelming majority of them are owned by the federal government – over 80%.

Yesterday’s announcement looks likely to discharge around $400 billion (1.6% of GDP) in student loan balances. Goldman Sachs estimates that middle income households will receive the biggest effective income boost from the announced debt forgiveness plan. Although lower-income households that have student debt will receive the largest proportional cut in debt payments, most lower-income households do not have student debt and will therefore not benefit from the current proposal, or likely already qualify for existing income-driven repayment programs that might also lower monthly payments. Aggregating across income quintiles, Goldman Sachs estimates imply that President Biden’s proposal will reduce student debt payments from roughly 0.4% to 0.3% of personal income, roughly proportional to the proposed 25% reduction in federal student debt outstanding.

Source: Goldman Sachs, FRED Economic Data, Noahpinion

Rough start for bonds

Bonds are off to a terrible start in 2022, and depending on which sector or index you look at, it could be the worst on record. Long duration bonds have gotten smacked. The aggregate bond market and intermediate-term bonds are in a technical correction. Short duration bonds are down but not nearly as much. Bond prices are inversely correlated to yields – and when the Federal Reserve, along with most central banks around the world, set on an aggressive path to hike rates in efforts to combat 40-year high levels of inflation, bonds will suffer. However, the good news is that forward-looking returns have much improved - now that their coupons are paying a much higher yield than recent years past.

Below are some eye-opening charts showing the magnitude of how much fixed income (bonds) has re-priced in 2022. When comparing this year’s performance versus all prior calendar-year returns, well… you can see how far off the map we are, whether it’s U.S. bonds or global bonds.

Source: Bianco Research

Market internals show the S&P 500 takes a breather

Breadth metrics have weakened across the major U.S. markets over the past week after becoming incrementally stronger since June – taking a breather and consolidating after a large-run up from the lows is normal. There are not yet signs that bulls should be concerned, but at the same time, there is not much cause for becoming overly aggressive until the S&P 500 decisively clears the 200-day moving average.

Thus far, the S&P 500 Advance/Decline Line is failing its test at the March peak. Breaking above this level will be a key data point for equity bulls. The A/D Line remains above the rising 50-day moving average, keeping the nascent uptrend in place. The percent of SPX stocks trading above their 20-Day Moving Average dropped to 36% (from 85% last week), while those issues trading above their 50-Day Moving Average dropped to 78% (from 91% last week).

Source: Potomac Fund Management

A ‘tsunami of shutoffs’: 20 million U.S. homes are behind on energy bills

Electricity prices are soaring, and many Americans are struggling to make their payments. One in six homes in the U.S., or ~20 million households, have fallen behind on utility bills, according to the National Energy Assistance Directors Association. In total, US households are on the hook for $16 billion in late energy payments, which is double the amount pre-Covid.

Underpinning these numbers is a blistering surge in electricity prices, propelled by the soaring cost of natural gas. The average price consumers pay for electricity surged 15.2% in July from a year earlier, the biggest 12-month increase since 2006. Regulation of electricity rates makes it hard for providers to immediately pass on higher fuel costs, so the recent hikes may be just the start.

Source: Bloomberg

U.S. mortgage rates soar to 5.55%

Mortgage rates in the U.S. surged to the highest since June, turning up the pressure in a housing market where demand has fallen sharply from its pandemic-era peak. The average 30-year fixed-rate mortgage rose to 5.55% after mortgage rates had moderated over the summer. Mortgage rates have significantly increased in 2022 – the 30-year FRM began the year at 3.11% – as the Federal Reserve has raised its target benchmark rate amid efforts to tighten financial conditions in the face of 40-year high inflation prints.

Chief Economist at FreddieMac, Sam Khater, had this to say: “The combination of higher mortgage rates and the slowdown in economic growth is weighing on the housing market. Home sales continue to decline, prices are moderating, and consumer confidence is low. But, amid waning demand, there are still potential homebuyers on the sidelines waiting to jump back into the market.”

Source: FreddieMac

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.