The Sandbox Daily (8.26.2022)

The Fed's PCE measure on inflation, 2022 returns in perspective for the 60-40 portfolio, the University of Texas System's endowment, Quiet Quitting, and a Weekly Recap

Welcome, Sandbox friends.

Today’s Daily discusses the July Personal Consumption Expenditures (PCE) inflation report, the 60-40 portfolio in historical context, the University of Texas System’s endowment is approaching Harvard’s AUM thanks to its footprint in the Permian Basin, the latest trend dubbed “quiet quitting” around the workplace, and a performance recap to snapshot the week in markets.

Let’s dig in.

EQUITIES: Dow -3.03% | Russell 2000 -3.30% | S&P 500 -3.37% | Nasdaq 100 -4.10%

FIXED INCOME: Barclays Agg Bond -0.20% | High Yield -1.65% | 2yr UST 3.378% | 10yr UST 3.026%

COMMODITIES: Brent Crude +1.48% to $100.81/barrel. Gold -1.18% to $1,750.5/oz.

BITCOIN: -4.24% to $20,673

US DOLLAR INDEX: +0.32% to 108.822

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: +17.36% to 25.56

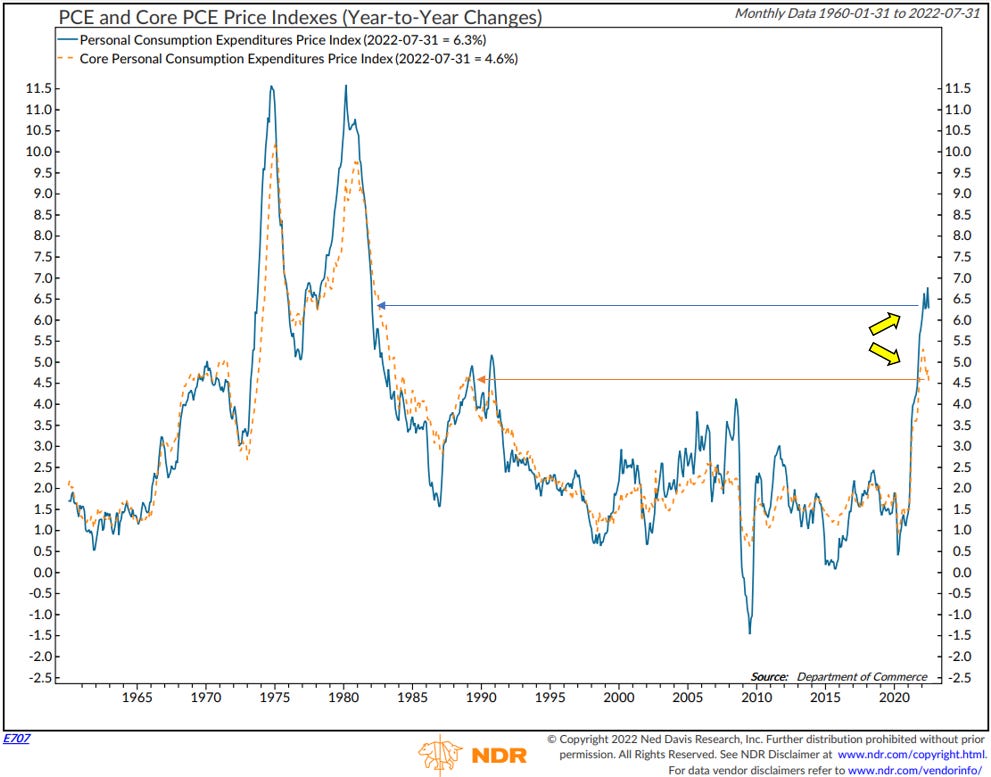

Fed’s preferred inflation measure (PCE) moderates but remains elevated

The Federal Reserve's preferred gauge of inflation produced the first negative print since the start of the pandemic and came in lower than where economists expected. The lower rate of inflation in July reflects a cyclical slowdown in demand and the continued, albeit slow, shift back in consumer preferences toward more services and fewer goods in the post-pandemic period.

The Personal Consumption Expenditures (PCE) Price Index fell -0.1% in July, its first decline since April 2020. Energy was a big driver, down -4.8% for the month, while food prices increased +1.3%. Core PCE, which excludes energy and food, ticked up +0.1%, the smallest gain since November 2020.

Headline PCE inflation moderated to +6.3% YoY from a peak rate of +6.8% in June, while core PCE continues to ease at +4.6% YoY which is down from a recent cycle high of +5.3% back in February.

Even though inflation has backed off from recent highs, it is still historically elevated, with headline inflation running close to its highest level since 1982, and the core near its highest level since 1989. It is still well above the Fed’s average inflation target of 2.0%, keeping monetary policy in restrictive territory.

While a data-dependent Fed will not pre-commit to a set number or size of rate hikes, many continue to expect a terminal fed funds rate of 3.50%-3.75% either late this year or early next year. At that time, the Fed may reassess its policy progress and impact on the economy, but talk of a hard pivot to rate cuts seems premature, given the uncertainty around the path of future inflation and the remarks by Chair Powell at the Jackson Hole Summit earlier today.

Source: Ned Davis Research, Bloomberg

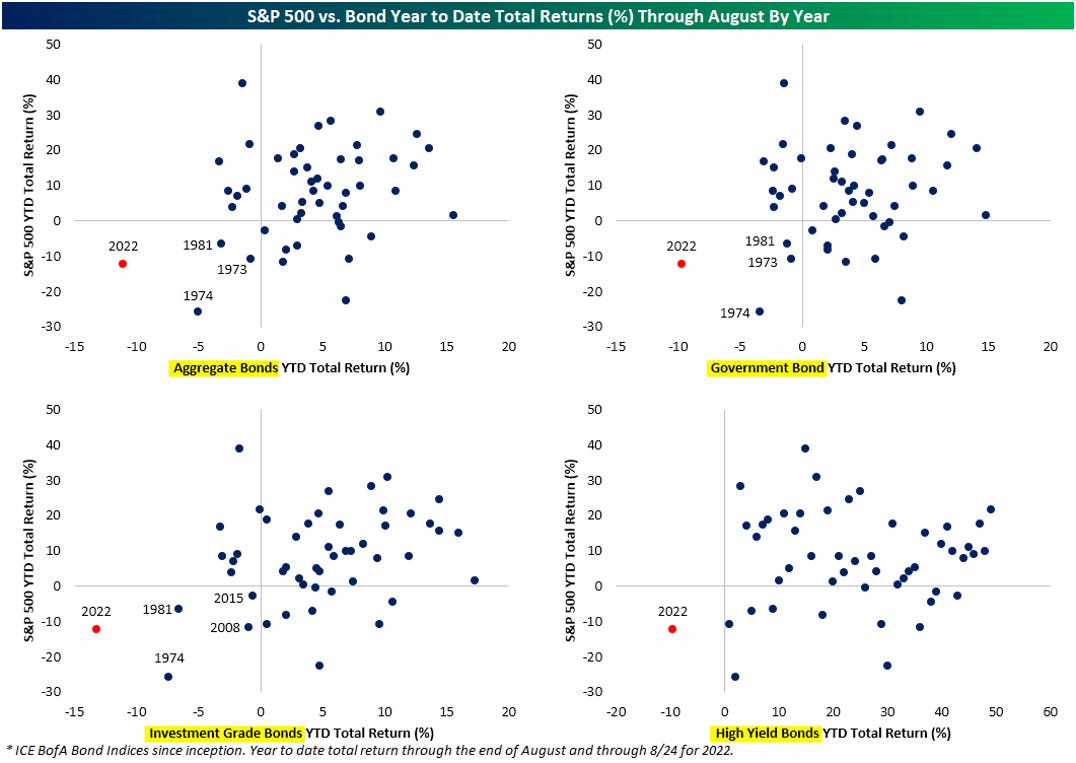

2022 slams both stocks and bonds

It’s no secret that 2022 has not been kind to the 60-40 portfolio. Both are in the red by 10%+ on a year-to-date basis headed into the final few days of August. In the charts below, we show the year-to-date total returns of the S&P 500 (y-axis) and the year-to-date total returns of various ICE Bank of America bond indices (x-axis) through August for each year going back to their respective inceptions (each index began in 1973 except for high yield which began in 1987). No matter which way you cut it, 2022 has been the worst year of the past half century for stocks and bonds combined.

Source: Bespoke Investment Group

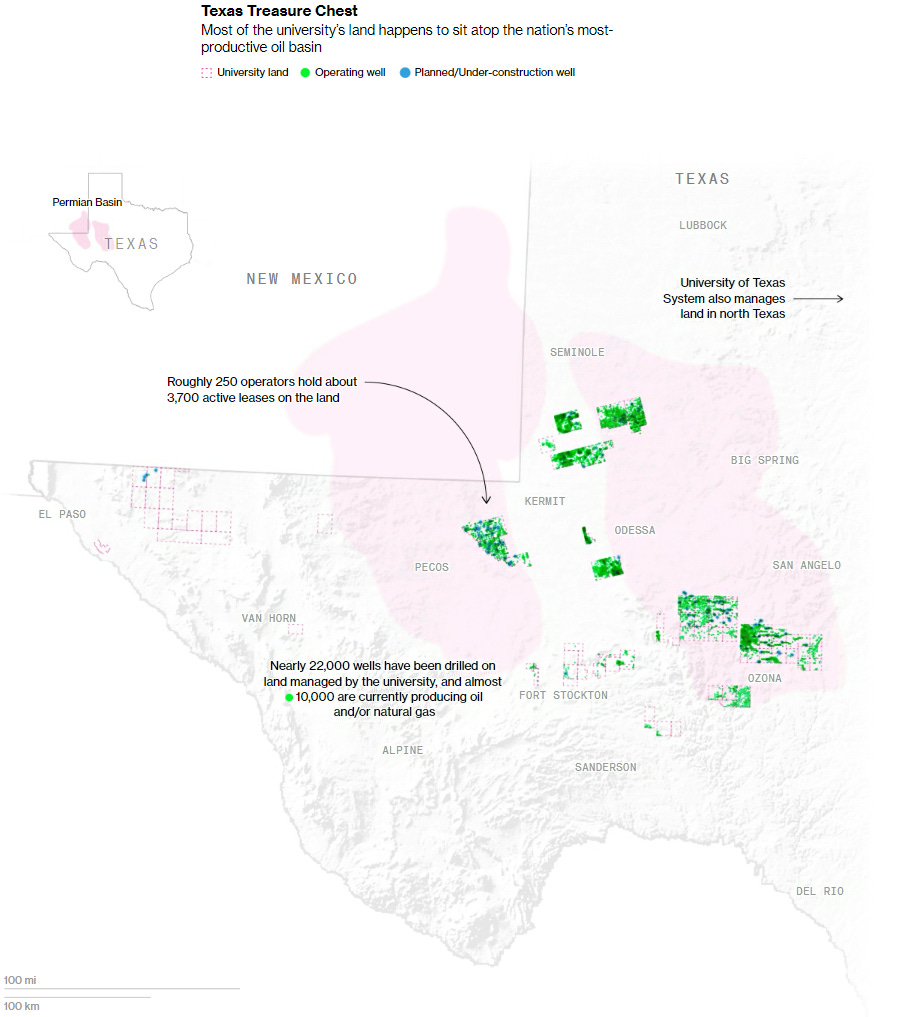

University of Texas System is narrowing the gap between its endowment and Harvard

The University of Texas System endowment ($42.9 billion) could become the richest endowment in the United States, approaching Harvard’s $53.2 billion endowment to occupy the No. 1 spot, Bloomberg reports. Why? Because at a time when most schools’ investment portfolios are falling alongside the broader market selloff, the University of Texas System has something they don’t: 2.1 million acres of oil-rich land.

The University of Texas System leases out the country’s largest oil field to some 250 drillers, including giants like ConocoPhillips, which pump out 300,000 barrels of crude oil per day and pay the university System royalties. And it’s a great time to be in the oil business. The UT System is expecting its biggest payout this year thanks to the steep rise in oil prices, which hit $120 a barrel in June. The UT System brings in roughly $6 million a day from its oil portfolio. In fact, the UT System has been collecting oil-related revenue streams for quite some time – the Santa Rita #1 was the first oil well to directly fund the University of Texas with its first royalty payment made on August 24, 1923.

Interestingly enough, UT’s trip to the top is a lonely one, as more universities are opting out of fossil fuel investments following activist and public pressure as endowments adopt greater use of ESG solutions. Just last year, Harvard and Yale promised to limit fossil fuel industry investments.

Fun fact: University of Texas isn’t the only university with a non-traditional investment portfolio. Emory is one of the largest private shareholders of Coca-Cola, Northwestern’s endowment is packed with royalties from the pain medication Lyrica, and even Harvard has owned some California vineyards since 2012.

Source: Bloomberg, Morning Brew

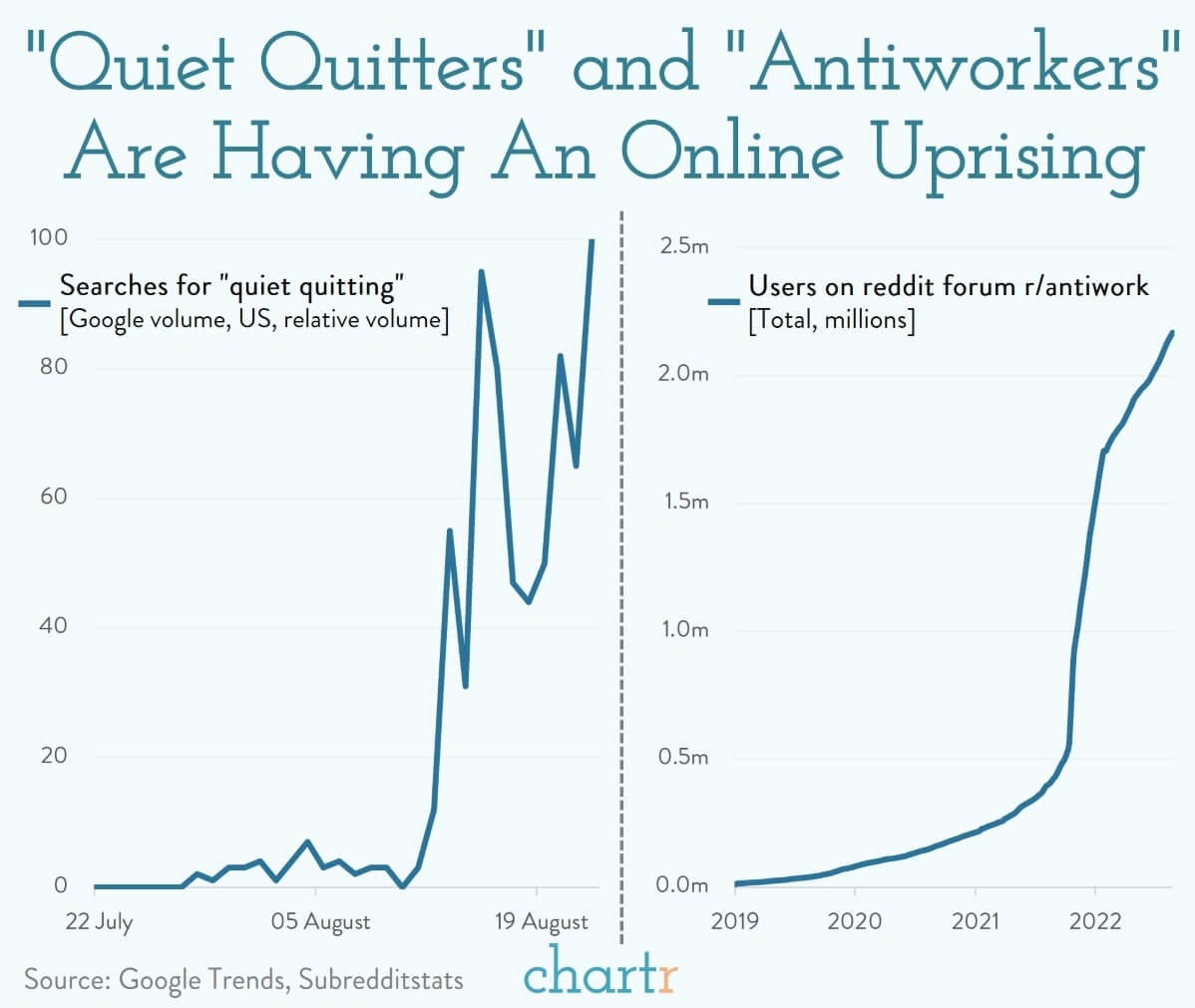

Quiet quitting

One of the hottest topics on social media in the last few weeks has been "quiet quitting," with videos using just one associated hashtag racking up nearly 40 million views on TikTok.

Normally when you think about someone quitting a job, you envision the explosive scene from Jerry Maguire. But online chatter around a relatively new trend know as “quiet quitting” is gaining significant steam, as shown by Google searches and Reddit users/forums.

The movement, often exclusively ascribed to Gen Z and younger Millennial employees, is a fairly broad church, though all participants push the rejection of hustle culture – the idea of going above and beyond to impress bosses and colleagues alike for career accolades and advancement. Quiet quitting embodies the idea that you should do your explicit job description, and your explicit job description only, in the workplace. Despite being relatively contained to social media, the idea has provoked numerous think pieces from mainstream publications on the subject and, of course, major backlash from corporate executives.

Wonkiness from the pandemic continues…

Source: Chartr, The Hustle

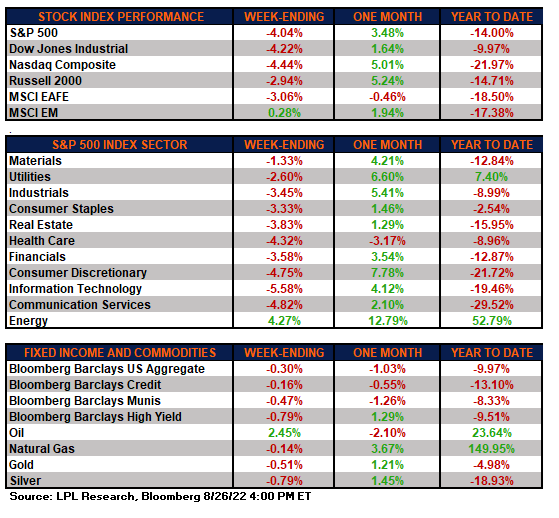

Stocks: Markets pulled back sharply this week as the S&P 500 Index ended its streak of four straight weekly gains. Markets got an unwelcomed reminder from Federal Reserve (Fed) Chairman Powell in his speech at Jackson Hole, as well as other Fed Presidents, that fighting inflation remains the central bank’s top priority and that rates may stay higher for longer than those calling for a quick pivot had anticipated. Cleveland Fed President, Loretta Mester, had this to say today regarding the Fed’s current tightening cycle: “We’re going to have to get interest rates up a little above 4% by sometime early next year, and hold them there.”

Bonds: The Bloomberg Aggregate Bond Index finished the week lower along with high-yield corporate bonds. Bonds lost ground as investors reassess the direction of rates given hawkish comments from the Fed today.

Commodities: Amid continued energy supply concerns in Europe from the Eastern European conflict, natural gas finished in the green this week. U.S. natural gas prices are near their highest level in 15 years, up over 150% year-to-date. The metals had a tepid performance this week as global demand is a concern amid the softening economic landscape in China and Europe.

Economic Weekly Roundup: The headline Personal Consumption Expenditure (PCE) deflator fell -0.1% in July, the first decline seen since the onset of the pandemic. Meanwhile, real personal spending rose +0.2%, which is a positive indicator for Q3 economic growth. The July savings rate was 5%, unchanged from the previous month. Elsewhere, the People’s Bank of China (PBOC) reduced the prime rates for both one and five-year loans in an attempt to strengthen demand for credit and stimulate the economy – similar actions were taken last week by the PBOC when they reduced the seven-day reverse repo rate and the one-year medium-term lending facility. Reducing rates that are tied to the Chinese property market should provide liquidity but doesn’t address the zero-COVID policy, a significant headwind for the economy.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.