The Sandbox Daily (8.9.2022)

Hedge Fund net positioning, labor force productivity, SPX P/E multiple, crypto in rally mode, and Softbank delivers massive losses

Welcome, Sandbox friends.

Today’s Daily discusses the weak net positioning in Hedge Funds, the drop in US labor force productivity rate, the S&P 500 forward P/E multiple, crypto’s resiliency off the June bottom, and SoftBank’s 2nd quarter record losses amidst the tech rout.

Let’s dig in.

EQUITIES: Dow -0.18% | S&P 500 -0.42% | Nasdaq 100 -1.15% | Russell 2000 -1.46%

FIXED INCOME: Barclays Agg Bond -0.22% | High Yield -0.74% | 2yr UST 3.268% | 10yr UST 2.779%

COMMODITIES: Brent Crude -0.12% to $96.53/barrel. Gold +0.32% to $1,810.8/oz.

BITCOIN: -2.72% to $23,181

VIX: +2.25% to 21.77

CBOE EQUITY PUT/CALL RATIO: 0.56

US DOLLAR INDEX: -0.12% to 106.310

Hedge fund net positioning is very weak

Unconvinced by the June-July rally, hedge funds are net underweight the S&P 500 by a larger magnitude than during the Covid-19 crash in early 2020. It is unlikely that hedge funds will remain on the sidelines for long and continue their risk-off stance with evidence of multiple breadth thrusts and large rips higher. If institutional positioning remains this light, expect these funds to be dragged into this rally and contribute to some of these big moves as they chase gainers. Some investors view this weak positioning as a contrarian bullish indicator.

Source: Fundstrat, Macro Hive, Bloomberg, CFTC

Productivity paradox

Nonfarm labor productivity growth (aka employee output per hour) declined at a -4.6% annual rate in Q2, down in three of the last four quarters; on a YoY basis, productivity sank a record 2.5% which is the lowest it’s ever been in a data series that goes back to 1947! Nonfarm output shrank at a -2.1% annual rate, down for the second consecutive quarter, while hours worked grew at a +2.6% rate. So, Americans totaled more hours worked while our economic output declined – thus creating a drop in our labor force productivity rate. As wages continue to make strong gains in 2022 while simultaneously delivering less in productivity, companies are faced with a precarious situation due to the very fact that labor costs are often the biggest ongoing expense for a business.

Source: Ned Davis Research, Axios

Stock valuations have declined significantly from their highs

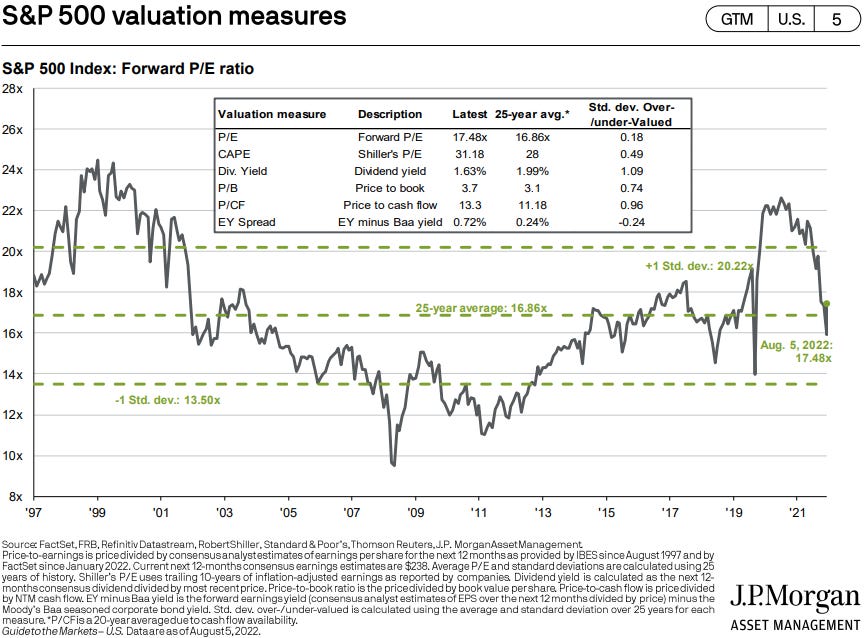

After a turbulent year for stocks with heightened volatility, deteriorating economic indicators, and geopolitical instability, it may be hard for individual investors assess where growth equities are in the current cycle or where they may be headed. Perhaps, the low point for growth stocks has passed, and they are on the path of recovery or even at the start of a new outperformance cycle. Or there could be further downside coming – no one knows.

Since stock prices are a driving component of equity valuations, the recent market decline has brought valuations significantly below their highs. During 2021, the next twelve months price-to-earnings (“P/E”) ratio for the S&P 500 Index was more than one standard deviation above its long-term average at 22x and was approaching extreme levels last seen during the dot-com bubble. As of June 30th, the popular valuation metric had declined to 15.9x, slightly below the average level of 16.9x over the past 25 years, as seen in the chart below. Today, the forward P/E multiple is 17.5x. Although valuations may decline further, the data indicates that currently the broad equity market in the U.S. is no longer overvalued and perhaps may present an attractive entry point for longer-term time horizons.

Source: JPMorgan

Crypto’s resiliency

Over the last week, the market’s flat performance for risk assets offered investors a break from the action and an opportunity to reassess positioning for the second half of 2022 – at the same time the market is absorbing two major economic releases: 1) last Friday’s BLS monthly jobs report showing the addition of 528k jobs in July and a 3.5% unemployment rate and 2) tomorrow’s U.S. Consumer Price Index showing the latest inflationary measures from July. Against a backdrop of tremendous uncertainty, Bitcoin and Ether have now gained 30.8% and 90.6% from their lows on June 18th, although each asset remains down roughly 50% in 2022 despite the recent bounce. This most recent performance should provide some reassurance to those investors that were concerned with digital assets’ ability to bounce when conditions warranted.

Source: Eaglebrook Advisors

SoftBank posts record losses

SoftBank Group reported a record $23.4 billion (3.16 trillion yen) net loss in the 2nd quarter as the selloff in global tech stocks continued to hammer its flagship Vision Fund. Global stock prices continued their slide during the 2nd quarter, hurting valuations of SoftBank’s key public holdings like Alibaba Group Holding (BABA), Uber Technologies (UBER), DoorDash Inc. (DASH), and Coupang Inc. (CPNG) to name a few. The Nasdaq 100, a barometer for tech heavyweights, lost 22% during the period, capping its worst quarterly performance since the global financial crisis in 2008.

Masayoshi Son, SoftBank’s outspoken founder and the mastermind behind the Vision Fund, sprayed unprecedented levels of funding on startups across the world over the past half-decade, particularly just as prices crested last year. Now, the company has erased more than $50 billion of gains from its peak, leaving SoftBank reporting a slight gain just above its cost.

Source: Bloomberg

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.