The Sandbox Daily (9.13.2022)

Reflecting on today's Consumer Price Index (CPI) August report

Welcome, Sandbox friends.

Today’s Daily discusses the talk of the tape -> the Consumer Price Index (CPI) report. But first, a few pictures to share from the Future Proof wealth management festival in Huntington Beach, California.

Let’s dig in.

Editor’s note: Future Proof

It’s inspiring to meet so many highly-skilled, dedicated, and talented people here in Huntington Beach, California at the Future Proof wealth management festival. We are learning a ton, meeting fascinating people, and generating fresh new ideas for the Sandbox community. Please enjoy a few of the sights from Day 3.

CNBC’s Scott Wapner and DoubleLine’s “The Bond King” Jeffrey Gundlach

All Star Charts (independent technical analysis and research)

CNBC’s Steve Liesman and Bob Pisani

Sandbox Financial Partners

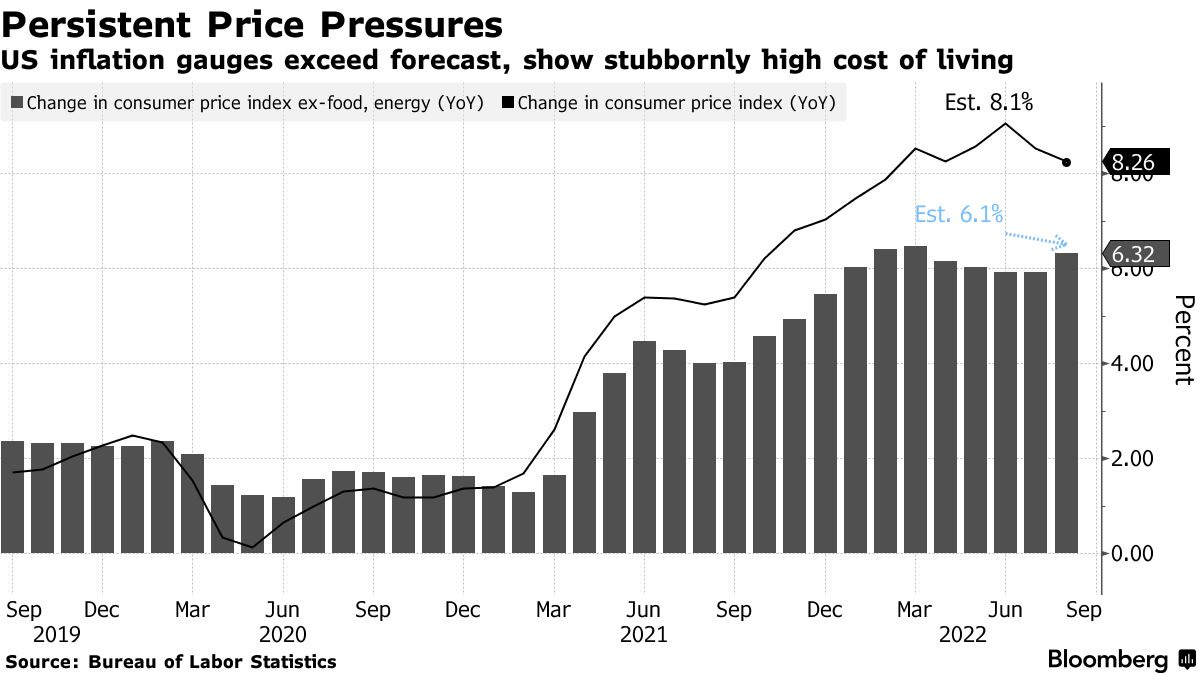

U.S. inflation tops forecasts, cementing odds of big Fed rate hike

The U.S. Consumer Price Index (CPI) increased +0.1% MoM from July, after no change in the prior month, Labor Department data showed Tuesday. Prices are up +8.3% YoY, a slight deceleration from +8.5% the prior month, largely due to recent declines in gasoline prices.

Core CPI, which excludes the more volatile food and energy categories, increased +0.6% in August, twice the gain in the previous month, and is up +6.3% YoY. The biggest driver of the monthly change in the core CPI was shelter, which has a weight of over 40% in that index. Rent and Owners’ Equivalent Rent (OER) each rose +0.7%. Despite the decline in housing market activity this year, softer home prices are reflected in the CPI with a significant lag, and will remain a source of higher inflation this year.

Some categories are showing persistent and extreme behavior:

Source: Ned Davis Research, Bloomberg

The Fed’s difficult proposition

Such broad-based inflation pressures continue to reflect supply/demand imbalances. Consumer demand remains strong – supported by low unemployment, excess savings accumulated during the pandemic, and the ongoing post-pandemic shift back toward more services consumption versus goods. At the same time, while some supply chain problems have eased, others such as labor shortages have persisted. This underscores the difficult task for the Fed to bring inflation down without causing a recession – the desired “soft landing.”

Source: Sandbox Financial Partners

Stocks sell off violently

Risk assets sold off aggressively following today’s inflation print. The market is digesting the implications of a “higher for longer” inflation narrative – the Federal Reserve will need to continue being aggressive by raising interest rates.

In fact, today’s price action reversed much of the S&P 500’s strong advances over the last few days - likely because the market was positioned for a softer inflation print.

It was so bad for the Nasdaq 100 that every single stock in its index basket fell today – first time this has happened since March 2020.

Source: Sandbox Financial Partners, Bloomberg

Fed rate hike expectations turned hawkish

The Federal Reserve’s upcoming policy meeting is September 20-21. With this singular data point, Fed rate hike expectations turned decidedly hawkish following today’s CPI report and suggests the Federal Reserve has more work to do in the months ahead.

September 21: 75 bps hike to 3.00%-3.25%

November 2: 75 bps hike to 3.75%-4.00%

December 14: 50-50 odds of 25 bps hike to 4.25%-4.50% or 50 bps hike to 4.50%-4.75%

Source: CME FedWatch Tool

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.