The Sandbox Daily (9.15.2022)

S&P 500, mortgage rates, retail sales, the Ethereum "Merge," and gold

Welcome, Sandbox friends.

Today’s Daily discusses the Tuesday’s stock market rout (again), mortgage rates continue to climb, retail sales hold firm in the face of sticky high inflation, the Ethereum network “Merge” is complete, and gold’s lack of absolute strength as an inflation hedge.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.56% | Russell 2000 -0.72% | S&P 500 -1.13% | Nasdaq 100 -1.71%

FIXED INCOME: Barclays Agg Bond -0.30% | High Yield -0.63% | 2yr UST 3.863% | 10yr UST 3.449%

COMMODITIES: Brent Crude -3.43% to $90.87/barrel. Gold -2.06% to $1,673.9/oz.

BITCOIN: -0.60% to $19,852

US DOLLAR INDEX: +0.09% to 109.717

CBOE EQUITY PUT/CALL RATIO: 0.75

VIX: +0.42% to 26.27

Another look at Tuesday’s stock market rout

Investors were expecting CPI inflation in August to follow the good news from July and continue to cool off. Instead, consumer prices actually rose +0.1% MoM relative to July and core inflation, which strips out energy and food, rose +0.6% in the month.

That rise in prices caught investors off guard, as higher inflation gives the Federal Reserve Open Markets Committee (FOMC) a stronger incentive to keep raising interest rates, sending the S&P 500 Index down -4.3%.

Using this visual showing the magnitude of daily price movement, Tuesday was the worst day of the year so far and one must have to go back to the highly volatile 2020 to find a sharper one-day decline for US equities. It’s also noteworthy how volatile 2022 has been in stock markets versus 2021 when you look at the aggregate number of dots outside the two vertical lines (representing returns of +2% and -2%).

Source: Chartr

Mortgage rates continue to climb

The average 30-year fixed mortgage rate with conforming loan balances hit the 6% mark for the first time since 2008 – rising to 6.02% – which is more than double what it was a year ago, per a report yesterday from the trade group Mortgage Bankers Association (MBA) and today from Freddie Mac. Mortgage rates, which had been easing slightly through July and August, pushed higher yet again, after Federal Reserve Chairman Jerome Powell made it clear to investors that the central bank would stay tough on inflation, even if it caused consumers some pain. The jump in rates adds to the cost of a home loan for both buyers and homeowners interested in refinancing. The national rate was 2.87% this time last year.

The MBA’s Joel Kan, Associate Vice President of Economic and Industry Forecasting, had this to say: “Higher mortgage rates have pushed refinance activity down more than 80% from last year and have contributed to more homebuyers staying on the sidelines.”

Source: Mortgage Bankers Association, Freddie Mac

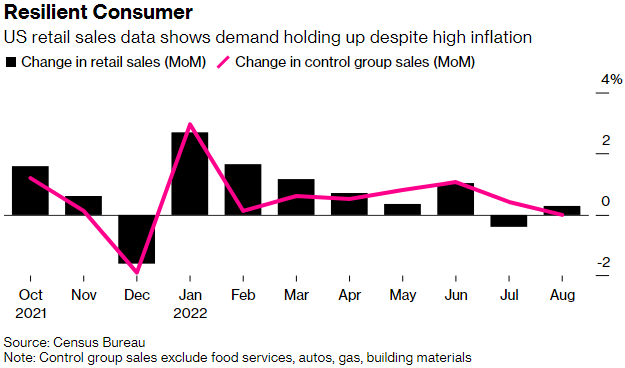

Retail sales hold firm in face of inflation

U.S. retail sales unexpectedly rose +0.3% in August after declining -0.4% a month earlier, as consumer demand for goods broadly held up but showed signs of moderating amid historic inflation. 8 of 13 retail categories grew last month. As a benefit from lower gasoline prices, consumers spent more on other purchases.

On a year-over-year trend basis, retail sales increased +9.3%, slightly up from the +9.2% pace in the previous month.

U.S. Retail Sales measures the total sales within the U.S. economy excluding food services. Retail sales are a good gauge of how the economy is doing. It can also give an idea of whether or not consumers are using their discretionary income.

Source: Ned Davis Research, Bloomberg

The Merge is complete

The Ethereum Merge is done – the joining of Ethereum’s newer Proof-of-Stake (PoS) Beacon Chain with the original Ethereum Mainnet to transition the Ethereum blockchain off the legacy Proof-of-Work (PoW) system. This will result in a 99.95% reduction in Ethereum’s energy consumption, and the ability to further scale the Ethereum ecosystem. It will result in Ethereum 2.0, a new version of Ethereum.

The Beacon Chain, added in December 2020, grows by using proof-of-stake (PoS), in which “validators” put up a share of their crypto as collateral (“staking”) for the privilege of being randomly selected to verify that a new block of data is correct. Once a certain number of them agree that the block is accurate, it’s added to the blockchain, and the validators are rewarded.

Gold not holding up as inflation hedge

The price action of Gold in 2021-2022 is not showing its traditional strength and reputation as an inflation hedge. With inflation hovering near 40-year highs, Gold is down -5% in 2022 and down -9% since the beginning of 2021. Gold also happens to find itself at the same level it was pre-Covid. Like many other asset classes, Gold is bouncing off key former support levels. Many investors will be watching to see if buyers continues to defend the line or we see a breakdown.

Source: Sandbox Financial Partners

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.