The Sandbox Daily (9.16.2022)

FedEx, Quantitative Tightening (QT), Goldman Sachs outlook, and a weekly market recap

Welcome, Sandbox friends.

Today’s Daily discusses the stern warning from FedEx, early market implications of the Fed’s Quantitative Tightening (QT) measures, Goldman Sachs outlook for the U.S. market, and a brief recap to snapshot the week in markets.

Let’s dig in.

EQUITIES: Dow -0.45% | Nasdaq 100 -0.55% | S&P 500 -0.72% | Russell 2000 -1.48%

FIXED INCOME: Barclays Agg Bond -0.09% | High Yield +0.34% | 2yr UST 3.873% | 10yr UST 3.451%

COMMODITIES: Brent Crude +0.73% to $91.53/barrel. Gold +0.62% to $1,684.2/oz.

BITCOIN: -0.55% to $19,742

US DOLLAR INDEX: -0.06% to 109.677

CBOE EQUITY PUT/CALL RATIO: 0.73

VIX: +0.11% to 26.30

Talk of today’s tape: FedEx

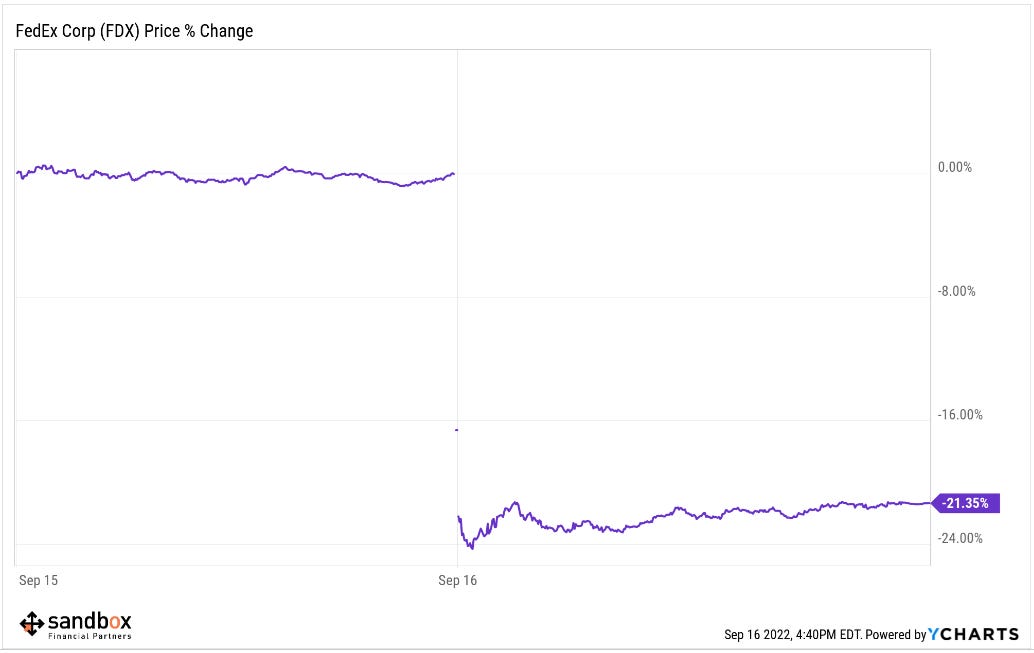

U.S. equities continued their downward slide, as a warning from FedEx sent ripples through the market on concerns about the health of the economy.

FedEx (FDX) was the worst-performing stock in the S&P 500 after the package delivery giant warned about falling revenue, announced cost-cutting measures, and CEO Raj Subramaniam predicted an economic recession ahead. FedEx withdrew its full-year guidance given in June, citing preliminary earnings and revenue data that fell well short of forecasts because of what it called “global volume softness that accelerated in the final weeks of the quarter.” The company noted the results were particularly impacted by macroeconomic weakness in Asia and service challenges in Europe. The market must decide if this signaling from FedEx represents concerns for the broader economy or if the guidance was more idiosyncratic in nature.

Source: Sandbox Financial Partners

Early signs of Quantitative Tightening (QT)

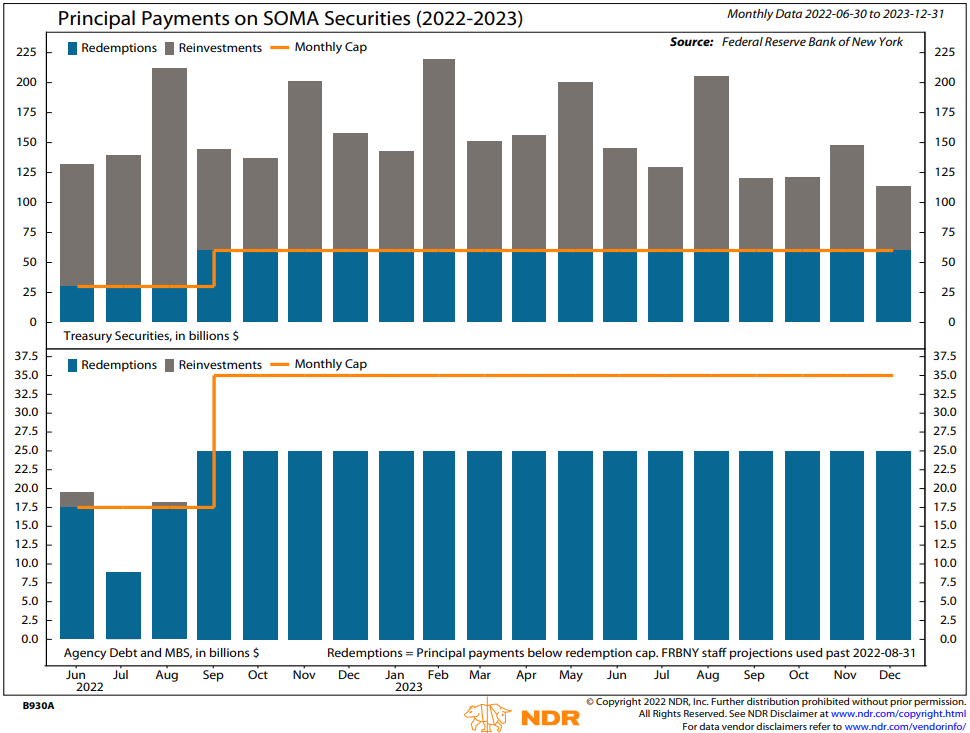

The Federal Reserve is currently using its two primary tools to tighten financial conditions in its efforts to quell inflation: (1) hiking interest rates (225 bps total thus far, more coming next week) and (2) balance sheet runoff. The latter monetary policy tool is of interest here.

In the May FOMC meeting, the Fed announced it would shrink its balance sheet through “balance sheet runoff.” From June to August, the Fed redeemed up to $47.5bn in securities per month that included $30bn in Treasuries and $17.5bn in agency mortgage-backed securities (MBS). Beginning September 1, those monthly redemption efforts doubled to $95bn per month ($60bn in Treasuries and $35bn for MBS). That should result in a runoff of $450bn this year and $1tn each in 2023 and 2024. To get the Fed’s securities holdings back to pre-pandemic level of roughly 20% of GDP as suggested by Governor Waller, we estimate the Fed would need to offload $2.8 trillion in a little under three years, or by April 2025, leaving $5.7 trillion. That is a lot of QT!

So, naturally, the question becomes: what are the (early) implications of QT on the market?

1. Trading liquidity in government bonds has been steadily declining all year. The same is true for the corporate bond market, too.

2. Volatility is higher than normal. The deterioration in liquidity has contributed to market volatility, where realized volatility is much higher than its historical mean – you must go back to the GFC and the European sovereign debt crisis to find comparable levels before the pandemic.

Source: Ned Davis Research

Goldman Sachs outlook

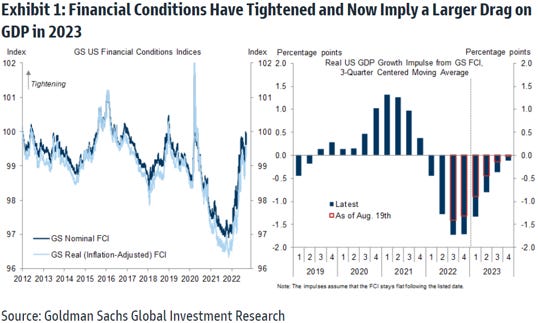

In a note published yesterday from Goldman Sachs, the bank published their forward guidance to reflect various pressures weighing on near-term growth: elevated core inflation, hawkish Fed commentary, upward revisions to Fed Funds terminal rate projections, sizable growth drags from the Russia-Ukraine conflict, tighter financial conditions, and a substantial slowdown in housing activity. To wit:

In the US, we expect Q4/Q4 growth will be flat in 2022, reflecting a large fiscal drag and a negative impulse from tighter financial conditions. We see a 30% probability of entering a recession over the next year and nearly even odds at a two-year horizon, although we think any recession would likely be mild. We expect core PCE inflation to decline to 4.2% by end-2022, although further supply chain disruptions, stronger wage growth, or firmer shelter inflation could keep inflation somewhat higher for longer. We see the unemployment rate declining to 3.6% by end-2022 before rising to 3.8% by end-2023, and 4.0% by end-2024.

Source: Goldman Sachs Investment Research

The week in review

Stocks: Markets worldwide suffered losses amid a hotter-than-expected August Consumer Price Index (CPI) print along with negative leaning Q3 corporate announcements. Given Tuesday’s inflation report, market participants are expecting the Federal Reserve to increase interest rates by at least 75 bps at its meeting next week to take its short-term interest rate to 3.25%. According to FactSet, earnings growth expectations for the third quarter are presently showing an increase of just +3.7% year-over-year, which is significantly down from the +9.8% growth estimate as it stood at the end of June. Moreover, analysts have slashed Q3 earnings expectations for every S&P 500 Index sector except energy. Seven out of 11 sectors are now expected to show a year-over-year decline in next quarter’s results.

Bonds: The Bloomberg Aggregate Bond Index finished the week lower as inflation and the Fed’s hawkish stance remains the major themes in the bond markets this year. Real yields, which are nominal yields taking into account inflation, continue to climb higher with 5-year, 10-year, and 30-year TIPs (Treasury Inflation Protected) yields the highest they’ve been since 2019. After spending the last two years largely in negative yielding territory, real yields are positive again.

Commodities: Even amid continued energy supply concerns in Europe from the Eastern European conflict, natural gas finished lower for the week and oil is down this week after reaching an annual low on September 7. Lower prices reflecting worries over demand if the economy falters. The metals mostly had a lower showing, as global demand concerns remain, with only silver up during the week.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.