The Sandbox Daily (9.19.2022)

FOMC, homebuilder sentiment, 1-yr U.S. Treasury bill, 2022 equity volatility

Welcome, Sandbox friends.

Today’s Daily discusses this week’s Federal Open Market Committee (FOMC) meeting, homebuilder sentiment drops again, the 1-year U.S. Treasury bill hits 4%, and putting 2022’s equity volatility in historical context.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.81% | Nasdaq 100 +0.77% | S&P 500 +0.69% | Dow +0.64%

FIXED INCOME: Barclays Agg Bond -0.11% | High Yield +0.38% | 2yr UST 3.947% | 10yr UST 3.483%

COMMODITIES: Brent Crude +0.48% to $91.97/barrel. Gold -0.08% to $1,682.9/oz.

BITCOIN: -0.80% to $19,429

US DOLLAR INDEX: -0.07% to 109.663

CBOE EQUITY PUT/CALL RATIO: 0.54

VIX: -2.05% to 25.76

Market ready for another 75 bps

The Federal Open Market Committee (FOMC) is set to meet on Tuesday and Wednesday this week where the policy-setting committee is expected to announce another 75 basis point increase to the federal funds rate, after hiking rates at four previous meetings in 2022: 25 bps (March), 50 bps (May), 75 bps (June), and 75 bps (July). The market is overwhelmingly positioned for an additional 75 bps to the target rate which would leave the fed funds rate at a target band of 3.00% to 3.25%.

The market will be paying close attention to Chairman Jerome Powell’s press conference on Wednesday afternoon for language and messaging on the terminal rate of the fed funds rate. Perhaps September may be the last of the super-sized rate hikes, in the event future CPI inflation prints come in less hot or the Federal Reserve slows the future path of rate hikes as it awaits the downstream effects from the policy lag making its way through the economy. For now, market consensus sees fed funds topping around 4.3% to 4.4%.

The scope of the current tightening cycle appears historically large. The share of global central banks that are currently in a hiking cycle is at record high. Therefore, the current hawkish central bank tightening cycle appears set to continue, and rising real yields remain a key headwind for risk assets.

Source: CME FedWatch Tool, Fundstrat, Goldman Sachs

Builder sentiment drops again

The National Association of Home Builders (NAHB) / Wells Fargo Housing Market Index (HMI) fell in September, coming in below consensus. This gauge is a closely watched survey of homebuilder sentiment. It was its ninth consecutive decline, bringing the index to its lowest level since May 2020. Excluding the pandemic, it was the lowest reading since May 2014. It implies further weakening in housing starts over the next several months.

Continued high construction costs, high mortgage rates, and worsening housing affordability were among the primary concerns of homebuilders. The report noted that more than half of the builders in the survey used incentives to stimulate demand. Indeed, 24% of builders reported reducing prices, up from 19% last month.

Source: Ned Davis Research

TINA trade over?

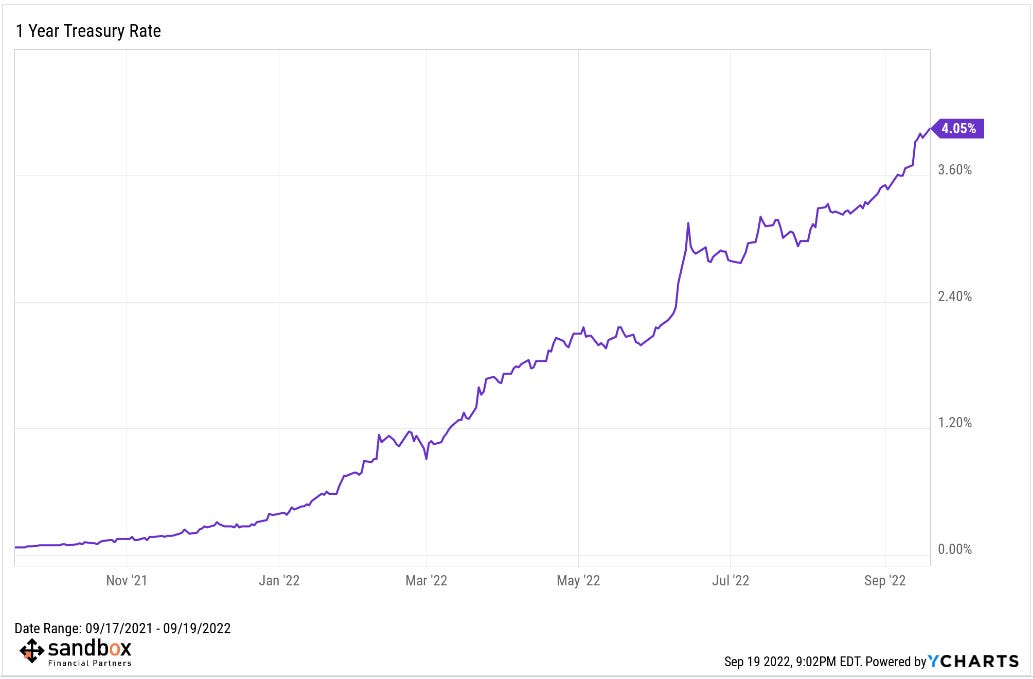

Today, the yield on the one-year U.S. Treasury bill is 4.05%. This time last year, the yield on the same one-year U.S. Treasury bill was 0.07%. The speed and magnitude of the shift in rates is remarkable. After years of claims that “there is no alternative” (TINA) to stocks, investors will be reconsidering cash as an asset class.

Source: Sandbox Financial Partners

A volatile year for stocks

Inflation and interest rates have rocked equity markets in 2022. After 178 trading days, the only years in which stocks experienced more volatility to this point:

1930s (Great Depression, World War II)

2002 (Dot-Com Crash)

2009 (Global Financial Crisis)

2020 (Covid-19 Pandemic)

Source: Charlie Bilello

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.