The Sandbox Daily (9.20.2022)

Sector divergence, housing affordability crisis, global bonds, the Merge, work-from-home update, and consumer mistrust

Welcome, Sandbox friends.

Today’s Daily discusses the sector divergence since the summer rally, the housing affordability issue affecting homebuyers in the DC-MD-VA metropolitan region, the route in global bonds, a brief post-mortem on the Ethereum Merge, a work from home (WFH) update, and consumer mistrust regarding personal information and cybersecurity.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.85% | Dow -1.01% | S&P 500 -1.13% | Russell 2000 -1.40%

FIXED INCOME: Barclays Agg Bond -0.47% | High Yield -0.45% | 2yr UST 3.963% | 10yr UST 3.559%

COMMODITIES: Brent Crude -1.75% to $90.36/barrel. Gold -0.61% to $1,672.6/oz.

BITCOIN: -3.34% to $18,936

US DOLLAR INDEX: +0.55% to 110.268

CBOE EQUITY PUT/CALL RATIO: 0.54

VIX: +5.43% to 27.16

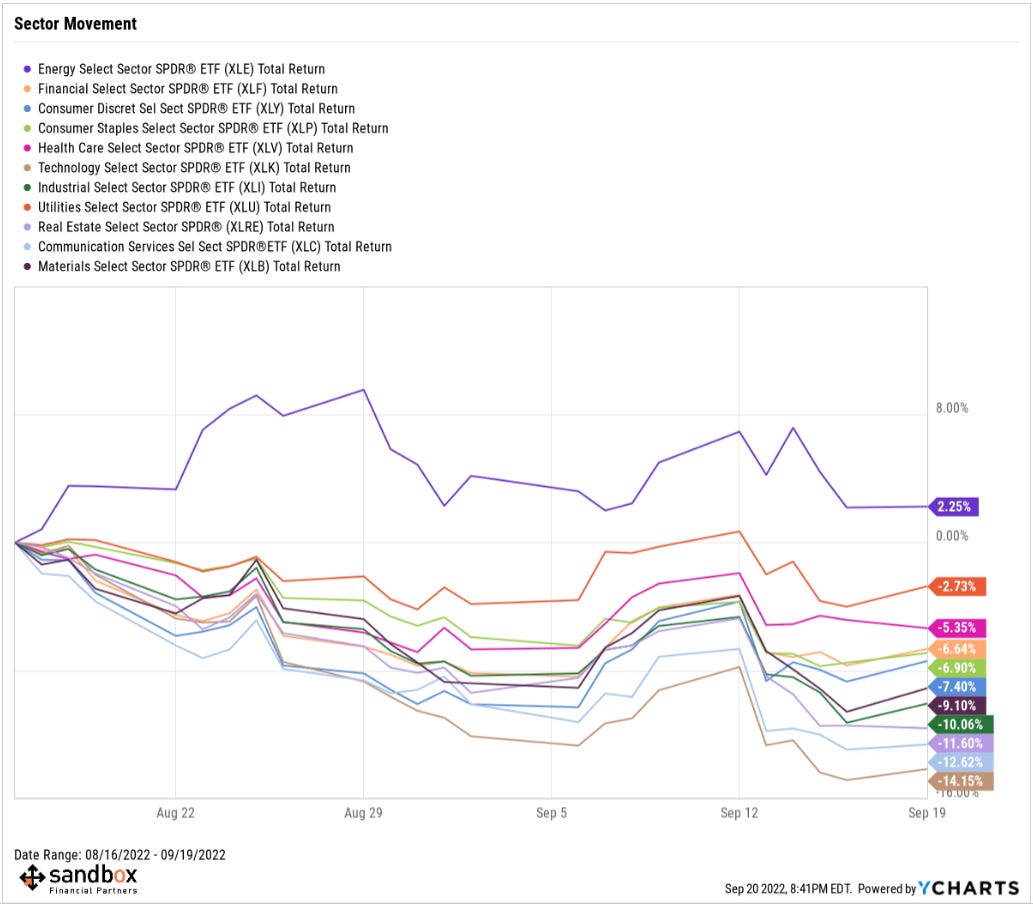

Sector divergence since the summer rally

Since August 16th, the date on which the summer rally petered out, stocks have retreated on the back of peak central bank hawkishness, sticky high inflation prints, and some mixed-albeit-softer economic data. So what stands out when reviewing equity performance by sector?

Energy and Financials are showing relative strength, two sectors which historically do the best in a rising rate environment. The sectors that should be leading in this environment are leading.

On the flip side, Communication Services and Technology are leading to the downside. The two most overvalued corners of the market heading into 2022 were hit the hardest prior to the summer rally, and again after the summer rally. So, if we are to retest and perhaps even undercut the June lows, one would expect the Communication Services and Technology groups to lead the way.

Source: Sandbox Financial Partners

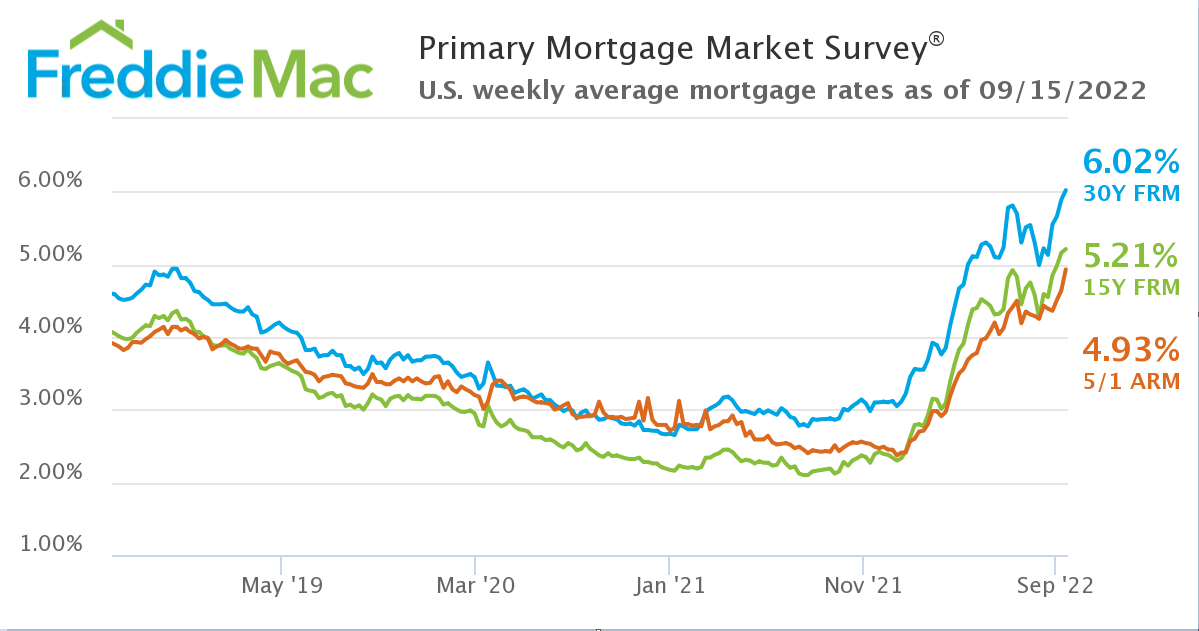

Housing affordability crisis

Mortgage rates in the United States have soared alongside Federal Reserve rate hikes. Per last week’s report from Freddie Mac, the average 30-year mortgage now stands above 6%, the highest since 2008, and more than double what it was a year ago.

The jump in rates adds to the cost of a home loan for both buyers and homeowners interested in refinancing. And while there are signs that the market value of homes is weakening, the absolute levels remain extremely high. As such, the monthly payment cost of a new home purchased with a 30-year fixed mortgage has absolutely exploded. Michael McDonough, chief economist for financial products at Bloomberg, produced various urban/metro homebuying scenarios that show how much a typical new homebuyer, who gets a 30-year fixed mortgage, with a 20% downpayment can expect to make in monthly payments – from 2010 to the present. Here’s what the DC-VA-MD market looks like:

Affordability – defined as the ability of someone on the median income to afford a median house at prevailing mortgage rates – has dipped to its lowest level since the top of the last housing boom in 2006.

Source: Freddie Mac, Joe Weisenthal

The rout in global bonds continue

Global bonds are suffering mightily this year amid rising rates, multi-decade high inflation, and a strong dollar. The Bloomberg Global Aggregate Bond Index is returning -17.48% year-to-date. No other year in the index’s history comes close to the dismal performance of 2022. For reference, the S&P 500 is down -19.10% year-to-date.

Source: Bianco Research

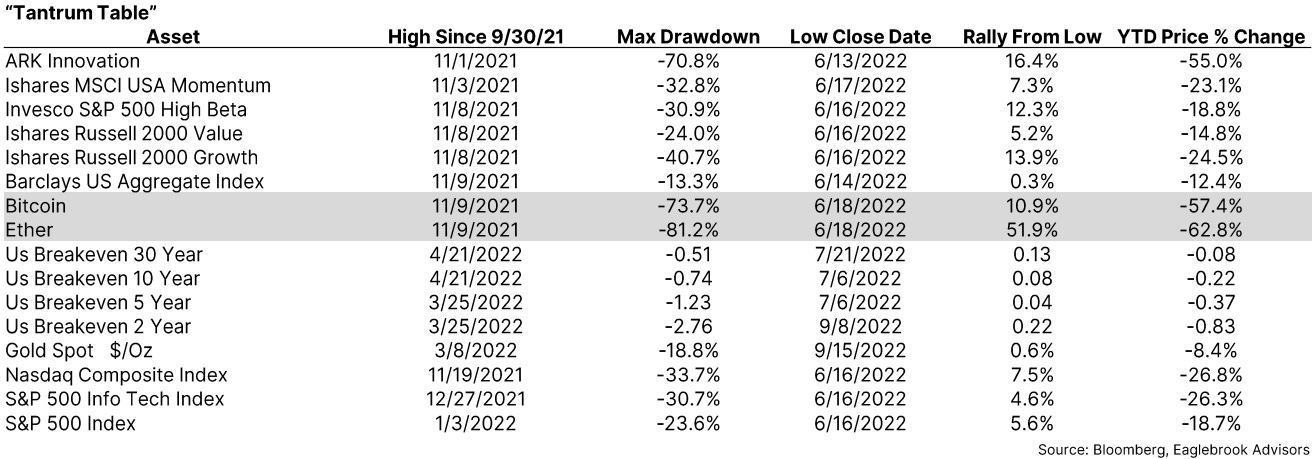

Reflecting on the Merge

The Merge is now complete. After many years of anticipation, Ethereum transitioned from the energy-intensive proof-of-work system to a proof-of-stake mechanism in the early hours of Thursday, September 15th. On the day of the Merge, ether declined -6.2%, with a weekly loss of -22.0%, while bitcoin declined -0.5% with a weekly loss of -8.9%; this compares to the weekly declines of -4.8% and -5.5% for the S&P 500 and the Nasdaq Composite. Much of last week’s declines are directly attributable to inflation data that overhangs on market sentiment and positioning.

Markets do not rise in a straight line, which often tests the conviction of long-term investors. While it’s not unusual to face a negative year of performance, it’s important to remember that over time, markets have climbed a wall of worry and generally average positive returns over longer time frames. So, with bitcoin down -57.4% and ether down -62.8% year-to-date, the crypto community must remain patient and maintain their conviction during this difficult macro backdrop.

Source: Eaglebrook Advisors

Work from home update

The percentage of people working primarily from home across all industries increased by 12.1% between 2019 and 2021. But, several industries had even larger increases – led by information at 32%.

Source: Indeed Hiring Lab

Consumer mistrust

CivicScience, a data aggregator on consumer data and behavior serving many Fortune 500 companies, recently released survey results on a wide range of cybersecurity topics that offer insight into just how much the average consumer does not trust the security and integrity of their personal information in the digital space.

The majority of Americans still don’t use password managers. Recent CivicScience data show that most U.S. adults (74%) don’t use or have not heard of password managers.

Trust in home tech products is also low. In recent years home technology products like Amazon’s Alexa speakers and Ring Video Doorbell systems have become increasingly popular. Yet, despite their popularity, many U.S. adults are more likely to distrust these devices than they are to trust them. Nearly half – 46% – of survey participants have low to no trust in smart home products to protect their privacy and personal data (such as data collected from video, search info, and voice commands).

Source: Civic Science

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.