The Sandbox Daily (9.2.2022)

August BLS jobs report, Federal Reserve's balance sheet runoff, NASA's Artemis I launch, and a weekly market recap

Welcome, Sandbox friends.

Today’s Daily discusses the August Bureau of Labor Statistics (BLS) jobs report released this morning, the Federal Reserve’s balance sheet runoff, NASA’s Artemis I launch scheduled for Saturday, and a brief recap to snapshot the week in markets.

Let’s dig in.

EQUITIES: Russell 2000 -0.72% | Dow -1.07% | S&P 500 -1.07% | Nasdaq 100 -1.44%

FIXED INCOME: Barclays Agg Bond +0.29% | High Yield -0.07% | 2yr UST 3.396% | 10yr UST 3.193%

COMMODITIES: Brent Crude +0.81% to $93.11/barrel. Gold +0.69% to $1,721.1/oz.

BITCOIN: -0.14% to $19,915

US DOLLAR INDEX: -0.07% to 109.613

CBOE EQUITY PUT/CALL RATIO: 0.84

VIX: -0.35% to 25.47

U.S. employers add 315,000 jobs as more workers join labor force

Nonfarm payrolls expanded by 315,000 in August, in line with economist’s expectations, while the prior two months were revised down by 107,000 – for a net gain of 208,000, bringing payrolls back to trend. Since the beginning of the year, employers have added 3.5 million jobs, bringing total employment to a record 152.7 million.

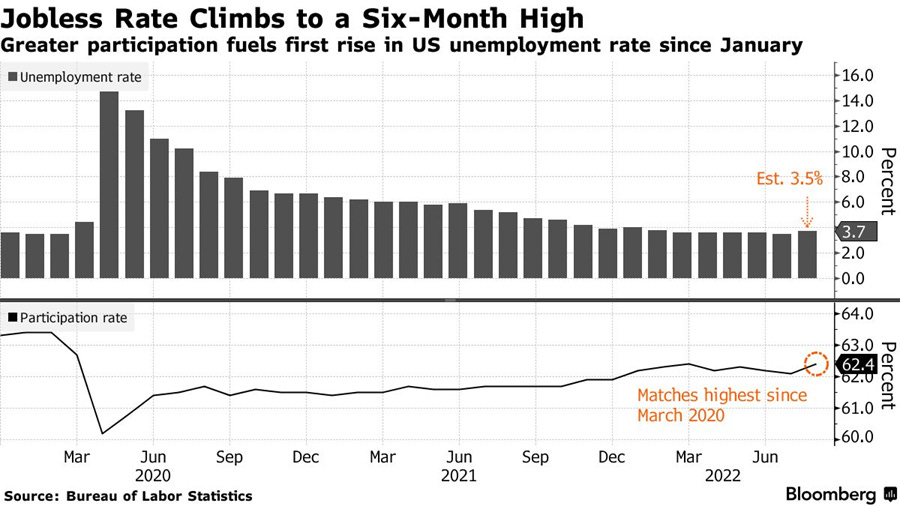

The unemployment rate unexpectedly rose to a six-month high of 3.7%, the first increase since January, for good reasons as the participation rate climbed.

The labor force participation rate -- the share of the population that is working or looking for work -- advanced to 62.4%, matching the highest since March 2020. The number of people in the labor force rose by a whopping 786,000, but not all of those net new workers immediately found jobs. That's good news for anyone who thinks the job market has been too tight. The jump in participation, which could lead to a further cooling in monthly wage growth, added to signs that inflation pressures are slowing.

The new data threads the macroeconomic needle – a “Goldilocks” interpretation – showing continued robustness in the labor market yet an easing of labor constraints – offering mixed implications for the Federal Reserve. As Fed Chairman Jerome Powell said recently, the labor market is still “clearly out of balance” but perhaps, the current labor market is finally moving in the right direction for policy makers.

Source: Ned Davis Research, Bloomberg, U.S. Bureau of Labor Statistics

The Fed’s “quantitative tightening” program

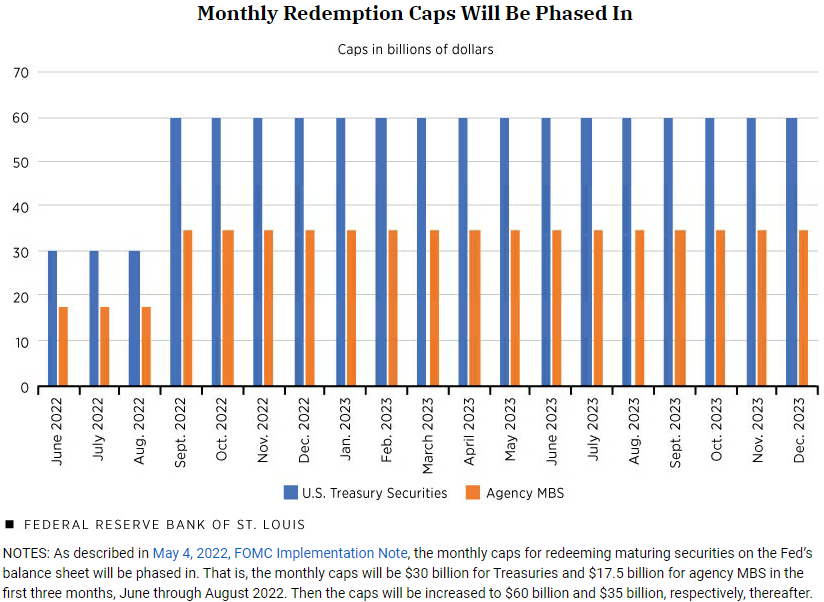

The Federal Reserve's program for unwinding the balance sheet – Quantitative Tightening (QT) – ramps up from $47.5 billion per month to $95 billion beginning in September as part of a broader plan to reduce its ~$9 trillion portfolio. If you recall, during the pandemic, the Fed was purchasing U.S. Treasury securities and agency mortgage-backed securities (MBS) to foster smooth normal market functioning and support the flow of credit to households and businesses by providing accommodative financial conditions. This action was in direct response to the COVID-19 shock that hit the global economy very hard. Now, the Fed is looking to unwind the assets on its balance sheet to remove its overwhelming presence in the marketplace.

The plan is to allow $60 billion in U.S. Treasury bonds and $35 billion of mortgage-backed securities to mature monthly without rolling or replacing into new purchases. The Fed may let additional Treasury Bills mature to reach their 95 billion goal, if there are not enough mortgages maturing or paying down in a given month. With the step up in QT comes reduced liquidity for the banking system and financial markets – for some investors, the withdrawal of support is a good reason to be pessimistic on this market.

The 2018 analog of QT taught us that liquidity dries up over time, and the effects take a while to be felt. The more illiquid corners of the market as well as the borrowing enterprises that heavily rely on leverage will feel the impact first. Since the $95 billion monthly pace of 2022 QT is almost double the rate we experienced in 2018, the adverse liquidity effects will arrive much sooner this time.

Source: Federal Reserve Bank of St. Louis, Bloomberg, Ned Davis Research, Lance Roberts

To the moon

Tomorrow – weather permitting – NASA will launch Artemis I at 2:17pm ET, its new moon rocket called the Space Launch System (SLS), the most powerful rocket ever built. The uncrewed mission will head toward the moon and complete one and a half orbits during its 42-day mission. If successful, the voyage will set the stage for a crewed “flyby” mission to the moon in 2024, which then paves the way for a potential lunar landing as soon as the following year. Live coverage of the launch can be viewed at the NASA website here.

The Space Launch System was first ordered by Congress in 2010, and is only now hitting the launchpad after numerous delays and billions in cost overruns. Plus, getting humans on the moon will require not only the rocket but also a vehicle to send astronauts from the capsule to the moon’s surface – SpaceX has been contracted to provide that lunar lander.

Here are a few reasons why NASA thinks it’s worth the trouble, per NPR:

Science: Lunar geologists say some parts of the moon are pivotal for understanding the beginnings of the solar system because there’s no atmosphere or flowing water to erode rocks.

Dress rehearsal for Mars: Before astronauts head to the Red Planet, they can work out all the kinks on the moon, which is 200 times closer to Earth than Mars.

Technological Advancement: Space enterprise has brought about dozens of new technologies to everyday life on Earth which should surprise no one, given NASA often employees the best and brightest minds across intersecting spheres of science and technology.

Source: NASA, New York Times, Morning Brew

The week in review

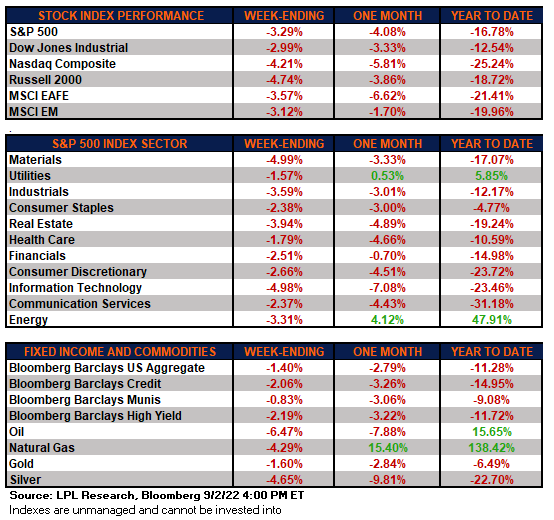

Stocks: Markets finished lower for a third straight week. The S&P 500 Index is down more than 8% from its mid-August peak after the index rallied 17% off its mid-June low. Federal Reserve (Fed) Chairman Powell’s foremost commitment to fighting inflation caused investors to take risk off the table. The AAII Investor Survey showed that the percentage of bulls fell almost 6% in the prior week to 21.9%, marking an eight-week low and the 41st consecutive week below the 38% historical average.

Bonds: The Bloomberg Aggregate Bond Index finished the week lower along with high-yield corporate bonds, as tracked by the Bloomberg High Yield index. Bonds lost ground, following last weeks’ selloff, as investors reassess the direction of rates given last week’s hawkish comments.

Commodities: Amid continued energy supply concerns in Europe from the Eastern European conflict, natural gas finished lower this week. The metals had poor performance as global demand remains a concern amid the softening economic landscape in China and Europe. West Texas Intermediate oil lost ground again this week as U.S. gasoline prices are set to decline for a 12th straight week, a major benefit for consumers.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.