The Sandbox Daily (9.22.2022)

Fed hikes another 75 bps, mortgage rates, global container costs, 2 year Treasury, Thursday Night Football

Welcome, Sandbox friends.

Today’s Daily discusses the 0.75% interest rate hike from the Federal Open Market Committee, mortgage rates rise again to 6.29%, global container rates continue to ease, the 2 Year U.S. Treasury Note is back above 4%, and Thursday Night Football scores a big win for Amazon.

Let’s dig in.

EQUITIES: Dow -0.35% | S&P 500 -0.84% | Nasdaq 100 -1.17% | Russell 2000 -2.26%

FIXED INCOME: Barclays Agg Bond -1.05% | High Yield -0.60% | 2yr UST 4.118% | 10yr UST 3.712%

COMMODITIES: Brent Crude +0.42% to $90.36/barrel. Gold -0.03% to $1,679.3/oz.

BITCOIN: +3.01% to $19,237

US DOLLAR INDEX: -0.05% to 111.257

CBOE EQUITY PUT/CALL RATIO: 0.71

VIX: -2.29% to 27.35

Fed rate hike

The Federal Reserve elected to hike their target Fed Funds rate by another 75 basis points yesterday, its 3rd consecutive 75 bps hike and 5th straight meeting in which the FOMC decided to increase rates (300 bps cumulatively in 2022). While the jumbo sized rate hike was well telegraphed, it highlights how concerned the Fed is that higher prices will stick around if it doesn’t take a firehose to the economy and stomp out inflation emphatically. Now, the country’s benchmark interest rate has reached its highest level since 2008, with the guidance target range of 3.00% to 3.25%. The median terminal forecast rate has rates hitting ~4.4% be the end of 2022 and ~4.6% in 2023.

What’s more, Federal Reserve Chairman Jerome Powell will remain steadfast in the committee’s mission to restore price stability. “No one knows whether this process will lead to a recession or if so, how significant that recession would be,” Powell told reporters after officials lifted the target range for their benchmark rate to 3% to 3.25%. “The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive, or restrictive for longer. Nonetheless, we’re committed to getting inflation back down to 2%.”

This is how investors reacted to the news:

Source: Bloomberg

Mortgage rates rise for 5th week in a row, hitting 6.29%

Mortgage rates in the United States rose for a fifth straight week, with the average for a 30-year, fixed rate loan surging to 6.29% from 6.02% last week, per a report today from Freddie Mac. Mortgage rates are now at their highest level in over a decade. Higher borrowing costs have shut down the pandemic housing frenzy, chilling purchases and eroding affordability for buyers still in the hunt. “The housing market continues to face headwinds,” stated Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac, Wall Street Journal, Bloomberg

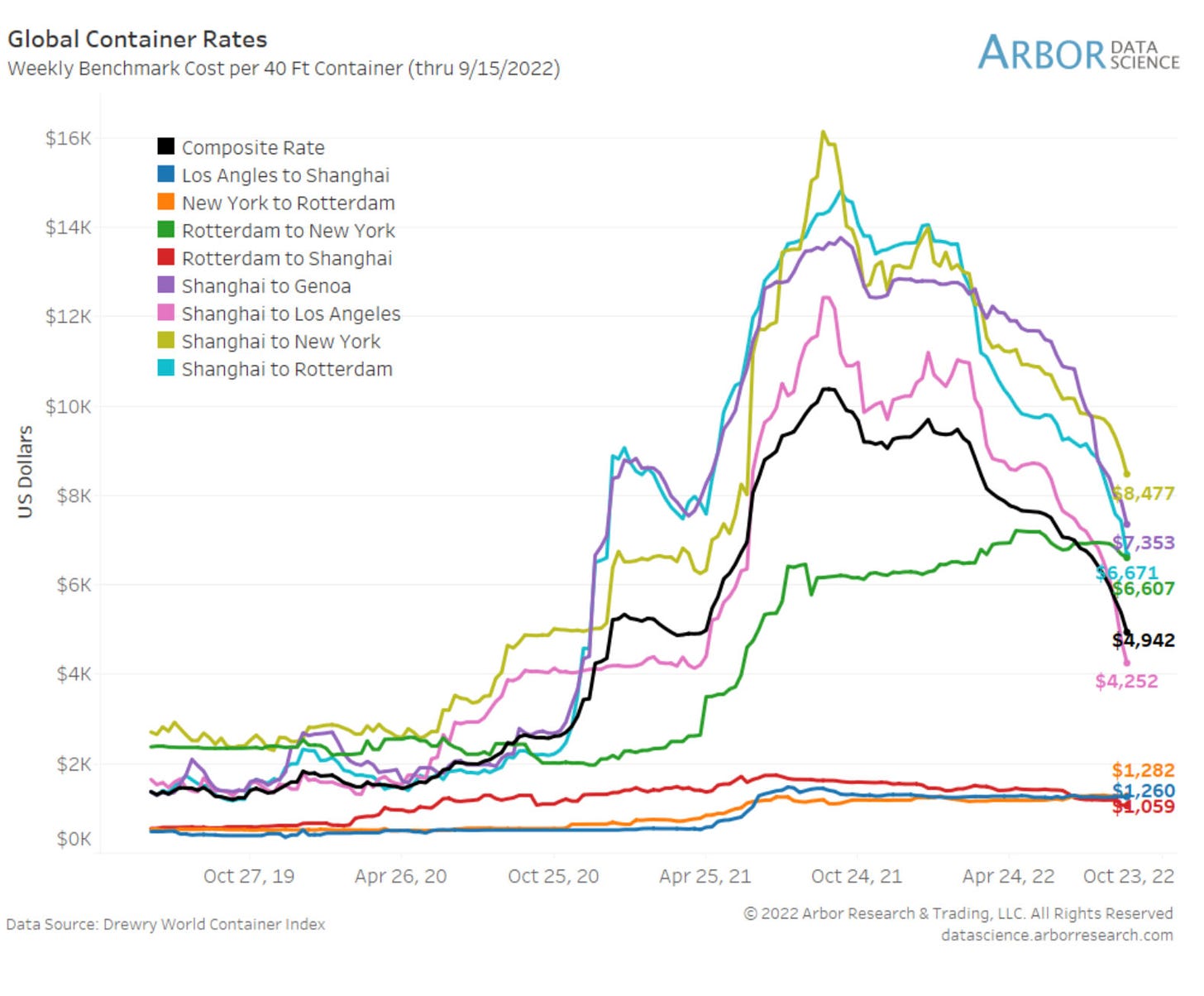

Global container rates continue to ease

Ocean freight rates, the cost of shipping containers of goods around the world, continue to collapse – the Drewry World Container Index was down -8% in the most recent weekly report and has dropped -52% YoY. Routes with the most dramatic declines have been those originating from Asia/Europe and ending in the United States. This reflects normalization of spending patters post pandemic and some easing among supply chains – both critically important to bringing down prices and getting goods to the final destination faster.

Source: Hellenic Shipping

2 year crosses 4%

The 2 Year U.S. Treasury Note is back above 4% for the first time since October 2007. The Federal Reserve is resolute in raising interest rates to slow aggregate demand, and the 2 Year Treasury reflects just how fast and how much rates have backed up in 2022. Comments from Fed Chair Jerome Powell’s press conference also remained hawkish, stressing that the central bank would “keep at it until we’re confident the job is done.”

Source: Sandbox Financial Partners

Thursday Night Football scores a big win for Amazon

Amazon’s first streaming broadcast of NFL Thursday Night Football, an AFC divisional matchup between the Kansas City Chiefs and the Los Angeles Chargers on Thursday, September 15th, attracted 15.3 million viewers across all platforms, as well as a record number of new Amazon Prime signups over a 3-hour period – including any 3-hour window over Prime Day, Cyber Monday, and Black Friday in its history.

Amazon paid $1 billion a year for an 11-year exclusive on Thursday night games, part of a high-stakes, astronomically priced set of rights renewals that reached a reported $110 billion. Amazon has told advertisers it is estimating an average audience of 12.6 million viewers for the season based on Nielsen numbers – which it resoundingly beat last week.

Tune in tonight to watch an AFC North divisional battle when the Cleveland Browns host the Pittsburgh Steelers.

Source: ESPN

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.