The Sandbox Daily (9.23.2022)

Congress, Goldman Sachs' updated S&P 500 forecast, cross-asset market relationships, onshoring jobs and supply chains, and a weekly market recap

Welcome, Sandbox friends.

Today’s Daily discusses the aging elected officials running Congress, Goldman Sachs updates their S&P 500 forecast, cross-asset relationships continue to show risk off mode, U.S. companies onshoring jobs and supply chains, and a brief recap to snapshot the week in markets.

Let’s dig in.

Markets in review

EQUITIES: Dow -1.62% | Nasdaq 100 -1.66% | S&P 500 -1.72% | Russell 2000 -2.48%

FIXED INCOME: Barclays Agg Bond -0.28% | High Yield -1.27% | 2yr UST 4.212% | 10yr UST 3.685%

COMMODITIES: Brent Crude -4.16% to $86.70/barrel. Gold -1.71% to $1,652.3/oz.

BITCOIN: -2.30% to $18,856

US DOLLAR INDEX: +1.51% to 113.027

CBOE EQUITY PUT/CALL RATIO: 0.83

VIX: +9.40% to 29.92

Quote of the day

Angela Bassett, of Hollywood fame, once had this to say:

It's important to surround yourself with good people, interesting people, young people, young ideas. Go places, learn new stuff. Look at the world with wonder – don't be tired about it.

Interesting people. Young people. Young ideas. This simple concept is a surefire way to preserve the pliability of your brain. As we all get older, we tend to get set in our ways. We confuse experience for knowledge. We start to see the world as a static environment, rather than the dynamic, ever-changing reality that we all live in.

This is true in life and investing. Over the years I have tried to keep a pulse on how other investment professionals process markets, what content they are consuming, and what ideas they are most excited about. These conversations lead to exciting opportunities, discovery of new ideas, and progress – all healthy elements for growth.

Source: Angela Bassett, Anthony Pompliano

America’s leaders are old and getting older

Speaking of interesting people, young people, young ideas – thank you, Angela – Congress is quite the opposite, in this regard.

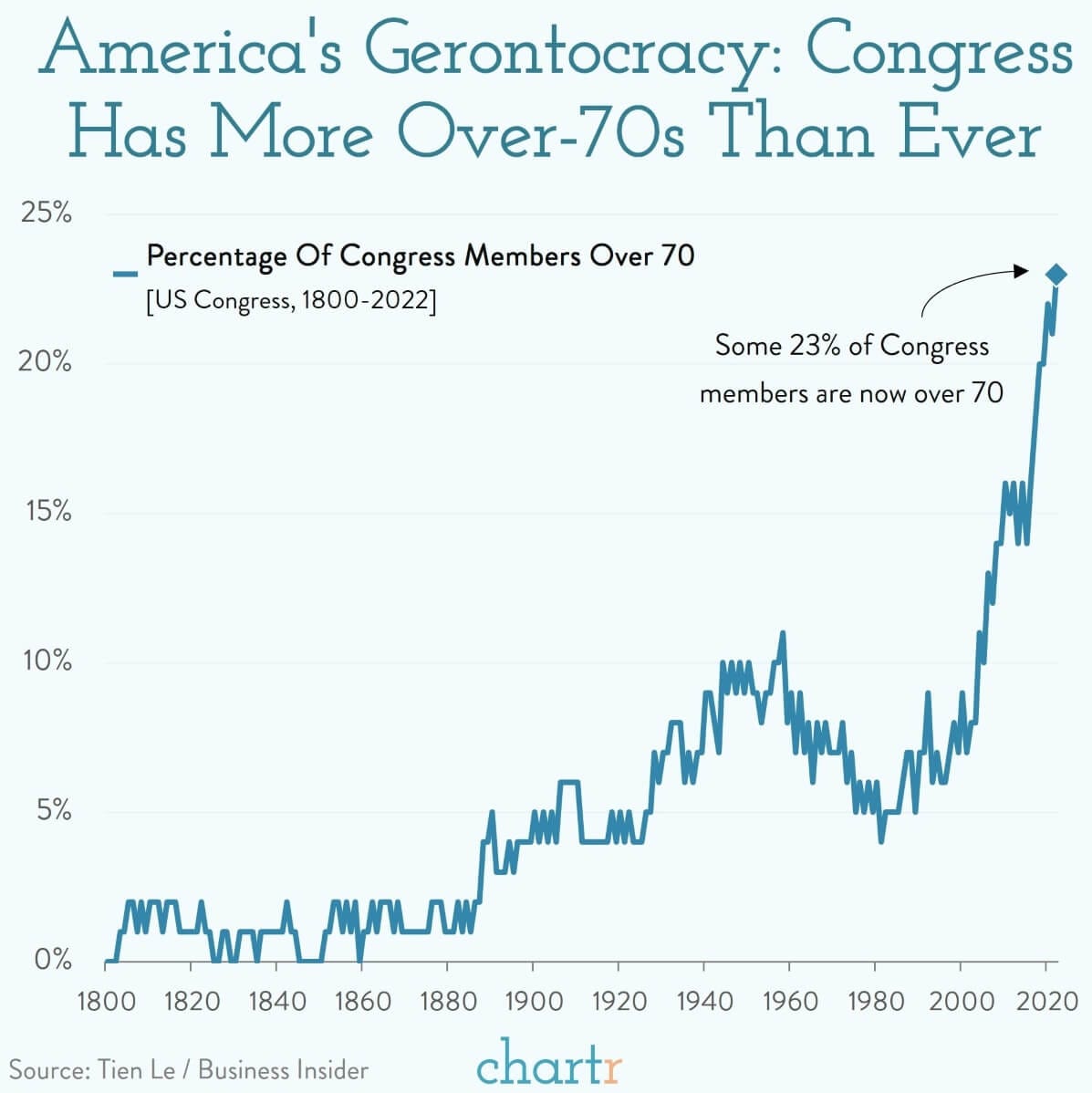

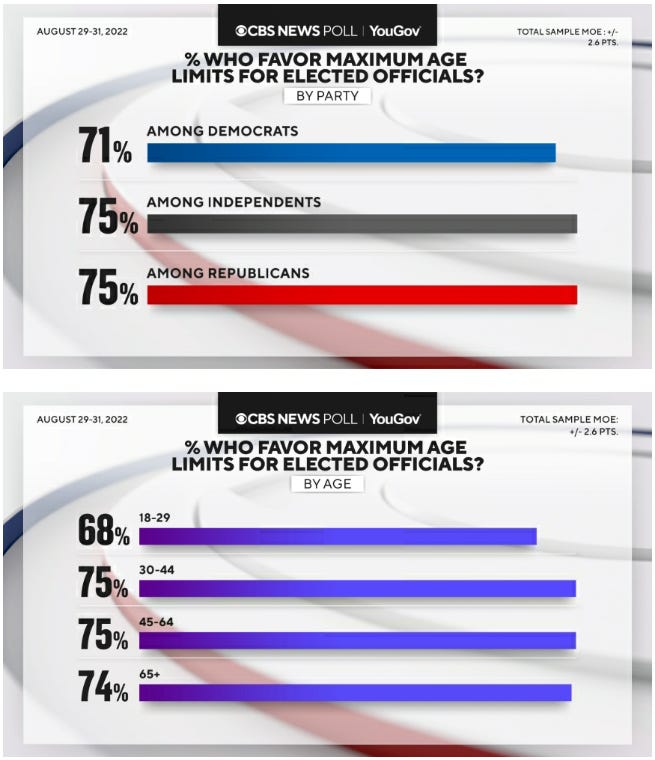

Data compiled by Insider, and visualized below, shows how dramatically Congress has aged in recent years. A stunning 23% of Congress' members are now over 70 years old, compared to 20 years ago when just 8% of legislators were 70+. If they keep their seats in November, two members would even turn 90 whilst serving in Congress next year.

With midterm elections just around the corner (November 8) and POTUS’s 80th birthday not far behind (November 20), discourse around America's aging congresspeople is getting louder – with a CBS poll showing remarkable bipartisan support and unison across age brackets to enact age limits of elected officials.

Want to dive deeper? Insider explores this topic in great detail.

Source: Chartr, Insider, CBS News

Higher rates, lower valuations: Goldman Sachs reduces S&P 500 targets

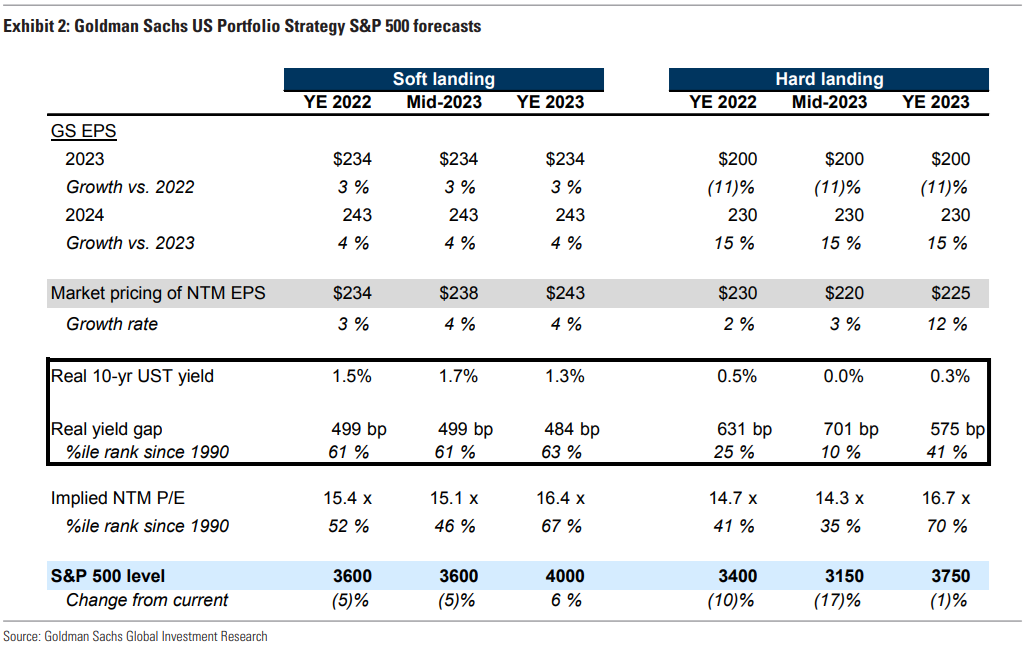

Markets are adjusting to the new, more hawkish reality after the Federal Reserve raised rates 75 basis points this week and lifted projections for where the base rate will be this year and next year. In response, Goldman Sachs has cut its year-end target for the S&P 500 to 3,600 from 4,300, citing higher interest rates. The forecast is skewed to the downside in part because of rising odds of a recession.

Per the report from David Kostin’s team at GS, the outlook is unusually murky. The forward paths of inflation, economic growth, interest rates, earnings, and valuations are all in flux more than usual with a wide distribution of potential outcomes. Furthermore, investor focus will soon turn from valuation to earnings in the near term; the pressing risk for stock investors is 3Q22 earnings season where record high profit margins will be under intense scrutiny. For context, Goldman estimates that in a recession falling S&P 500 earnings-per-share (EPS) could cause the S&P 500 index to decline to 3150 – maintaining 3% EPS growth but a lower P/E multiple of 15x (vs. 18x) – resulting in the so-called “hard landing” scenario.

Source: Goldman Sachs

Cross-asset relationships continue to show risk off mode

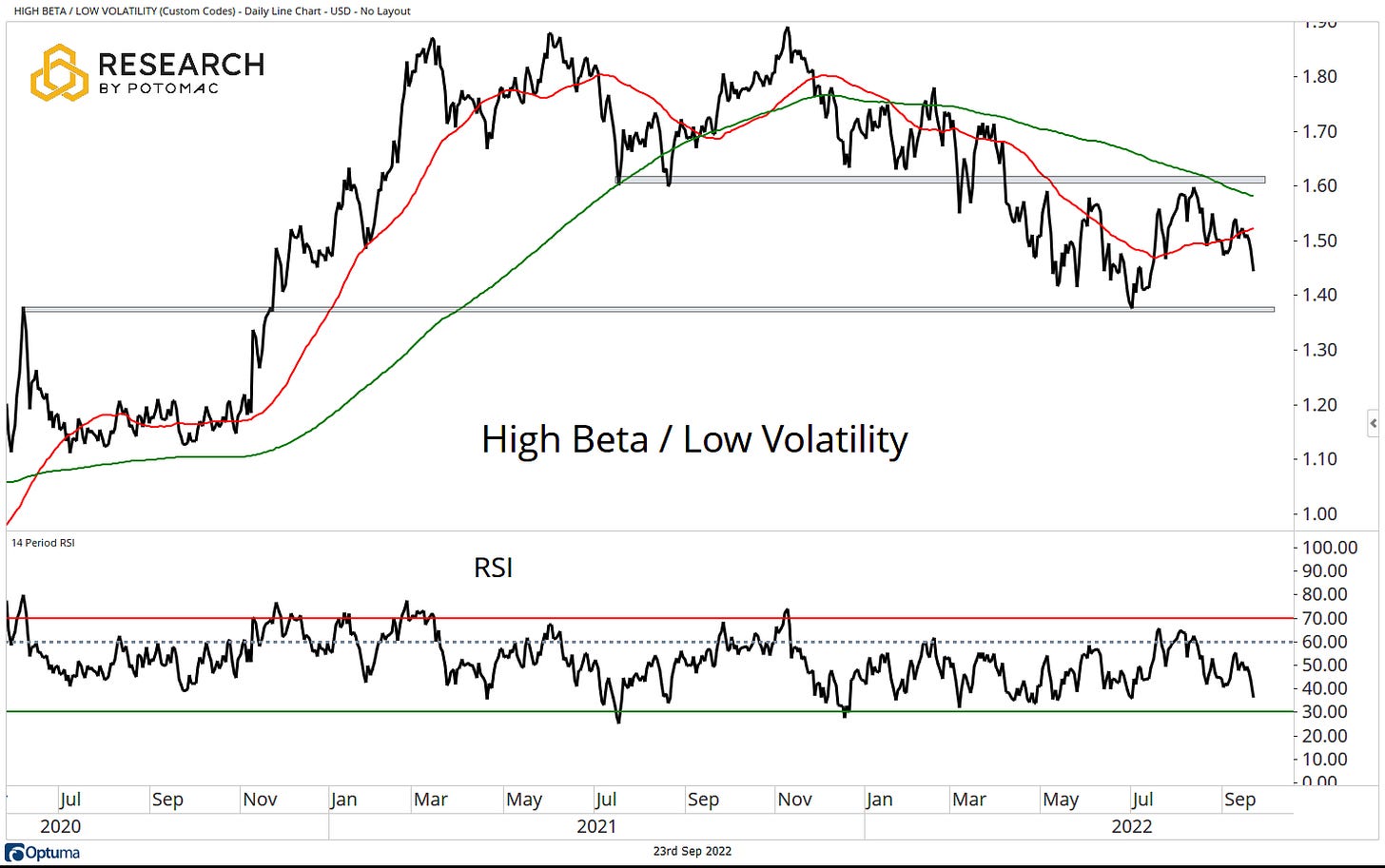

Tracking inter-market relationships can provide valuable information on market positioning, risk appetite, and sentiment. Two key measures show the trend has continued to demonstrate more bearishness over the past week.

The High Beta/Low Volatility ratio has fallen below the 50 DMA and firmly remains under the declining 200 DMA as it now trades in a consolidation zone. A break of support could signal the next stage of risk aversion in the market.

The High Yield/Treasury ratio remains stuck between support and resistance, yet is also below the 50 DMA and 200 DMA. The declining downtrend here remains neutral.

Breadth metrics were weaker this week – Advance/Decline line and New Highs vs. New Lows – so Bulls and Bears alike will be closely monitoring these cross-asset relationships for signals of further weakness or perhaps a reversal from all this selling pressure.

Source: Potomac Fund Management

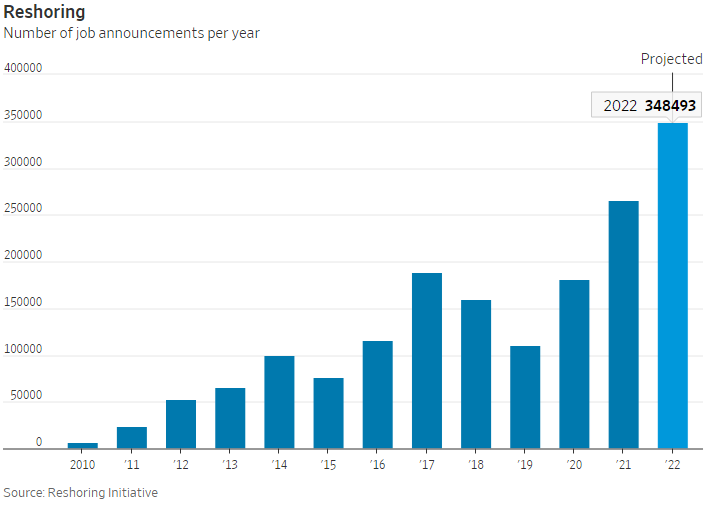

U.S. companies on pace to bring home record number of overseas jobs

American companies are on pace to reshore, or return to the United States, nearly 350,000 jobs this year, according to a report published Friday by the Reshoring Initiative. That would be the highest number on record since the group began tracking the data in 2010. The Reshoring Initiative lobbies for bringing manufacturing jobs back to the U.S.

To be sure, globalization has been a tailwind for investors and large companies for much of the past 30 years, particularly U.S. firms. Increased trade across borders boosted profits and productivity and allowed countries to focus on the goods and services they were best equipped to produce. Globalization has also provided multinational companies with new customers and new pools of low-cost labor.

But the Covid-19 pandemic, which snarled supply chains worldwide, pushed many executives to think about bringing their business closer to home. Russia’s invasion of Ukraine, which upended commodities markets, is another motivator.

“We think it’ll be a long-term trend,” said Jill Carey Hall, U.S. equity strategist at Bank of America Corp. ”Before Covid there was…a little uptick but obviously Covid was one big trend and you’ve seen a continued big jump up this year.”

Source: Reshoring Initiative, Wall Street Journal

The week in review

Stocks: Markets worldwide were down sharply this week with the S&P 500 Index finishing over 3% lower for the fourth week in the past five. Investors are worried that given Q3 earnings warnings and other signs of a slowing economy, the Federal Reserve (Fed) will steer the economy into a “hard landing” as they attempt to curb present price pressures.

Moreover, many market participants believe that Q3 estimates, which have been slashed over 6% from the end of June, will have to be cut further amid a deteriorating macroeconomic landscape. Bullish investors in the latest American Association of Individual Investors (AAII) fell to 17.7% last week compared to 26.1% two weeks ago.

Bonds: The Bloomberg Aggregate Bond Index finished the week lower as inflation and the Fed’s hawkish stance remains the major themes in the bond markets this year. High-yield corporate bonds, as tracked by the Bloomberg High Yield index, underperformed mirroring their equity counterparts. 2-year Treasuries reached 4.1% and the 10-year’s reached over 3.7%, which are the highest levels seen since 2007 and 2010 respectively.

Commodities: Even amid continued energy supply concerns in Europe from the Eastern European conflict, natural gas and oil declined for the second straight week. Lower prices reflect ongoing concerns over demand as well as the state of the global economy. The metals had a negative showing this week.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.