The Sandbox Daily (9.29.2022)

investor sentiment, share repurchases, global bonds, labor market, global population

Welcome, Sandbox friends.

Today’s Daily discusses the depressed sentiment among investors, tracking share repurchase events ahead of 2023, the rout in global bonds, continued strength in the labor market, and the world’s population at 8 billion.

Let’s dig in.

Markets in review

EQUITIES: Dow -1.54% | S&P 500 -2.11% | Russell 2000 -2.35% | Nasdaq 100 -2.86%

FIXED INCOME: Barclays Agg Bond -0.52% | High Yield -0.94% | 2yr UST 4.194% | 10yr UST 3.792%

COMMODITIES: Brent Crude -0.84% to $88.57/barrel. Gold -0.07% to $1,668.8/oz.

BITCOIN: -0.84% to $19,408

US DOLLAR INDEX: -0.42% to 112.135

CBOE EQUITY PUT/CALL RATIO: 0.75

VIX: +5.50% to 31.84

Investor sentiment reflects market turmoil

The American Association of Individual Investors (AAII) weekly survey produced its 2nd consecutive downtrodden report. Bears outnumbered Bulls by a wide margin: 60.8% vs. 20.0%. In fact, this is just the second of five times in the 35-year history of the survey that bears have exceeded 60% – one of the other five instances was just last week.

Looking at the full data series going back to 1987, the only other times we’ve witnessed sentiment this poor:

Fall of 1990 (-20% bear market that bottomed in October 1990)

March 2009 (week of the Great Financial Crisis lows)

And when looking at the net reading on the survey, bullish – bearish sentiment, the current reading is inside the top 10 worst measurements in its history, and the 6-month and 12-month prospective returns become quite attractive. In fact, 89% of the outcomes are positive for 6-month and 12-month returns on the S&P 500 when reviewing the 23 worst AAII readings.

Source: American Association of Individual Investors, Charlie Bilello, Fundstrat

Tracking share repurchase events ahead of 2023

On August 16, President Biden signed the Inflation Reduction Act (IRA) into law. With its passage comes a new 1% excise tax on corporate net share repurchases. “The buyback tax” aims to penalize companies for engaging in this type of shareholder accretive activity.

Corporate event data shows a downtick in total buyback announcements this year after a 2021 surge. It’s important to recognize that this data is a count of announcements among companies around the world—it does not measure the dollar value of share repurchase authorizations or executions.

This cautious approach may only reflect current market sentiment and management exercising caution over capital allocation. It’s quite possible that the next few months could feature unanticipated buyback program initiations among U.S. companies seeking to pull-forward share repurchases before next year’s 1% tax hits. We might already be seeing this—Bank of America Global Research reports that its corporate clients bought back stock at the highest rate since January in the week after the bill went into effect.

Source: FactSet

The rout in global bonds continues

Global bonds are suffering mightily this year amid rising rates, multi-decade high inflation, and a strong dollar. The Bloomberg Global Aggregate Bond Index is returning -20.3% year-to-date. No other year in the index’s history comes close to the dismal performance of 2022. For reference, the S&P 500 is down -23.6% year-to-date.

But it’s not just the size of the move that’s historically unique – the volatility of price action on a day-to-day basis is equally troubling. The ICE BofAML MOVE Index, the "VIX” of the bond market, closed at its second highest level since the Global Financial Crisis; the only day higher was March 9, 2020 arguably the worst market day of the pandemic. When the MOVE Index gets to these elevated levels, the Fed historically is working on some policy easing measure (rate cuts, stimulus package, etc.).

Source: Bianco Research

Labor demand strength persisting

Initial claims for unemployment insurance dropped to 193k last week, down in six of the past seven weeks and the lowest level since April. The four-week average of claims, which smooths out week-to-week volatility, fell to a four month low of 207,000. The trend is only modestly above its cycle low back in April and is hovering near its pre-pandemic level.

This report reflects that labor demand remains strong, despite aggressive efforts by the Fed to tighten financial conditions and cool down the economy. The current Fed policy impact on labor market conditions does come with a significant lag, is more pronounced in fast tightening cycles, and varies by industry – so we continue to wait on labor market stresses or fractures to pop up. The real fed funds rate leads private sector payroll growth by 12-18 months; this implies softer labor market conditions by the spring of 2023, and elevated risk of recession also around that time.

Source: Ned Davis Research, Bloomberg

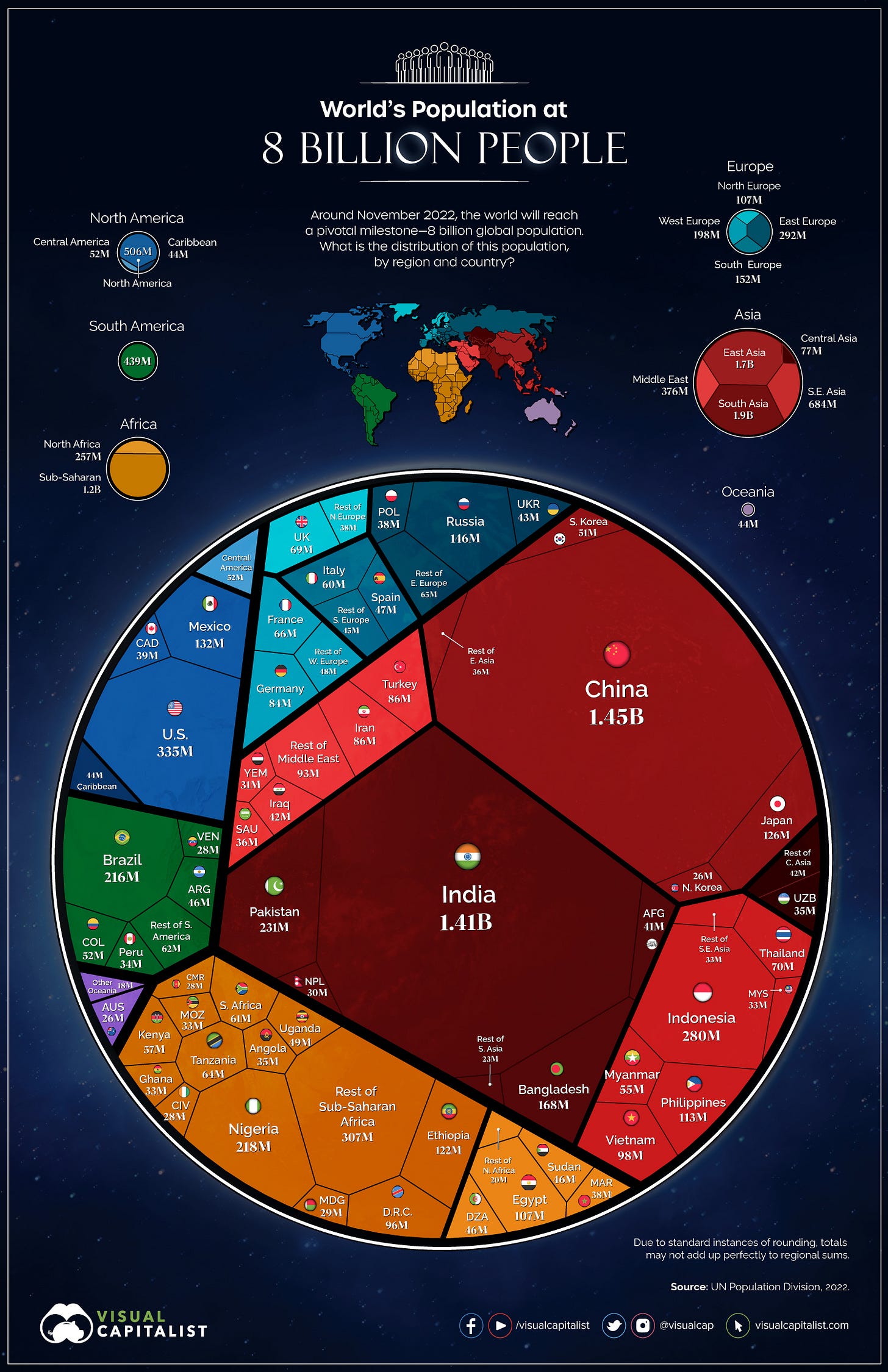

World’s population at 8 billion

The United Nations is estimating that on November 15th, 2022, the world population will surpass 8 billion people. In just 48 years, the world population has doubled in size, jumping from four to eight billion. Of course, humans are not equally spread throughout the planet, and countries take all shapes and sizes. This visualization shows how the eight billion people are distributed around the world.

Source: Visual Capitalist, United Nations (Department of Economic and Social Affairs)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.