The Sandbox Daily (9.30.2022)

The Fed's preferred measure on inflation (PCE), technical breakdown, NAAIM Exposure Index, Britain's tax cuts, and a weekly market recap

Welcome, Sandbox friends.

Today’s Daily discusses the August Personal Consumption Expenditures (PCE) inflation report, technical breadth indicators confirming the new lows, softer market positioning as demonstrated by the NAAIM Exposure Index, Britain’s market route stoking contagion fears, and a brief recap to snapshot the week in markets.

What a relief to see an equally dismal September and third quarter come to a close. As stated by Bloomberg editor John Authers: “In the past few days, global markets have been clobbered by an unprecedented effort from the world’s central banks to lift interest rates and stamp out soaring inflation. This is shifting the tectonic plates beneath the world economy, and threatens dangerous developments in society and in politics as we all try to adapt.”

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 -0.61% | S&P 500 -1.51% | Dow -1.71% | Nasdaq 100 -1.73%

FIXED INCOME: Barclays Agg Bond -0.24% | High Yield -0.46% | 2yr UST 4.264% | 10yr UST 3.823%

COMMODITIES: Brent Crude -0.76% to $87.90/barrel. Gold +0.10% to $1,670.4/oz.

BITCOIN: -0.18% to $19,464

US DOLLAR INDEX: -0.01% to 112.154

CBOE EQUITY PUT/CALL RATIO: 0.91

VIX: -0.69% to 31.62

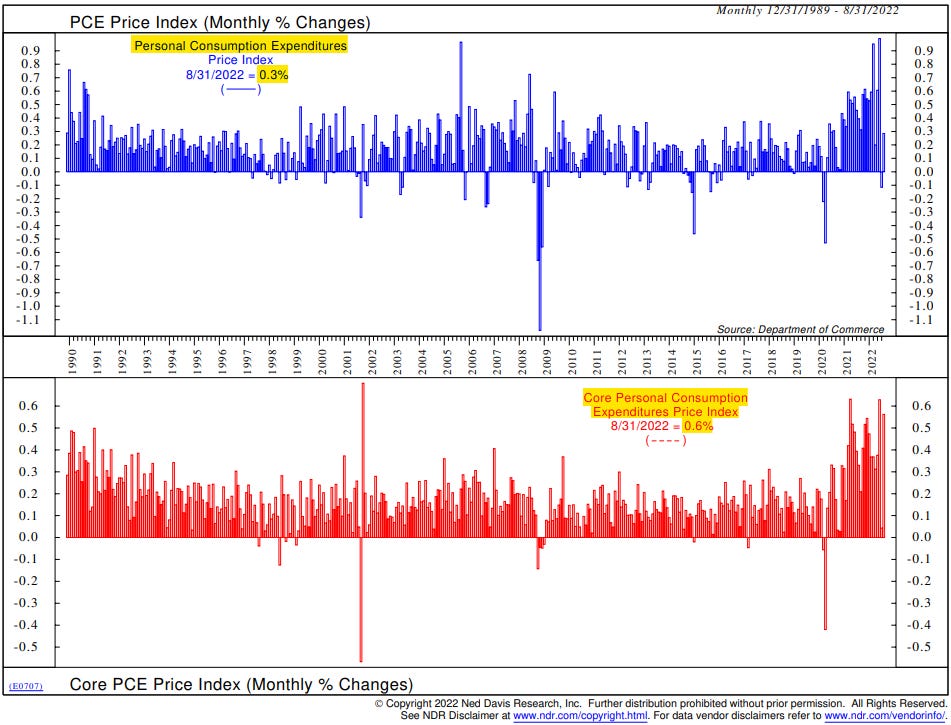

Fed’s preferred inflation gauge rose more than expected in August

The Personal Consumption Expenditures (PCE) Price Index rebounded +0.3% in August, after it dropped -0.1% in July. Food prices rose +0.8%, while energy prices fell -5.5%. The Core PCE Price Index, which excludes food and energy, jumped +0.6%. It was the 3rd biggest monthly gain in core prices in this business cycle and the 4th biggest jump since October 2001. It came on the heels of a similarly large increase in core CPI prices, so this report is not a complete surprise.

On a YoY basis, PCE prices edged down slightly to +6.2% from +6.4% in the previous month, but core PCE prices strengthened to +4.9% from +4.7%. While both indexes are holding below their cycle peaks earlier this year, the increase in core inflation, which tends to be stickier, suggests that a return to the Fed’s 2.0% inflation target is a long ways off. Goods price inflation continued to moderate, with durable goods prices easing to +5.3% YoY, the slowest pace since April 2021. But services inflation accelerated to +5.0% YoY, near its fastest rate since March 1989.

The durability of consumer demand has been a key source of support for the economy, but it’s also contributed to persistent price pressures. Fed Chair Jerome Powell last week reiterated the central bank’s commitment to restoring price stability and indicated the American public will have to endure some “pain” to return inflation back to its desired target of 2%.

Source: Ned Davis Research

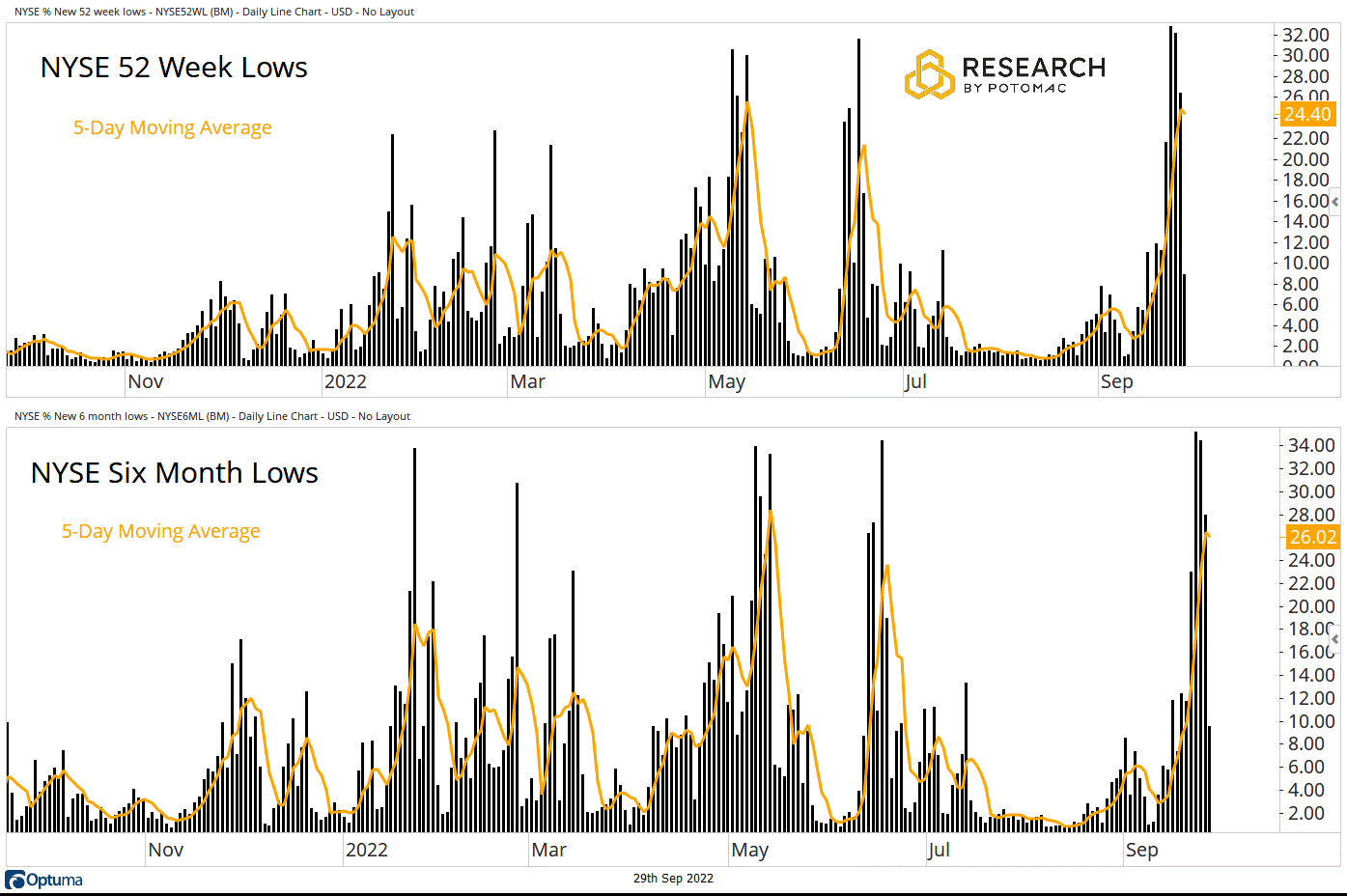

Internal breadth metrics confirm new lows

With the S&P 500 undercutting the June lows, it’s significant to note that breadth metrics fell to the same levels that were reached at the June nadir. The bulls were hoping for these technical metrics to register higher readings than the June lows – potentially sending a signal that the June low was a durable bottom – but that is different from how price action played out this week with the index sputtering into the quarter-end close. The technical damage and intensity of this low matching the summer swoon only increases the odds that the S&P 500 has not registered the low for the cycle.

Breadth metrics for the S&P 500 showed further deterioration this week.

Advance/Decline Line: Below the 50-day moving average, making a new low for the cycle

S&P 500 % of issues above their 200-Day Moving Average: 14%, from 19% last week

S&P 500 % of issues above their 50-Day Moving Average: 6%, from 14% last week

S&P 500 % of issues above their 20-Day Moving Average: 8%, from 6% last week

And if we broaden out the aperture to include all issues trading on the New York Stock Exchange, the 5-day moving averages of issues on the NYSE making new 52-week and 6-month lows continued higher over the past week, exceeding the levels that were seen when the S&P 500 made a low in June – more evidence showing the Bears remain in control of the trend.

Source: Potomac Fund Management

NAAIM Exposure Index shows weaker positioning post summer rally

The National Association of Active Investment Managers (NAAIM) Exposure Index moved lower down to 12.6%, undercutting this summer's lows and down to the lowest levels since March 2020. The NAAIM report shows the collective professional money manager’s weekly average exposure to equities (scaled from -200% which is leveraged short to +200% which is fully levered long).

The index has meaningfully rolled over since mid-August, indicating active investment fund managers are shedding risk and/or adding downside protection. This latest reading is approaching an attractive level where fund managers generally feel more comfortable putting risk back on.

Source: All Star Charts

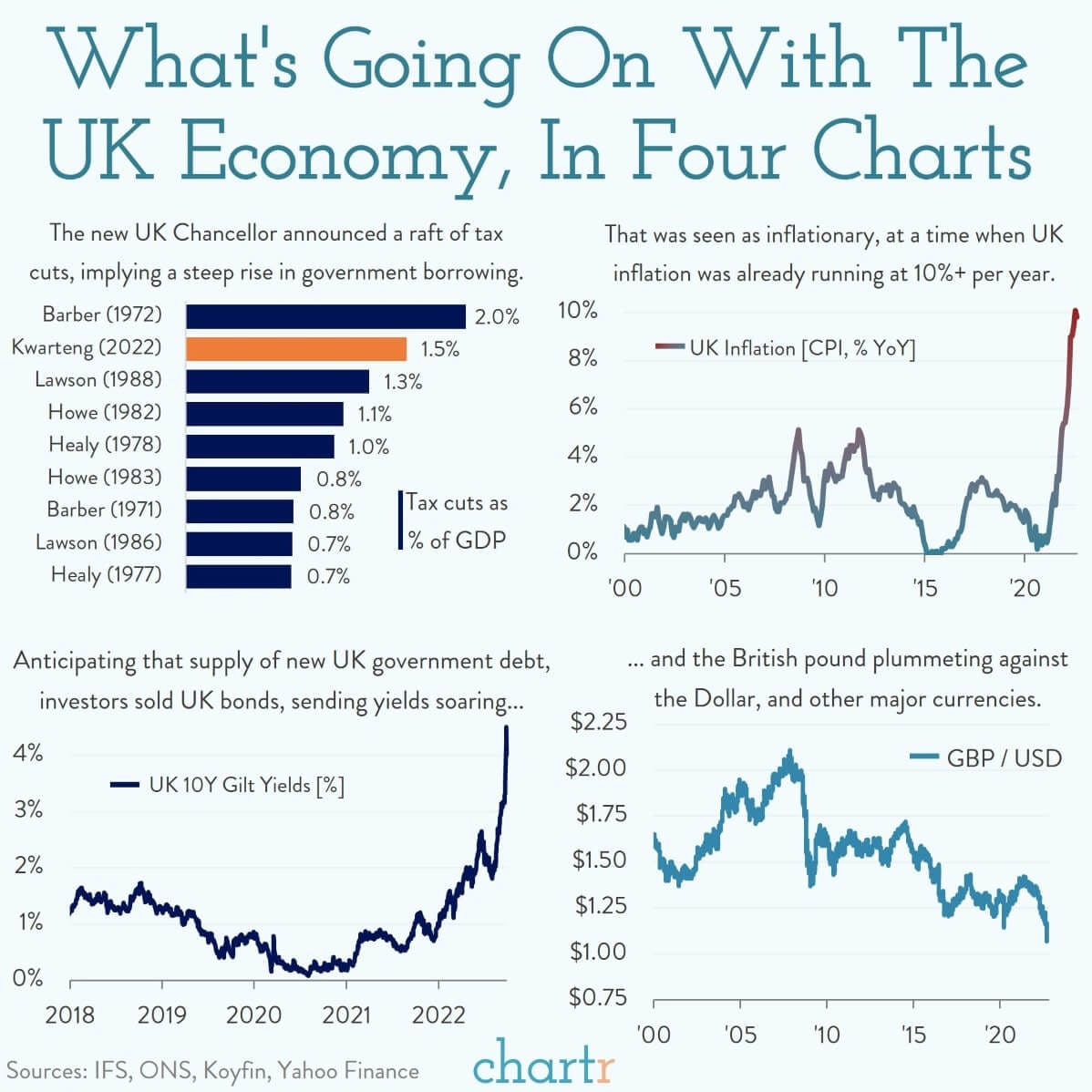

Britain’s tax cut policy announcement sets local market ablaze

The United Kingdom has had quite a month. After mourning the passing of their longest-reigning monarch, the country's economy has been met with upheaval this week over a proposed plan of tax cuts. Last week, the new U.K. chancellor Kwasi Kwarteng announced a “new era” of growth with tax cuts worth 1.5% of GDP — the largest set of cuts in any U.K. budget in almost 50 years and a throwback to trickle-down economics. Unfortunately, the market response to this fiscal package was an unmitigated disaster.

What was the collateral damage? Sterling crashed, pension funds fought off margin calls, the government’s 40-year bond sold down to 25 (vs. par of 100), sovereign credit default swap spreads blew out, and economists around the world heaped criticism on the move calling it “reckless.” The Bank of England indicated it would defend its proposed tax cuts policy by buying long-dated bonds to calm rate and currency markets.

While the stimulus could provide a short-term adrenaline shot to growth, it will increase sovereign debt through further budget deficits, stoke core inflationary pressures, and weigh on the pound.

Source: Chartr, Bloomberg

The week in review

Stocks: Markets worldwide were down sharply this week with the S&P 500 Index finishing lower by more than -1% for the fifth week in the past six. Investors continue to sell risk amid Q3 slashed earnings estimates and warnings. In addition, signs of a slowing economy are leading many traders to believe that the Federal Reserve will inadvertently steer the economy into a hard landing as they attempt to curb present price pressures.

Bonds: The Bloomberg Aggregate Bond Index finished the week lower as bond investors continue to believe that inflation conditions will, most likely, remain resinous even amid the Fed’s hawkish stance this year. High Yield corporate bonds, as tracked by the Bloomberg High Yield index, underperformed mirroring their equity counterparts; HY spreads (the additional compensation for owning riskier bonds) were only higher by 0.04% and, at current levels, are still not indicating that an economic slowdown/contraction is imminent.

Commodities: Amid continued energy supply concerns stemming in Europe from the Russian invasion of Ukraine as well as worldwide, oil increased in price this week. As for the mysterious Nord Stream pipeline leaks in the Baltic Sea, NATO declared them acts of sabotage and said the alliance would respond to any deliberate attacks on its critical infrastructure.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.